After yesterday's solid 3Y auction, the market considered the results briefly, pushed yields lower for about a basis point and then saw the recent move wider in yields extend overnight, with some wondering if yesterday's auction success would be repeated in today's sale of $39BN in 10Y notes (specifically a reopening of 9Year-11Month cusip CLW9). The answer was yes and then some.

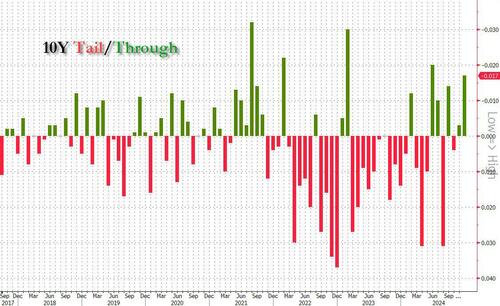

Pricing at a high yield of 4.235%, down from last month's 4.347%, the auction stopped through the When Issued 4.250% by 1.7bps, an improvement to last month's 0.3bps through and the biggest stop through since June.

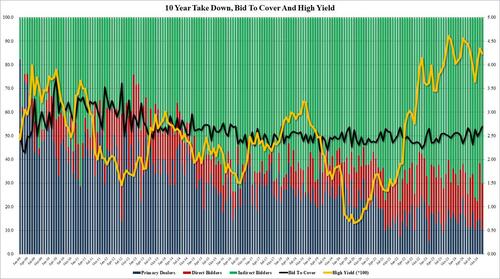

The bid to cover was a whopper: rising to 2.70 from 2.58 in November, and the highest since June 2016!

The internals were also solid, with Indirects awarded 70.0 up from 61.7 in November if just below the six-auction average of 70.6. And with Directs taking down 19.5%, Dealers were left holding just 10.5% of the auction, the lowest since September.

Overall, this was a stellar 10Y auction, one which impressed on virtually all metrics and yet even though there was a kneejerk move lower in the 10 Yield , which dipped to 4.23% from 4.25% before the result, yields have since pushed right back up and the 10Y was back at 4.25% at last check as the market starts realizing that after the December rate cut... that's pretty much it for the Fed's easing cycle.

After yesterday’s solid 3Y auction, the market considered the results briefly, pushed yields lower for about a basis point and then saw the recent move wider in yields extend overnight, with some wondering if yesterday’s auction success would be repeated in today’s sale of $39BN in 10Y notes (specifically a reopening of 9Year-11Month cusip CLW9). The answer was yes and then some.

Pricing at a high yield of 4.235%, down from last month’s 4.347%, the auction stopped through the When Issued 4.250% by 1.7bps, an improvement to last month’s 0.3bps through and the biggest stop through since June.

The bid to cover was a whopper: rising to 2.70 from 2.58 in November, and the highest since June 2016!

The internals were also solid, with Indirects awarded 70.0 up from 61.7 in November if just below the six-auction average of 70.6. And with Directs taking down 19.5%, Dealers were left holding just 10.5% of the auction, the lowest since September.

Overall, this was a stellar 10Y auction, one which impressed on virtually all metrics and yet even though there was a kneejerk move lower in the 10 Yield , which dipped to 4.23% from 4.25% before the result, yields have since pushed right back up and the 10Y was back at 4.25% at last check as the market starts realizing that after the December rate cut… that’s pretty much it for the Fed’s easing cycle.

Loading…