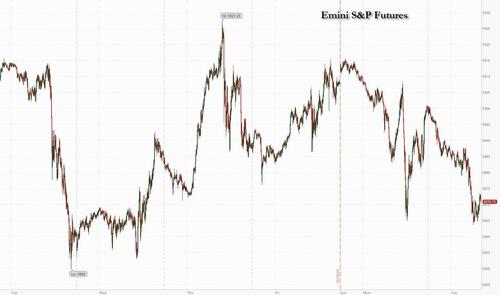

US futures are lower, extending yesterday’s losses, as treasuries extended their recent rout sending 10Y yields surging briefly above 4.22% before retracing some of the move as traders priced in the growing probability of a red sweep. The Treasury rout has gone global, pushing interest rates across the world higher. As of 8am ET, S&P 500 futures dropped 0.3%, pointing to the first back-to-back decline in about 30 sessions for the gauge. Nasdaq 100 futures underperformed, dropping 0.4%, as tech stocks start to groan against the weight of surging rates; megacap tech all showed declines: TSLA -0.8%, GOOG -0.5%, AMZN -0.5%. The yield on 10-year Treasuries added one basis point to 4.21% after an 11 basis-point surge at the start of the week; the USD is flattish after reversing a modest earlier loss. Commodities are mixed: Oil added 0.5%, base metals are lower, and precious metals are higher: silver rises +1% to $34.5, a new 12 year high. The only macro today are the October Philly Fed and Richmond Fed reports.

In premarket trading, Philip Morris rises 2% after lifting its profit outlook amid strong sales of tobacco alternatives such as Zyn and IQOS. 3M climbed 4% after increasing the low end of its 2024 profit forecast and reporting 3Q earnings that topped analyst estimates as a push to boost productivity gained traction. Polaris tumbled 7% after the automaker lowered its full-year earnings per share and sales guidance. Here are some of the biggest US movers today:

- Cheesecake Factory (CAKE) gains 3% following a report that activist investor JCP Investment Management has built a stake in the restaurant chain.

- Danaher (DHR) rises 2% after the life-sciences firm reported 3Q profit and sales that topped the average analyst estimate.

- General Electric (GE) drops 4% as sales fell short of Wall Street’s expectations last quarter, tempering enthusiasm for its improved profit outlook as the jet engine maker grapples with supply-chain limitations that are weighing on deliveries.

- General Motors (GM) ticks 1% higher after signaling solid US demand for its highest-margin vehicles even as the broader market softens, posting better-than-expected results for the latest quarter.

- IRhythm (IRTC) jump 20% after the company said it received FDA 510(k) clearance for design updates to its Zio AT device.

- Medpace (MEDP) drops 12% after the health care services company cut its revenue forecast for the full year.

- Zions (ZION) rises 2% as 3Q earnings per share beat estimates.

Investors further pared paring back their expectations for Fed rate cuts after central bank officials indicated a preference for reducing rates at a slower pace after recent resilient economic data. The inflationary impact of a possible Donald Trump presidential win is also weighing, given his promised tax cuts and trade tariffs could ultimately entail higher rates.

“This is very clearly linked to trading a victory of the Republicans — and therefore to an agenda which would be much more inflationist than that of the Democrats. We’re in a market that is betting on Trump,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. “The rise in yields is starting to threaten equity markets." (see more here "Wall Street Going "All-In On Trump".")

Elsewhere, exposure to the S&P 500 has reached levels that were followed by a 10% slump in the past, Citigroup Inc. strategists said. Still, despite the mounting risks, the current winning streak for US stocks ranks among the very best since 1928, according to data compiled by SentimenTrader. And even though US equities are expensive, going underweight is a tough call for investors in the environment where S&P 500 reached 47 record highs this year starting from January, said Vera Fehling, DWS Europe chief investment officer.

"If you said then: ‘things are looking quite stretched’ — you would have massively underperformed," she added. "It’s difficult to explain going into the end of such a year with a significant underweight in US equities."

European equities appear cheap by comparison and got even cheaper on Tuesday after the Stoxx 600 benchmark declined 0.8%, led by real estate and utilities sectors, which suffer when the cost of borrowing money rises. Major markets are all lower (UKX -0.6%, SX5E -0.4%, SXXP -0.7%, DAX -0.1%.) with Spain lagging. SAP is driving the tech sector to outperform after the German software giant delivered a beat on several key metrics in the third quarter and boosted some elements of its guidance for the full year. ING shares slip as Barclays downgraded the bank to equal-weight from overweight. Here are the most notable European movers:

- SAP shares gain as much as 5.9%, reaching a record high, after the software giant delivered a beat on several key metrics in 3Q and boosted some elements of its guidance for the full year.

- DNB Bank shares advance as much as 5.1% after Norway’s largest lender reported what Citi says were “impressive” quarterly results, with revenue beating estimates amid the best 3Q for fees.

- ING shares decline as much as 1.7%, the worst-performing stock on the Stoxx 600 Banks Index, as Barclays cut the recommendation on the lender to equal-weight from overweight.

- Traton shares rise as much as 5.4% after the truck maker issued preliminary third-quarter results ahead of expectations, with its International and Scania units driving the beat.

- Logitech shares gain as much as 4.2% after the Swiss maker of computer accessories boosted its operating income expectations for the full year.

- Saab shares advance as much as 5.9%, the most since June, as analysts praise the Swedish defense firm’s third-quarter order intake and cash flow.

- Boliden shares climb as much as 7.5%, after the miner reported 3Q revenue that beat the average analyst estimate, with Morgan Stanley noting mines and smelter-production volumes came in higher than expected.

- Randstad shares rise as much as 5.1% after the Dutch staffing company said that it has seen stable volumes in the first weeks of October, adding that it expects to benefit from easier 4Q comparables.

- Morgan Sindall shares rise as much as 11% after the construction and regeneration group said its annual results will be significantly ahead of expectations, driven by its Fit Out division that designs, builds and refurbishes commercial and office spaces.

- IHG shares drop as much as 2.8% after the hotel operator reported third-quarter revenue per available room that Morgan Stanley said missed consensus estimates.

- Eurofins Scientific shares drop as much as 12% after the laboratory-testing company reported third-quarter revenue that missed estimates.

- Hunting shares plunge as much as 19%, the most in over two years, after the energy services provider cut its annual earnings guidance due to challenges within its US onshore division that caused its Titan unit to disappoint, according to analysts.

So far about 47% of MSCI Europe companies reported results below expectations while only 27% delivered beats, according to data compiled by Bloomberg Intelligence. L’Oreal is set to report earnings later today, with analysts watching the impact of Chinese economic weakness on the stock.

Earlier in the session, Asian stocks fell on Tuesday, dragged by weakness in the technology and financial sectors, amid lower expectations for Federal Reserve interest-rate cuts. The MSCI Asia Pacific Index fell as much as 1.1%, with TSMC and Commonwealth Bank of Australia among the biggest drags. The decline follows comments from some US central bank officials signaling they favor a slower pace of rate reductions. Australian and Korean benchmarks were among the biggest decliners. Japanese stocks slid as uncertainty surrounding the Oct. 27 general election weighed on local markets. Stocks in India were also lower, led by automakers amid lackluster trading debut for Hyundai Motor Co.’s local unit. Stocks gained in Hong Kong after declining on Monday. China’s commitment to delivering stimulus is an ongoing focal point for traders in addition to the US presidential vote, which is about two weeks away. Focus is also turning to earnings performance this results season, which could help determine the near-term path for the MSCI Asia gauge.

In FX, the Bloomberg Dollar Spot Index was flat after rallying 0.4% on Monday. One-month implied volatility in BBDXY stands above 9.61, fresh cycle high; risk reversals on the tenor steady around 0.5 vol The Australian and New Zealand dollars outperformed their Group-of-10 peers as higher bond yields and gains in Chinese equities boosted sentiment.

In rates, treasuries fell for a second day, adding to Monday’s steep selloff as Fed officials indicated a preference for reducing rates at a slower pace. US 10-year yields rise 2 bps, topping 4.2% for the first time since July. Oil also continues to rise, adding to upward pressure on yields from shifting Fed policy outlook and focus on next month’s US presidential election and fiscal outlook. European government bond are also lower, with UK and German 10-year borrowing costs rising 3 bps and 4 bps respectively. Italy 10-year is ~3bp cheaper vs Treasuries, underperforming amid 7- and 30-year bond syndication. Treasury auctions this week include Wednesday’s $13b 20-year bond reopening and a $24b 5-year TIPS sale Thursday.

In commodities, oil prices reversed course, with WTI now up 0.5% at $71 a barrel. Spot gold rises $13 to just below Monday’s record high. Gold rose - approaching Monday’s record high - with haven demand coming from traders focused on the conflict in the Middle East and the looming US vote. Silver jumped 1% to hit $34.50, a new 12 year high.

US economic data calendar includes October Philadelphia Fed non-manufacturing activity (8:30am) and Richmond Fed manufacturing index (10am); Fed’s Harker is scheduled to speak at 10am

Market Snapshot

S&P 500 futures down 0.3% to 5,877.00

Brent Futures down 0.5% to $73.95/bbl

Gold spot up 0.6% to $2,736.07

US Dollar Index down 0.10% to 103.90

Top Overnight News

- Share buybacks on mainland China’s biggest exchanges have soared to a record high this year as Beijing pushes for companies to return cash to shareholders as part of its efforts to revive a flagging stock market. There have been Rmb235bn ($33bn) in buybacks across mainland-listed shares so far in 2024, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022, according to Chinese financial data provider Wind. FT

- U.S. rules that will ban certain U.S. investments in artificial intelligence in China are under final review, according to a government posting, suggesting the restrictions are coming soon. RTRS

- China’s youth unemployment rate dips in Sept to 17.6%, down 120bp from 18.8% in August. CNBC

- HSBC’s cost-cutting shakeup intensified. The lender said it will combine its global commercial and institutional banking operations, and create a new International Wealth and Premier Banking business. Pam Kaur was named as CFO. BBG

- Israel is apparently considering an Egyptian proposal for a 2-week ceasefire in with Hamas in Gaza that could potentially build into a more permanent deal. NBC News

- Federal Reserve Bank of San Francisco President Mary Daly said she expected the US central bank would continue cutting interest rates to guard against further weakening in the labor market. BBG

- The US Securities and Exchange Commission’s examiners will step up scrutiny of financial firms’ use of artificial intelligence next year, the latest sign of regulators’ growing concerns about the emerging technologies. BBG

- US drinkers are continuing to cut back on their vodka, whisky and tequila intake in a sign that, despite the improved economic environment, consumers are finding higher prices hard to swallow. FT

- GM shares jumped premarket after signaling solid US demand for its highest-margin vehicles, and raising the low end of its profit forecast. GE Aerospace reported a profit jump and raised its full-year guidance as the jet-engine maker capitalizes on its strong order book. BBG

- Fed's Daly (2024 voter) said the Fed will continue to adjust policy and a 50bps cut was to right-size policy, while she expects additional cuts going forward. Daly said the recent Fed rate cut was a close call and she came down strongly in favour of a 50bps cut, as well as noted that a 50bps cut was needed and they didn’t want to find out they had overtightened and taken jobs from people. She also said they will be data-dependent for the Fed's November meeting and haven't seen anything so far that would suggest they would not continue to cut rates, while she noted policy is absolutely still tight and would want to be open-minded to continue to ease policy if inflation is falling, even if the economy is strong.

- Fed's Schmid (2025 voter) called for a cautious, gradual and deliberate approach to rate cuts, while he prefers to avoid outsized rate cuts and noted that they are seeing a normalisation of the labour market, not a deterioration. Furthermore, Schmid said current policy is restrictive, but not very restrictive, as well as noted the balance sheet is probably influencing longer-term rates and that they should be normalising the Fed's balance sheet on both size and duration.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with participants somewhat cautious following the mostly negative bias stateside amid a lack of major catalysts, ongoing geopolitical tensions in the Middle East and a higher yield environment. ASX 200 retreated from the open with Real Estate and Healthcare leading the broad downturn seen across sectors. Nikkei 225 was pressured following its recent failure to hold on to the 39,000 level despite a weaker currency. Hang Seng and Shanghai Comp shrugged off early weakness to trade in the green albeit with price action choppy as the attention turned to earnings updates, while the PBoC conducted its first swap operation involving securities brokerages, funds and insurance companies worth CNY 50bln on Monday.

Top Asian News

- Chow Tai Fook Jewellery (1929 HK) reports same store sales down 24.3%; HY revenue decreases by 18%; HY Net profit decreases by 42%.

- China's FX regulator said the Yuan exchange is basically stable at reasonable and balanced levels, while it added that cross-border capital turned to inflows in the first three quarters of this year and cross-border capital flow has been balanced since the start of 2024. Furthermore, it stated the FX market shows relatively strong resilience and market expectations and trading are in order overall.

- FT article suggests that there is no sign yet of determined Chinese reforms or spending to spur more household consumption, despite many agreeing that President Xi's thinking on stimulus has changed. Focus is reportedly still largely on repairing local governments' and banks' balance sheets.

- China State Planner say China will continue to issue ultra long term special government bonds in 2025; and further optimise their allocation next year.

European bourses, Stoxx 600 (-0.2%) began the session mostly, but modestly on the backfoot, (ex-DAX 40 & Euro Stoxx 50; benefiting from post-earning strength in SAP) and have traded in a busy range throughout the morning; in recent trade, indicies are now broadly in the red, due to geopolitical updates out of Israel. European sectors hold a strong negative bias; Tech is by far and away the clear outperformer, lifted by post-earning strength in SAP (+5.4%). Real Estate is towards the foot of the pile, given the relatively higher yield environment. US Equity Futures (ES -0.1%, NQ -0.2%, RTY -0.4%) are modestly in the red to varying degrees and with slight underperformance in the RTY, which was subject to hefty selling pressure in the prior session. ASML (ASML NA) CEO says 2025 will be a growth year, the long term will still see growth. "Not everyone is surfing the AI wave". "What we have seen in the last few months is people beginning to push the breaks". "China demand is for mainstream chips, older generations of technology". "Normal Chinese demand is for 20-25% of ASML's sales, expect it to return to those levels". "China may be able to produce some 5 or 3 nanometre chips, but few, using older tech". It is clear the US will push for more export restrictions to China. "The Netherlands and Europe will start to discuss with China export restrictions make sense"

Top European News

- UK Shadow Chancellor Hunt warned Chancellor Reeves against hiking business taxes ahead of next week's Budget, according to FT.

- Italy's budget deficit seen at 3.9% of GDP in 2024 (exp. 3.8%); GDP expected to grow 0.8% in 2024 (exp. 0.9%) and 0.9% in 2025 (est. 1.1%)

FX

- USD is broadly slightly softer vs. peers and to varying degrees. That being said, DXY remains in close proximity to Monday's 104.01 peak and above its 200DMA at 103.72.

- EUR is marginally firmer vs. the USD but unable to scale back much of the downside from yesterday which saw the pair match last week's multi-month low at 1.0810. Docket ahead sees a slew of ECB speakers.

- Cable is continuing to pivot around the 1.30 mark within a 1.2980-1.3014 range. Focus today will be on today's trio of BoE speakers with Governor Bailey being the obvious highlight, with focus on if he echoes his recent dovish rhetoric.

- JPY is unable to claw back any of the losses vs. the USD seen during yesterday's session which brought the pair above its 100DMA at 150.73 and breifly onto a 151 handle. If upside resumes, technicians flag the 200DMA at 151.34.

- Antipodeans are both firmer vs. the USD and attempting to atone for recent losses. Overnight, AUD/USD printed a fresh low for the month at 0.6652 before paring losses (no clear fundamental driver was behind the move). NZD/USD has endured similar price action after recovering from a 0.6022 base overnight.

- Goldman Sachs says the EUR could drop as much as 10% under Trump tariff and domestic tax cuts.

Fixed Income

- Bunds are under pressure in a continuation of the action seen on Monday which was primarily a function of supply and energy upside. Bunds are around a 132.69 trough, having faded from Monday’s 133.06 low. The complex was fairly unreactive to a new German 2026 auction.

- USTs are in-fitting with the above, and in a continuation of the "Trump trade" seen in the prior session. Region awaits its own supply which comes on Wednesday with a 20yr tap, but before that, Fed's Harker.

- Gilts are pressured in-fitting with the above and roughly in-line with peers. Docket ahead sees a Bank of England trio of Governor Bailey, Breeden and Greene. Currently just off a 96.67 base and erring back towards opening levels of 96.88.

- Orders for Italy's new seven-year over EUR 70bln (spread at 7bps) whilst 30-year BTP tap demand is in excess of EUR 80bln (spread at 9bps), according to Reuters.

- UK sells GBP 900mln 0.625% 2045 I/L Gilt: b/c 3.57x (prev. 3.44x) & real yield 1.328% (prev. 1.20%).

- Germany sells EUR 4.162bln vs exp. EUR 5.0bln 2.00% 2026 Schatz: b/c 2.61x, average yield 2.16%, and retention 16.76%.

Commodities

- Crude oil is subdued following a firmer session on Monday despite a lack of fresh drivers but as markets still await Israel's attack on Iran. The complex then lifted off worst levels amid reports that Israeli PM Netanyahu will hold consultations tonight with a specific number of his cabinet ministers at the headquarters of the Ministry of Defense in Tel Aviv, via Al Jazeera. Thereafer, reports that Iran was involved in the assassination attempt on Netanyahu, crude soared to session highs of USD 75.06/bbl.

- Spot gold is firmer intraday with the complex buoyed by the aforementioned geopolitics, ahead of US elections, and with extra momentum after notching fresh all-time highs. XAU resides in a current USD 2,719-2,738.50/oz range.

- Base metals are mostly firmer trade in the complex with gains in most industrial metals pinned on hopes of Chinese stimulus, although iron ore prices retreated with desks citing concerns of softening steel demand.

- US is reportedly in talks with Southeast Asian nations to deploy small modular nuclear reactors, according to Bloomberg.

- China crude steel output -6.1% Y/Y to 77.1mln tonnes in September 2024; global steel output -4.7% Y/Y to 143.6mln tonnes, according to worldsteel.

Geopolitics: Middle East

- Israeli PM Netanyahu will hold consultations tonight with a specific number of his cabinet ministers at the headquarters of the Ministry of Defense in Tel Aviv, via Al Jazeera citing Israeli media.

- "Officials at the Iranian embassy in Beirut are involved in the assassination attempt on PM Netanyahu. The Israeli investigation shows Iranian involvement in launching the drone towards Netanyahu's house", via Kans' Kai on X citing Saudi Al-Hadath channel

- "Al-Arabiya correspondent: Netanyahu meets today with security leaders in Tel Aviv after meeting with Blinken", according to Al Arabiya

- Israeli Home Front said sirens sounded in Haifa, its Gulf and dozens of cities and sites in northern Israel, while it was later reported that Israeli media and military announced sirens sounded in central Israel's Samaria area, West Bank settlements, Acre and areas in upper Galilee.

- Israel's Channel 14 reported that the homes of senior officials in Iran were added as possible targets for Israeli attack and the Air Force will know the exact target of the attack shortly before implementation, according to Al Jazeera. Furthermore, Israel's Channel 14 cited Israeli sources that stated plans for the strike against Iran were presented by the military leadership and the Mossad to the Prime Minister and Minister of Defence, according to Sky News Arabia.

- US Secretary of State Blinken said he is heading to Israel and other stations in the region to discuss ending the war in Gaza, returning the hostages and alleviating the suffering of the Palestinians, according to Al Jazeera.

Geopolitics: Other

- UK is to lend Ukraine an additional GBP 2.26bln for weapons to fight Russia with the loans to be repaid using interest generated from USD 300bln of Russian frozen assets, according to The Guardian.

US Event Calendar

- 08:30: Oct. Philadelphia Fed Non-Manufactu, est. 4.1, prior -6.1

- 10:00: Oct. Richmond Fed Business Conditio, prior -3

- 10:00: Oct. Richmond Fed Index, est. -17, prior -21

Central Bank Speakers

- 09:00: ECB’s Centeno Speaks in Washington

- 10:00: Fed’s Harker Speaks at Fintech Conference

- 10:00: Fed’s Harker Gives Opening Remarks

DB's Jim Reid concludes the overnight wrap

Only two weeks until the big day. One that I've been looking forward to for what seems an exceptionally long time. Yes, the kids will go back to school after an extended 2-week half-term. As predicted last week my wife was already fed up with them last night after one day of holiday yesterday. The twins are so noisy! I'm off to Center Parcs with them all for a long weekend on Friday so I won't be spared.

With two weeks to go today until the election, markets have started the week a bit more nervously than during the last 6 where the the S&P 500 has gone up each week for only the second time since the pandemic. Yesterday it started the week -0.18% but with bigger sell-offs elsewhere and extending into the Asian session this morning. The sell-off was much more pronounced among sovereign bonds though, with the 10yr Treasury yield (+11.3bps) reaching its highest level (4.20%) since late July, shortly before the weak payroll report, the Japanese mini-crash and the associated brief market turmoil. Moreover, the move was primarily driven by higher real yields, with the 10yr real yield (+10.2bps) moving up to 1.88%, which is its highest level since the end of July. Overnight, 10yr USTs are another +1.4bps higher as we go to print.

There were several factors behind the move but none that particularly dominated yesterday. In the background there has been a rising concern about debts and deficits, particularly ahead of the US election. Indeed, the IMF pointed out in their recent Fiscal Monitor that global public debt is forecast to exceed $100 trillion this year, and rise further in the medium term, so this is a growing issue as policymakers gather for the IMF/World Bank Annual Meetings in Washington this week. Moreover, our US economists have pointed out that irrespective of who wins the presidency or congress, they could see deficits in the 7-9% area over 2026-28, which is a level unprecedented outside of major wars or massive economic shocks like the GFC and Covid-19.

In addition to the long-end moves, expectations of Fed easing continue to drift lower, with Fed funds pricing for next March (+8.0bps to 4.05%) moving back above 4% for the first time since the start of August, after having fallen to below 3.4% in late September. This came as Fed speakers continued to express preference for gradual easing moving forward, with Kansas City President Schmid favouring “modest” reductions while Minneapolis Fed President Kashkari was “forecasting some more modest cuts”.

Another factor behind the bond selloff were growing inflation risks, and yesterday saw Brent crude oil prices (+1.68%) pick up again to $74.29/bbl. That comes amidst growing focus on Israel’s expected retaliation against Iran’s missile strikes earlier this month, which is still yet to materialise. But oil prices were reacting to several weekend developments, including the drone strike on the private home of Israeli PM Netanyahu that we mentioned yesterday. Indeed, foreign minister Israel Katz said over the weekend that there was “no doubt that another red line has been crossed here”. Meanwhile, although the classic safe haven of gold (-0.06%) closed marginally lower, after posting four consecutive session ATHs, this morning its +0.43% higher as I type and back at what would be record closing levels again.

Over in Europe, the bond selloff was even more aggressive, with yields on 10yr bunds (+9.9bps), OATs (+12.1bps) and BTPs (+15.3bps) all seeing large moves higher. In part, that’s because investors have pared back their expectations for a larger 50bp rate cut at the ECB’s December meeting, and we had a lot of commentary from several officials to digest as well. For instance, Lithuania’s Simkus said that he didn’t see the need for cuts bigger than 25bps, and Slovakia’s Kazimir said that the December meeting was “wide open”.

Back to the US election, the general consensus across polls, betting averages and forecasting models is that Trump has gained ground on Harris, but the race is still within the margin of error across the key battleground states. Now clearly that could change, but from a market perspective, the Trump bump has meant that beneficiaries of the “Trump trade” have continued to do well in recent sessions. Most notably, Trump Media & Technology Group (+5.81%) was up to its highest since July yesterday just after Biden pulled out of the Presidential race.

Returning to yesterday, equities struggled, particularly as bond yields kept on rising. The S&P 500 (-0.18%) posted a modest decline, but it was a broad-based one, with the equal weighted version of the index seeing its worst day in more than six weeks (-0.85%). Small-caps struggled in particular as the Russell 2000 (-1.60%) saw its worst day since early September. Information technology (+0.93%) was the only major sector within the S&P 500 to post a gain. The Mag-7 (+0.64%) advanced as Nvidia (+4.14%) hit a new record high, while the NASDAQ (+0.27%) moved to within half a percent of its all-time high from July. Over in Europe, markets closed around the intra-day lows of the US session, with the STOXX 600 (-0.66%) and the DAX (-1.00%) both losing significant ground.

Whilst there were several short-term catalysts for the selloff, it’s also worth bearing in mind that the market performance has been pretty incredible over recent months. Only last week, we saw US IG credit spreads reach their tightest level since 2005, and the S&P 500 is up for 37 of the last 51 weeks, which is a joint record back to 1989. This means that traditional valuation metrics are now looking increasingly stretched by historic standards, at a time when geopolitical risks are elevated and the soft landing is now increasingly priced in as the likely outcome, so it should in theory get harder from here. Henry took a look at some of these reasons for caution yesterday here.

Asian equity markets are mostly lower this morning. The S&P/ASX 200 (-1.68%) is the biggest underperformer in the region, followed by the Nikkei (-1.43%), the Topix (-1.14%), and the KOSPI (-1.17%). However, Chinese equities are defying the regional trend, with the Hang Seng (+0.41%) and the CSI 300 (+0.47%) posting gains. S&P 500 (-0.18%) and NASDAQ 100 (-0.26%) futures are edging lower. Aussie 10yr yields are +14.5bps with JGBs +2.6bps.

Early morning data showed that South Korea’s producer prices declined by -0.2% in September, matching the decline from the previous month.

There was very little data to speak of yesterday, although we did get the Conference Board’s leading index from the US. That showed a decline of -0.5% in September (vs. -0.3% expected). In level terms, that also left the index at its lowest level since May 2016. The monthly reading hasn’t been positive since February 2022 so the release has lost some of its shock value recently given how well growth as performed over the last few quarters. Separately in Germany, producer prices remained in deflationary territory in September, at -1.4% year-on-year (vs. -1.1% expected).

To the day ahead now, and central bank speakers include ECB President Lagarde, the ECB’s Centeno, Knot, Holzmann, Villeroy, Rehn and Panetta, the Fed’s Harker, BoE Governor Bailey, and the BoE’s Greene and Breeden. Otherwise, earnings releases include General Electric, General Motors and Verizon.

US futures are lower, extending yesterday’s losses, as treasuries extended their recent rout sending 10Y yields surging briefly above 4.22% before retracing some of the move as traders priced in the growing probability of a red sweep. The Treasury rout has gone global, pushing interest rates across the world higher. As of 8am ET, S&P 500 futures dropped 0.3%, pointing to the first back-to-back decline in about 30 sessions for the gauge. Nasdaq 100 futures underperformed, dropping 0.4%, as tech stocks start to groan against the weight of surging rates; megacap tech all showed declines: TSLA -0.8%, GOOG -0.5%, AMZN -0.5%. The yield on 10-year Treasuries added one basis point to 4.21% after an 11 basis-point surge at the start of the week; the USD is flattish after reversing a modest earlier loss. Commodities are mixed: Oil added 0.5%, base metals are lower, and precious metals are higher: silver rises +1% to $34.5, a new 12 year high. The only macro today are the October Philly Fed and Richmond Fed reports.

In premarket trading, Philip Morris rises 2% after lifting its profit outlook amid strong sales of tobacco alternatives such as Zyn and IQOS. 3M climbed 4% after increasing the low end of its 2024 profit forecast and reporting 3Q earnings that topped analyst estimates as a push to boost productivity gained traction. Polaris tumbled 7% after the automaker lowered its full-year earnings per share and sales guidance. Here are some of the biggest US movers today:

- Cheesecake Factory (CAKE) gains 3% following a report that activist investor JCP Investment Management has built a stake in the restaurant chain.

- Danaher (DHR) rises 2% after the life-sciences firm reported 3Q profit and sales that topped the average analyst estimate.

- General Electric (GE) drops 4% as sales fell short of Wall Street’s expectations last quarter, tempering enthusiasm for its improved profit outlook as the jet engine maker grapples with supply-chain limitations that are weighing on deliveries.

- General Motors (GM) ticks 1% higher after signaling solid US demand for its highest-margin vehicles even as the broader market softens, posting better-than-expected results for the latest quarter.

- IRhythm (IRTC) jump 20% after the company said it received FDA 510(k) clearance for design updates to its Zio AT device.

- Medpace (MEDP) drops 12% after the health care services company cut its revenue forecast for the full year.

- Zions (ZION) rises 2% as 3Q earnings per share beat estimates.

Investors further pared paring back their expectations for Fed rate cuts after central bank officials indicated a preference for reducing rates at a slower pace after recent resilient economic data. The inflationary impact of a possible Donald Trump presidential win is also weighing, given his promised tax cuts and trade tariffs could ultimately entail higher rates.

“This is very clearly linked to trading a victory of the Republicans — and therefore to an agenda which would be much more inflationist than that of the Democrats. We’re in a market that is betting on Trump,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. “The rise in yields is starting to threaten equity markets.” (see more here “Wall Street Going “All-In On Trump“.”)

Elsewhere, exposure to the S&P 500 has reached levels that were followed by a 10% slump in the past, Citigroup Inc. strategists said. Still, despite the mounting risks, the current winning streak for US stocks ranks among the very best since 1928, according to data compiled by SentimenTrader. And even though US equities are expensive, going underweight is a tough call for investors in the environment where S&P 500 reached 47 record highs this year starting from January, said Vera Fehling, DWS Europe chief investment officer.

“If you said then: ‘things are looking quite stretched’ — you would have massively underperformed,” she added. “It’s difficult to explain going into the end of such a year with a significant underweight in US equities.”

European equities appear cheap by comparison and got even cheaper on Tuesday after the Stoxx 600 benchmark declined 0.8%, led by real estate and utilities sectors, which suffer when the cost of borrowing money rises. Major markets are all lower (UKX -0.6%, SX5E -0.4%, SXXP -0.7%, DAX -0.1%.) with Spain lagging. SAP is driving the tech sector to outperform after the German software giant delivered a beat on several key metrics in the third quarter and boosted some elements of its guidance for the full year. ING shares slip as Barclays downgraded the bank to equal-weight from overweight. Here are the most notable European movers:

- SAP shares gain as much as 5.9%, reaching a record high, after the software giant delivered a beat on several key metrics in 3Q and boosted some elements of its guidance for the full year.

- DNB Bank shares advance as much as 5.1% after Norway’s largest lender reported what Citi says were “impressive” quarterly results, with revenue beating estimates amid the best 3Q for fees.

- ING shares decline as much as 1.7%, the worst-performing stock on the Stoxx 600 Banks Index, as Barclays cut the recommendation on the lender to equal-weight from overweight.

- Traton shares rise as much as 5.4% after the truck maker issued preliminary third-quarter results ahead of expectations, with its International and Scania units driving the beat.

- Logitech shares gain as much as 4.2% after the Swiss maker of computer accessories boosted its operating income expectations for the full year.

- Saab shares advance as much as 5.9%, the most since June, as analysts praise the Swedish defense firm’s third-quarter order intake and cash flow.

- Boliden shares climb as much as 7.5%, after the miner reported 3Q revenue that beat the average analyst estimate, with Morgan Stanley noting mines and smelter-production volumes came in higher than expected.

- Randstad shares rise as much as 5.1% after the Dutch staffing company said that it has seen stable volumes in the first weeks of October, adding that it expects to benefit from easier 4Q comparables.

- Morgan Sindall shares rise as much as 11% after the construction and regeneration group said its annual results will be significantly ahead of expectations, driven by its Fit Out division that designs, builds and refurbishes commercial and office spaces.

- IHG shares drop as much as 2.8% after the hotel operator reported third-quarter revenue per available room that Morgan Stanley said missed consensus estimates.

- Eurofins Scientific shares drop as much as 12% after the laboratory-testing company reported third-quarter revenue that missed estimates.

- Hunting shares plunge as much as 19%, the most in over two years, after the energy services provider cut its annual earnings guidance due to challenges within its US onshore division that caused its Titan unit to disappoint, according to analysts.

So far about 47% of MSCI Europe companies reported results below expectations while only 27% delivered beats, according to data compiled by Bloomberg Intelligence. L’Oreal is set to report earnings later today, with analysts watching the impact of Chinese economic weakness on the stock.

Earlier in the session, Asian stocks fell on Tuesday, dragged by weakness in the technology and financial sectors, amid lower expectations for Federal Reserve interest-rate cuts. The MSCI Asia Pacific Index fell as much as 1.1%, with TSMC and Commonwealth Bank of Australia among the biggest drags. The decline follows comments from some US central bank officials signaling they favor a slower pace of rate reductions. Australian and Korean benchmarks were among the biggest decliners. Japanese stocks slid as uncertainty surrounding the Oct. 27 general election weighed on local markets. Stocks in India were also lower, led by automakers amid lackluster trading debut for Hyundai Motor Co.’s local unit. Stocks gained in Hong Kong after declining on Monday. China’s commitment to delivering stimulus is an ongoing focal point for traders in addition to the US presidential vote, which is about two weeks away. Focus is also turning to earnings performance this results season, which could help determine the near-term path for the MSCI Asia gauge.

In FX, the Bloomberg Dollar Spot Index was flat after rallying 0.4% on Monday. One-month implied volatility in BBDXY stands above 9.61, fresh cycle high; risk reversals on the tenor steady around 0.5 vol The Australian and New Zealand dollars outperformed their Group-of-10 peers as higher bond yields and gains in Chinese equities boosted sentiment.

In rates, treasuries fell for a second day, adding to Monday’s steep selloff as Fed officials indicated a preference for reducing rates at a slower pace. US 10-year yields rise 2 bps, topping 4.2% for the first time since July. Oil also continues to rise, adding to upward pressure on yields from shifting Fed policy outlook and focus on next month’s US presidential election and fiscal outlook. European government bond are also lower, with UK and German 10-year borrowing costs rising 3 bps and 4 bps respectively. Italy 10-year is ~3bp cheaper vs Treasuries, underperforming amid 7- and 30-year bond syndication. Treasury auctions this week include Wednesday’s $13b 20-year bond reopening and a $24b 5-year TIPS sale Thursday.

In commodities, oil prices reversed course, with WTI now up 0.5% at $71 a barrel. Spot gold rises $13 to just below Monday’s record high. Gold rose – approaching Monday’s record high – with haven demand coming from traders focused on the conflict in the Middle East and the looming US vote. Silver jumped 1% to hit $34.50, a new 12 year high.

US economic data calendar includes October Philadelphia Fed non-manufacturing activity (8:30am) and Richmond Fed manufacturing index (10am); Fed’s Harker is scheduled to speak at 10am

Market Snapshot

S&P 500 futures down 0.3% to 5,877.00

Brent Futures down 0.5% to $73.95/bbl

Gold spot up 0.6% to $2,736.07

US Dollar Index down 0.10% to 103.90

Top Overnight News

- Share buybacks on mainland China’s biggest exchanges have soared to a record high this year as Beijing pushes for companies to return cash to shareholders as part of its efforts to revive a flagging stock market. There have been Rmb235bn ($33bn) in buybacks across mainland-listed shares so far in 2024, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022, according to Chinese financial data provider Wind. FT

- U.S. rules that will ban certain U.S. investments in artificial intelligence in China are under final review, according to a government posting, suggesting the restrictions are coming soon. RTRS

- China’s youth unemployment rate dips in Sept to 17.6%, down 120bp from 18.8% in August. CNBC

- HSBC’s cost-cutting shakeup intensified. The lender said it will combine its global commercial and institutional banking operations, and create a new International Wealth and Premier Banking business. Pam Kaur was named as CFO. BBG

- Israel is apparently considering an Egyptian proposal for a 2-week ceasefire in with Hamas in Gaza that could potentially build into a more permanent deal. NBC News

- Federal Reserve Bank of San Francisco President Mary Daly said she expected the US central bank would continue cutting interest rates to guard against further weakening in the labor market. BBG

- The US Securities and Exchange Commission’s examiners will step up scrutiny of financial firms’ use of artificial intelligence next year, the latest sign of regulators’ growing concerns about the emerging technologies. BBG

- US drinkers are continuing to cut back on their vodka, whisky and tequila intake in a sign that, despite the improved economic environment, consumers are finding higher prices hard to swallow. FT

- GM shares jumped premarket after signaling solid US demand for its highest-margin vehicles, and raising the low end of its profit forecast. GE Aerospace reported a profit jump and raised its full-year guidance as the jet-engine maker capitalizes on its strong order book. BBG

- Fed’s Daly (2024 voter) said the Fed will continue to adjust policy and a 50bps cut was to right-size policy, while she expects additional cuts going forward. Daly said the recent Fed rate cut was a close call and she came down strongly in favour of a 50bps cut, as well as noted that a 50bps cut was needed and they didn’t want to find out they had overtightened and taken jobs from people. She also said they will be data-dependent for the Fed’s November meeting and haven’t seen anything so far that would suggest they would not continue to cut rates, while she noted policy is absolutely still tight and would want to be open-minded to continue to ease policy if inflation is falling, even if the economy is strong.

- Fed’s Schmid (2025 voter) called for a cautious, gradual and deliberate approach to rate cuts, while he prefers to avoid outsized rate cuts and noted that they are seeing a normalisation of the labour market, not a deterioration. Furthermore, Schmid said current policy is restrictive, but not very restrictive, as well as noted the balance sheet is probably influencing longer-term rates and that they should be normalising the Fed’s balance sheet on both size and duration.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with participants somewhat cautious following the mostly negative bias stateside amid a lack of major catalysts, ongoing geopolitical tensions in the Middle East and a higher yield environment. ASX 200 retreated from the open with Real Estate and Healthcare leading the broad downturn seen across sectors. Nikkei 225 was pressured following its recent failure to hold on to the 39,000 level despite a weaker currency. Hang Seng and Shanghai Comp shrugged off early weakness to trade in the green albeit with price action choppy as the attention turned to earnings updates, while the PBoC conducted its first swap operation involving securities brokerages, funds and insurance companies worth CNY 50bln on Monday.

Top Asian News

- Chow Tai Fook Jewellery (1929 HK) reports same store sales down 24.3%; HY revenue decreases by 18%; HY Net profit decreases by 42%.

- China’s FX regulator said the Yuan exchange is basically stable at reasonable and balanced levels, while it added that cross-border capital turned to inflows in the first three quarters of this year and cross-border capital flow has been balanced since the start of 2024. Furthermore, it stated the FX market shows relatively strong resilience and market expectations and trading are in order overall.

- FT article suggests that there is no sign yet of determined Chinese reforms or spending to spur more household consumption, despite many agreeing that President Xi’s thinking on stimulus has changed. Focus is reportedly still largely on repairing local governments’ and banks’ balance sheets.

- China State Planner say China will continue to issue ultra long term special government bonds in 2025; and further optimise their allocation next year.

European bourses, Stoxx 600 (-0.2%) began the session mostly, but modestly on the backfoot, (ex-DAX 40 & Euro Stoxx 50; benefiting from post-earning strength in SAP) and have traded in a busy range throughout the morning; in recent trade, indicies are now broadly in the red, due to geopolitical updates out of Israel. European sectors hold a strong negative bias; Tech is by far and away the clear outperformer, lifted by post-earning strength in SAP (+5.4%). Real Estate is towards the foot of the pile, given the relatively higher yield environment. US Equity Futures (ES -0.1%, NQ -0.2%, RTY -0.4%) are modestly in the red to varying degrees and with slight underperformance in the RTY, which was subject to hefty selling pressure in the prior session. ASML (ASML NA) CEO says 2025 will be a growth year, the long term will still see growth. “Not everyone is surfing the AI wave”. “What we have seen in the last few months is people beginning to push the breaks”. “China demand is for mainstream chips, older generations of technology”. “Normal Chinese demand is for 20-25% of ASML’s sales, expect it to return to those levels”. “China may be able to produce some 5 or 3 nanometre chips, but few, using older tech”. It is clear the US will push for more export restrictions to China. “The Netherlands and Europe will start to discuss with China export restrictions make sense”

Top European News

- UK Shadow Chancellor Hunt warned Chancellor Reeves against hiking business taxes ahead of next week’s Budget, according to FT.

- Italy’s budget deficit seen at 3.9% of GDP in 2024 (exp. 3.8%); GDP expected to grow 0.8% in 2024 (exp. 0.9%) and 0.9% in 2025 (est. 1.1%)

FX

- USD is broadly slightly softer vs. peers and to varying degrees. That being said, DXY remains in close proximity to Monday’s 104.01 peak and above its 200DMA at 103.72.

- EUR is marginally firmer vs. the USD but unable to scale back much of the downside from yesterday which saw the pair match last week’s multi-month low at 1.0810. Docket ahead sees a slew of ECB speakers.

- Cable is continuing to pivot around the 1.30 mark within a 1.2980-1.3014 range. Focus today will be on today’s trio of BoE speakers with Governor Bailey being the obvious highlight, with focus on if he echoes his recent dovish rhetoric.

- JPY is unable to claw back any of the losses vs. the USD seen during yesterday’s session which brought the pair above its 100DMA at 150.73 and breifly onto a 151 handle. If upside resumes, technicians flag the 200DMA at 151.34.

- Antipodeans are both firmer vs. the USD and attempting to atone for recent losses. Overnight, AUD/USD printed a fresh low for the month at 0.6652 before paring losses (no clear fundamental driver was behind the move). NZD/USD has endured similar price action after recovering from a 0.6022 base overnight.

- Goldman Sachs says the EUR could drop as much as 10% under Trump tariff and domestic tax cuts.

Fixed Income

- Bunds are under pressure in a continuation of the action seen on Monday which was primarily a function of supply and energy upside. Bunds are around a 132.69 trough, having faded from Monday’s 133.06 low. The complex was fairly unreactive to a new German 2026 auction.

- USTs are in-fitting with the above, and in a continuation of the “Trump trade” seen in the prior session. Region awaits its own supply which comes on Wednesday with a 20yr tap, but before that, Fed’s Harker.

- Gilts are pressured in-fitting with the above and roughly in-line with peers. Docket ahead sees a Bank of England trio of Governor Bailey, Breeden and Greene. Currently just off a 96.67 base and erring back towards opening levels of 96.88.

- Orders for Italy’s new seven-year over EUR 70bln (spread at 7bps) whilst 30-year BTP tap demand is in excess of EUR 80bln (spread at 9bps), according to Reuters.

- UK sells GBP 900mln 0.625% 2045 I/L Gilt: b/c 3.57x (prev. 3.44x) & real yield 1.328% (prev. 1.20%).

- Germany sells EUR 4.162bln vs exp. EUR 5.0bln 2.00% 2026 Schatz: b/c 2.61x, average yield 2.16%, and retention 16.76%.

Commodities

- Crude oil is subdued following a firmer session on Monday despite a lack of fresh drivers but as markets still await Israel’s attack on Iran. The complex then lifted off worst levels amid reports that Israeli PM Netanyahu will hold consultations tonight with a specific number of his cabinet ministers at the headquarters of the Ministry of Defense in Tel Aviv, via Al Jazeera. Thereafer, reports that Iran was involved in the assassination attempt on Netanyahu, crude soared to session highs of USD 75.06/bbl.

- Spot gold is firmer intraday with the complex buoyed by the aforementioned geopolitics, ahead of US elections, and with extra momentum after notching fresh all-time highs. XAU resides in a current USD 2,719-2,738.50/oz range.

- Base metals are mostly firmer trade in the complex with gains in most industrial metals pinned on hopes of Chinese stimulus, although iron ore prices retreated with desks citing concerns of softening steel demand.

- US is reportedly in talks with Southeast Asian nations to deploy small modular nuclear reactors, according to Bloomberg.

- China crude steel output -6.1% Y/Y to 77.1mln tonnes in September 2024; global steel output -4.7% Y/Y to 143.6mln tonnes, according to worldsteel.

Geopolitics: Middle East

- Israeli PM Netanyahu will hold consultations tonight with a specific number of his cabinet ministers at the headquarters of the Ministry of Defense in Tel Aviv, via Al Jazeera citing Israeli media.

- “Officials at the Iranian embassy in Beirut are involved in the assassination attempt on PM Netanyahu. The Israeli investigation shows Iranian involvement in launching the drone towards Netanyahu’s house”, via Kans’ Kai on X citing Saudi Al-Hadath channel

- “Al-Arabiya correspondent: Netanyahu meets today with security leaders in Tel Aviv after meeting with Blinken”, according to Al Arabiya

- Israeli Home Front said sirens sounded in Haifa, its Gulf and dozens of cities and sites in northern Israel, while it was later reported that Israeli media and military announced sirens sounded in central Israel’s Samaria area, West Bank settlements, Acre and areas in upper Galilee.

- Israel’s Channel 14 reported that the homes of senior officials in Iran were added as possible targets for Israeli attack and the Air Force will know the exact target of the attack shortly before implementation, according to Al Jazeera. Furthermore, Israel’s Channel 14 cited Israeli sources that stated plans for the strike against Iran were presented by the military leadership and the Mossad to the Prime Minister and Minister of Defence, according to Sky News Arabia.

- US Secretary of State Blinken said he is heading to Israel and other stations in the region to discuss ending the war in Gaza, returning the hostages and alleviating the suffering of the Palestinians, according to Al Jazeera.

Geopolitics: Other

- UK is to lend Ukraine an additional GBP 2.26bln for weapons to fight Russia with the loans to be repaid using interest generated from USD 300bln of Russian frozen assets, according to The Guardian.

US Event Calendar

- 08:30: Oct. Philadelphia Fed Non-Manufactu, est. 4.1, prior -6.1

- 10:00: Oct. Richmond Fed Business Conditio, prior -3

- 10:00: Oct. Richmond Fed Index, est. -17, prior -21

Central Bank Speakers

- 09:00: ECB’s Centeno Speaks in Washington

- 10:00: Fed’s Harker Speaks at Fintech Conference

- 10:00: Fed’s Harker Gives Opening Remarks

DB’s Jim Reid concludes the overnight wrap

Only two weeks until the big day. One that I’ve been looking forward to for what seems an exceptionally long time. Yes, the kids will go back to school after an extended 2-week half-term. As predicted last week my wife was already fed up with them last night after one day of holiday yesterday. The twins are so noisy! I’m off to Center Parcs with them all for a long weekend on Friday so I won’t be spared.

With two weeks to go today until the election, markets have started the week a bit more nervously than during the last 6 where the the S&P 500 has gone up each week for only the second time since the pandemic. Yesterday it started the week -0.18% but with bigger sell-offs elsewhere and extending into the Asian session this morning. The sell-off was much more pronounced among sovereign bonds though, with the 10yr Treasury yield (+11.3bps) reaching its highest level (4.20%) since late July, shortly before the weak payroll report, the Japanese mini-crash and the associated brief market turmoil. Moreover, the move was primarily driven by higher real yields, with the 10yr real yield (+10.2bps) moving up to 1.88%, which is its highest level since the end of July. Overnight, 10yr USTs are another +1.4bps higher as we go to print.

There were several factors behind the move but none that particularly dominated yesterday. In the background there has been a rising concern about debts and deficits, particularly ahead of the US election. Indeed, the IMF pointed out in their recent Fiscal Monitor that global public debt is forecast to exceed $100 trillion this year, and rise further in the medium term, so this is a growing issue as policymakers gather for the IMF/World Bank Annual Meetings in Washington this week. Moreover, our US economists have pointed out that irrespective of who wins the presidency or congress, they could see deficits in the 7-9% area over 2026-28, which is a level unprecedented outside of major wars or massive economic shocks like the GFC and Covid-19.

In addition to the long-end moves, expectations of Fed easing continue to drift lower, with Fed funds pricing for next March (+8.0bps to 4.05%) moving back above 4% for the first time since the start of August, after having fallen to below 3.4% in late September. This came as Fed speakers continued to express preference for gradual easing moving forward, with Kansas City President Schmid favouring “modest” reductions while Minneapolis Fed President Kashkari was “forecasting some more modest cuts”.

Another factor behind the bond selloff were growing inflation risks, and yesterday saw Brent crude oil prices (+1.68%) pick up again to $74.29/bbl. That comes amidst growing focus on Israel’s expected retaliation against Iran’s missile strikes earlier this month, which is still yet to materialise. But oil prices were reacting to several weekend developments, including the drone strike on the private home of Israeli PM Netanyahu that we mentioned yesterday. Indeed, foreign minister Israel Katz said over the weekend that there was “no doubt that another red line has been crossed here”. Meanwhile, although the classic safe haven of gold (-0.06%) closed marginally lower, after posting four consecutive session ATHs, this morning its +0.43% higher as I type and back at what would be record closing levels again.

Over in Europe, the bond selloff was even more aggressive, with yields on 10yr bunds (+9.9bps), OATs (+12.1bps) and BTPs (+15.3bps) all seeing large moves higher. In part, that’s because investors have pared back their expectations for a larger 50bp rate cut at the ECB’s December meeting, and we had a lot of commentary from several officials to digest as well. For instance, Lithuania’s Simkus said that he didn’t see the need for cuts bigger than 25bps, and Slovakia’s Kazimir said that the December meeting was “wide open”.

Back to the US election, the general consensus across polls, betting averages and forecasting models is that Trump has gained ground on Harris, but the race is still within the margin of error across the key battleground states. Now clearly that could change, but from a market perspective, the Trump bump has meant that beneficiaries of the “Trump trade” have continued to do well in recent sessions. Most notably, Trump Media & Technology Group (+5.81%) was up to its highest since July yesterday just after Biden pulled out of the Presidential race.

Returning to yesterday, equities struggled, particularly as bond yields kept on rising. The S&P 500 (-0.18%) posted a modest decline, but it was a broad-based one, with the equal weighted version of the index seeing its worst day in more than six weeks (-0.85%). Small-caps struggled in particular as the Russell 2000 (-1.60%) saw its worst day since early September. Information technology (+0.93%) was the only major sector within the S&P 500 to post a gain. The Mag-7 (+0.64%) advanced as Nvidia (+4.14%) hit a new record high, while the NASDAQ (+0.27%) moved to within half a percent of its all-time high from July. Over in Europe, markets closed around the intra-day lows of the US session, with the STOXX 600 (-0.66%) and the DAX (-1.00%) both losing significant ground.

Whilst there were several short-term catalysts for the selloff, it’s also worth bearing in mind that the market performance has been pretty incredible over recent months. Only last week, we saw US IG credit spreads reach their tightest level since 2005, and the S&P 500 is up for 37 of the last 51 weeks, which is a joint record back to 1989. This means that traditional valuation metrics are now looking increasingly stretched by historic standards, at a time when geopolitical risks are elevated and the soft landing is now increasingly priced in as the likely outcome, so it should in theory get harder from here. Henry took a look at some of these reasons for caution yesterday here.

Asian equity markets are mostly lower this morning. The S&P/ASX 200 (-1.68%) is the biggest underperformer in the region, followed by the Nikkei (-1.43%), the Topix (-1.14%), and the KOSPI (-1.17%). However, Chinese equities are defying the regional trend, with the Hang Seng (+0.41%) and the CSI 300 (+0.47%) posting gains. S&P 500 (-0.18%) and NASDAQ 100 (-0.26%) futures are edging lower. Aussie 10yr yields are +14.5bps with JGBs +2.6bps.

Early morning data showed that South Korea’s producer prices declined by -0.2% in September, matching the decline from the previous month.

There was very little data to speak of yesterday, although we did get the Conference Board’s leading index from the US. That showed a decline of -0.5% in September (vs. -0.3% expected). In level terms, that also left the index at its lowest level since May 2016. The monthly reading hasn’t been positive since February 2022 so the release has lost some of its shock value recently given how well growth as performed over the last few quarters. Separately in Germany, producer prices remained in deflationary territory in September, at -1.4% year-on-year (vs. -1.1% expected).

To the day ahead now, and central bank speakers include ECB President Lagarde, the ECB’s Centeno, Knot, Holzmann, Villeroy, Rehn and Panetta, the Fed’s Harker, BoE Governor Bailey, and the BoE’s Greene and Breeden. Otherwise, earnings releases include General Electric, General Motors and Verizon.

Loading…