Ether hit a two-month high as the planned software upgrade to the Ethereum blockchain underwent a major successful test, paving the way for one of the most significant changes in the cryptocurrency sector as Ethereum transitions to Ethereum 2.0, and from Proof of Work to Proof of Stake.

As Bloomberg reports, "the Goerli test conducted late Wednesday New York time was a kind of dress-rehearsal for switching the Ethereum network from proof-of-work to a more energy-efficient proof-of-stake system. The full shift is expected next month."

Ethereum co-founder Vitalik Buterin retweeted a post saying the test had activated proof-of-stake.

BREAKING:

— bankless.eth (@BanklessHQ) August 11, 2022

The Goerli Testnet has activated Proof of Stake

Mainnet🔜™

In another tweet, Tim Beiko, a computer scientist who coordinates Ethereum developers, posted a screenshot suggesting the test of the planned merge had been successful. Kunal Goel, a research analyst at crypto intelligence firm Messari, also said the Goerli test had been passed.

pandas on the screen! pic.twitter.com/0nYll6gImH

— Tim Beiko | timbeiko.eth 🐼 (@TimBeiko) August 11, 2022

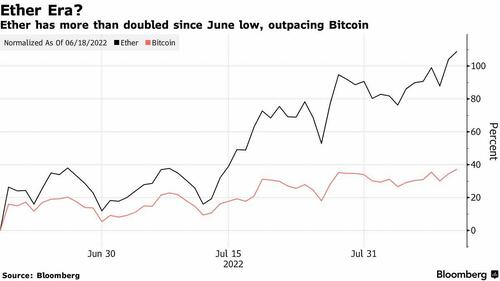

The token rose as much as 4.1% on Thursday and was trading at around $1,900 - more than double a June low below $900 and far outpacing the rebound in Bitcoin over the period. Ether had surged to a record of more than $4,800 in November.

The recent surge in Ether, the native coin of Ethereum - the most important commercial blockchain and one which Goldman last year called the Amazon of crypto - and its ride higher atop the optimism surrounding the merge, as the planned network upgrade is known, have become emblematic of the nascent crypto rebound from this year’s painful rout.

The much-anticipated software upgrade has been in the works for years, and Ethereum’s dominant role as a commercial highway in crypto underlines the sensitivity of the change. Unlike Bitcoin which serves merely as a store of value, the Ethereum blockchain supports more than 3,400 active decentralized apps, allowing for everything from gaming to trading. Ether tokens have a $229 billion market value, according to CoinMarketCap.

And so, after years of delays, Ethereum core developers developers have tentatively scheduled the “merge" for the week of September 15. If successful, between the PoS transition and the upcoming Fed pivot, ETH could be orders of magnitude higher by this time next year.

Official mainnet TTD. Historic tweet right here.

— eric.eth (@econoar) August 11, 2022

Looks like ~Sept 15 for PoS activation on Ethereum mainnet. https://t.co/ePbBPNuNQ2

Ether hit a two-month high as the planned software upgrade to the Ethereum blockchain underwent a major successful test, paving the way for one of the most significant changes in the cryptocurrency sector as Ethereum transitions to Ethereum 2.0, and from Proof of Work to Proof of Stake.

As Bloomberg reports, “the Goerli test conducted late Wednesday New York time was a kind of dress-rehearsal for switching the Ethereum network from proof-of-work to a more energy-efficient proof-of-stake system. The full shift is expected next month.”

Ethereum co-founder Vitalik Buterin retweeted a post saying the test had activated proof-of-stake.

BREAKING:

The Goerli Testnet has activated Proof of Stake

Mainnet🔜™

— bankless.eth (@BanklessHQ) August 11, 2022

In another tweet, Tim Beiko, a computer scientist who coordinates Ethereum developers, posted a screenshot suggesting the test of the planned merge had been successful. Kunal Goel, a research analyst at crypto intelligence firm Messari, also said the Goerli test had been passed.

pandas on the screen! pic.twitter.com/0nYll6gImH

— Tim Beiko | timbeiko.eth 🐼 (@TimBeiko) August 11, 2022

The token rose as much as 4.1% on Thursday and was trading at around $1,900 – more than double a June low below $900 and far outpacing the rebound in Bitcoin over the period. Ether had surged to a record of more than $4,800 in November.

The recent surge in Ether, the native coin of Ethereum – the most important commercial blockchain and one which Goldman last year called the Amazon of crypto – and its ride higher atop the optimism surrounding the merge, as the planned network upgrade is known, have become emblematic of the nascent crypto rebound from this year’s painful rout.

The much-anticipated software upgrade has been in the works for years, and Ethereum’s dominant role as a commercial highway in crypto underlines the sensitivity of the change. Unlike Bitcoin which serves merely as a store of value, the Ethereum blockchain supports more than 3,400 active decentralized apps, allowing for everything from gaming to trading. Ether tokens have a $229 billion market value, according to CoinMarketCap.

And so, after years of delays, Ethereum core developers developers have tentatively scheduled the “merge” for the week of September 15. If successful, between the PoS transition and the upcoming Fed pivot, ETH could be orders of magnitude higher by this time next year.

Official mainnet TTD. Historic tweet right here.

Looks like ~Sept 15 for PoS activation on Ethereum mainnet. https://t.co/ePbBPNuNQ2

— eric.eth (@econoar) August 11, 2022