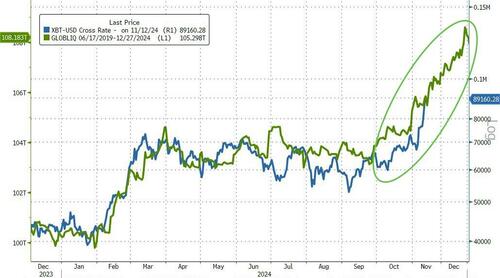

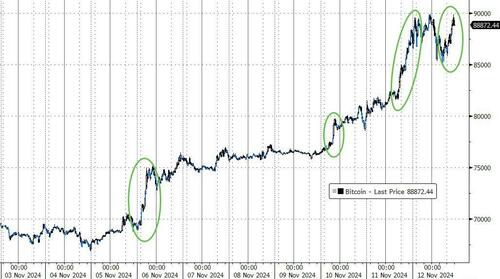

Bitcoin came within a few bucks of the $90,000 Maginot Line today - up a stunning 30% since right before the election results started to pour in...

Source: Bloomberg

Winter is over?

Source: Bloomberg

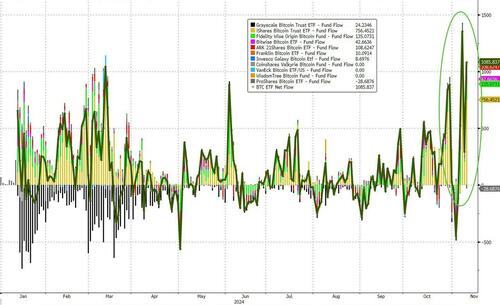

Massive inflows into BTC and ETH ETFs over the last week have helped...

Source: Bloomberg

...and so has the sudden resurgence in global liquidity...

Source: Bloomberg

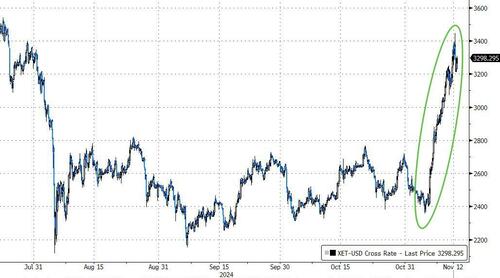

Ethereum was actually lower on the day today after topping $3400 intraday

Source: Bloomberg

...as the post-election DeFi mania wears off...

Source: Bloomberg

The dollar was another huuuge winner today... up over 5% in the last seven weeks to two-year highs...

Source: Bloomberg

The dollar strength has started to hammer gold - which is now down at near two-month lows...

Source: Bloomberg

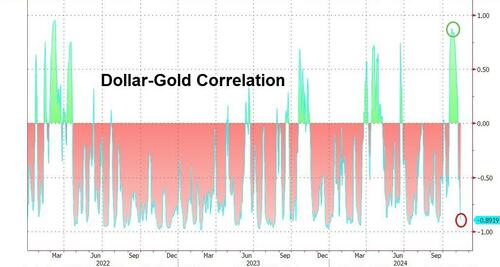

The gold-dollar correlation regime has normalized after both surging together for a few months...

Source: Bloomberg

Yields surged today, playing catch up after yesterday's holiday (the long-end was a slight laggard with 10Y +13bps, 2Y +9bps). Yields are now back up near the post-election spike highs...

Source: Bloomberg

10Y Yields are back at their highest in five-months...

Source: Bloomberg

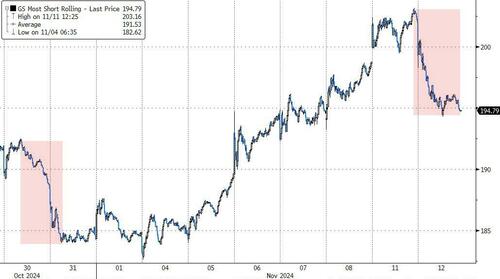

Small Caps were really ugly today (-1.8%) while The Dow ended on the lows of the day...

...as the 'short squeeze' finally stalled (worst day for 'most shorted' stocks since Sept 3rd)...

Source: Bloomberg

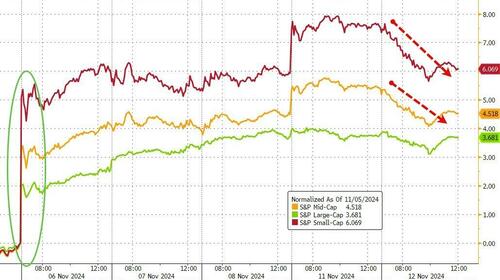

...and yields start to hurt from the bottom up (small-caps, then mid-caps) after the bigly squeeze from the election...

Source: Bloomberg

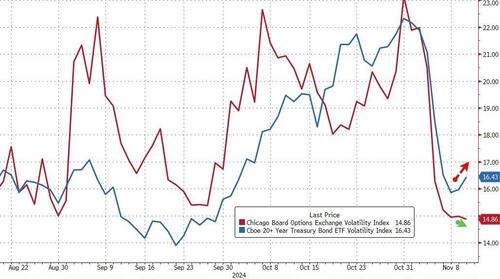

Bond vol is starting to pick up a little...

Source: Bloomberg

Crude oil prices were flat today with WTI holding around $68, still notably down from the election...

Source: Bloomberg

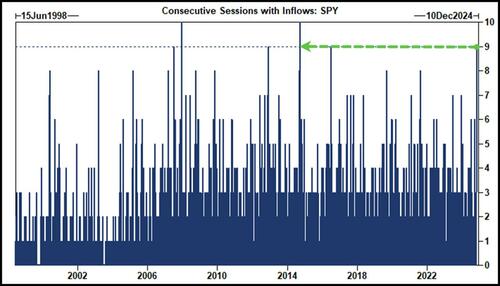

Finally, investors want equities: SPY has witnessed 9 consecutive days of inflows (totaling to ~$18bn over the period)...

Source: Goldman Sachs

As Goldman Sachs trader John Flood notes, the longest streak of inflows SPY has seen is 10 days, which was last witnessed in 2014.

Bitcoin came within a few bucks of the $90,000 Maginot Line today – up a stunning 30% since right before the election results started to pour in…

Source: Bloomberg

Winter is over?

Source: Bloomberg

Massive inflows into BTC and ETH ETFs over the last week have helped…

Source: Bloomberg

…and so has the sudden resurgence in global liquidity…

Source: Bloomberg

Ethereum was actually lower on the day today after topping $3400 intraday

Source: Bloomberg

…as the post-election DeFi mania wears off…

Source: Bloomberg

The dollar was another huuuge winner today… up over 5% in the last seven weeks to two-year highs…

Source: Bloomberg

The dollar strength has started to hammer gold – which is now down at near two-month lows…

Source: Bloomberg

The gold-dollar correlation regime has normalized after both surging together for a few months…

Source: Bloomberg

Yields surged today, playing catch up after yesterday’s holiday (the long-end was a slight laggard with 10Y +13bps, 2Y +9bps). Yields are now back up near the post-election spike highs…

Source: Bloomberg

10Y Yields are back at their highest in five-months…

Source: Bloomberg

Small Caps were really ugly today (-1.8%) while The Dow ended on the lows of the day…

…as the ‘short squeeze’ finally stalled (worst day for ‘most shorted’ stocks since Sept 3rd)…

Source: Bloomberg

…and yields start to hurt from the bottom up (small-caps, then mid-caps) after the bigly squeeze from the election…

Source: Bloomberg

Bond vol is starting to pick up a little…

Source: Bloomberg

Crude oil prices were flat today with WTI holding around $68, still notably down from the election…

Source: Bloomberg

Finally, investors want equities: SPY has witnessed 9 consecutive days of inflows (totaling to ~$18bn over the period)…

Source: Goldman Sachs

As Goldman Sachs trader John Flood notes, the longest streak of inflows SPY has seen is 10 days, which was last witnessed in 2014.

Loading…