So much for any optimism that the US economy can avoid a hard landing.

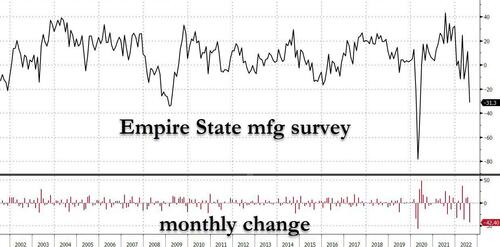

One (business) day after the UMich survey hinted that economic optimism is set to jump amid collapsing inflation expectations, moments ago the New York Fed's Empire State Manufacturing Survey unexpectedly cratered from 11.1 to -31.3, slicking through consensus expectations for a 5.0 print like a hot knife through butter, and suffering the 2nd biggest monthly drop on record.

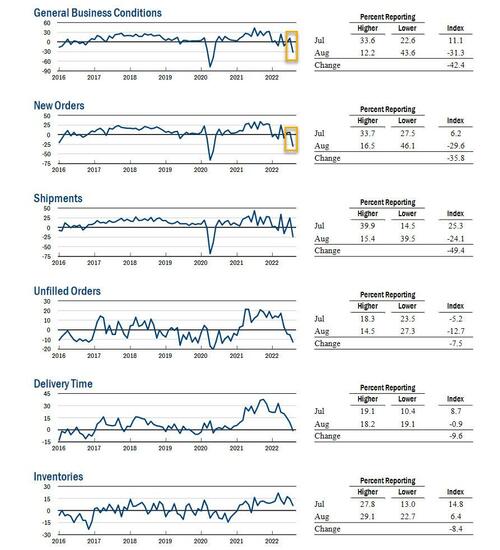

The big miss of the month's first regional manufacturing survey was driven by a decline across all indicators, but especially by a sharp drop in the forward looking New Orders which tanked to -29.6 from +6.2, while the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments, and strongly hinting that a hard-landing recession is inevitable and that, for all the posturing, a Fed rate cut is imminent after all.

Some more details:

- Manufacturing activity declined significantly in New York State, according to the August survey. The general business conditions index plunged forty-two points to -31.3, the second largest monthly decline in the index on record, and among the lowest levels in the survey’s history.

- Twelve percent of respondents reported that conditions had improved over the month, and forty-four percent reported that conditions had worsened.

- The new orders index dropped thirty-six points to -29.6, and the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments.

- The unfilled orders index fell to -12.7, indicating that unfilled orders shrank for a third consecutive month.

- The delivery times index declined to around zero, indicating that delivery times held steady, the first month they have not lengthened in nearly two years.

- The inventories index fell to 6.4, signaling that inventories increased marginally.

Mocking the relentless data fudging by the politicized BLS, the report showed that the index of employees moved down eleven points to 7.4, pointing to a small increase in employment, and the average workweek index fell to -13.1, indicating a decline in hours worked. The prices paid index fell nine points to 55.5, its lowest level in over a year, indicating a deceleration in input price increases. The prices received index was little changed at 32.7.

Looking ahead, the index for future business conditions came in at 2.1, suggesting that firms were not optimistic about the six-month outlook. The indexes for future new orders and shipments were positive, but remained at low levels. On the other side, employment is expected to pick up - which makes zero sense considering expectations of plunging inflation - and delivery times are expected to decline over the next six months. Only modest increases in capital spending and technology spending are planned for the months ahead, which of course means, much more stock buybacks.

So much for any optimism that the US economy can avoid a hard landing.

One (business) day after the UMich survey hinted that economic optimism is set to jump amid collapsing inflation expectations, moments ago the New York Fed’s Empire State Manufacturing Survey unexpectedly cratered from 11.1 to -31.3, slicking through consensus expectations for a 5.0 print like a hot knife through butter, and suffering the 2nd biggest monthly drop on record.

The big miss of the month’s first regional manufacturing survey was driven by a decline across all indicators, but especially by a sharp drop in the forward looking New Orders which tanked to -29.6 from +6.2, while the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments, and strongly hinting that a hard-landing recession is inevitable and that, for all the posturing, a Fed rate cut is imminent after all.

Some more details:

- Manufacturing activity declined significantly in New York State, according to the August survey. The general business conditions index plunged forty-two points to -31.3, the second largest monthly decline in the index on record, and among the lowest levels in the survey’s history.

- Twelve percent of respondents reported that conditions had improved over the month, and forty-four percent reported that conditions had worsened.

- The new orders index dropped thirty-six points to -29.6, and the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments.

- The unfilled orders index fell to -12.7, indicating that unfilled orders shrank for a third consecutive month.

- The delivery times index declined to around zero, indicating that delivery times held steady, the first month they have not lengthened in nearly two years.

- The inventories index fell to 6.4, signaling that inventories increased marginally.

Mocking the relentless data fudging by the politicized BLS, the report showed that the index of employees moved down eleven points to 7.4, pointing to a small increase in employment, and the average workweek index fell to -13.1, indicating a decline in hours worked. The prices paid index fell nine points to 55.5, its lowest level in over a year, indicating a deceleration in input price increases. The prices received index was little changed at 32.7.

Looking ahead, the index for future business conditions came in at 2.1, suggesting that firms were not optimistic about the six-month outlook. The indexes for future new orders and shipments were positive, but remained at low levels. On the other side, employment is expected to pick up – which makes zero sense considering expectations of plunging inflation – and delivery times are expected to decline over the next six months. Only modest increases in capital spending and technology spending are planned for the months ahead, which of course means, much more stock buybacks.