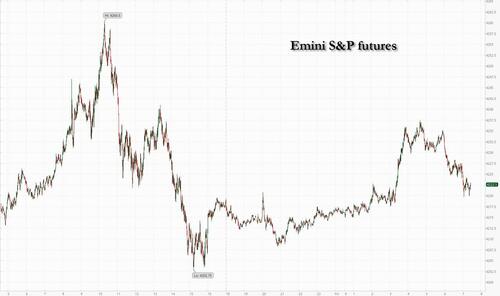

European stocks and US futures rallied on the last day of the week, however traded well off session highs in extremely low-volume trading and tracked the sudden drop in oil, as investors pressed bets that easing inflation will allow the Fed to pivot to less aggressive rate hiking (if not ease outright). S&P 500 and Nasdaq 100 contracts rose about 0.3%, with both underlying indexes set to post their longest sequence of weekly gains since November. Treasury yields were steady at 2.87% and the US dollar rose but was set for the worst week since May. Crude oil fell, reducing its biggest weekly gain in about four months. Gold headed for a fourth weekly gain and Bitcoin was summarily smacked down below the $24,000 level yet again as crypto bears fight to preserve the upper hand.

For the second day in a row an attempt to void the bear market rally narrative by pushing spoos above the 50% fib retracement level is being defended by bears, with futures trading at 4222, or right on top of the critical level, which also doubles as the 100DMA. If broken through it could lead to substantial upside gains as even more bears throw in the towel.

In premarket trading, Alibaba led a premarket decline in US-listed China stocks after some of the nation’s largest state-owned companies announced plans to delist from American exchanges. Bank stocks traded higher, set to gain for a fourth straight day as investors continue to pile into stocks amid signs that inflation is cooling. In corporate news, Huobi Group founder Leon Li is in talks with a clutch of investors to sell his majority stake in the crypto-exchange at a valuation of as much as $3 billion. Here are some of the other notable premarket movers:

- Rivian (RIVN US) shares fall 1.4% in premarket trading after the electric vehicle-maker forecast a bigger adjusted Ebitda loss for the full year than previously expected.

- Expensify (EXFY US) shares fall 14% in premarket trading after the software company’s second-quarter revenue missed the average analyst estimate.

- Toast (TOST US) shares soar 15% in premarket trading after the company boosted its revenue guidance for the full year and beat analyst estimates.

- Chinese stocks in US slip in premarket trading after China Life Insurance (LFC US), PetroChina (PTR US) and Sinopec (SNP US) announced plans to delist American depository shares from the NYSE.

- Ciena (CIEN US) gains 2.9% in premarket trading as Morgan Stanley upgrades its rating on to overweight with strong quarters seen ahead for the telecoms and networking equipment firm.

- Co-Diagnostics (CODX US) shares plunge as much as 40% in US premarket trading, after the molecular diagnostics firm flagged lower volumes for its Covid-19 test.

- Olo (OLO US) falls 31% in premarket trading, after the restaurant delivery platform cut revenue guidance.

- Phunware (PHUN US) falls almost 7% in premarket trading after the enterprise cloud platform posted revenue and Ebitda that missed the average estimate.

- Poshmark (POSH US) gave a weaker-than- expected quarterly revenue forecast as the online marketplace for second-hand goods sees sales growth being held back by macro pressures. The stock fell about 5% in postmarket trading on Thursday.

- SmartRent’s (SMRT US) lowered full-year guidance represents a more attainable earnings outlook for the smart-home automation company, Cantor Fitzgerald said. Shares fell 16% in postmarket trading.

Traders pared back bets on Fed rate hikes after a report on Thursday showed US producer prices fell in July from a month earlier for the first time in over two years. That added to Wednesday’s data on slower increases in consumer prices to provide signs of cooling but still troubling inflation. Swaps referencing the Fed’s September meeting point to some uncertainty over whether a half-point or another 75 basis-point rate hike is on the cards.

Working hard to prevent stocks from rising even more, in the latest US central banker comments, San Francisco Fed President Mary Daly said inflation is too high, adding she anticipates more restrictive monetary policy in 2023. Her baseline is a half-point September hike but she’s open to another 75 basis-point move if necessary, Daly said in a Bloomberg Television interview.

“The macroeconomic environment may be starting to improve a little bit, with a peak in US CPI calling into question the need to hike rates aggressively,” economists at Rand Merchant Bank in Johannesburg said. “Inflation is still high and the Fed will still need to increase rates, but the situation is not as bad as many had feared.”

European stocks erased early gains as energy stocks fell with crude oil futures and investors weighed the impact of recent macroeconomic data on central bank policy. The Stoxx Europe 600 index fell 0.1% by 12:03 p.m. in London after gaining as much as 0.5% earlier. Health care giant GSK Plc was among outperformers, trimming a rout this week that was driven by worries about Zantac litigation, with some analysts suggesting the selloff may have been extreme. Elsewhere, travel and leisure was lifted by gains for Flutter Entertainment Plc following earnings, while consumer staples and miners declined. The region’s main stocks benchmark has risen about 10% since early July, with gains this week spurred by softer-than-expected US inflation data. Still, many investors are skeptical over the impact the report will have on monetary policy.

“We’re having another moment where the market is not listening to central banks,” said Tatjana Greil Castro, co-head of public markets at Muzinich & Co. “Marginally, investors are very reluctant to sell anything and want to buy,” she told Bloomberg Television.

Paradoxically, at the same time, data from Bank of America showed outflows from European equity funds continued for a 26th week at $4.8 billion. The recent bounce for the region’s benchmark is likely to fizzle out in the absence of a pickup in economic growth, BofA’s strategists said.

Here are the biggest European movers:

- Flutter shares rise as much as much as 13% after the gambling firm reported 1H earnings that beat estimates. The strong update was led by the US and Australia, according to Goodbody.

- GSK shares rise as much as 5% after its worst two-day rout on Zantac litigation worries. In response to the selloff on Zantac, GSK downplayed cancer risks from ranitidine and said it will vigorously defend all claims. Sanofi, also caught up in the Zantac-related selloff, rises as much as 3.2%, while Haleon edges up as much as 2%.

- Telecom Italia gains as much as 9.1% following a Bloomberg News report that Italy’s far-right Brothers of Italy party is promoting a plan to take the phone company private and sell off its in a bid to cut its debt pile by more than half.

- Nexi shares surge as much as 7.4% amid a Reuters report that the payment firm has received several unsolicited approaches from private equity firms, including Silver Lake, to take the company private.

- Boozt shares rise as much as 18%, the most since October 2020, with DNB (buy) highlighting a strong beat on the bottom line for the Swedish ecommerce retailer.

- Argenx shares rise as much as 3.7% after KBC reiterates its buy recommendation, saying the biotech is executing on schedule after yesterday’s European approval for Vyvgart, and with regulatory filing submitted in China.

- Kingfisher shares drop as much as 4.2% after UBS cut its recommendation on the stock to sell from neutral, citing a softening outlook for the UK do-it-yourself (DIY) and do-it-for- me (DIFM) categories.

- 888 Holdings shares drop as much as 16%, the most since February 2015, after the gambling company reported results and forecast 2H revenue will be in line with 1H.

- Galenica shares fall as much as 2.5%, with Credit Suisse recommending staying put due to “demanding” valuation.

Asian stocks rose to a two-month high as Japan lifted the region higher in a catch-up rally, with traders digesting another downside surprise in US inflation. The MSCI Asia Pacific Index rose as much as 0.7%, poised for a third day of gains. Japan’s Topix Index added 2% after traders returned from a holiday, while markets in the rest of the region were mixed. Chinese shares fluctuated in a narrow range. Concerns on US inflation eased further after an unexpected month-on-month fall in July’s producer price index, which came a day after slower-than-expected US consumer prices. Stocks were initially strong overnight, before the rally faltered on concerns it may have gone to far. Gains in Asia were more modest on Friday, following hawkish commentary from a Fed speaker.

Some optimism has emerged across Asia this week as traders bet on slower interest-rate increases by the Fed amid easing price pressures. The regional stock benchmark headed for a fourth weekly gain, the longest streak since January 2021. Still, the gauge is down more than 15% this year, trailing other equity benchmarks in the US and Europe. “Clearly in the last month and a half, people sort of moved from that inflationary fear to the Goldilocks scenario. And I think that gives a bit of time for reflection,” Joshua Crabb, head of Asia Pacific equities at Robeco, said in a Bloomberg TV interview. The current earnings season is critical because “we’re also gonna see how much demand destruction that inflation is gonna put forward.”

Australia's S&P/ASX 200 index fell 0.5% to close at 7,032.50, dragged by losses in mining and health shares. Still, the benchmark climbed 0.2% for the week in its fourth straight week of gains. The materials sub-gauge contributed most to the gauge’s decline on Friday after iron ore fell, as a report showed stockpiles of the steel-making ingredient are still rising. In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,730.52. The nation’s food prices surged 7.4% from a year earlier in July, the largest increase in four months, according to data released by Statistics New Zealand

Indian stocks clocked their longest stretch of weekly gains since the middle of January as a pickup in foreign buying pushed key indexes higher. The S&P BSE Sensex rose 0.2% to 59,462.78 in Mumbai, taking its weekly gains to almost 2%. This was the fourth week of advance for the key index. The NSE Nifty 50 Index also climbed 0.2% on Friday. Of the 30 stocks in the Sensex, half fell and the rest climbed. Reliance Industries offered the biggest boost to the key gauge. Thirteen of 19 sectoral sub-indexes compiled by BSE Ltd. rose, led by a gauge of oil and gas companies. Foreign investors have bought a net $3.2 billion of Indian shares since the end of June through Aug. 10. That’s after dumping about $33 billion in the previous nine months as concerns over the Federal Reserve’s aggressive tightening boosted the dollar and spurred outflows from emerging market assets. “FPIs flows were positive this week. With results season coming towards a close, market focus will shift towards macro factors that includes inflation, central bank rate action, oil prices and recession concerns in key economies globally,” Shrikant Chouhan, head of equity research at Kotak Securities wrote in a note.

In FX, Bloomberg dollar spot index is in a holding pattern, up about 0.1%. NZD and AUD are the strongest performers in G-10 FX, SEK and GBP underperform. The Swedish krona led losses after weaker-than-expected inflation data, with the pound also lagging after stronger-than-expected data showed the UK economy shrank in the second quarter. The yen also underperformed. The Canadian dollar and Norwegian krone led gains, with NOK/SEK hitting the highest since April

In rates, Treasuries were slightly richer across the curve with gains led by long-end, although futures remain near bottom of Thursday’s range. Curve mildly flatter, but spreads broadly hold Thursday’s steepening move. Gilts underperform after raft of UK data including 2Q GDP which contracted less than expected. US yields richer by as much as 4bp across long-end of the curve with 5s30s spreads steeper by more than 2bp on the day; 10-year yields around 2.865%, richer by 2bp on the day and outperforming bunds, gilts by 3.5bp and 5.5bp in the sector. Gilts underperform bunds and Treasuries, trading about 3-4bps higher across the yield curve after UK 2Q GDP contracted less than expected, with traders raising BOE tightening bets. German 10-year yield briefly rose above 1%, now up about 2bps to 0.99%. Peripheral spreads widen to Germany. Treasuries 10-year yield down 1 bps to 2.87%.

In commodities, WTI crude is trading slightly lower at ~$94, within Thursday’s range, and gold is down close to $3 at ~$1,787

Looking to the day ahead now, and data releases include the UK’s GDP reading for Q2, Euro Area industrial production for June, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for August.

Market Snapshot

- S&P 500 futures up 0.6% to 4,234.25

- STOXX Europe 600 up 0.4% to 442.02

- MXAP up 0.6% to 163.27

- MXAPJ up 0.2% to 531.44

- Nikkei up 2.6% to 28,546.98

- Topix up 2.0% to 1,973.18

- Hang Seng Index up 0.5% to 20,175.62

- Shanghai Composite down 0.1% to 3,276.89

- Sensex up 0.3% to 59,482.94

- Australia S&P/ASX 200 down 0.5% to 7,032.51

- Kospi up 0.2% to 2,527.94

- German 10Y yield little changed at 1.00%

- Euro down 0.2% to $1.0295

- Brent Futures up 0.3% to $99.90/bbl

- Brent Futures up 0.3% to $99.87/bbl

- Gold spot down 0.1% to $1,787.09

- U.S. Dollar Index up 0.25% to 105.35

Top Overnight News from Bloomberg

- Three of China’s largest state-owned companies announced plans to delist from US exchanges as the two countries struggle to come to an agreement allowing American regulators to inspect audits of Chinese businesses

- The cooler inflation reading for July is welcome news and may mean it’s appropriate for the Federal Reserve to slow its interest-rate increase to 50 basis points at its September meeting, but the fight against fast price growth is far from over, San Francisco Fed President Mary Daly said.

- China may be ready to curb some of the excess liquidity sloshing in the banking system as it turns its focus to mitigating risks in the financial industry.

- In the fight against pandemic inflation, Latin America led the world into a new age of tight money. Eighteen months later, there’s not much sign that being first in will help the region to become first out

- The UK economy shrank in the second quarter for the first time since the pandemic, driven by a decline in spending by households and on fighting the coronavirus

A more detailed look at global markets courtesy of Newsquawk

Asia-Pc stocks were mixed following a similar indecisive lead from Wall Street where stocks and treasuries faded the initial gains from the softer-than-expected PPI data, although Japan outperformed on return from holiday. ASX 200 was dragged lower by losses across nearly all sectors including the top-weighted financial industry despite the confirmation of a return to profit for IAG, while energy bucked the trend after a recent rebound in oil. Nikkei 225 notched firm gains as it played catch-up to global peers and took its first opportunity to react to the softer inflationary signals from the US, while Softbank was among the top performers as it expects to gain USD 34bln from reducing its stake in Alibaba. Hang Seng and Shanghai Comp were both subdued in early trade amid weakness in property stocks and ongoing COVID-related headwinds, although the Hong Kong benchmark gradually recovered with earnings releases also in the limelight.

Top Asian News

- Japanese PM Kishida plans to hold a meeting on August 15th to address rising goods prices, wages and daily life, while he called for additional measures on dealing with rising food and energy prices, according to Reuters.

- Jardine Matheson Slumps 9.6% as MSCI Cuts Co. Weight in Indexes

- Baltic States Abandon East European Cooperation With China

- Gold Set for Fourth Weekly Gain on Signs Fed to Ease Rate Hikes

- Asian Gas Prices Rally on Rush by Japan to Secure Winter Supply

European bourses are firmer, but action has been relatively contained with newsflow slim, Euro Stoxx 50 +0.2%; however, benchmarks waned alongside US futures following China ADS updates. Currently, ES +0.4% but similarly off best levels amid Chinese stocks announcing intentions to delist their ADSs and reports that Germany is being looked at as a banking base. China Life (2628 HK), PetroChina (857 HK), Sinopec (386 HK) plan to delist ADSs from NYSE; last trading day for China Life expected to be on or after 1st September. Subsequently, China's Securities Regulator says it is normal within capital markets for companies to list and delist. Chinese brokers are reportedly looking at Germany as a banking base amid tensions with the US, via Bloomberg citing sources. SMIC (0981 HK) CEO says increasing geopolitical tensions, elevated inflation and a cyclical downturn in demand for chips has resulted in "some panic" within the industry, via FT. Huawei - H1 2022 (CNY): Revenue -5.9% Y/Y to 301.6bln. Net Profit 15.08bln (prev. 31.39bln Y/Y). Device Business Revenue -25.3% Y/Y. 2022 will probably be the most challenging year historically for our devices business Chinese and Hong Kong regulators are to announce adjustments to the trading calendar for the stock connect

Top European News

- Union Leaders Kick Off Rallies Across UK in Living Cost Protest

- Baltic States Abandon East European Cooperation With China

- Swedish Core Inflation Surge Fuels Bets of Faster Rate Hikes

- JPMorgan Strategists Say US 2Q Earnings Fall 3% Excluding Energy

- Ukraine Latest: Putin’s Economy in Focus; More Grain on the Move

FX

- DXY attempts to recover from its post-CPI lows as it eyes yesterday’s 105.46 high.

- EUR, JPY, and GBP are under pressure from the firmer Dollar; EUR/USD eyes some notable OpEx for the NY cut.

- The non-US Dollars are resilient this morning on the back of the general risk tone across stocks and the rise in commodities.

- Fleeting SEK upside was seen in wake of inflation data, with the metrics being in-line/below expectations.

Fixed Income

- Core benchmarks are little changed overall on the session and particularly when compared to price action seen earlier in the week.

- Further pressure seen following the Gilt open in wake of UK GDP metrics.

- USTs in-fitting with peers and the yield curve, currently, does not exhibit any overt bias

Commodities

- WTI and Brent hold an upside bias in Europe amid the broader risk tone.

- Spot gold is relatively uneventful as the firming Dollar keeps the yellow metal capped under USD 1,800/oz.

- Base metals markets are relatively mixed with the market breadth shallow, although LME copper extends on gains above USD 8k/t.

US Event Calendar

- 08:30: July Import Price Index YoY, est. 9.4%, prior 10.7%; MoM, est. -0.9%, prior 0.2%

- July Export Price Index YoY, prior 18.2%; MoM, est. -1.0%, prior 0.7%

- 10:00: Aug. U. of Mich. Sentiment, est. 52.5, prior 51.5

- Aug. U. of Mich. Current Conditions, est. 57.8, prior 58.1

- Aug. U. of Mich. Expectations, est. 48.5, prior 47.3

- Aug. U. of Mich. 1 Yr Inflation, est. 5.1%, prior 5.2%; 5-10 Yr Inflation, est. 2.8%, prior 2.9%

DB's Jim Reid concludes the overnight wrap

This will be the last EMR from me for a couple of weeks as I'm off on holiday. We're going to Cornwall rather than our usual France trip this summer as transporting a child in a wheelchair around a beach was seen as mildly easier than doing the same up and down a mountain. Hopefully this time next year we'll be back in the invigorating mountain air. If you're reading this having originated from Cornwall please don't take offence! However I've never liked beach holidays and I think I'm too old to change my mind. The kids on the other hand can't contain their excitement. So expect me to spend most of my time in an uncomfortable wetsuit trying desperately to ensure that they don't get washed away. Give me the stress of payrolls or CPI any day over that. I'll be gazing longingly from the sea at the golf course next door.

Life's been quite a beach for markets of late but the last 24 hours have been a bit strange, as a second successive weaker-than-expected US inflation reading (PPI) actually left longer dated yields notably higher than where they were before the better than expected CPI on Wednesday, and at one point they were +23bps above where they were immediately after the first of these two dovish prints. The S&P 500 also reversed earlier gains of more than +1% to finish lower at -0.07%. Maybe we shouldn't read too much into summer illiquidity but the moves have been a bit all over the place of late.

While the combination of below-expectations inflation and worsening labour data (see below) initially drove a dovish-Fed interpretation, the price action reverted throughout the day, and we closed with still around even odds between a 50bp or 75bp hike at the September FOMC meeting (61.8bps implied).

When it came to Treasuries, despite the selloff, there was a decent amount of curve steepening, with the 2yr yield climbing +0.4bps whilst the 10yr yield rose by +10.6bps to 2.89%, the highest since July 20th. This helped the 2s10s curve to see its biggest daily steepening move in over 3 months and closing at -33bps, but still having closed inverted 29 for days running. 30yr Treasuries (+14.2bps) hit the highest since July 8 after receiving a lukewarm reception at auction. Maybe the longer end yield rises actually reflect a view that the Fed will be less likely to need to choke the recovery off now inflation is cooling. So maybe yields would have been lower this week with stronger inflation prints? Or is that just the silly season getting to me? To add to the ups and downs, this morning in Asia, 10yr UST yields (-2.73 bps) are edging lower, trading at 2.86% with the 2yr yield down -1.86 bps at 3.20% thus flattening the curve a tad as we go to press.

Over in equities, the S&P 500 (-0.07%) was marginally lower last night after increasing more than +1% in the New York morning. Small caps were a big outperformer, with the Russell 2000 index up by +0.31% to reach its highest level since April as the near-term growth outlook still looks OK, whereas the NASDAQ bore the brunt of the gradual duration selloff throughout the day, falling -0.58%. Overnight, contracts on the S&P 500 (+0.14%) and NASDAQ 100 (+0.22%) are moving slightly higher again.

In terms of the details of that inflation print, US producer prices fell by -0.5% in July, which was some way beneath expectations for a +0.2% rise, and marks the biggest monthly decline since April 2020 when the economy was experiencing Covid lockdowns. As with the CPI release the previous day, the PPI was dragged down by a sharp fall in energy prices, which fell by -9.0% on the month, and that helped the annual headline measure fall from +11.3% in June down to +9.8% in July. Even if you just looked at core PPI however, the reading was still softer than expected, with the monthly gain excluding food and energy at +0.2% (vs. +0.4% expected), which sent the annual gain down to +7.6%.

The prospect that the Fed would be more cautious in hiking rates was given a slight bit of extra support thanks to additional signs that the labour market was softening. The weekly initial jobless claims for the week through August 6 came in at 262k (vs. 265k expected), which is their highest level since November, and the smoother 4-week moving average also rose to a post-November high of 252k. Continuing claims climbed to 1428k, above expectations. Recall, our US economics team has showed that once the 4-week average of continuing claims increases 11% over recent lows near-term recession alarms start sounding. We’re at 1399k on the 4-week moving average on claims, still a reasonable distance from this 11% increase of 1465k. Overall, although the weekly claims data is slowly getting worse, it's still happening in a sea of huge job openings and generally big job growth. Perhaps the labour market is behaving slightly different from usual in that you can have both big job openings but claims edging up because of a sudden skills mismatch post Covid. If so it makes traditional clues to the future direction of the economy more difficult to decipher. For us the US jobs market is still healthy for now. I suspect it won't be in 12 months time but that's a story for another day.

For Europe, the newsflow continued to be much more downbeat than in the US of late, as concerns mounted across the continent about the energy situation this winter. Natural gas futures rose a further +1.34% yesterday to €208 per megawatt-hour, putting them at their highest levels since early March just after Russia’s invasion of Ukraine began. Power prices also soared to fresh records, with German prices for next year up +5.24% to €449 per megawatt-hour, whilst French prices were up +6.62% to €615 per megawatt-hour. Governments are coming under increasing pressure to do something about this, and German Chancellor Scholz said yesterday that there would be further relief measures for consumers.

Growing concerns about an imminent recession meant that European equities also had a lacklustre day, with the STOXX 600 only up +0.06%. Sovereign bonds also lost ground, with yields on 10yr bunds (+8.2bps), OATs (+8.3bps) and BTPs (+3.8bps) all moving higher on the day, although gilts were the biggest underperformer on this side of the Atlantic with yields up by +10.8bps.

Asian equity markets are relatively quiet this morning with the exception of the Nikkei (+2.37%) which is surging and catching-up up after a holiday on Thursday, whilst the Hang Seng (+0.09%), the Shanghai Composite (+0.16%), the CSI (+0.08%) and the Kospi (+0.02%) are all edging up.

Elsewhere, the San Francisco Fed President Mary Daly in her overnight remarks indicated that a 50 bps interest rate hike in September “makes sense” following two back-to-back 75-basis-point hikes in June and July given recent economic data including on inflation. However, she added that she is open for a bigger rate hike if the data showed it was needed.

To the day ahead now, and data releases include the UK’s GDP reading for Q2, Euro Area industrial production for June, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for August.

European stocks and US futures rallied on the last day of the week, however traded well off session highs in extremely low-volume trading and tracked the sudden drop in oil, as investors pressed bets that easing inflation will allow the Fed to pivot to less aggressive rate hiking (if not ease outright). S&P 500 and Nasdaq 100 contracts rose about 0.3%, with both underlying indexes set to post their longest sequence of weekly gains since November. Treasury yields were steady at 2.87% and the US dollar rose but was set for the worst week since May. Crude oil fell, reducing its biggest weekly gain in about four months. Gold headed for a fourth weekly gain and Bitcoin was summarily smacked down below the $24,000 level yet again as crypto bears fight to preserve the upper hand.

For the second day in a row an attempt to void the bear market rally narrative by pushing spoos above the 50% fib retracement level is being defended by bears, with futures trading at 4222, or right on top of the critical level, which also doubles as the 100DMA. If broken through it could lead to substantial upside gains as even more bears throw in the towel.

In premarket trading, Alibaba led a premarket decline in US-listed China stocks after some of the nation’s largest state-owned companies announced plans to delist from American exchanges. Bank stocks traded higher, set to gain for a fourth straight day as investors continue to pile into stocks amid signs that inflation is cooling. In corporate news, Huobi Group founder Leon Li is in talks with a clutch of investors to sell his majority stake in the crypto-exchange at a valuation of as much as $3 billion. Here are some of the other notable premarket movers:

- Rivian (RIVN US) shares fall 1.4% in premarket trading after the electric vehicle-maker forecast a bigger adjusted Ebitda loss for the full year than previously expected.

- Expensify (EXFY US) shares fall 14% in premarket trading after the software company’s second-quarter revenue missed the average analyst estimate.

- Toast (TOST US) shares soar 15% in premarket trading after the company boosted its revenue guidance for the full year and beat analyst estimates.

- Chinese stocks in US slip in premarket trading after China Life Insurance (LFC US), PetroChina (PTR US) and Sinopec (SNP US) announced plans to delist American depository shares from the NYSE.

- Ciena (CIEN US) gains 2.9% in premarket trading as Morgan Stanley upgrades its rating on to overweight with strong quarters seen ahead for the telecoms and networking equipment firm.

- Co-Diagnostics (CODX US) shares plunge as much as 40% in US premarket trading, after the molecular diagnostics firm flagged lower volumes for its Covid-19 test.

- Olo (OLO US) falls 31% in premarket trading, after the restaurant delivery platform cut revenue guidance.

- Phunware (PHUN US) falls almost 7% in premarket trading after the enterprise cloud platform posted revenue and Ebitda that missed the average estimate.

- Poshmark (POSH US) gave a weaker-than- expected quarterly revenue forecast as the online marketplace for second-hand goods sees sales growth being held back by macro pressures. The stock fell about 5% in postmarket trading on Thursday.

- SmartRent’s (SMRT US) lowered full-year guidance represents a more attainable earnings outlook for the smart-home automation company, Cantor Fitzgerald said. Shares fell 16% in postmarket trading.

Traders pared back bets on Fed rate hikes after a report on Thursday showed US producer prices fell in July from a month earlier for the first time in over two years. That added to Wednesday’s data on slower increases in consumer prices to provide signs of cooling but still troubling inflation. Swaps referencing the Fed’s September meeting point to some uncertainty over whether a half-point or another 75 basis-point rate hike is on the cards.

Working hard to prevent stocks from rising even more, in the latest US central banker comments, San Francisco Fed President Mary Daly said inflation is too high, adding she anticipates more restrictive monetary policy in 2023. Her baseline is a half-point September hike but she’s open to another 75 basis-point move if necessary, Daly said in a Bloomberg Television interview.

“The macroeconomic environment may be starting to improve a little bit, with a peak in US CPI calling into question the need to hike rates aggressively,” economists at Rand Merchant Bank in Johannesburg said. “Inflation is still high and the Fed will still need to increase rates, but the situation is not as bad as many had feared.”

European stocks erased early gains as energy stocks fell with crude oil futures and investors weighed the impact of recent macroeconomic data on central bank policy. The Stoxx Europe 600 index fell 0.1% by 12:03 p.m. in London after gaining as much as 0.5% earlier. Health care giant GSK Plc was among outperformers, trimming a rout this week that was driven by worries about Zantac litigation, with some analysts suggesting the selloff may have been extreme. Elsewhere, travel and leisure was lifted by gains for Flutter Entertainment Plc following earnings, while consumer staples and miners declined. The region’s main stocks benchmark has risen about 10% since early July, with gains this week spurred by softer-than-expected US inflation data. Still, many investors are skeptical over the impact the report will have on monetary policy.

“We’re having another moment where the market is not listening to central banks,” said Tatjana Greil Castro, co-head of public markets at Muzinich & Co. “Marginally, investors are very reluctant to sell anything and want to buy,” she told Bloomberg Television.

Paradoxically, at the same time, data from Bank of America showed outflows from European equity funds continued for a 26th week at $4.8 billion. The recent bounce for the region’s benchmark is likely to fizzle out in the absence of a pickup in economic growth, BofA’s strategists said.

Here are the biggest European movers:

- Flutter shares rise as much as much as 13% after the gambling firm reported 1H earnings that beat estimates. The strong update was led by the US and Australia, according to Goodbody.

- GSK shares rise as much as 5% after its worst two-day rout on Zantac litigation worries. In response to the selloff on Zantac, GSK downplayed cancer risks from ranitidine and said it will vigorously defend all claims. Sanofi, also caught up in the Zantac-related selloff, rises as much as 3.2%, while Haleon edges up as much as 2%.

- Telecom Italia gains as much as 9.1% following a Bloomberg News report that Italy’s far-right Brothers of Italy party is promoting a plan to take the phone company private and sell off its in a bid to cut its debt pile by more than half.

- Nexi shares surge as much as 7.4% amid a Reuters report that the payment firm has received several unsolicited approaches from private equity firms, including Silver Lake, to take the company private.

- Boozt shares rise as much as 18%, the most since October 2020, with DNB (buy) highlighting a strong beat on the bottom line for the Swedish ecommerce retailer.

- Argenx shares rise as much as 3.7% after KBC reiterates its buy recommendation, saying the biotech is executing on schedule after yesterday’s European approval for Vyvgart, and with regulatory filing submitted in China.

- Kingfisher shares drop as much as 4.2% after UBS cut its recommendation on the stock to sell from neutral, citing a softening outlook for the UK do-it-yourself (DIY) and do-it-for- me (DIFM) categories.

- 888 Holdings shares drop as much as 16%, the most since February 2015, after the gambling company reported results and forecast 2H revenue will be in line with 1H.

- Galenica shares fall as much as 2.5%, with Credit Suisse recommending staying put due to “demanding” valuation.

Asian stocks rose to a two-month high as Japan lifted the region higher in a catch-up rally, with traders digesting another downside surprise in US inflation. The MSCI Asia Pacific Index rose as much as 0.7%, poised for a third day of gains. Japan’s Topix Index added 2% after traders returned from a holiday, while markets in the rest of the region were mixed. Chinese shares fluctuated in a narrow range. Concerns on US inflation eased further after an unexpected month-on-month fall in July’s producer price index, which came a day after slower-than-expected US consumer prices. Stocks were initially strong overnight, before the rally faltered on concerns it may have gone to far. Gains in Asia were more modest on Friday, following hawkish commentary from a Fed speaker.

Some optimism has emerged across Asia this week as traders bet on slower interest-rate increases by the Fed amid easing price pressures. The regional stock benchmark headed for a fourth weekly gain, the longest streak since January 2021. Still, the gauge is down more than 15% this year, trailing other equity benchmarks in the US and Europe. “Clearly in the last month and a half, people sort of moved from that inflationary fear to the Goldilocks scenario. And I think that gives a bit of time for reflection,” Joshua Crabb, head of Asia Pacific equities at Robeco, said in a Bloomberg TV interview. The current earnings season is critical because “we’re also gonna see how much demand destruction that inflation is gonna put forward.”

Australia’s S&P/ASX 200 index fell 0.5% to close at 7,032.50, dragged by losses in mining and health shares. Still, the benchmark climbed 0.2% for the week in its fourth straight week of gains. The materials sub-gauge contributed most to the gauge’s decline on Friday after iron ore fell, as a report showed stockpiles of the steel-making ingredient are still rising. In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,730.52. The nation’s food prices surged 7.4% from a year earlier in July, the largest increase in four months, according to data released by Statistics New Zealand

Indian stocks clocked their longest stretch of weekly gains since the middle of January as a pickup in foreign buying pushed key indexes higher. The S&P BSE Sensex rose 0.2% to 59,462.78 in Mumbai, taking its weekly gains to almost 2%. This was the fourth week of advance for the key index. The NSE Nifty 50 Index also climbed 0.2% on Friday. Of the 30 stocks in the Sensex, half fell and the rest climbed. Reliance Industries offered the biggest boost to the key gauge. Thirteen of 19 sectoral sub-indexes compiled by BSE Ltd. rose, led by a gauge of oil and gas companies. Foreign investors have bought a net $3.2 billion of Indian shares since the end of June through Aug. 10. That’s after dumping about $33 billion in the previous nine months as concerns over the Federal Reserve’s aggressive tightening boosted the dollar and spurred outflows from emerging market assets. “FPIs flows were positive this week. With results season coming towards a close, market focus will shift towards macro factors that includes inflation, central bank rate action, oil prices and recession concerns in key economies globally,” Shrikant Chouhan, head of equity research at Kotak Securities wrote in a note.

In FX, Bloomberg dollar spot index is in a holding pattern, up about 0.1%. NZD and AUD are the strongest performers in G-10 FX, SEK and GBP underperform. The Swedish krona led losses after weaker-than-expected inflation data, with the pound also lagging after stronger-than-expected data showed the UK economy shrank in the second quarter. The yen also underperformed. The Canadian dollar and Norwegian krone led gains, with NOK/SEK hitting the highest since April

In rates, Treasuries were slightly richer across the curve with gains led by long-end, although futures remain near bottom of Thursday’s range. Curve mildly flatter, but spreads broadly hold Thursday’s steepening move. Gilts underperform after raft of UK data including 2Q GDP which contracted less than expected. US yields richer by as much as 4bp across long-end of the curve with 5s30s spreads steeper by more than 2bp on the day; 10-year yields around 2.865%, richer by 2bp on the day and outperforming bunds, gilts by 3.5bp and 5.5bp in the sector. Gilts underperform bunds and Treasuries, trading about 3-4bps higher across the yield curve after UK 2Q GDP contracted less than expected, with traders raising BOE tightening bets. German 10-year yield briefly rose above 1%, now up about 2bps to 0.99%. Peripheral spreads widen to Germany. Treasuries 10-year yield down 1 bps to 2.87%.

In commodities, WTI crude is trading slightly lower at ~$94, within Thursday’s range, and gold is down close to $3 at ~$1,787

Looking to the day ahead now, and data releases include the UK’s GDP reading for Q2, Euro Area industrial production for June, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for August.

Market Snapshot

- S&P 500 futures up 0.6% to 4,234.25

- STOXX Europe 600 up 0.4% to 442.02

- MXAP up 0.6% to 163.27

- MXAPJ up 0.2% to 531.44

- Nikkei up 2.6% to 28,546.98

- Topix up 2.0% to 1,973.18

- Hang Seng Index up 0.5% to 20,175.62

- Shanghai Composite down 0.1% to 3,276.89

- Sensex up 0.3% to 59,482.94

- Australia S&P/ASX 200 down 0.5% to 7,032.51

- Kospi up 0.2% to 2,527.94

- German 10Y yield little changed at 1.00%

- Euro down 0.2% to $1.0295

- Brent Futures up 0.3% to $99.90/bbl

- Brent Futures up 0.3% to $99.87/bbl

- Gold spot down 0.1% to $1,787.09

- U.S. Dollar Index up 0.25% to 105.35

Top Overnight News from Bloomberg

- Three of China’s largest state-owned companies announced plans to delist from US exchanges as the two countries struggle to come to an agreement allowing American regulators to inspect audits of Chinese businesses

- The cooler inflation reading for July is welcome news and may mean it’s appropriate for the Federal Reserve to slow its interest-rate increase to 50 basis points at its September meeting, but the fight against fast price growth is far from over, San Francisco Fed President Mary Daly said.

- China may be ready to curb some of the excess liquidity sloshing in the banking system as it turns its focus to mitigating risks in the financial industry.

- In the fight against pandemic inflation, Latin America led the world into a new age of tight money. Eighteen months later, there’s not much sign that being first in will help the region to become first out

- The UK economy shrank in the second quarter for the first time since the pandemic, driven by a decline in spending by households and on fighting the coronavirus

A more detailed look at global markets courtesy of Newsquawk

Asia-Pc stocks were mixed following a similar indecisive lead from Wall Street where stocks and treasuries faded the initial gains from the softer-than-expected PPI data, although Japan outperformed on return from holiday. ASX 200 was dragged lower by losses across nearly all sectors including the top-weighted financial industry despite the confirmation of a return to profit for IAG, while energy bucked the trend after a recent rebound in oil. Nikkei 225 notched firm gains as it played catch-up to global peers and took its first opportunity to react to the softer inflationary signals from the US, while Softbank was among the top performers as it expects to gain USD 34bln from reducing its stake in Alibaba. Hang Seng and Shanghai Comp were both subdued in early trade amid weakness in property stocks and ongoing COVID-related headwinds, although the Hong Kong benchmark gradually recovered with earnings releases also in the limelight.

Top Asian News

- Japanese PM Kishida plans to hold a meeting on August 15th to address rising goods prices, wages and daily life, while he called for additional measures on dealing with rising food and energy prices, according to Reuters.

- Jardine Matheson Slumps 9.6% as MSCI Cuts Co. Weight in Indexes

- Baltic States Abandon East European Cooperation With China

- Gold Set for Fourth Weekly Gain on Signs Fed to Ease Rate Hikes

- Asian Gas Prices Rally on Rush by Japan to Secure Winter Supply

European bourses are firmer, but action has been relatively contained with newsflow slim, Euro Stoxx 50 +0.2%; however, benchmarks waned alongside US futures following China ADS updates. Currently, ES +0.4% but similarly off best levels amid Chinese stocks announcing intentions to delist their ADSs and reports that Germany is being looked at as a banking base. China Life (2628 HK), PetroChina (857 HK), Sinopec (386 HK) plan to delist ADSs from NYSE; last trading day for China Life expected to be on or after 1st September. Subsequently, China’s Securities Regulator says it is normal within capital markets for companies to list and delist. Chinese brokers are reportedly looking at Germany as a banking base amid tensions with the US, via Bloomberg citing sources. SMIC (0981 HK) CEO says increasing geopolitical tensions, elevated inflation and a cyclical downturn in demand for chips has resulted in “some panic” within the industry, via FT. Huawei – H1 2022 (CNY): Revenue -5.9% Y/Y to 301.6bln. Net Profit 15.08bln (prev. 31.39bln Y/Y). Device Business Revenue -25.3% Y/Y. 2022 will probably be the most challenging year historically for our devices business Chinese and Hong Kong regulators are to announce adjustments to the trading calendar for the stock connect

Top European News

- Union Leaders Kick Off Rallies Across UK in Living Cost Protest

- Baltic States Abandon East European Cooperation With China

- Swedish Core Inflation Surge Fuels Bets of Faster Rate Hikes

- JPMorgan Strategists Say US 2Q Earnings Fall 3% Excluding Energy

- Ukraine Latest: Putin’s Economy in Focus; More Grain on the Move

FX

- DXY attempts to recover from its post-CPI lows as it eyes yesterday’s 105.46 high.

- EUR, JPY, and GBP are under pressure from the firmer Dollar; EUR/USD eyes some notable OpEx for the NY cut.

- The non-US Dollars are resilient this morning on the back of the general risk tone across stocks and the rise in commodities.

- Fleeting SEK upside was seen in wake of inflation data, with the metrics being in-line/below expectations.

Fixed Income

- Core benchmarks are little changed overall on the session and particularly when compared to price action seen earlier in the week.

- Further pressure seen following the Gilt open in wake of UK GDP metrics.

- USTs in-fitting with peers and the yield curve, currently, does not exhibit any overt bias

Commodities

- WTI and Brent hold an upside bias in Europe amid the broader risk tone.

- Spot gold is relatively uneventful as the firming Dollar keeps the yellow metal capped under USD 1,800/oz.

- Base metals markets are relatively mixed with the market breadth shallow, although LME copper extends on gains above USD 8k/t.

US Event Calendar

- 08:30: July Import Price Index YoY, est. 9.4%, prior 10.7%; MoM, est. -0.9%, prior 0.2%

- July Export Price Index YoY, prior 18.2%; MoM, est. -1.0%, prior 0.7%

- 10:00: Aug. U. of Mich. Sentiment, est. 52.5, prior 51.5

- Aug. U. of Mich. Current Conditions, est. 57.8, prior 58.1

- Aug. U. of Mich. Expectations, est. 48.5, prior 47.3

- Aug. U. of Mich. 1 Yr Inflation, est. 5.1%, prior 5.2%; 5-10 Yr Inflation, est. 2.8%, prior 2.9%

DB’s Jim Reid concludes the overnight wrap

This will be the last EMR from me for a couple of weeks as I’m off on holiday. We’re going to Cornwall rather than our usual France trip this summer as transporting a child in a wheelchair around a beach was seen as mildly easier than doing the same up and down a mountain. Hopefully this time next year we’ll be back in the invigorating mountain air. If you’re reading this having originated from Cornwall please don’t take offence! However I’ve never liked beach holidays and I think I’m too old to change my mind. The kids on the other hand can’t contain their excitement. So expect me to spend most of my time in an uncomfortable wetsuit trying desperately to ensure that they don’t get washed away. Give me the stress of payrolls or CPI any day over that. I’ll be gazing longingly from the sea at the golf course next door.

Life’s been quite a beach for markets of late but the last 24 hours have been a bit strange, as a second successive weaker-than-expected US inflation reading (PPI) actually left longer dated yields notably higher than where they were before the better than expected CPI on Wednesday, and at one point they were +23bps above where they were immediately after the first of these two dovish prints. The S&P 500 also reversed earlier gains of more than +1% to finish lower at -0.07%. Maybe we shouldn’t read too much into summer illiquidity but the moves have been a bit all over the place of late.

While the combination of below-expectations inflation and worsening labour data (see below) initially drove a dovish-Fed interpretation, the price action reverted throughout the day, and we closed with still around even odds between a 50bp or 75bp hike at the September FOMC meeting (61.8bps implied).

When it came to Treasuries, despite the selloff, there was a decent amount of curve steepening, with the 2yr yield climbing +0.4bps whilst the 10yr yield rose by +10.6bps to 2.89%, the highest since July 20th. This helped the 2s10s curve to see its biggest daily steepening move in over 3 months and closing at -33bps, but still having closed inverted 29 for days running. 30yr Treasuries (+14.2bps) hit the highest since July 8 after receiving a lukewarm reception at auction. Maybe the longer end yield rises actually reflect a view that the Fed will be less likely to need to choke the recovery off now inflation is cooling. So maybe yields would have been lower this week with stronger inflation prints? Or is that just the silly season getting to me? To add to the ups and downs, this morning in Asia, 10yr UST yields (-2.73 bps) are edging lower, trading at 2.86% with the 2yr yield down -1.86 bps at 3.20% thus flattening the curve a tad as we go to press.

Over in equities, the S&P 500 (-0.07%) was marginally lower last night after increasing more than +1% in the New York morning. Small caps were a big outperformer, with the Russell 2000 index up by +0.31% to reach its highest level since April as the near-term growth outlook still looks OK, whereas the NASDAQ bore the brunt of the gradual duration selloff throughout the day, falling -0.58%. Overnight, contracts on the S&P 500 (+0.14%) and NASDAQ 100 (+0.22%) are moving slightly higher again.

In terms of the details of that inflation print, US producer prices fell by -0.5% in July, which was some way beneath expectations for a +0.2% rise, and marks the biggest monthly decline since April 2020 when the economy was experiencing Covid lockdowns. As with the CPI release the previous day, the PPI was dragged down by a sharp fall in energy prices, which fell by -9.0% on the month, and that helped the annual headline measure fall from +11.3% in June down to +9.8% in July. Even if you just looked at core PPI however, the reading was still softer than expected, with the monthly gain excluding food and energy at +0.2% (vs. +0.4% expected), which sent the annual gain down to +7.6%.

The prospect that the Fed would be more cautious in hiking rates was given a slight bit of extra support thanks to additional signs that the labour market was softening. The weekly initial jobless claims for the week through August 6 came in at 262k (vs. 265k expected), which is their highest level since November, and the smoother 4-week moving average also rose to a post-November high of 252k. Continuing claims climbed to 1428k, above expectations. Recall, our US economics team has showed that once the 4-week average of continuing claims increases 11% over recent lows near-term recession alarms start sounding. We’re at 1399k on the 4-week moving average on claims, still a reasonable distance from this 11% increase of 1465k. Overall, although the weekly claims data is slowly getting worse, it’s still happening in a sea of huge job openings and generally big job growth. Perhaps the labour market is behaving slightly different from usual in that you can have both big job openings but claims edging up because of a sudden skills mismatch post Covid. If so it makes traditional clues to the future direction of the economy more difficult to decipher. For us the US jobs market is still healthy for now. I suspect it won’t be in 12 months time but that’s a story for another day.

For Europe, the newsflow continued to be much more downbeat than in the US of late, as concerns mounted across the continent about the energy situation this winter. Natural gas futures rose a further +1.34% yesterday to €208 per megawatt-hour, putting them at their highest levels since early March just after Russia’s invasion of Ukraine began. Power prices also soared to fresh records, with German prices for next year up +5.24% to €449 per megawatt-hour, whilst French prices were up +6.62% to €615 per megawatt-hour. Governments are coming under increasing pressure to do something about this, and German Chancellor Scholz said yesterday that there would be further relief measures for consumers.

Growing concerns about an imminent recession meant that European equities also had a lacklustre day, with the STOXX 600 only up +0.06%. Sovereign bonds also lost ground, with yields on 10yr bunds (+8.2bps), OATs (+8.3bps) and BTPs (+3.8bps) all moving higher on the day, although gilts were the biggest underperformer on this side of the Atlantic with yields up by +10.8bps.

Asian equity markets are relatively quiet this morning with the exception of the Nikkei (+2.37%) which is surging and catching-up up after a holiday on Thursday, whilst the Hang Seng (+0.09%), the Shanghai Composite (+0.16%), the CSI (+0.08%) and the Kospi (+0.02%) are all edging up.

Elsewhere, the San Francisco Fed President Mary Daly in her overnight remarks indicated that a 50 bps interest rate hike in September “makes sense” following two back-to-back 75-basis-point hikes in June and July given recent economic data including on inflation. However, she added that she is open for a bigger rate hike if the data showed it was needed.

To the day ahead now, and data releases include the UK’s GDP reading for Q2, Euro Area industrial production for June, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for August.