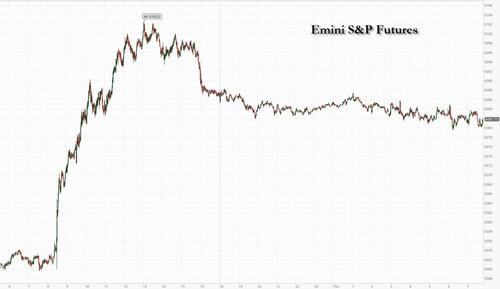

US equity futures and European bourses trade lower as bond yields rise 2-3bps across the curve as Treasury yields rose ahead of the Fed's policy meeting next week and ahead of today's ECB rate cut (preview here). As of 8:00am ET, S&P futures are down 0.2% and Nasdaq futures slide 0.4% after disappointing guidance by Adobe sent the stock tumbling, even though pre-mkt, Mag7 names are mostly higher led by GOOG/TSLA, but Tech overall is lagging after the Nasdaq set a new ATH yesterday. Both indexes made strong gains on Wednesday, when an in-line US inflation print cemented swap markets’ expectations of a a quarter-point rate cut at the Fed’s Dec. 17-18 meeting. The USD is weaker and commodities are mostly bid led by energy, Ags, and base metals. Banks are weaker despite positive reports at an industry conference. Today’s macro focus is on PPI (Core exp. 0.2% MoM, 3.2% YoY) and Jobless Claims (exp. 220K).

In premarket trading, Adobe tumbled 11% after giving a disappointing annual sales outlook, underscoring anxieties that the software company may lose business to emerging artificial intelligence-based startups.

- Gambling.com Group (GAMB) climbs 5% as the company is in advanced negotiations to buy OddsJam, an online service that helps sports bettors find the best odds, according to people familiar with the matter.

- Keros Therapeutics (KROS) plunges 71% after halting higher dosing in a part of the drug developer’s trial of an experimental therapy for patients with a lung disease, citing side effects.

- Kroger (KR), whose planned merger with fellow grocery giant Albertsons was scuttled this week, climbs 2% after announcing a $7.5 billion share buyback program.

- Lovesac (LOVE) tumbles 19% after the furniture retailer cut its net sales guidance for the full year.

Next up we get the European Central Bank, which is expected to lower policy rates by a quarter-point, following on from the Swiss National Bank’s surprising 50 basis-point reduction earlier in the day. With an ECB cut, its fourth this year, already baked in, traders will wait for clues from rate-setters on the extent of loosening needed in this cycle.

“We anticipate a dovish 25-basis-point rate cut, alongside signals of flexibility on future adjustments,” said Mohamad Al-Saraf, an FX and rates analyst at Danske Bank. “Post-decision communication will be pivotal, given divisions within the Governing Council.” Ahead of the ECB, the euro firmed as much as 0.7% against the Swiss franc, while Switzerland’s stocks and bonds climbed immediately after the rate cut, which aims to prevent further franc gains and stop an inflation undershoot.

The ECB cut will be the latest of this week’s moves towards more policy easing by major central banks. Prior to the Swiss rate cut, Canada lowered its policy rates by a half point, Australia hinted it’s moving toward cuts and China vowed to deliver rate cuts. Japan, however, signaled it’s in no hurry to hike rates.

Traders are also waiting for US producer inflation numbers due later Thursday, alongside the weekly jobless claims print for further clues on prices and the health of the economy. Analysts at Brown Brothers Harriman noted that still-elevated price pressures “argue for a shallow Fed easing cycle.”

Among individual stock movers, software firm Adobe Inc. dropped more than 10% in US premarket trading after a weaker-than-expected full-year forecast, while Uber Technologies Inc. was lifted by upbeat management comments at an industry conference.

European stocks are little changed as losses in retail and health care shares are offset by gains in autos and energy. Luxury goods firm Brunello Cucinelli SpA rallied after an increased revenue growth forecast. Luxury stocks were broadly firmer alongside other China-exposed sectors such as miners, after the country’s commerce ministry said it’s open to trade talks with the US. Here are the biggest movers Thursday:

- Lonza shares jump as much as 7.7%, the most since July, after the health care group announced that it would divest from its capsule business at an appropriate time

- Diageo shares rise as much as 3.9% after the alcoholic beverage maker was upgraded by analysts at UBS in a note published on Wednesday. They believe the earnings downgrade cycle is approaching its end and see upside potential to its US business

- Grifols shares gained as much as 9.2% after the Spanish drugmaker raised €1.3 billion in a private debt placement and its long-term rating was upgraded by S&P to B+ from B

- Temenos shares gain as much as 7.9% to a one-month high after it received an upgrade to buy from hold at Jefferies, which sees the Swiss banking software firm’s new CEO and strategy as providing a “welcome kick-start”

- Brunello Cucinelli shares rise as much as 7.1% to a eight-month high after the luxury goods maker increased its revenue growth forecast. Analysts said that this shows the Italian firm’s resilience and the benefits of its exposure to the US market and wealthy clients

- Watches of Switzerland shares gain 4.1% after Kepler Cheuvreux lifts to buy on its exposure to high-end watches and the US market

- Inditex shares drop as much as 3.3%, after RBC downgraded the Zara owner to underperform from sector perform. RBC notes the valuation remains quite full, even with the sharp decline after Wednesday’s nine-month earning

- Sopra Steria shares fall as much as 6.9%, the most since July, after some analysts found the IT services provider’s new Ebit margin outlook disappointing. The firm’s management will explain its strategy at its capital markets day this morning

- Nemetschek drops as much as 4.8%, the most in 14 weeks, after JPMorgan starts coverage of the German real estate software firm at underweight and says earnings-growth trajectory is being overestimated by consensus

- SThree shares plummet as much as 36%, a record drop that has sent the stock to a four-year low, after the recruitment company significantly downgraded its profit expectations for FY25

Earlier in the session, Asian stocks rose, driven by gains in tech shares after benign US inflation backed the case for a Federal Reserve rate cut next week. The MSCI Asia Pacific Index jumped as much as 1.1%, the most in a week. Major contributors to the gauge’s rise included TSMC, Tencent and Samsung Electronics. A sub-gauge of information technology shares gained as much as 1.8%. The advance tracks a rally on Wall Street, where the tech-heavy Nasdaq 100 Index jumped 1.9% to a record high. Also of focus in the region is whether China will release details on the outcome of a key economic meeting that’s expected to conclude Thursday. Benchmarks in Hong Kong rose more than 1% on bets for stronger stimulus. Japanese equities closed higher for a fourth consecutive day, supported by the yen’s recent weakness. Bloomberg News reported that Bank of Japan officials see little cost to waiting before raising interest rates. Shares in South Korea jumped on expectations that President Yoon Suk Yeol may get impeached in a parliament vote this weekend for his failed martial law bid. Some market watchers have been saying that his ouster will ease political uncertainty and help stabilize sentiment.

“We are yet to be convinced to go overweight in Chinese equities, largely because we have not really seen a meaningful pick up in domestic demand,” Dayeon Hong, a multi-asset portfolio manager at Shinhan Asset Management Co. in Seoul, said in a Bloomberg TV interview. She added that China may see more upside potential in growth next year if boosted by “moderately loose” monetary policy and proactive fiscal policy.

In FX, the Bloomberg dollar index steadied as China set a stronger yuan fixing, a day after the currency weakened following a Reuters report that a depreciation was being considered. The euro adds a few pips ahead of the ECB decision where a 25-bp interest rate cut is widely expected. Most economists also saw the Swiss National Bank delivering a quarter-point reduction but policymakers opted for a larger 50-bp move, sending the franc to the bottom of the G-10 FX leader board with 0.2% fall against the dollar. The Aussie dollar is still the best performer, rising 0.8% after solid jobs data prompted traders to pare their rate cut bets.

In rates, treasury futures are near session lows in early US dealing as concession continues to build for $22 billion 30-year bond auction at 1pm New York time. Treasuries fell for a fourth day, pushing US 10-year yields up 3 bps to 4.30%. European government bonds also decline, led by Italy. Other factors include crude oil extending its weekly climb and a curve-steepening selloff in gilts. ECB rate decision at 8:15am is expected to be a quarter-point rate cut, following a surprise 50bp cut by the SNB. US yields are 2.5bp to 3bp higher across maturities, with the 10-year around 4.3%, outperforming gilts by roughly 1bp in the sector; US curve spreads are little changed on the day. Week’s Treasury auction cycle concludes with the 30-year bond reopening; demand was strong for Wednesday’s 10-year note sale , which stopped through by 1.7bp.

In commodities, oil prices are off the highs after the IEA said markets still face a glut next year despite the recent OPEC+ decision. WTI rises 0.2% to $70.40. Spot gold falls $5. Bitcoin rises back above $100,000.

Today's US economic data calendar includes November PPI and weekly jobless claims (8:30am) and 3Q household change in net worth (12pm).

Market Snapshot

- S&P 500 futures down 0.2% to 6,082.00

- STOXX Europe 600 little changed at 519.44

- MXAP up 0.7% to 187.53

- MXAPJ up 0.6% to 589.57

- Nikkei up 1.2% to 39,849.14

- Topix up 0.9% to 2,773.03

- Hang Seng Index up 1.2% to 20,397.05

- Shanghai Composite up 0.8% to 3,461.50

- Sensex down 0.4% to 81,228.48

- Australia S&P/ASX 200 down 0.3% to 8,330.26

- Kospi up 1.6% to 2,482.12

- German 10Y yield little changed at 2.16%

- Euro up 0.2% to $1.0513

- Brent Futures up 0.4% to $73.83/bbl

- Brent Futures up 0.4% to $73.84/bbl

- Gold spot down 0.1% to $2,716.44

- US Dollar Index down 0.16% to 106.54

Top Overnight News

- Donald Trump invited Xi Jinping to attend his inauguration, CBS reported. Xi’s attendance would be unprecedented and may signal an effort by Trump to court him amidst threats of fresh tariffs against China. BBG

- The Bank of Japan is leaning toward keeping interest rates steady next week as policymakers prefer to spend more time scrutinizing overseas risks and clues on next year's wage outlook. Any such decision will heighten the chance of an interest rate hike at the central bank's subsequent meeting in January or March. RTRS

- The Japanese parliament’s lower house passed a ¥13.9 trillion extra budget to help finance PM Shigeru Ishiba’s economic stimulus package. BBG

- South Korea’s opposition filed a second impeachment motion against President Yoon Suk Yeol as more ruling party members indicated they’ll support it. BBG

- The Swiss franc fell after the SNB delivered a bigger-than-expected half-point cut to its key rate to 0.5%. Another reduction will probably come in March, taking the rate to 0.25%, citing pressure from the easing of other central banks. BBG

- Mike Waltz, Trump’s national security advisor, warned that Iran will see a significant increase in sanctions and pressure once the new administration takes office. BBG

- Hamas has yielded to two of Israel’s key demands for a cease-fire deal in Gaza, raising hopes of an agreement that could release some hostages within days despite the repeated collapse of previous negotiations. WSJ

- Oil markets globally will see plentiful supply in 2025 even if the OPEC+ production cuts aren’t unwound according to the IEA (oil supply is on track to increase 630K B/D this year and 1.9M in 2025 even in the absence of OPEC+ unwinding). IEA

- The US plans a new loophole-closing rule aimed at curbing Chinese firms’ sourcing of AI chips from unrestricted third-party countries, the SCMP reported. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually mimicked the sentiment on Wall Street and traded mostly higher following a slow start to the session and despite a lack of macro news flow. ASX 200 saw its earlier gains hampered after a strong Aussie jobs report which followed the dovish RBA yesterday, in which Governor Bullock said the Board will be watching all data including employment. Nikkei 225 reclaimed the 40,000 level for the first time since mid-October with gains driven by the Industrial and IT sectors, although at one point, the upside was capped by the firmer JPY. Hang Seng and Shanghai Comp were somewhat lethargic at the start, but momentum picked up, although there was little notable reaction seen on reports that US President-elect Trump invited Chinese President Xi to attend his inauguration next month, whilst it was not clear whether Xi has accepted the invitation. Participants now await the outcome of the Central Economic Work Conference.

Top Asian News

- South Korean opposition files a second motion to impeach President Yoon, via Bloomberg

- China's Commerce Ministry say China is open to contact and communication with the Trump administration's economic and trade team

- US President-elect Trump has invited Chinese President Xi to attend his inauguration next month, multiple sources told CBS News; it was not clear whether Xi has accepted the invitation.

- BoJ is reportedly leaning toward keeping rates steady next week, according to Reuters sources; there is no consensus within the bank on the final decision, some believe conditions have been met for a December hike; BoJ could hike if FOMC decision triggers JPY selloff. Many policymakers appear in no rush to pull the trigger with little risk of inflation overshooting, sources added.

- Japanese companies are reportedly worried about tariff hikes and US-China relations, according to a Reuters survey; Nearly three-quarters of Japanese companies expect Trump's next term to have a negative impact on the business environment.

- South Korean Finance Minister said they will closely monitor financial markets and respond to boost investor sentiment if needed, according to Reuters.

- South Korean President Yoon said he will fight until the last moment, according to Reuters.

European bourses began the session entirely in the green, albeit modestly so. As the morning progressed, some indices slipped into negative territory to display a slightly more mixed picture in Europe. European sectors began the session with a strong positive bias, but in a turn of fortunes now display a mostly negative picture. Autos lead, followed by Energy/Basic Resources; the pair lifted by gains in the underlying. Retail is the clear underperformer, continuing the pressure seen in the prior session. US equity futures are very modestly on the backfoot, with the NQ paring back some of the hefty gains seen in the prior session.

Top European News

- UK RICS Housing Survey (Nov) 25.0 vs. Exp. 19.0 (Prev. 16.0); highest since September 2022.

- India-UK Free Trade Agreement talks to commence at the end of January, according to an Indian government source cited by Reuters.

- Swiss SNB Policy Rate (Q4) 0.50% vs. Exp. 0.75% (Prev. 1.00%); "also remains willing to be active in the foreign exchange market as necessary". SNB's Schlegel says development of CHF is still the important factor. Remains willing to intervene as necessary. Rate cuts remain the main policy instrument if further easing is required. Uncertainty on future inflation path is high, inflationary pressure has decreased markedly over the medium term. SNB still has room for further interest rate moves. Main instrument is policy rate, with that can influence the economy and exchange rate. This step us intended to stabilise inflation between 0 and 2%. Can tolerate weakening of inflation below 0-2% target range, as long as it is temporary. SNB Chair Schlegel says the SNB does not like negative interest rates; the likelihood of negative interest rates has become small.

- German Economy expected to stagnated in 2025 (prev. forecast 0.5%); German GDP expected to expand by 0.9% in 2026.

- Ifo institute forecasts Germany's growth between 0.4 - 1.1% in 2025. If German economy fails to overcome structural challenges, only 0.4% growth compared to the 1.1% if the right economic policy course is set. Expects 2.3% inflation in 2025 and 2.0% in 2026, in both scenarios

FX

- USD is steady after an early bout of weakness that didn't appear to be driven by any particularly obvious catalyst. Looking ahead, focus remains on price data following yesterday's CPI report with PPI metrics due on deck. DXY remains within yesterday's 106.26-80 range.

- EUR/USD is just about holding above the 1.05 mark in the run-up to today's ECB rate decision. Consensus looks for the ECB to deliver a 25bps rate cut with just an 18% chance of a deeper 50bps cut. EUR/USD currently sits within yesterday's 1.0480-1.0539 range.

- USD/JPY is a touch higher after a choppy APAC session which saw initial JPY strength fade following source reporting via Reuters that the BoJ is leaning towards keeping rates steady next week, albeit, there is no consensus within the bank on the final decision. Currently sits towards the top end of yesterday's 151.00-152.86 range.

- GBP is relatively contained vs. the USD as UK-specific drivers remain light. Tomorrow's monthly GDP print unlikely to be a gamechanger for the BoE. Cable briefly eclipsed yesterday's best, printing a session peak at 1.2787 before settling into yesterday's 1.2714-1.2782 range.

- AUD is at the top of the G10 leaderboard following the Aussie jobs report which saw Employment Change topping forecasts (driven by full-time employment) whilst the Unemployment Rate surprisingly fell to 3.9% despite forecasts of an uptick to 4.2% from 4.1%, although the Participation Rate surprisingly dipped. AUD/USD saw a boost nonetheless and moved back onto a 0.64 handle.

- CHF is on the backfoot after the SNB surprised markets by pulling the trigger on a deeper 50bps cut vs. expectations of a smaller 25bps move. The decision was accompanied by a reiteration that the Bank remains willing to intervene in the FX market as necessary whilst 2024 and 2025 inflation forecasts were lowered.

- PBoC set USD/CNY mid-point at 7.1854 vs exp. 7.2438 (prev. 7.1843)

Brazil Central Bank

- Brazilian Selic Interest Rate 12.25% vs. Exp. 12.0% (Prev. 11.25%); decision unanimous; in light of more adverse inflation scenario, the committee sees hikes of the same magnitude at the next two meetings.

- Brazilian Finance Minister Haddad said BCB decision was a surprise but pricing pointed to a move like that; and added there is no decision about changing the fiscal package, according to Reuters.

- Banxico financial stability report: Mexico's financial system has a resilient and solid position; stress tests confirmed that the banking system as a whole has the capacity to absorb significant shocks.

Fixed Income

- USTs are in the red, but only modestly so. Action which came after a selloff emerged at the end of Wednesday’s US session into settlement, no specific driver behind this at the time. Currently at a low of 110-16 and continuing to slip from an initial 110-24 high print.

- Bunds are a little softer in-fitting with peers but ultimately awaiting the ECB later. Macro drivers otherwise have been somewhat light aside from the SNB which delivered a 50bps move. An announcement which sparked some modest EGB upside. As it stands, Bunds are at a 135.56 base having faded from an SNB-driven peak of 135.85, downside which was marginally added to by SNB’s Schlegel remarking that they do not like negative rates and the likelihood of a return to NIRP is small.

- OATs are a little softer with President Macron expected to announce his new PM today. As it stands, it is unclear who Macron will propose with the likes of former Justice Minister Bayrou and current Defense Minister Lecornu among those touted.

- Gilts are in-fitting with peers. Lost the 95.00 mark early doors and has since slipped to a 94.89 base.

- Italy sells EUR 8.5bln vs exp. EUR 6.75-8.5bln 2.70% 2027, 3.15% 2031, 3.35% 2035, 4.30% 2054 BTP:

Commodities

- WTI and Brent are incrementally firmer on the session, though only modestly so in comparison to the action seen on Wednesday. Nonetheless, benchmarks continue to advance on the USD 70/bbl and USD 73/bbl handles respectively; in recent trade, prices have almost entirely pared overnight strength. Downside was seen following the IEA OMR, where it cut its 2024 world oil demand growth forecast.

- Gold is essentially unchanged at the USD 2715/oz level. Unable to gain any traction amid ongoing USD strength and yield advances, though the metal has avoided a move into the red seemingly on the back of the tepid/mixed European risk tone.

- Base metals generally hold a positive bias; copper is a little more contained, with 3M LME just above the USD 9.2k mark.

- Saudi crude supply to China is to rise to around 46mln barrels in January, via Reuters citing sources (around 36.5mln in Dec., around 46mln in Nov).

- IEA Monthly Oil Market Report: cuts 2024 world oil demand growth forecast to 840k BPD (prev. 920k BPD); raises 2025 forecast to 1.1mln BPD (prev. 990k BPD), citing Chinese stimulus measures. World oil market looks comfortably supplied next year. Current balances suggest a 950k BPD overhand in 2025 if OPEC+ begins unwinding voluntary cuts as of the end of March 2025.

- India is reportedly to decide soon on whether to impose curbs on the imports of steelmaking raw materials, via Reuters citing sources.

Geopolitics: Middle East

- Israeli troops have entered Syria buffer zone on a temporary basis, according to Bloomberg

- "Hamas agreed to the presence of Israeli forces in Gaza after a ceasefire goes into effect", according to Kann News.

- "Israeli army announces the withdrawal from the tents area in southern Lebanon in accordance with the ceasefire agreement ", according to Al Arabiya.

Geopolitics: Other

- China's President Xi says China is willing to strengthen strategic alignment with Russia, and tap into the intrinsic driving force of bilateral cooperation, via state media.

- Russia's Navy Chief says that NATO has increased its military activity in the arctic region, via Ria; naval grouping of Russian nuclear forces has been completely renewed, via Tass.

- US President-elect Trump is reportedly considering ex-intelligence chief Richard Grenell as Special Envoy for Iran, according to Reuters sources; the article suggests consideration of a key ally for the position sends a signal that Trump may be open to talks.

- US House of Representatives passed USD 895bln defence policy bill, according to Reuters.

US Event Calendar

- 08:30: Dec. Initial Jobless Claims, est. 220,000, prior 224,00008:30: Nov. PPI Final Demand YoY, est. 2.6%, prior

- Nov. Continuing Claims, est. 1.88m, prior 1.87m

- 08:30: Nov. PPI Final Demand MoM, est. 0.2%, prior 0.2%

- Nov. PPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- Nov. PPI Final Demand YoY, est. 2.6%, prior 2.4%

- Nov. PPI Ex Food and Energy YoY, est. 3.2%, prior 3.1%

- 12:00: 3Q US Household Change in Net Worth, prior $2.76t

DB's Jim Reid concludes the overnight wrap

Markets put in a decent performance yesterday, as the US CPI report came in broadly as expected, which was seen as giving the all-clear for the Fed to cut rates next week. That meant futures dialled up the likelihood of a 25bp rate cut to 99% by the close. And on top of that, the S&P 500 (+0.82%) ended the session just a whisker beneath its all-time high, with the Magnificent 7 (+3.08%) powering forward to a new record.

In terms of the details of that CPI print, the monthly headline and core CPI readings were both at +0.31% in November. So that was basically in line with the +0.3% print the consensus was expecting. So even though inflation was still running a bit too fast for the Fed to be comfortable, markets were relieved that it wasn’t an even higher number that would prevent the Fed cutting rates next week. After all, core CPI has now been running at +0.3% for four consecutive months, and the 3-month annualised rate for core CPI ticked up to +3.7%, so this isn’t just a case of one strong print. And in turn, that’s led to growing concern that inflation is becoming sticky above target, even if we’re not seeing the really high numbers of a couple of years ago. For the year-on-year numbers, the latest release meant headline CPI ticked up to +2.7%, whilst the core CPI print was steady at 3.3%, where it’s been for the last three months now.

Admittedly, one piece of good news was that shelter and services inflation moderated, and those are fairly sticky categories, even if this decline was offset by stronger goods prices. But even though Treasury yields fell by several basis points after the CPI print, lingering inflation concerns saw this move reverse later on. For instance, 10yr yields closed near the session highs (+4.5bps to 4.27%), rising for a third consecutive day despite a solid 10yr auction.

Nevertheless, when it comes to the Fed, the CPI print left little doubt among investors that another rate cut will happen next week. Indeed, futures moved up the likelihood of a cut from 86% right before the CPI came out to 99% by the close. It’s true that inflation is still too fast for their liking, but last week’s jobs report also saw a fresh rise in the unemployment rate, so our US economists think that will still enable them to cut next week.

Looking forward, central banks will stay in the spotlight today, as the ECB are announcing their latest policy decision at 13:15 London time. They’re widely expected to cut their deposit rate by another 25bps, taking it down to 3%, and that would bring their total rate cuts to 100bps since they began in June. Our European economists are also looking for a 25bp cut today, and they expect the doves and hawks to compromise on a mildly dovish evolution in communications. For next year, they then see the ECB continuing to cut by 25bps per meeting in H1, followed by quarterly 25bp cuts in H2, leaving the deposit rate at 1.5% by end-2025. See their full preview here for more details.

Ahead of the ECB, European assets put in a strong performance yesterday. At the front-end, bond yields fell across the continent, with French, Italian and Spanish 2yr yields falling to their lowest levels since 2022. And while 10yr bund yields inched up (+0.7bps), both the Italian and Spanish 10yr spreads over bunds reached their tightest level in three years yesterday, at 106bps and 63bps, respectively. Equities put in a decent performance too, with the STOXX 600 (+0.28%) clawing back some of the previous day’s losses as the DAX (+0.34%), CAC 40 (+0.39%) and FTSE 100 (+0.26%) all advanced.

For US equities, it was another day of the tech mega caps dominating. Four of the Magnificent 7 posted new record highs, namely Alphabet (+5.52%), Amazon (+2.32%), Meta (+2.16%) and Tesla (+5.93%). And Broadcom (+6.63%) surged after a report that it was working on an AI chip with Apple. That saw the S&P 500 (+0.82%) close less than 0.1% beneath its all-time high, even though the equal-weighted version of the index is still over -2% beneath its record.

Elsewhere yesterday, the Bank of Canada delivered a 50bp rate cut that took their policy rate down to 3.25%. That’s the second 50bp cut in a row they’ve delivered, but they sounded more cautious about future cuts, saying in their statement that “we will be evaluating the need for further reductions in the policy rate one decision at a time.” That saw the 10yr Canadian yield move +6.7bps higher to 3.08%.

Meanwhile in Germany, the election process started to get under way yesterday, as Chancellor Scholz requested a confidence vote next Monday in the Bundestag. It follows the collapse of the federal coalition last month, when Scholz sacked the finance minister Christian Lindner, who leads the FDP. Once the government loses the vote of no confidence, Scholz can then request an election from the President, which is planned for February 23.

Overnight in Asia, those strong gains on Wall Street have continued across the board, with global markets hopeful about another Fed rate cut. Most of the major indices have posted a decent gain, including the Nikkei (+1.28%), the Hang Seng (+1.31%), the CSI 300 (+0.59%), the Shanghai Comp (+0.50%) and the KOSPI (+1.22%). The only notable exception to that is Australia’s S&P/ASX 200 (-0.28%), which follows a very strong employment report for November that’s led markets to dial back the likelihood of rate cuts from the RBA. It showed the unemployment rate unexpectedly falling to 3.9% (vs. 4.2% expected), and Australia’s government bond yield is up +8.0bps overnight in response, and the Australian Dollar has strengthened by +0.73% against the US Dollar. Looking forward, US equity futures are pointing a bit lower this morning, with those on the S&P 500 down -0.13%, whilst the 10yr Treasury (+1.2bps) is up to 4.28% overnight.

Separately in the FX space, yesterday saw the Japanese yen weaken after Bloomberg reported that Bank of Japan officials saw little cost of waiting to hike rates. The report suggested that even if they waited until January or longer, they only saw a low risk of inflation overshooting. Following the report, investors further dialled back the likelihood of a December rate hike, and the Japanese Yen ended the session -0.32% weaker against the US Dollar, where it remains unchanged this morning. In the meantime, China’s offshore yuan weakened -0.29% yesterday, which followed a Reuters report that policymakers were considering allowing the currency to depreciate as a response to any trade war with the US.

To the day ahead now, and the main highlight will be the ECB’s latest policy decision, along with President Lagarde’s subsequent press conference. In terms of data, we’ll also get the US PPI for November and the weekly initial jobless claims.

US equity futures and European bourses trade lower as bond yields rise 2-3bps across the curve as Treasury yields rose ahead of the Fed’s policy meeting next week and ahead of today’s ECB rate cut (preview here). As of 8:00am ET, S&P futures are down 0.2% and Nasdaq futures slide 0.4% after disappointing guidance by Adobe sent the stock tumbling, even though pre-mkt, Mag7 names are mostly higher led by GOOG/TSLA, but Tech overall is lagging after the Nasdaq set a new ATH yesterday. Both indexes made strong gains on Wednesday, when an in-line US inflation print cemented swap markets’ expectations of a a quarter-point rate cut at the Fed’s Dec. 17-18 meeting. The USD is weaker and commodities are mostly bid led by energy, Ags, and base metals. Banks are weaker despite positive reports at an industry conference. Today’s macro focus is on PPI (Core exp. 0.2% MoM, 3.2% YoY) and Jobless Claims (exp. 220K).

In premarket trading, Adobe tumbled 11% after giving a disappointing annual sales outlook, underscoring anxieties that the software company may lose business to emerging artificial intelligence-based startups.

- Gambling.com Group (GAMB) climbs 5% as the company is in advanced negotiations to buy OddsJam, an online service that helps sports bettors find the best odds, according to people familiar with the matter.

- Keros Therapeutics (KROS) plunges 71% after halting higher dosing in a part of the drug developer’s trial of an experimental therapy for patients with a lung disease, citing side effects.

- Kroger (KR), whose planned merger with fellow grocery giant Albertsons was scuttled this week, climbs 2% after announcing a $7.5 billion share buyback program.

- Lovesac (LOVE) tumbles 19% after the furniture retailer cut its net sales guidance for the full year.

Next up we get the European Central Bank, which is expected to lower policy rates by a quarter-point, following on from the Swiss National Bank’s surprising 50 basis-point reduction earlier in the day. With an ECB cut, its fourth this year, already baked in, traders will wait for clues from rate-setters on the extent of loosening needed in this cycle.

“We anticipate a dovish 25-basis-point rate cut, alongside signals of flexibility on future adjustments,” said Mohamad Al-Saraf, an FX and rates analyst at Danske Bank. “Post-decision communication will be pivotal, given divisions within the Governing Council.” Ahead of the ECB, the euro firmed as much as 0.7% against the Swiss franc, while Switzerland’s stocks and bonds climbed immediately after the rate cut, which aims to prevent further franc gains and stop an inflation undershoot.

The ECB cut will be the latest of this week’s moves towards more policy easing by major central banks. Prior to the Swiss rate cut, Canada lowered its policy rates by a half point, Australia hinted it’s moving toward cuts and China vowed to deliver rate cuts. Japan, however, signaled it’s in no hurry to hike rates.

Traders are also waiting for US producer inflation numbers due later Thursday, alongside the weekly jobless claims print for further clues on prices and the health of the economy. Analysts at Brown Brothers Harriman noted that still-elevated price pressures “argue for a shallow Fed easing cycle.”

Among individual stock movers, software firm Adobe Inc. dropped more than 10% in US premarket trading after a weaker-than-expected full-year forecast, while Uber Technologies Inc. was lifted by upbeat management comments at an industry conference.

European stocks are little changed as losses in retail and health care shares are offset by gains in autos and energy. Luxury goods firm Brunello Cucinelli SpA rallied after an increased revenue growth forecast. Luxury stocks were broadly firmer alongside other China-exposed sectors such as miners, after the country’s commerce ministry said it’s open to trade talks with the US. Here are the biggest movers Thursday:

- Lonza shares jump as much as 7.7%, the most since July, after the health care group announced that it would divest from its capsule business at an appropriate time

- Diageo shares rise as much as 3.9% after the alcoholic beverage maker was upgraded by analysts at UBS in a note published on Wednesday. They believe the earnings downgrade cycle is approaching its end and see upside potential to its US business

- Grifols shares gained as much as 9.2% after the Spanish drugmaker raised €1.3 billion in a private debt placement and its long-term rating was upgraded by S&P to B+ from B

- Temenos shares gain as much as 7.9% to a one-month high after it received an upgrade to buy from hold at Jefferies, which sees the Swiss banking software firm’s new CEO and strategy as providing a “welcome kick-start”

- Brunello Cucinelli shares rise as much as 7.1% to a eight-month high after the luxury goods maker increased its revenue growth forecast. Analysts said that this shows the Italian firm’s resilience and the benefits of its exposure to the US market and wealthy clients

- Watches of Switzerland shares gain 4.1% after Kepler Cheuvreux lifts to buy on its exposure to high-end watches and the US market

- Inditex shares drop as much as 3.3%, after RBC downgraded the Zara owner to underperform from sector perform. RBC notes the valuation remains quite full, even with the sharp decline after Wednesday’s nine-month earning

- Sopra Steria shares fall as much as 6.9%, the most since July, after some analysts found the IT services provider’s new Ebit margin outlook disappointing. The firm’s management will explain its strategy at its capital markets day this morning

- Nemetschek drops as much as 4.8%, the most in 14 weeks, after JPMorgan starts coverage of the German real estate software firm at underweight and says earnings-growth trajectory is being overestimated by consensus

- SThree shares plummet as much as 36%, a record drop that has sent the stock to a four-year low, after the recruitment company significantly downgraded its profit expectations for FY25

Earlier in the session, Asian stocks rose, driven by gains in tech shares after benign US inflation backed the case for a Federal Reserve rate cut next week. The MSCI Asia Pacific Index jumped as much as 1.1%, the most in a week. Major contributors to the gauge’s rise included TSMC, Tencent and Samsung Electronics. A sub-gauge of information technology shares gained as much as 1.8%. The advance tracks a rally on Wall Street, where the tech-heavy Nasdaq 100 Index jumped 1.9% to a record high. Also of focus in the region is whether China will release details on the outcome of a key economic meeting that’s expected to conclude Thursday. Benchmarks in Hong Kong rose more than 1% on bets for stronger stimulus. Japanese equities closed higher for a fourth consecutive day, supported by the yen’s recent weakness. Bloomberg News reported that Bank of Japan officials see little cost to waiting before raising interest rates. Shares in South Korea jumped on expectations that President Yoon Suk Yeol may get impeached in a parliament vote this weekend for his failed martial law bid. Some market watchers have been saying that his ouster will ease political uncertainty and help stabilize sentiment.

“We are yet to be convinced to go overweight in Chinese equities, largely because we have not really seen a meaningful pick up in domestic demand,” Dayeon Hong, a multi-asset portfolio manager at Shinhan Asset Management Co. in Seoul, said in a Bloomberg TV interview. She added that China may see more upside potential in growth next year if boosted by “moderately loose” monetary policy and proactive fiscal policy.

In FX, the Bloomberg dollar index steadied as China set a stronger yuan fixing, a day after the currency weakened following a Reuters report that a depreciation was being considered. The euro adds a few pips ahead of the ECB decision where a 25-bp interest rate cut is widely expected. Most economists also saw the Swiss National Bank delivering a quarter-point reduction but policymakers opted for a larger 50-bp move, sending the franc to the bottom of the G-10 FX leader board with 0.2% fall against the dollar. The Aussie dollar is still the best performer, rising 0.8% after solid jobs data prompted traders to pare their rate cut bets.

In rates, treasury futures are near session lows in early US dealing as concession continues to build for $22 billion 30-year bond auction at 1pm New York time. Treasuries fell for a fourth day, pushing US 10-year yields up 3 bps to 4.30%. European government bonds also decline, led by Italy. Other factors include crude oil extending its weekly climb and a curve-steepening selloff in gilts. ECB rate decision at 8:15am is expected to be a quarter-point rate cut, following a surprise 50bp cut by the SNB. US yields are 2.5bp to 3bp higher across maturities, with the 10-year around 4.3%, outperforming gilts by roughly 1bp in the sector; US curve spreads are little changed on the day. Week’s Treasury auction cycle concludes with the 30-year bond reopening; demand was strong for Wednesday’s 10-year note sale , which stopped through by 1.7bp.

In commodities, oil prices are off the highs after the IEA said markets still face a glut next year despite the recent OPEC+ decision. WTI rises 0.2% to $70.40. Spot gold falls $5. Bitcoin rises back above $100,000.

Today’s US economic data calendar includes November PPI and weekly jobless claims (8:30am) and 3Q household change in net worth (12pm).

Market Snapshot

- S&P 500 futures down 0.2% to 6,082.00

- STOXX Europe 600 little changed at 519.44

- MXAP up 0.7% to 187.53

- MXAPJ up 0.6% to 589.57

- Nikkei up 1.2% to 39,849.14

- Topix up 0.9% to 2,773.03

- Hang Seng Index up 1.2% to 20,397.05

- Shanghai Composite up 0.8% to 3,461.50

- Sensex down 0.4% to 81,228.48

- Australia S&P/ASX 200 down 0.3% to 8,330.26

- Kospi up 1.6% to 2,482.12

- German 10Y yield little changed at 2.16%

- Euro up 0.2% to $1.0513

- Brent Futures up 0.4% to $73.83/bbl

- Brent Futures up 0.4% to $73.84/bbl

- Gold spot down 0.1% to $2,716.44

- US Dollar Index down 0.16% to 106.54

Top Overnight News

- Donald Trump invited Xi Jinping to attend his inauguration, CBS reported. Xi’s attendance would be unprecedented and may signal an effort by Trump to court him amidst threats of fresh tariffs against China. BBG

- The Bank of Japan is leaning toward keeping interest rates steady next week as policymakers prefer to spend more time scrutinizing overseas risks and clues on next year’s wage outlook. Any such decision will heighten the chance of an interest rate hike at the central bank’s subsequent meeting in January or March. RTRS

- The Japanese parliament’s lower house passed a ¥13.9 trillion extra budget to help finance PM Shigeru Ishiba’s economic stimulus package. BBG

- South Korea’s opposition filed a second impeachment motion against President Yoon Suk Yeol as more ruling party members indicated they’ll support it. BBG

- The Swiss franc fell after the SNB delivered a bigger-than-expected half-point cut to its key rate to 0.5%. Another reduction will probably come in March, taking the rate to 0.25%, citing pressure from the easing of other central banks. BBG

- Mike Waltz, Trump’s national security advisor, warned that Iran will see a significant increase in sanctions and pressure once the new administration takes office. BBG

- Hamas has yielded to two of Israel’s key demands for a cease-fire deal in Gaza, raising hopes of an agreement that could release some hostages within days despite the repeated collapse of previous negotiations. WSJ

- Oil markets globally will see plentiful supply in 2025 even if the OPEC+ production cuts aren’t unwound according to the IEA (oil supply is on track to increase 630K B/D this year and 1.9M in 2025 even in the absence of OPEC+ unwinding). IEA

- The US plans a new loophole-closing rule aimed at curbing Chinese firms’ sourcing of AI chips from unrestricted third-party countries, the SCMP reported. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually mimicked the sentiment on Wall Street and traded mostly higher following a slow start to the session and despite a lack of macro news flow. ASX 200 saw its earlier gains hampered after a strong Aussie jobs report which followed the dovish RBA yesterday, in which Governor Bullock said the Board will be watching all data including employment. Nikkei 225 reclaimed the 40,000 level for the first time since mid-October with gains driven by the Industrial and IT sectors, although at one point, the upside was capped by the firmer JPY. Hang Seng and Shanghai Comp were somewhat lethargic at the start, but momentum picked up, although there was little notable reaction seen on reports that US President-elect Trump invited Chinese President Xi to attend his inauguration next month, whilst it was not clear whether Xi has accepted the invitation. Participants now await the outcome of the Central Economic Work Conference.

Top Asian News

- South Korean opposition files a second motion to impeach President Yoon, via Bloomberg

- China’s Commerce Ministry say China is open to contact and communication with the Trump administration’s economic and trade team

- US President-elect Trump has invited Chinese President Xi to attend his inauguration next month, multiple sources told CBS News; it was not clear whether Xi has accepted the invitation.

- BoJ is reportedly leaning toward keeping rates steady next week, according to Reuters sources; there is no consensus within the bank on the final decision, some believe conditions have been met for a December hike; BoJ could hike if FOMC decision triggers JPY selloff. Many policymakers appear in no rush to pull the trigger with little risk of inflation overshooting, sources added.

- Japanese companies are reportedly worried about tariff hikes and US-China relations, according to a Reuters survey; Nearly three-quarters of Japanese companies expect Trump’s next term to have a negative impact on the business environment.

- South Korean Finance Minister said they will closely monitor financial markets and respond to boost investor sentiment if needed, according to Reuters.

- South Korean President Yoon said he will fight until the last moment, according to Reuters.

European bourses began the session entirely in the green, albeit modestly so. As the morning progressed, some indices slipped into negative territory to display a slightly more mixed picture in Europe. European sectors began the session with a strong positive bias, but in a turn of fortunes now display a mostly negative picture. Autos lead, followed by Energy/Basic Resources; the pair lifted by gains in the underlying. Retail is the clear underperformer, continuing the pressure seen in the prior session. US equity futures are very modestly on the backfoot, with the NQ paring back some of the hefty gains seen in the prior session.

Top European News

- UK RICS Housing Survey (Nov) 25.0 vs. Exp. 19.0 (Prev. 16.0); highest since September 2022.

- India-UK Free Trade Agreement talks to commence at the end of January, according to an Indian government source cited by Reuters.

- Swiss SNB Policy Rate (Q4) 0.50% vs. Exp. 0.75% (Prev. 1.00%); “also remains willing to be active in the foreign exchange market as necessary”. SNB’s Schlegel says development of CHF is still the important factor. Remains willing to intervene as necessary. Rate cuts remain the main policy instrument if further easing is required. Uncertainty on future inflation path is high, inflationary pressure has decreased markedly over the medium term. SNB still has room for further interest rate moves. Main instrument is policy rate, with that can influence the economy and exchange rate. This step us intended to stabilise inflation between 0 and 2%. Can tolerate weakening of inflation below 0-2% target range, as long as it is temporary. SNB Chair Schlegel says the SNB does not like negative interest rates; the likelihood of negative interest rates has become small.

- German Economy expected to stagnated in 2025 (prev. forecast 0.5%); German GDP expected to expand by 0.9% in 2026.

- Ifo institute forecasts Germany’s growth between 0.4 – 1.1% in 2025. If German economy fails to overcome structural challenges, only 0.4% growth compared to the 1.1% if the right economic policy course is set. Expects 2.3% inflation in 2025 and 2.0% in 2026, in both scenarios

FX

- USD is steady after an early bout of weakness that didn’t appear to be driven by any particularly obvious catalyst. Looking ahead, focus remains on price data following yesterday’s CPI report with PPI metrics due on deck. DXY remains within yesterday’s 106.26-80 range.

- EUR/USD is just about holding above the 1.05 mark in the run-up to today’s ECB rate decision. Consensus looks for the ECB to deliver a 25bps rate cut with just an 18% chance of a deeper 50bps cut. EUR/USD currently sits within yesterday’s 1.0480-1.0539 range.

- USD/JPY is a touch higher after a choppy APAC session which saw initial JPY strength fade following source reporting via Reuters that the BoJ is leaning towards keeping rates steady next week, albeit, there is no consensus within the bank on the final decision. Currently sits towards the top end of yesterday’s 151.00-152.86 range.

- GBP is relatively contained vs. the USD as UK-specific drivers remain light. Tomorrow’s monthly GDP print unlikely to be a gamechanger for the BoE. Cable briefly eclipsed yesterday’s best, printing a session peak at 1.2787 before settling into yesterday’s 1.2714-1.2782 range.

- AUD is at the top of the G10 leaderboard following the Aussie jobs report which saw Employment Change topping forecasts (driven by full-time employment) whilst the Unemployment Rate surprisingly fell to 3.9% despite forecasts of an uptick to 4.2% from 4.1%, although the Participation Rate surprisingly dipped. AUD/USD saw a boost nonetheless and moved back onto a 0.64 handle.

- CHF is on the backfoot after the SNB surprised markets by pulling the trigger on a deeper 50bps cut vs. expectations of a smaller 25bps move. The decision was accompanied by a reiteration that the Bank remains willing to intervene in the FX market as necessary whilst 2024 and 2025 inflation forecasts were lowered.

- PBoC set USD/CNY mid-point at 7.1854 vs exp. 7.2438 (prev. 7.1843)

Brazil Central Bank

- Brazilian Selic Interest Rate 12.25% vs. Exp. 12.0% (Prev. 11.25%); decision unanimous; in light of more adverse inflation scenario, the committee sees hikes of the same magnitude at the next two meetings.

- Brazilian Finance Minister Haddad said BCB decision was a surprise but pricing pointed to a move like that; and added there is no decision about changing the fiscal package, according to Reuters.

- Banxico financial stability report: Mexico’s financial system has a resilient and solid position; stress tests confirmed that the banking system as a whole has the capacity to absorb significant shocks.

Fixed Income

- USTs are in the red, but only modestly so. Action which came after a selloff emerged at the end of Wednesday’s US session into settlement, no specific driver behind this at the time. Currently at a low of 110-16 and continuing to slip from an initial 110-24 high print.

- Bunds are a little softer in-fitting with peers but ultimately awaiting the ECB later. Macro drivers otherwise have been somewhat light aside from the SNB which delivered a 50bps move. An announcement which sparked some modest EGB upside. As it stands, Bunds are at a 135.56 base having faded from an SNB-driven peak of 135.85, downside which was marginally added to by SNB’s Schlegel remarking that they do not like negative rates and the likelihood of a return to NIRP is small.

- OATs are a little softer with President Macron expected to announce his new PM today. As it stands, it is unclear who Macron will propose with the likes of former Justice Minister Bayrou and current Defense Minister Lecornu among those touted.

- Gilts are in-fitting with peers. Lost the 95.00 mark early doors and has since slipped to a 94.89 base.

- Italy sells EUR 8.5bln vs exp. EUR 6.75-8.5bln 2.70% 2027, 3.15% 2031, 3.35% 2035, 4.30% 2054 BTP:

Commodities

- WTI and Brent are incrementally firmer on the session, though only modestly so in comparison to the action seen on Wednesday. Nonetheless, benchmarks continue to advance on the USD 70/bbl and USD 73/bbl handles respectively; in recent trade, prices have almost entirely pared overnight strength. Downside was seen following the IEA OMR, where it cut its 2024 world oil demand growth forecast.

- Gold is essentially unchanged at the USD 2715/oz level. Unable to gain any traction amid ongoing USD strength and yield advances, though the metal has avoided a move into the red seemingly on the back of the tepid/mixed European risk tone.

- Base metals generally hold a positive bias; copper is a little more contained, with 3M LME just above the USD 9.2k mark.

- Saudi crude supply to China is to rise to around 46mln barrels in January, via Reuters citing sources (around 36.5mln in Dec., around 46mln in Nov).

- IEA Monthly Oil Market Report: cuts 2024 world oil demand growth forecast to 840k BPD (prev. 920k BPD); raises 2025 forecast to 1.1mln BPD (prev. 990k BPD), citing Chinese stimulus measures. World oil market looks comfortably supplied next year. Current balances suggest a 950k BPD overhand in 2025 if OPEC+ begins unwinding voluntary cuts as of the end of March 2025.

- India is reportedly to decide soon on whether to impose curbs on the imports of steelmaking raw materials, via Reuters citing sources.

Geopolitics: Middle East

- Israeli troops have entered Syria buffer zone on a temporary basis, according to Bloomberg

- “Hamas agreed to the presence of Israeli forces in Gaza after a ceasefire goes into effect”, according to Kann News.

- “Israeli army announces the withdrawal from the tents area in southern Lebanon in accordance with the ceasefire agreement “, according to Al Arabiya.

Geopolitics: Other

- China’s President Xi says China is willing to strengthen strategic alignment with Russia, and tap into the intrinsic driving force of bilateral cooperation, via state media.

- Russia’s Navy Chief says that NATO has increased its military activity in the arctic region, via Ria; naval grouping of Russian nuclear forces has been completely renewed, via Tass.

- US President-elect Trump is reportedly considering ex-intelligence chief Richard Grenell as Special Envoy for Iran, according to Reuters sources; the article suggests consideration of a key ally for the position sends a signal that Trump may be open to talks.

- US House of Representatives passed USD 895bln defence policy bill, according to Reuters.

US Event Calendar

- 08:30: Dec. Initial Jobless Claims, est. 220,000, prior 224,00008:30: Nov. PPI Final Demand YoY, est. 2.6%, prior

- Nov. Continuing Claims, est. 1.88m, prior 1.87m

- 08:30: Nov. PPI Final Demand MoM, est. 0.2%, prior 0.2%

- Nov. PPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- Nov. PPI Final Demand YoY, est. 2.6%, prior 2.4%

- Nov. PPI Ex Food and Energy YoY, est. 3.2%, prior 3.1%

- 12:00: 3Q US Household Change in Net Worth, prior $2.76t

DB’s Jim Reid concludes the overnight wrap

Markets put in a decent performance yesterday, as the US CPI report came in broadly as expected, which was seen as giving the all-clear for the Fed to cut rates next week. That meant futures dialled up the likelihood of a 25bp rate cut to 99% by the close. And on top of that, the S&P 500 (+0.82%) ended the session just a whisker beneath its all-time high, with the Magnificent 7 (+3.08%) powering forward to a new record.

In terms of the details of that CPI print, the monthly headline and core CPI readings were both at +0.31% in November. So that was basically in line with the +0.3% print the consensus was expecting. So even though inflation was still running a bit too fast for the Fed to be comfortable, markets were relieved that it wasn’t an even higher number that would prevent the Fed cutting rates next week. After all, core CPI has now been running at +0.3% for four consecutive months, and the 3-month annualised rate for core CPI ticked up to +3.7%, so this isn’t just a case of one strong print. And in turn, that’s led to growing concern that inflation is becoming sticky above target, even if we’re not seeing the really high numbers of a couple of years ago. For the year-on-year numbers, the latest release meant headline CPI ticked up to +2.7%, whilst the core CPI print was steady at 3.3%, where it’s been for the last three months now.

Admittedly, one piece of good news was that shelter and services inflation moderated, and those are fairly sticky categories, even if this decline was offset by stronger goods prices. But even though Treasury yields fell by several basis points after the CPI print, lingering inflation concerns saw this move reverse later on. For instance, 10yr yields closed near the session highs (+4.5bps to 4.27%), rising for a third consecutive day despite a solid 10yr auction.

Nevertheless, when it comes to the Fed, the CPI print left little doubt among investors that another rate cut will happen next week. Indeed, futures moved up the likelihood of a cut from 86% right before the CPI came out to 99% by the close. It’s true that inflation is still too fast for their liking, but last week’s jobs report also saw a fresh rise in the unemployment rate, so our US economists think that will still enable them to cut next week.

Looking forward, central banks will stay in the spotlight today, as the ECB are announcing their latest policy decision at 13:15 London time. They’re widely expected to cut their deposit rate by another 25bps, taking it down to 3%, and that would bring their total rate cuts to 100bps since they began in June. Our European economists are also looking for a 25bp cut today, and they expect the doves and hawks to compromise on a mildly dovish evolution in communications. For next year, they then see the ECB continuing to cut by 25bps per meeting in H1, followed by quarterly 25bp cuts in H2, leaving the deposit rate at 1.5% by end-2025. See their full preview here for more details.

Ahead of the ECB, European assets put in a strong performance yesterday. At the front-end, bond yields fell across the continent, with French, Italian and Spanish 2yr yields falling to their lowest levels since 2022. And while 10yr bund yields inched up (+0.7bps), both the Italian and Spanish 10yr spreads over bunds reached their tightest level in three years yesterday, at 106bps and 63bps, respectively. Equities put in a decent performance too, with the STOXX 600 (+0.28%) clawing back some of the previous day’s losses as the DAX (+0.34%), CAC 40 (+0.39%) and FTSE 100 (+0.26%) all advanced.

For US equities, it was another day of the tech mega caps dominating. Four of the Magnificent 7 posted new record highs, namely Alphabet (+5.52%), Amazon (+2.32%), Meta (+2.16%) and Tesla (+5.93%). And Broadcom (+6.63%) surged after a report that it was working on an AI chip with Apple. That saw the S&P 500 (+0.82%) close less than 0.1% beneath its all-time high, even though the equal-weighted version of the index is still over -2% beneath its record.

Elsewhere yesterday, the Bank of Canada delivered a 50bp rate cut that took their policy rate down to 3.25%. That’s the second 50bp cut in a row they’ve delivered, but they sounded more cautious about future cuts, saying in their statement that “we will be evaluating the need for further reductions in the policy rate one decision at a time.” That saw the 10yr Canadian yield move +6.7bps higher to 3.08%.

Meanwhile in Germany, the election process started to get under way yesterday, as Chancellor Scholz requested a confidence vote next Monday in the Bundestag. It follows the collapse of the federal coalition last month, when Scholz sacked the finance minister Christian Lindner, who leads the FDP. Once the government loses the vote of no confidence, Scholz can then request an election from the President, which is planned for February 23.

Overnight in Asia, those strong gains on Wall Street have continued across the board, with global markets hopeful about another Fed rate cut. Most of the major indices have posted a decent gain, including the Nikkei (+1.28%), the Hang Seng (+1.31%), the CSI 300 (+0.59%), the Shanghai Comp (+0.50%) and the KOSPI (+1.22%). The only notable exception to that is Australia’s S&P/ASX 200 (-0.28%), which follows a very strong employment report for November that’s led markets to dial back the likelihood of rate cuts from the RBA. It showed the unemployment rate unexpectedly falling to 3.9% (vs. 4.2% expected), and Australia’s government bond yield is up +8.0bps overnight in response, and the Australian Dollar has strengthened by +0.73% against the US Dollar. Looking forward, US equity futures are pointing a bit lower this morning, with those on the S&P 500 down -0.13%, whilst the 10yr Treasury (+1.2bps) is up to 4.28% overnight.

Separately in the FX space, yesterday saw the Japanese yen weaken after Bloomberg reported that Bank of Japan officials saw little cost of waiting to hike rates. The report suggested that even if they waited until January or longer, they only saw a low risk of inflation overshooting. Following the report, investors further dialled back the likelihood of a December rate hike, and the Japanese Yen ended the session -0.32% weaker against the US Dollar, where it remains unchanged this morning. In the meantime, China’s offshore yuan weakened -0.29% yesterday, which followed a Reuters report that policymakers were considering allowing the currency to depreciate as a response to any trade war with the US.

To the day ahead now, and the main highlight will be the ECB’s latest policy decision, along with President Lagarde’s subsequent press conference. In terms of data, we’ll also get the US PPI for November and the weekly initial jobless claims.

Loading…