Authored by Jeffrey Tucker via The Epoch Times,

It’s a reasonable supposition that a recession will become obvious to all by next summer. It will then be declared by year’s end. The following year it could become backdated with data revisions that take us to 2022. At that point, it will become obvious to people that we have a major problem. Money velocity will freeze up and banks will start failing.

That’s a lot to consider so let’s unpack this a bit.

Consider history. In October 1929, the stock market crashed. Many people on Wall Street suffered but Main Street was largely unaffected. The Hoover Administration got busy with some efforts to loosen credit but without success as credit markets slowly dried up. Throughout 1931, public sentiment toggled between pessimism and denial. Many people thought it was a temporary blip that would go away.

No one called it the Great Depression. That came much later.

By the election of 1932, enough people were concerned about the economic situation but the campaigns did not really focus entirely on that. The big issue was Prohibition. Hoover did not have a strong opinion but Franklin Delano Roosevelt spoke out loudly for repeal. His fiscal policy pushed frugality and balanced budgets, and he decried Hoover as a big spender.

FDR won of course. But before the inauguration, the economic environment became dramatically worse. A banking crisis developed, and FDR used emergency powers to impose a bank holiday and repeal the gold standard. As part of this, he imposed a ban on private gold ownership. It was enforced with fines and jail terms.

Central planning then ensued with massive fiscal stimulus, crazed agricultural policies that required digging up crops to create artificial shortages, and price and wage controls.

All of this unfolded over the course of four years, the first three of which were not at the time thought to be much of a crisis generally speaking. Today it is obvious that 1929 marked the beginning but that was not apparent at the time.

It is not discernible in our time that we are already in recession but that is due to some brittle statistical measures. If you extend the inflation numbers to include housing and interest, plus extra fees and shrinkflation, minus hedonic adjustments, and then adjust the output numbers by the result, you end up in a recession now.

Do you remember the two successive quarters of declining GDP in 2022? At the time, it was said that this was not a recession, even though every definition of recession was two declining quarters of GDP. It was said at the time that the data was not enough to declare it because labor markets were strong.

Trouble was that this too was an illusion. Most of the job gains were in fact in part-time jobs and multiple job holders, and those gains went to foreign-born workers and not natives. Overall, jobs held by native-born workers that are full-time are down relative to four years ago. No one in the mainstream press admitted this.

The jobs report that came out last week was the first glimpse of truth because it was brazenly awful, underperforming every prediction. It also chronicled major job losses in manufacturing and professional services. Those are hard-core recession signs that are likely going to worsen.

All this data will start to be revised next year as the conventional wisdom will change. It will be widely admitted that the economy is weaker than we previously supposed. This will happen regardless of who wins. For one winner, it will serve as an attack and for another winner, it will serve as pretext for extreme intervention like the promised price controls on rents and groceries.

Meanwhile, we will be revisiting the inflation problem. The Fed has already added $1.1 trillion to the money stock over the last 12 months plus lowered interest rates. The effect of this easing has not affected mortgage rates because investors are expecting higher rates in the future. The Fed can control overnight lending but the shape of the yield curve is determined on the bond market.

If major changes are proposed in terms of spending cuts, the bond market will freak out and the United States could repeat the experience of the UK just a few years ago. New prime minister Liz Truss was quickly hounded out of office on grounds that her spending cuts had spooked the bond markets.

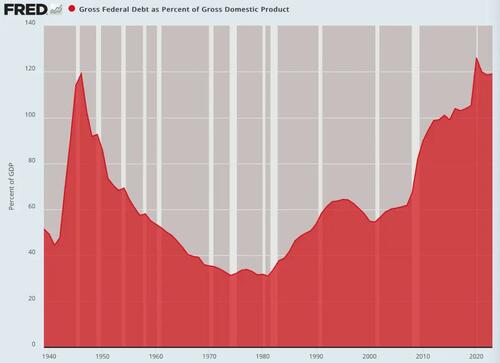

U.S. creditworthiness is already on a hair trigger as the debt pileup has reached astronomical levels. The entire purpose of this wild spending has been to balloon the GDP as much as possible to prevent a recession from being declared already. The debt-to-GDP level is now higher than it was in the Second World War, and getting worse by the day.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

The easy solution is dramatic spending cuts but that won’t happen if the bond market starts panicking with quality downgrades. There are only two private institutions that grade U.S. bonds and both are subject to being muscled by political concerns. Such an event could easily overwhelm a new administration. The political people will go into overdrive and demand that the Fed accommodate the bond market, fueling more inflation.

I truly wish that none of this would happen but the truth is that economic forces are always and everywhere more powerful than political ones. There are structural problems alive in U.S. economic life today that are not easily solved by policies of any sort.

But in U.S. political culture, whatever takes place under one president’s watch is blamed on the officeholder regardless. That the circumstances have been created by the previous administration or have nothing to do with existing policy has no relevance in the political culture. That alone makes it nearly impossible for a sitting president to plead with the public for patience.

In 1981, Reagan did make a plea for patience, and lost a great deal of Congressional support in the midterm elections of 1982. He was fortunate that the economic recovery came in time for the 1984 election that granted him a second term. But that was a very close call, and that was also under conditions that were not as structurally dire as conditions today.

As a result, the new administration will encounter pressure to achieve the impossible: immediately improve American living standards without imposing any pain at all. Such a demand is impossible to grant. As a result, whatever happens in this election will likely be reversed in the midterms of 2026, meaning that we cannot count on any kind of policy consistency for many years to come.

Maybe I’m wrong. I hope so. But from what I’m looking at, I don’t see how a frank acknowledgement of current conditions can be put off for another year.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Authored by Jeffrey Tucker via The Epoch Times,

It’s a reasonable supposition that a recession will become obvious to all by next summer. It will then be declared by year’s end. The following year it could become backdated with data revisions that take us to 2022. At that point, it will become obvious to people that we have a major problem. Money velocity will freeze up and banks will start failing.

That’s a lot to consider so let’s unpack this a bit.

Consider history. In October 1929, the stock market crashed. Many people on Wall Street suffered but Main Street was largely unaffected. The Hoover Administration got busy with some efforts to loosen credit but without success as credit markets slowly dried up. Throughout 1931, public sentiment toggled between pessimism and denial. Many people thought it was a temporary blip that would go away.

No one called it the Great Depression. That came much later.

By the election of 1932, enough people were concerned about the economic situation but the campaigns did not really focus entirely on that. The big issue was Prohibition. Hoover did not have a strong opinion but Franklin Delano Roosevelt spoke out loudly for repeal. His fiscal policy pushed frugality and balanced budgets, and he decried Hoover as a big spender.

FDR won of course. But before the inauguration, the economic environment became dramatically worse. A banking crisis developed, and FDR used emergency powers to impose a bank holiday and repeal the gold standard. As part of this, he imposed a ban on private gold ownership. It was enforced with fines and jail terms.

Central planning then ensued with massive fiscal stimulus, crazed agricultural policies that required digging up crops to create artificial shortages, and price and wage controls.

All of this unfolded over the course of four years, the first three of which were not at the time thought to be much of a crisis generally speaking. Today it is obvious that 1929 marked the beginning but that was not apparent at the time.

It is not discernible in our time that we are already in recession but that is due to some brittle statistical measures. If you extend the inflation numbers to include housing and interest, plus extra fees and shrinkflation, minus hedonic adjustments, and then adjust the output numbers by the result, you end up in a recession now.

Do you remember the two successive quarters of declining GDP in 2022? At the time, it was said that this was not a recession, even though every definition of recession was two declining quarters of GDP. It was said at the time that the data was not enough to declare it because labor markets were strong.

Trouble was that this too was an illusion. Most of the job gains were in fact in part-time jobs and multiple job holders, and those gains went to foreign-born workers and not natives. Overall, jobs held by native-born workers that are full-time are down relative to four years ago. No one in the mainstream press admitted this.

The jobs report that came out last week was the first glimpse of truth because it was brazenly awful, underperforming every prediction. It also chronicled major job losses in manufacturing and professional services. Those are hard-core recession signs that are likely going to worsen.

All this data will start to be revised next year as the conventional wisdom will change. It will be widely admitted that the economy is weaker than we previously supposed. This will happen regardless of who wins. For one winner, it will serve as an attack and for another winner, it will serve as pretext for extreme intervention like the promised price controls on rents and groceries.

Meanwhile, we will be revisiting the inflation problem. The Fed has already added $1.1 trillion to the money stock over the last 12 months plus lowered interest rates. The effect of this easing has not affected mortgage rates because investors are expecting higher rates in the future. The Fed can control overnight lending but the shape of the yield curve is determined on the bond market.

If major changes are proposed in terms of spending cuts, the bond market will freak out and the United States could repeat the experience of the UK just a few years ago. New prime minister Liz Truss was quickly hounded out of office on grounds that her spending cuts had spooked the bond markets.

U.S. creditworthiness is already on a hair trigger as the debt pileup has reached astronomical levels. The entire purpose of this wild spending has been to balloon the GDP as much as possible to prevent a recession from being declared already. The debt-to-GDP level is now higher than it was in the Second World War, and getting worse by the day.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

The easy solution is dramatic spending cuts but that won’t happen if the bond market starts panicking with quality downgrades. There are only two private institutions that grade U.S. bonds and both are subject to being muscled by political concerns. Such an event could easily overwhelm a new administration. The political people will go into overdrive and demand that the Fed accommodate the bond market, fueling more inflation.

I truly wish that none of this would happen but the truth is that economic forces are always and everywhere more powerful than political ones. There are structural problems alive in U.S. economic life today that are not easily solved by policies of any sort.

But in U.S. political culture, whatever takes place under one president’s watch is blamed on the officeholder regardless. That the circumstances have been created by the previous administration or have nothing to do with existing policy has no relevance in the political culture. That alone makes it nearly impossible for a sitting president to plead with the public for patience.

In 1981, Reagan did make a plea for patience, and lost a great deal of Congressional support in the midterm elections of 1982. He was fortunate that the economic recovery came in time for the 1984 election that granted him a second term. But that was a very close call, and that was also under conditions that were not as structurally dire as conditions today.

As a result, the new administration will encounter pressure to achieve the impossible: immediately improve American living standards without imposing any pain at all. Such a demand is impossible to grant. As a result, whatever happens in this election will likely be reversed in the midterms of 2026, meaning that we cannot count on any kind of policy consistency for many years to come.

Maybe I’m wrong. I hope so. But from what I’m looking at, I don’t see how a frank acknowledgement of current conditions can be put off for another year.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Loading…