In the end, we're all just suckers for lower prices and higher quality...almost as if that's how and why free markets work...

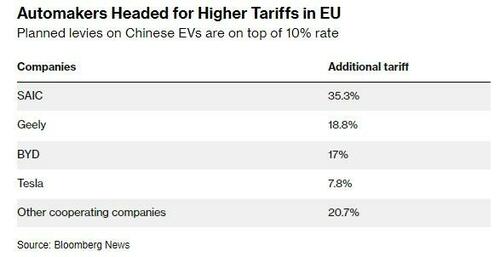

On that note it looks like the EU is starting to cave on preventing Chinese EV makers from doing business in Europe. Previously, the EU had sought to implement devastating tariffs on Chinese companies for supposedly skewing the European market with more supply and lower prices.

In fact, the European Union is sending officials to Beijing for further talks to explore alternatives to tariffs on Chinese electric vehicles, according to a new report from Bloomberg.

Reaching a deal to replace the new tariffs remains complex, with plans still in development but the two sides are examining a "price undertakings" agreement to regulate export prices and volumes as an alternative to tariffs.

Bloomberg writes that after eight rounds of talks, the proposals on the table still fall short of EU standards, including WTO compliance and enforceability requirements.

Negotiators have recently made progress, considering ways to simplify terms for potential price undertakings, particularly for new EV models not yet exported. One focus is preventing cross-compensation, where EV pricing deals might be offset by sales of hybrids or other goods.

However, another challenge is China’s insistence on a single umbrella deal for all manufacturers, managed by a national trade group representing key exporters, like SAIC Motor and BMW Brilliance.

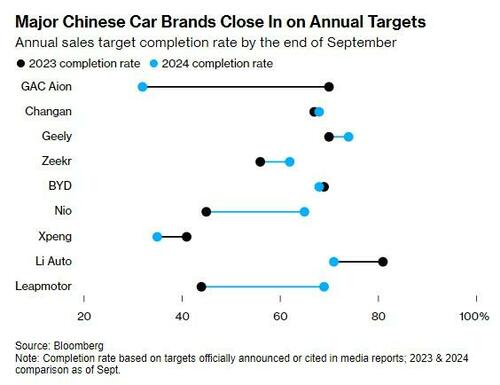

Recall, we wrote just days ago that Chinese EV makers were having a bang-up end of the year regardless. China's major EV makers ended Q3 stronger than last year, with solid deliveries reducing the need for discounts.

Now, analysts predict a sales surge in Q4. EV and hybrid sales are booming, driven by expanded subsidies, boosting stock prices and Tesla's best Chinese quarter. In September, EVs and hybrids made up about 53% of new car sales.

Bloomberg Intelligence analyst Joanna Chen commented: “Industry demand has been better than expected since the third quarter following China’s beefed-up subsidies but many automakers still need a major push in the fourth quarter to hit their annual sales targets.”

She continued: “The first nine months usually contribute 70% of annual car sales and automakers below that threshold are under greater pressure to step up discounts in the quarter.”

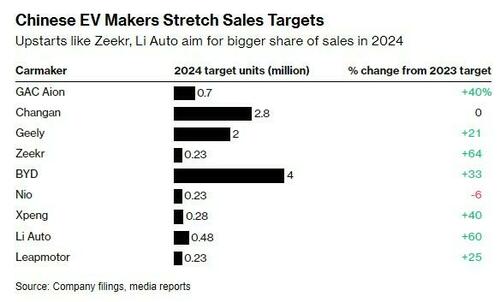

Chinese EV sales are expected to rise further following a recent directive for government agencies to increase purchases of new energy vehicles. For example, Zhejiang Leapmotor, Nio, and Zeekr are thriving through major deals and brand expansions. Top-sellers BYD and Geely are on course to hit ambitious sales targets of 4 million and 2 million, respectively. BYD's earlier pricing strategies triggered months of market-wide discounting, we noted.

Yale Zhang, managing director at Shanghai-based consultancy AutoForesight, added:

“I do not see a need to launch another price war. Most of them are in pretty good shape. The majority of these NEV or carmakers will reach their volumes.”

In the end, we’re all just suckers for lower prices and higher quality…almost as if that’s how and why free markets work…

On that note it looks like the EU is starting to cave on preventing Chinese EV makers from doing business in Europe. Previously, the EU had sought to implement devastating tariffs on Chinese companies for supposedly skewing the European market with more supply and lower prices.

In fact, the European Union is sending officials to Beijing for further talks to explore alternatives to tariffs on Chinese electric vehicles, according to a new report from Bloomberg.

Reaching a deal to replace the new tariffs remains complex, with plans still in development but the two sides are examining a “price undertakings” agreement to regulate export prices and volumes as an alternative to tariffs.

Bloomberg writes that after eight rounds of talks, the proposals on the table still fall short of EU standards, including WTO compliance and enforceability requirements.

Negotiators have recently made progress, considering ways to simplify terms for potential price undertakings, particularly for new EV models not yet exported. One focus is preventing cross-compensation, where EV pricing deals might be offset by sales of hybrids or other goods.

However, another challenge is China’s insistence on a single umbrella deal for all manufacturers, managed by a national trade group representing key exporters, like SAIC Motor and BMW Brilliance.

Recall, we wrote just days ago that Chinese EV makers were having a bang-up end of the year regardless. China’s major EV makers ended Q3 stronger than last year, with solid deliveries reducing the need for discounts.

Now, analysts predict a sales surge in Q4. EV and hybrid sales are booming, driven by expanded subsidies, boosting stock prices and Tesla’s best Chinese quarter. In September, EVs and hybrids made up about 53% of new car sales.

Bloomberg Intelligence analyst Joanna Chen commented: “Industry demand has been better than expected since the third quarter following China’s beefed-up subsidies but many automakers still need a major push in the fourth quarter to hit their annual sales targets.”

She continued: “The first nine months usually contribute 70% of annual car sales and automakers below that threshold are under greater pressure to step up discounts in the quarter.”

Chinese EV sales are expected to rise further following a recent directive for government agencies to increase purchases of new energy vehicles. For example, Zhejiang Leapmotor, Nio, and Zeekr are thriving through major deals and brand expansions. Top-sellers BYD and Geely are on course to hit ambitious sales targets of 4 million and 2 million, respectively. BYD’s earlier pricing strategies triggered months of market-wide discounting, we noted.

Yale Zhang, managing director at Shanghai-based consultancy AutoForesight, added:

“I do not see a need to launch another price war. Most of them are in pretty good shape. The majority of these NEV or carmakers will reach their volumes.”

Loading…