Tesla shares continue to trade at record highs to close the week, regaining popularity as investors focus on full self-driving, robotaxi, new lost-coast models, and Optimus robots.

The stock has delivered a stunning performance year-to-date, surging 70% and commanding a $1.3 trillion market capitalization.

Meanwhile, Elon Musk commented on X this week that Bill Gates' Tesla short could potentially "bankrupt" the billionaire.

If Tesla does become the world’s most valuable company by far, that short position will bankrupt even Bill Gates

— Elon Musk (@elonmusk) December 10, 2024

Heading into 2025, a team of analysts from Deutsche Bank hosted an investor meeting with Tesla's head of investor relations, Travis Axelrod, to explore the key drivers behind the stock's performance.

"The majority of focus was naturally around FSD, robotaxi, and Optimus but we also covered the status of new models in 2025 and puts/takes regarding margin," DB's Edison Yu and Winnie Dong wrote in a note to clients.

They summarized the key takeaways in the conversation with Axelrod:

New models and 2025 volume growth

The new Tesla model (we refer to as "Model Q") should launch in 1H25 and will be priced <$30k including subsidies (i.e., $37,499 if US EV tax credit goes away).

Additionally in the 2H, there will be other new vehicles released that are intended to augment Tesla's TAM. We suspect one model will be a 3-row longer wheelbase Model Y variant in China.

All these new models will be built on existing lines. Management once again highlighted volume growth of 20-30% in 2025; the rationale behind this growth range is based on ability to maximize existing capacity utilization.

Operationally, Tesla commented that hitting the high end of the range would be contingent on essentially flawless execution and is confident that the China supply chain can scale up fairly quickly while it may be harder in N. America.

Tesla's plan for the Mexico plant will continue to hinge upon geo-political dynamics and the tariff situation under the new Trump Administration.

Puts and takes for 2025 margins

Tesla explained that 2025 will be a year of product launches, and whenever that happens, there will be disruption to profitability as it will be in the early days of building a product and have more inefficient fixed cost absorption.

But this could be offset by a lower cost of goods sold from the more affordable products.

2025 margins will also hinge upon where ASP lands based on the demand curve.

The main goal is to focus on growing volume and garnering incremental gross profit (as opposed to targeting a certain gross margin %), delivering

Robotaxi operations

Still expects to launch robotaxi services in CA and TX next year using existing vehicles (3/Y), generating paid rides.

In terms of the UI, the company plans to use an internally developed ridehail app and control the "value chain."

Tesla believes it would be reasonable to assume some type of teleoperator would be needed at least initially for safety/redundancy purposes.

Tesla views regulation as the biggest headwind to broad deployment of robotaxi, which the company hopes will be adjusted at the federal level through updating of rules at NHTSA.

Management intends to start off entirely with the company-owned fleet and eventually dynamically adjust supply based on customer demand/ traffic patterns.

Cybercab development

Unboxed manufacturing should result in ~$20-30k COGS per vehicle, at run rate, a number which isn't possible under current, traditional manufacturing processes.

CyberCab, when production starts in 2026, will be the first product to use unboxed manufacturing with the expectation that any products released subsequently will also use unboxed processes.

At full run rate production, the company expects to build a CyberCab for less than $30k.

As the CyberCab rollout occurs in 2026, the company will need to make investments across its service/cleaning and charging apparatus (e.g., install wireless charging) with TX and CA likely the first states to see a rollout given proximity to manufacturing facilities and headquarters.

FSD progress

V13 has just been rolled out to early access users, and typically takes about 2-3 weeks to roll out to the broader audience if no issues are found.

This version should demonstrate 3-5x performance improvement vs. v12.5 from a miles between critical intervention perspective (1 every ~10k miles).

Management continues to target launch of an unsupervised version of FSD between Q2 and Q3 of next year, coinciding with start of robotaxi operations. This could be some iteration of v13.x depending on level of progress. Important to note that FSD can be unsupervised even if it doesn't surpass human level safety threshold early on as long as Tesla feels comfortable taking on the risk/liability.

In general, the large improvement seen over the past year can be attributed to the increase in training compute, from 20k to ~90k GPUs in the span of 10 months. Tesla can now train dozens of end-to-end models in a few weeks vs. only one, enabling much faster iteration/improvement.

In terms of FSD attach rate, Tesla commented that it has seen an increase after the V12 release to N. America (>20%) vs. in April this year, and another jump during the 10/10 event. Adoption rate should continue to increase as Tesla increasingly fine-tunes its marketing strategy to offer more free trials.

Competition in autonomous driving

Management doesn't see any true competition in the US/Europe from a cost/scale perspective.

For pure play robotaxi efforts like Waymo and Cruise, Tesla believes they're essentially using more sensors (e.g., lidar) to compensate for deficiencies in the rules-based software (almost as a buffer).

Unlike Tesla with a massive fleet of customers to generate a large amount of data, Waymo is reliant on a very small fleet that cannot generate enough data to effectively train large E2E models.

Separately, Waymo also does not have proper scale/vertical integration in making cars and associated parts, forcing them to partner with an OEM. As such, even if Waymo switches to E2E approach, it would likely still be at a cost/scale advantage considering the largest cost in Tesla's view is the D&A.

In respect to China, Tesla does observe more entities taking a similar approach (E2E vision-only architecture). Its own commercial efforts are still in motion, working on getting approval from the local government to take data out of the country to improve performance of its E2E models, still aiming for 1Q25 roll-out. Chinese competitors appear to be quickly pivoting toward using E2E model for perception but path planning is still mainly using rules-based.

For Europe, the regulations around autonomous driving makes it a challenging backdrop, given the driver has to approve the automatic response of the vehicle, which would defeat the purpose of self-driving functionality.

Looking farther out, the 3rd gen Dojo chip which is expected to launch in 2028 will be another big enabler because the 1st gen cannot compete on cost/performance vs. Nvidia and 2nd gen (in 2026) still can't compete on performance (should be at cost parity though). At that point, the economics around training compute become much more favorable.

Evolution of Optimus

The objective remains to have >1k humanoid robots deployed internally in factories and then selling to external customers in 2026. Performance will be limited to fairly basic material handling tasks for industrial environments as opposed to home lifestyle which would happen much later on.

From a development perspective, the "intelligence" of Optimus will continue to improve and should at some point mirror the rapid improvement seen in FSD over the past year. Currently, Optimus is being trained by data sets generated through teleoperation and videos of itself performing tasks paired with motor/actuator data to essentially map out framework that can align with human movement. Ultimately, after the compatibility is fully mapped out, Optimus should be able to train/learn by watching videos of humans performing tasks in a "DIY" type of manner, similar to how FSD learns from humans driving.

In terms of manufacturing, the aspirational target is getting the BoM down to ~$30k. The engineering team is still iterating and there will likely be changes depending on what parts need to be re-engineered to reduce cost as opposed to scale volume components.

When selling to customers, the strategy could either be to sell the HW+SW together or lease out the robot. Tesla is confident that the economics could be very favorable in replacing human labor especially in the US.

Other considerations

Megapack demand remains very strong with the company standing by its expectations for more than 100% growth this year, implying ~27 GWh of production. Next year, the new Shanghai factory will come online and the US could potentially provide up to ~40 GWh.

The company believes that the recent court ruling rejecting Musk's pay package was wrong and will be appealing the decision, though there is no timeline on its response.

Based on their conversation, the analysts raised their price target on Tesla from $295 to $370. Here is their explanation:

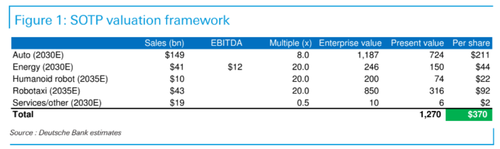

We raise our price target from $295 to $370, mainly assigning greater value to Tesla's autonomy efforts. Specifically, we refine our valuation framework to include FSD sales (both one-time and subscription), robotaxi operations, and OEM licensing fees into the "Robotaxi" bucket whereas previously we included FSD in the "Auto" line. Moreover, given our belief the new US administration can streamline federal regulations around deployment of robotaxi, we increase our robotaxi forecasts and use a higher 20x EV/Revenue multiple on 2035E sales of > $40bn (vs. prior 15x) akin to leading E2E AI peers. We also assume some type of service to be deployed overseas in that time frame. Other elements of our valuation are essentially unchanged except we lower our Energy multiple from 25x EV/ EBITDA to 20x given de-rating seen recently by comparable companies.

The summarized key takeaways from DB analysts offer valuable insights into the company as 2024 winds down and the new year approaches.

Tesla shares continue to trade at record highs to close the week, regaining popularity as investors focus on full self-driving, robotaxi, new lost-coast models, and Optimus robots.

The stock has delivered a stunning performance year-to-date, surging 70% and commanding a $1.3 trillion market capitalization.

Meanwhile, Elon Musk commented on X this week that Bill Gates’ Tesla short could potentially “bankrupt” the billionaire.

If Tesla does become the world’s most valuable company by far, that short position will bankrupt even Bill Gates

— Elon Musk (@elonmusk) December 10, 2024

Heading into 2025, a team of analysts from Deutsche Bank hosted an investor meeting with Tesla’s head of investor relations, Travis Axelrod, to explore the key drivers behind the stock’s performance.

“The majority of focus was naturally around FSD, robotaxi, and Optimus but we also covered the status of new models in 2025 and puts/takes regarding margin,” DB’s Edison Yu and Winnie Dong wrote in a note to clients.

They summarized the key takeaways in the conversation with Axelrod:

New models and 2025 volume growth

The new Tesla model (we refer to as “Model Q”) should launch in 1H25 and will be priced <$30k including subsidies (i.e., $37,499 if US EV tax credit goes away).

Additionally in the 2H, there will be other new vehicles released that are intended to augment Tesla’s TAM. We suspect one model will be a 3-row longer wheelbase Model Y variant in China.

All these new models will be built on existing lines. Management once again highlighted volume growth of 20-30% in 2025; the rationale behind this growth range is based on ability to maximize existing capacity utilization.

Operationally, Tesla commented that hitting the high end of the range would be contingent on essentially flawless execution and is confident that the China supply chain can scale up fairly quickly while it may be harder in N. America.

Tesla’s plan for the Mexico plant will continue to hinge upon geo-political dynamics and the tariff situation under the new Trump Administration.

Puts and takes for 2025 margins

Tesla explained that 2025 will be a year of product launches, and whenever that happens, there will be disruption to profitability as it will be in the early days of building a product and have more inefficient fixed cost absorption.

But this could be offset by a lower cost of goods sold from the more affordable products.

2025 margins will also hinge upon where ASP lands based on the demand curve.

The main goal is to focus on growing volume and garnering incremental gross profit (as opposed to targeting a certain gross margin %), delivering

Robotaxi operations

Still expects to launch robotaxi services in CA and TX next year using existing vehicles (3/Y), generating paid rides.

In terms of the UI, the company plans to use an internally developed ridehail app and control the “value chain.”

Tesla believes it would be reasonable to assume some type of teleoperator would be needed at least initially for safety/redundancy purposes.

Tesla views regulation as the biggest headwind to broad deployment of robotaxi, which the company hopes will be adjusted at the federal level through updating of rules at NHTSA.

Management intends to start off entirely with the company-owned fleet and eventually dynamically adjust supply based on customer demand/ traffic patterns.

Cybercab development

Unboxed manufacturing should result in ~$20-30k COGS per vehicle, at run rate, a number which isn’t possible under current, traditional manufacturing processes.

CyberCab, when production starts in 2026, will be the first product to use unboxed manufacturing with the expectation that any products released subsequently will also use unboxed processes.

At full run rate production, the company expects to build a CyberCab for less than $30k.

As the CyberCab rollout occurs in 2026, the company will need to make investments across its service/cleaning and charging apparatus (e.g., install wireless charging) with TX and CA likely the first states to see a rollout given proximity to manufacturing facilities and headquarters.

FSD progress

V13 has just been rolled out to early access users, and typically takes about 2-3 weeks to roll out to the broader audience if no issues are found.

This version should demonstrate 3-5x performance improvement vs. v12.5 from a miles between critical intervention perspective (1 every ~10k miles).

Management continues to target launch of an unsupervised version of FSD between Q2 and Q3 of next year, coinciding with start of robotaxi operations. This could be some iteration of v13.x depending on level of progress. Important to note that FSD can be unsupervised even if it doesn’t surpass human level safety threshold early on as long as Tesla feels comfortable taking on the risk/liability.

In general, the large improvement seen over the past year can be attributed to the increase in training compute, from 20k to ~90k GPUs in the span of 10 months. Tesla can now train dozens of end-to-end models in a few weeks vs. only one, enabling much faster iteration/improvement.

In terms of FSD attach rate, Tesla commented that it has seen an increase after the V12 release to N. America (>20%) vs. in April this year, and another jump during the 10/10 event. Adoption rate should continue to increase as Tesla increasingly fine-tunes its marketing strategy to offer more free trials.

Competition in autonomous driving

Management doesn’t see any true competition in the US/Europe from a cost/scale perspective.

For pure play robotaxi efforts like Waymo and Cruise, Tesla believes they’re essentially using more sensors (e.g., lidar) to compensate for deficiencies in the rules-based software (almost as a buffer).

Unlike Tesla with a massive fleet of customers to generate a large amount of data, Waymo is reliant on a very small fleet that cannot generate enough data to effectively train large E2E models.

Separately, Waymo also does not have proper scale/vertical integration in making cars and associated parts, forcing them to partner with an OEM. As such, even if Waymo switches to E2E approach, it would likely still be at a cost/scale advantage considering the largest cost in Tesla’s view is the D&A.

In respect to China, Tesla does observe more entities taking a similar approach (E2E vision-only architecture). Its own commercial efforts are still in motion, working on getting approval from the local government to take data out of the country to improve performance of its E2E models, still aiming for 1Q25 roll-out. Chinese competitors appear to be quickly pivoting toward using E2E model for perception but path planning is still mainly using rules-based.

For Europe, the regulations around autonomous driving makes it a challenging backdrop, given the driver has to approve the automatic response of the vehicle, which would defeat the purpose of self-driving functionality.

Looking farther out, the 3rd gen Dojo chip which is expected to launch in 2028 will be another big enabler because the 1st gen cannot compete on cost/performance vs. Nvidia and 2nd gen (in 2026) still can’t compete on performance (should be at cost parity though). At that point, the economics around training compute become much more favorable.

Evolution of Optimus

The objective remains to have >1k humanoid robots deployed internally in factories and then selling to external customers in 2026. Performance will be limited to fairly basic material handling tasks for industrial environments as opposed to home lifestyle which would happen much later on.

From a development perspective, the “intelligence” of Optimus will continue to improve and should at some point mirror the rapid improvement seen in FSD over the past year. Currently, Optimus is being trained by data sets generated through teleoperation and videos of itself performing tasks paired with motor/actuator data to essentially map out framework that can align with human movement. Ultimately, after the compatibility is fully mapped out, Optimus should be able to train/learn by watching videos of humans performing tasks in a “DIY” type of manner, similar to how FSD learns from humans driving.

In terms of manufacturing, the aspirational target is getting the BoM down to ~$30k. The engineering team is still iterating and there will likely be changes depending on what parts need to be re-engineered to reduce cost as opposed to scale volume components.

When selling to customers, the strategy could either be to sell the HW+SW together or lease out the robot. Tesla is confident that the economics could be very favorable in replacing human labor especially in the US.

Other considerations

Megapack demand remains very strong with the company standing by its expectations for more than 100% growth this year, implying ~27 GWh of production. Next year, the new Shanghai factory will come online and the US could potentially provide up to ~40 GWh.

The company believes that the recent court ruling rejecting Musk’s pay package was wrong and will be appealing the decision, though there is no timeline on its response.

Based on their conversation, the analysts raised their price target on Tesla from $295 to $370. Here is their explanation:

We raise our price target from $295 to $370, mainly assigning greater value to Tesla’s autonomy efforts. Specifically, we refine our valuation framework to include FSD sales (both one-time and subscription), robotaxi operations, and OEM licensing fees into the “Robotaxi” bucket whereas previously we included FSD in the “Auto” line. Moreover, given our belief the new US administration can streamline federal regulations around deployment of robotaxi, we increase our robotaxi forecasts and use a higher 20x EV/Revenue multiple on 2035E sales of > $40bn (vs. prior 15x) akin to leading E2E AI peers. We also assume some type of service to be deployed overseas in that time frame. Other elements of our valuation are essentially unchanged except we lower our Energy multiple from 25x EV/ EBITDA to 20x given de-rating seen recently by comparable companies.

The summarized key takeaways from DB analysts offer valuable insights into the company as 2024 winds down and the new year approaches.

Loading…