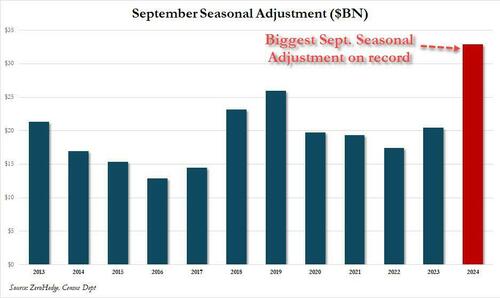

On the day the Biden admin decided to flagrantly misrepresent the last retail sales report before the election, and used the biggest ever September seasonal adjustment on record to make an unadjusted retail sales decline into a blazing hot print, once again misleading the Fed that the economy is doing much better than it is, something Powell lamented after the BLS recently "revised out" some 818K jobs ...

... China decided to out BS the BLS, and moments ago reported economic "data" that was fake, goalseeked and, well, BS from top to bottom.

In its Friday morning data dump when Beijing reported all the key economic metrics for the month, as one would expect from the only country eager to outmanipulate the US when it comes to rigging econ data, every single data point beat estimates but only ever so slightly, you know... to make it realistic:

- Q3 GDP 4.6%, beating estimates of 4.5% (but down from 4.7$ in Q2).

- Retail Sales Sept 3.2%, beating estimates of 2.5%, and up from 2.1%

- Industrial Output 5.4%, beating estimates of 4.5%, and up from 4.5%

- Fixed Investment Jan-Sept 3.4%, beating estimates of 3.3%, and unch sequentially

- Urban jobless rate dropped to 5.1% from 5.3% in August

Why this miraculous "beat" across the board? Simple: to instill confidence that the fake bazooka which Beijing pretended to fire in late September, yet which appears to be just another major dud where Xi Jinping hopes to sent stocks and home prices surging without actually massively expanding credit into the economy, is already succeeding. The better-than-expected retail sales figures in September also received a boost from government subsidies for buying home appliances, which saw a 21% surge in sales from a year ago, picking up from a 3% gain in the previous month.

Alas, as we discussed earlier, it is doing anything but and investors are already fleeing from Chinese markets just days after mainland stocks soared as much as 30% on what in retrospect appears to have been hollow promises, lies and David Tepper dumping his bags while using gullible CNBC viewers as exit liquidity telling them to buy China no questions asked.

Yet not even the fake data could cover up that China's economy continues to sink: yes, the numbers may have beat, but the Q3 GDP - the slowest since Q1 2023 - remains well below the government’s target for full-year growth of 5% and less than the 4.7% recorded in the previous quarter as sluggish consumption and a property slump weighed on household sentiment.

“It makes the official growth target of 5% difficult to achieve if this trend continues to year end,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “This may be why the government decided in the Politburo meeting to change policy stance and boost growth.”

The National Bureau of Statistics said there’s reason for caution despite improvements in the main indicators as the stimulus measures are rolled out. “We also need to see that the external environment is increasingly complex and grim, and the economy’s foundation for rebound and improvement needs to be further solidified,” a spokesperson said in a statement accompanying the release, pretending it is somehow everyone else's fault Beijing has completely lost its ability to reflate the economy.

Data released before Friday painted a mixed picture for growth in September. Exports slowed sharply, curbing a trade rebound that has been a bright spot for the economy. Deflationary pressures continued to build, with consumer prices still weak and factory gate prices falling for 24 straight months.

The softer growth will underscore the need for more support for the economy from Beijing, which in late September announced its biggest monetary stimulus since the pandemic and followed up with promises of heavy fiscal spending, yet which have yet to materialize.

As noted earlier, China’s markets reacted exuberantly to the news of monetary stimulus but - once Jim Cramer said to rush into Chinese stocks - have slumped as desperate investors await confirmation of the coming fiscal stimulus. The CSI 300 index of Shanghai- and Shenzhen-listed stocks and Hong Kong’s Hang Seng benchmark are down in October, although they remain up for the year to date.

Efforts by the country’s economic planner, finance ministry and housing ministry to boost confidence have been consistent duds, falling far short of investor expectations. The Hang Seng Mainland Properties index fell 6.7% on Thursday after the housing ministry’s support for the real estate sector disappointed markets. Authorities have yet to quantify the extra fiscal spending, but analysts have said this might be announced at a standing committee meeting of the National People’s Congress, China’s rubber-stamp parliament, in the coming weeks.

And amusingly, just as Chinese and Hong Kong stocks slumped after the strong Chinese data (because they were not misses, taking away from the urgency to stimulate more), with the CSI 300 already into negative territory, the central bank stepped in yet again with what has now become a daily market-boosting gimmick, which today came in the form of a slew of headlines to show that more easing and support for markets lie ahead.

- *PBOC SAYS FIRST BATCH OF SFISF QUOTAS EXCEEDED 200 BILLION YUAN

- *PAN REITERATES PBOC MAY FURTHER LOWER RRR YEAR-END: CAILIAN

As a result, the CSI 300 is now up nearly 1%, although not even the algos buying Chinese stocks will be fooled for long and having seen this same old song and dance day after day, the selling will resume momentarily as traders indicate they no longer want words but demand actions.

On the day the Biden admin decided to flagrantly misrepresent the last retail sales report before the election, and used the biggest ever September seasonal adjustment on record to make an unadjusted retail sales decline into a blazing hot print, once again misleading the Fed that the economy is doing much better than it is, something Powell lamented after the BLS recently “revised out” some 818K jobs …

… China decided to out BS the BLS, and moments ago reported economic “data” that was fake, goalseeked and, well, BS from top to bottom.

In its Friday morning data dump when Beijing reported all the key economic metrics for the month, as one would expect from the only country eager to outmanipulate the US when it comes to rigging econ data, every single data point beat estimates but only ever so slightly, you know… to make it realistic:

- Q3 GDP 4.6%, beating estimates of 4.5% (but down from 4.7$ in Q2).

- Retail Sales Sept 3.2%, beating estimates of 2.5%, and up from 2.1%

- Industrial Output 5.4%, beating estimates of 4.5%, and up from 4.5%

- Fixed Investment Jan-Sept 3.4%, beating estimates of 3.3%, and unch sequentially

- Urban jobless rate dropped to 5.1% from 5.3% in August

Why this miraculous “beat” across the board? Simple: to instill confidence that the fake bazooka which Beijing pretended to fire in late September, yet which appears to be just another major dud where Xi Jinping hopes to sent stocks and home prices surging without actually massively expanding credit into the economy, is already succeeding. The better-than-expected retail sales figures in September also received a boost from government subsidies for buying home appliances, which saw a 21% surge in sales from a year ago, picking up from a 3% gain in the previous month.

Alas, as we discussed earlier, it is doing anything but and investors are already fleeing from Chinese markets just days after mainland stocks soared as much as 30% on what in retrospect appears to have been hollow promises, lies and David Tepper dumping his bags while using gullible CNBC viewers as exit liquidity telling them to buy China no questions asked.

Yet not even the fake data could cover up that China’s economy continues to sink: yes, the numbers may have beat, but the Q3 GDP – the slowest since Q1 2023 – remains well below the government’s target for full-year growth of 5% and less than the 4.7% recorded in the previous quarter as sluggish consumption and a property slump weighed on household sentiment.

“It makes the official growth target of 5% difficult to achieve if this trend continues to year end,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “This may be why the government decided in the Politburo meeting to change policy stance and boost growth.”

The National Bureau of Statistics said there’s reason for caution despite improvements in the main indicators as the stimulus measures are rolled out. “We also need to see that the external environment is increasingly complex and grim, and the economy’s foundation for rebound and improvement needs to be further solidified,” a spokesperson said in a statement accompanying the release, pretending it is somehow everyone else’s fault Beijing has completely lost its ability to reflate the economy.

Data released before Friday painted a mixed picture for growth in September. Exports slowed sharply, curbing a trade rebound that has been a bright spot for the economy. Deflationary pressures continued to build, with consumer prices still weak and factory gate prices falling for 24 straight months.

The softer growth will underscore the need for more support for the economy from Beijing, which in late September announced its biggest monetary stimulus since the pandemic and followed up with promises of heavy fiscal spending, yet which have yet to materialize.

As noted earlier, China’s markets reacted exuberantly to the news of monetary stimulus but – once Jim Cramer said to rush into Chinese stocks – have slumped as desperate investors await confirmation of the coming fiscal stimulus. The CSI 300 index of Shanghai- and Shenzhen-listed stocks and Hong Kong’s Hang Seng benchmark are down in October, although they remain up for the year to date.

Efforts by the country’s economic planner, finance ministry and housing ministry to boost confidence have been consistent duds, falling far short of investor expectations. The Hang Seng Mainland Properties index fell 6.7% on Thursday after the housing ministry’s support for the real estate sector disappointed markets. Authorities have yet to quantify the extra fiscal spending, but analysts have said this might be announced at a standing committee meeting of the National People’s Congress, China’s rubber-stamp parliament, in the coming weeks.

And amusingly, just as Chinese and Hong Kong stocks slumped after the strong Chinese data (because they were not misses, taking away from the urgency to stimulate more), with the CSI 300 already into negative territory, the central bank stepped in yet again with what has now become a daily market-boosting gimmick, which today came in the form of a slew of headlines to show that more easing and support for markets lie ahead.

- *PBOC SAYS FIRST BATCH OF SFISF QUOTAS EXCEEDED 200 BILLION YUAN

- *PAN REITERATES PBOC MAY FURTHER LOWER RRR YEAR-END: CAILIAN

As a result, the CSI 300 is now up nearly 1%, although not even the algos buying Chinese stocks will be fooled for long and having seen this same old song and dance day after day, the selling will resume momentarily as traders indicate they no longer want words but demand actions.

Loading…