We thought last month's US budget deficit was bad. Boy, were we wrong.

It is only fitting that the twilight days of the Biden admin would exhibit more of the same fakeness that defined not only all of the past four years, but certainly the fakeness of that Kamala Harris presidential campaign which had a billion dollars a month ago and ended up in failure, broke... and millions in debt. We are talking, of course, about the relentless debt-funded spree that somehow became synonymous with economic success in the US.

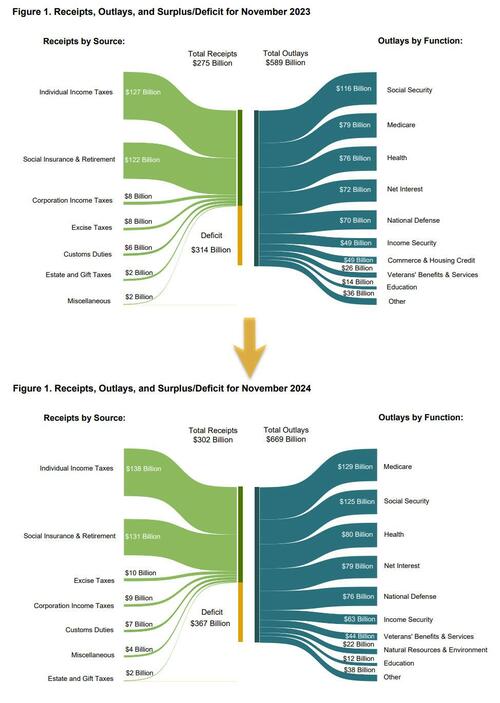

According to the latest Treasury data released today, in November - the second month of fiscal 2025 - the US spent a massive $584.2 billion, a 14% increase from the prior year, and a record for the month of November. For those who remember out outrage from a month ago, will also remember that the latest deficit number follows what was also a record government outlay for the month of October.

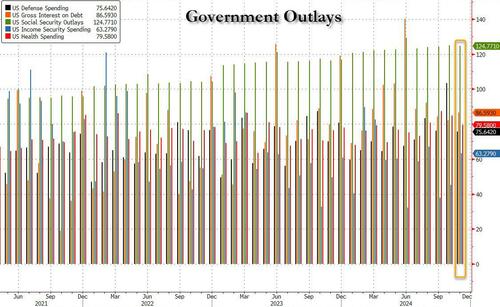

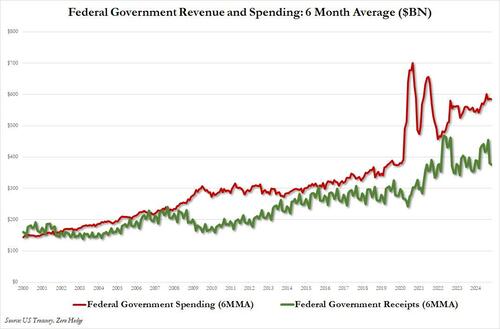

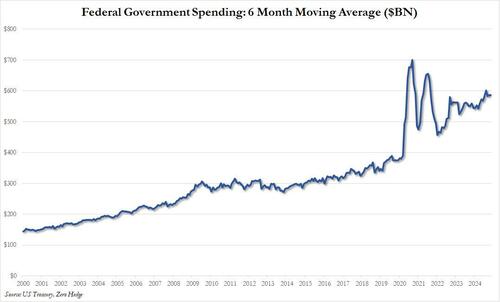

On a trailing 6 month moving average basis, to smooth out outliers months, the spending hit $586 billion, effectively at an all time high with just the record spending spree during covid pushing government spending higher.

The surge in spending was driven primarily by higher spending on health, defense and Social Security, but mostly a huge $50BN spike on Medicare outlays!

The long-term chart of government spending shows what we all know: DOGE or not DOGE, there is no stopping this train.

The surge in spending was far greater than the much more modest increase in tax revenues: in November, the US government collected $301.8 billion in taxes, up 9.8% from the $274.8 billion last November. As shown in the next chart, while spending continued to grow exponentially, tax receipts have flatlined, and the 6 month average in October was just $380 billion, the same as three years ago!

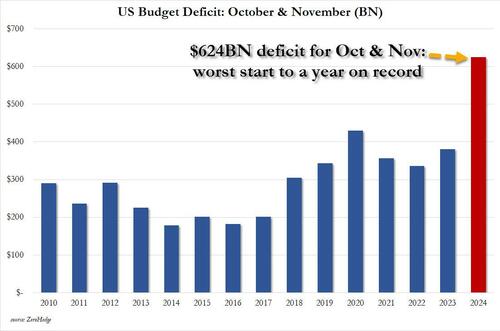

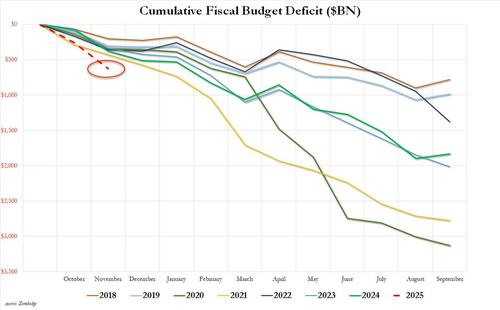

To be sure, there were some calendar effects in play. Recall that last month we said that October 2023's tax receipts were unusually higher due to deferred tax receipts that were received that month from companies and individuals affected by disasters including wildfires in California. Taking that into account, the October budget deficit would have been 22% higher (and would offset the freak September surplus which we are convinced was staged to make the last month of fiscal 2024 look abnormally good for the Biden admin). And since some of this calendar effect also nets in November, to avoid the calendar shifts across months we combined the first two months of fiscal 2025. What we got was this shocker of a chart:

It shows that in October and November, the US deficit exploded to a staggering $624.2 billion, and even though this included several calendar adjustments - which explains the freak September surplus which as we said was due to calendar effects - the November deficit of $367 billion was $14 billion more than consensus estimates of $353 billion. Worse, combining October and November we find that not only was the combined number of $624 billion some 64% higher than the corresponding period one year ago, but it was also the highest deficit on record for the first two-months of the year (and that includes the spending insanity during the covid crisis).

Putting the deficit in context, the budget deficit in October and November - the first two months of fiscal 2025 - are now officially the worst start a year for the US Treasury on record.

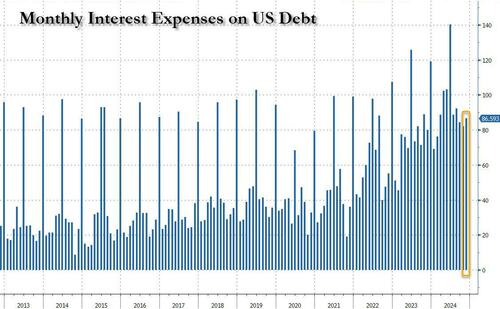

Taking a closer look at what has been the most terrifying trend in the US income statement for some time now, the Treasury’s debt-servicing costs rose once again in November. Gross interest costs totaled $87 billion, up $7 billion from $80 billion in the same month a year before.

And if the November print seems low by recent standards, just wait one month: the December gross interest payment will be an absolute shocker as that's when the bulk of interest payments take place. For December, expect a number north of $150 billion in interest alone!

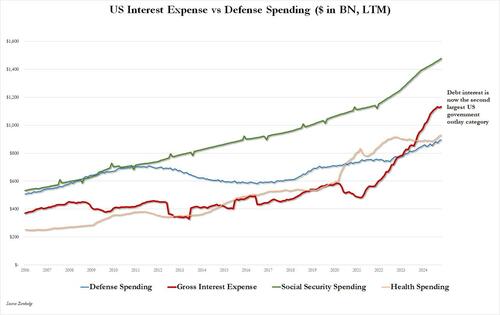

And while we wait, this is what a chart of LTM spending across the main categories looks like. Yes, gross interest spending is not only the second largest outlay for the US government, just shy of $1.2 trillion, it's also the highest it has ever been, and will continue rising, especially if/when the Fed ends its easing cycle prematurely due to rising prices sparking the next meltup.... in US interest payment.

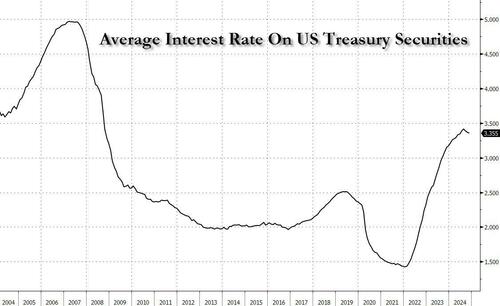

The good news is that for now (certainly until the December explosion), the surge in US interest payments has been delayed. That's because the weighted average interest rate for total outstanding debt at the end of November was 3.36%, at roughly 15-year highs, but down slightly from the month before, the third monthly decline.

However, don't expect this decline in interest spending to persist because even though the Fed has cut rates twice since September, this has been more than offset by the surge in debt which at last check was now $36.2 trillion, up half a trillion from a month ago, and unless Elon's Department for Government Efficiency (DOGE) manages to somehow slash trillions in both spending and interest, this is what US debt will look like for the next few years, guaranteeing that interest on said debt will very soon become the single largest spending category for the US government.

It's either going to work or it's not. Here is the alternative https://t.co/cHZA2wHnPB pic.twitter.com/LMEI4tISZL

— zerohedge (@zerohedge) November 13, 2024

For those who were still unsure if buying votes has a cost associated with it, now you know.

The mindblowing figures illustrate the monumental challenge for Trump and all those promising to rein in US debt, which has exploded to 120% of GDP after four years of Biden's "drunken-sailor" spending ways. The last hope for the US is that Trump has tapped Elon Musk and Vivek Ramaswamy to look at ways to cut spending. Alas, these figures show that the bulk of the outlays are in areas that are bound to be a politically explosive to address, in other words any cuts even remotely close to the $2 trillion suggested by Vivek would lead to a full-blown deep state revolt... and government cataclysm.

It's also why attempts to reroute the US from its inevitable collision with the iceberg of fiscal devastation will likewise end in ruin.

We thought last month’s US budget deficit was bad. Boy, were we wrong.

It is only fitting that the twilight days of the Biden admin would exhibit more of the same fakeness that defined not only all of the past four years, but certainly the fakeness of that Kamala Harris presidential campaign which had a billion dollars a month ago and ended up in failure, broke… and millions in debt. We are talking, of course, about the relentless debt-funded spree that somehow became synonymous with economic success in the US.

According to the latest Treasury data released today, in November – the second month of fiscal 2025 – the US spent a massive $584.2 billion, a 14% increase from the prior year, and a record for the month of November. For those who remember out outrage from a month ago, will also remember that the latest deficit number follows what was also a record government outlay for the month of October.

On a trailing 6 month moving average basis, to smooth out outliers months, the spending hit $586 billion, effectively at an all time high with just the record spending spree during covid pushing government spending higher.

The surge in spending was driven primarily by higher spending on health, defense and Social Security, but mostly a huge $50BN spike on Medicare outlays!

The long-term chart of government spending shows what we all know: DOGE or not DOGE, there is no stopping this train.

The surge in spending was far greater than the much more modest increase in tax revenues: in November, the US government collected $301.8 billion in taxes, up 9.8% from the $274.8 billion last November. As shown in the next chart, while spending continued to grow exponentially, tax receipts have flatlined, and the 6 month average in October was just $380 billion, the same as three years ago!

To be sure, there were some calendar effects in play. Recall that last month we said that October 2023’s tax receipts were unusually higher due to deferred tax receipts that were received that month from companies and individuals affected by disasters including wildfires in California. Taking that into account, the October budget deficit would have been 22% higher (and would offset the freak September surplus which we are convinced was staged to make the last month of fiscal 2024 look abnormally good for the Biden admin). And since some of this calendar effect also nets in November, to avoid the calendar shifts across months we combined the first two months of fiscal 2025. What we got was this shocker of a chart:

It shows that in October and November, the US deficit exploded to a staggering $624.2 billion, and even though this included several calendar adjustments – which explains the freak September surplus which as we said was due to calendar effects – the November deficit of $367 billion was $14 billion more than consensus estimates of $353 billion. Worse, combining October and November we find that not only was the combined number of $624 billion some 64% higher than the corresponding period one year ago, but it was also the highest deficit on record for the first two-months of the year (and that includes the spending insanity during the covid crisis).

Putting the deficit in context, the budget deficit in October and November – the first two months of fiscal 2025 – are now officially the worst start a year for the US Treasury on record.

Taking a closer look at what has been the most terrifying trend in the US income statement for some time now, the Treasury’s debt-servicing costs rose once again in November. Gross interest costs totaled $87 billion, up $7 billion from $80 billion in the same month a year before.

And if the November print seems low by recent standards, just wait one month: the December gross interest payment will be an absolute shocker as that’s when the bulk of interest payments take place. For December, expect a number north of $150 billion in interest alone!

And while we wait, this is what a chart of LTM spending across the main categories looks like. Yes, gross interest spending is not only the second largest outlay for the US government, just shy of $1.2 trillion, it’s also the highest it has ever been, and will continue rising, especially if/when the Fed ends its easing cycle prematurely due to rising prices sparking the next meltup…. in US interest payment.

The good news is that for now (certainly until the December explosion), the surge in US interest payments has been delayed. That’s because the weighted average interest rate for total outstanding debt at the end of November was 3.36%, at roughly 15-year highs, but down slightly from the month before, the third monthly decline.

However, don’t expect this decline in interest spending to persist because even though the Fed has cut rates twice since September, this has been more than offset by the surge in debt which at last check was now $36.2 trillion, up half a trillion from a month ago, and unless Elon’s Department for Government Efficiency (DOGE) manages to somehow slash trillions in both spending and interest, this is what US debt will look like for the next few years, guaranteeing that interest on said debt will very soon become the single largest spending category for the US government.

It’s either going to work or it’s not. Here is the alternative https://t.co/cHZA2wHnPB pic.twitter.com/LMEI4tISZL

— zerohedge (@zerohedge) November 13, 2024

For those who were still unsure if buying votes has a cost associated with it, now you know.

The mindblowing figures illustrate the monumental challenge for Trump and all those promising to rein in US debt, which has exploded to 120% of GDP after four years of Biden’s “drunken-sailor” spending ways. The last hope for the US is that Trump has tapped Elon Musk and Vivek Ramaswamy to look at ways to cut spending. Alas, these figures show that the bulk of the outlays are in areas that are bound to be a politically explosive to address, in other words any cuts even remotely close to the $2 trillion suggested by Vivek would lead to a full-blown deep state revolt… and government cataclysm.

It’s also why attempts to reroute the US from its inevitable collision with the iceberg of fiscal devastation will likewise end in ruin.

Loading…