By Charles Kennedy of Oilprice.com

Russian crude oil exports by sea have dropped by 11% from a recent high in October, due to maintenance at the Baltic port of Primorsk, pressure for Russia to align with its OPEC+ quota, and increased sanctions pressure.

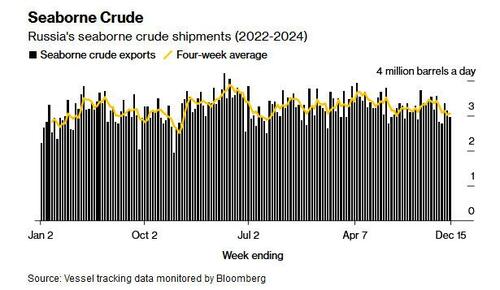

In the four weeks to December 15, Russia’s seaborne crude exports averaged 3.06 million barrels per day (bpd), tanker-tracking data monitored by Bloomberg showed on Tuesday.

That’s 11% lower compared to a recent peak of a four-week average volume of 3.46 million bpd in early October, according to the data reported by Bloomberg’s Julian Lee.

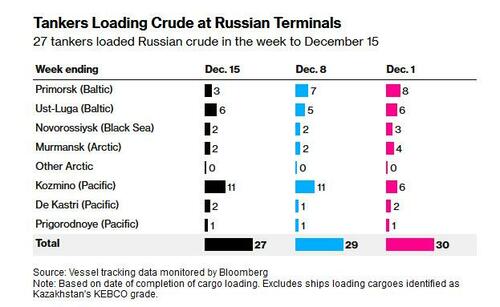

In the most recent week to December 15, observed Russian crude oil exports from Primorsk have slumped as the port saw a halt of four days in departures, according to data from port agents seen by Bloomberg. The partial halt to the loading program suggests that there has been either maintenance work on the loading terminal or the pipeline that serves it, according to Bloomberg.

Apart from physical disruption to loadings, Russian crude oil exports have fallen as Moscow has been under increased pressure to fall in line with its OPEC+ quota as part of the group that looks to support oil prices.

Moreover, the UK and the EU have ramped up sanctions on the so-called shadow fleet used by Russia to ship its crude oil and petroleum products.

At the end of November, the UK sanctioned as many as 30 tankers identified as belonging to Russia’s shadow fleet that circumvents the Western oil sanctions, in its single largest sanctions package aimed at Russia’s dark fleet and at stifling Putin’s oil revenues.

The EU on Monday adopted the 15th package of sanctions against Russia, which targets 52 new vessels from Russia’s shadow fleet, increasing the total number of such listings to 79. These non-EU vessels are subject to a port access ban and a ban on provision of services.

Moreover, the Biden administration is said to be mulling over additional sanctions against Russia’s oil industry ahead of President-elect Donald Trump’s inauguration in January.

By Charles Kennedy of Oilprice.com

Russian crude oil exports by sea have dropped by 11% from a recent high in October, due to maintenance at the Baltic port of Primorsk, pressure for Russia to align with its OPEC+ quota, and increased sanctions pressure.

In the four weeks to December 15, Russia’s seaborne crude exports averaged 3.06 million barrels per day (bpd), tanker-tracking data monitored by Bloomberg showed on Tuesday.

That’s 11% lower compared to a recent peak of a four-week average volume of 3.46 million bpd in early October, according to the data reported by Bloomberg’s Julian Lee.

In the most recent week to December 15, observed Russian crude oil exports from Primorsk have slumped as the port saw a halt of four days in departures, according to data from port agents seen by Bloomberg. The partial halt to the loading program suggests that there has been either maintenance work on the loading terminal or the pipeline that serves it, according to Bloomberg.

Apart from physical disruption to loadings, Russian crude oil exports have fallen as Moscow has been under increased pressure to fall in line with its OPEC+ quota as part of the group that looks to support oil prices.

Moreover, the UK and the EU have ramped up sanctions on the so-called shadow fleet used by Russia to ship its crude oil and petroleum products.

At the end of November, the UK sanctioned as many as 30 tankers identified as belonging to Russia’s shadow fleet that circumvents the Western oil sanctions, in its single largest sanctions package aimed at Russia’s dark fleet and at stifling Putin’s oil revenues.

The EU on Monday adopted the 15th package of sanctions against Russia, which targets 52 new vessels from Russia’s shadow fleet, increasing the total number of such listings to 79. These non-EU vessels are subject to a port access ban and a ban on provision of services.

Moreover, the Biden administration is said to be mulling over additional sanctions against Russia’s oil industry ahead of President-elect Donald Trump’s inauguration in January.

Loading…