The largest blemish on Joe Biden’s economic legacy is the fact that, despite robust growth, low unemployment and a roaring stock market, many Americans felt worse off during his presidency than they did before. One of the reasons behind this seeming disconnect is simple and it has to do with inflation, disinflation and wage growth, or the lack thereof.

Shortly after Biden took office in January 2021, inflation began to surge. The Covid-19 pandemic and the supply-chain crisis that followed, combined with generous stimulus spending and Russia’s invasion of Ukraine in early 2022 had created a perfect storm of inflationary pressures that resulted in prices climbing faster than they had since the early 1980s. And despite inflation coming down notably from its mid-2022 highs, prices have not come down – at least on the aggregate.

That’s because bringing down inflation, i.e. disinflation, is not to be mistaken for falling prices, which would be deflation.

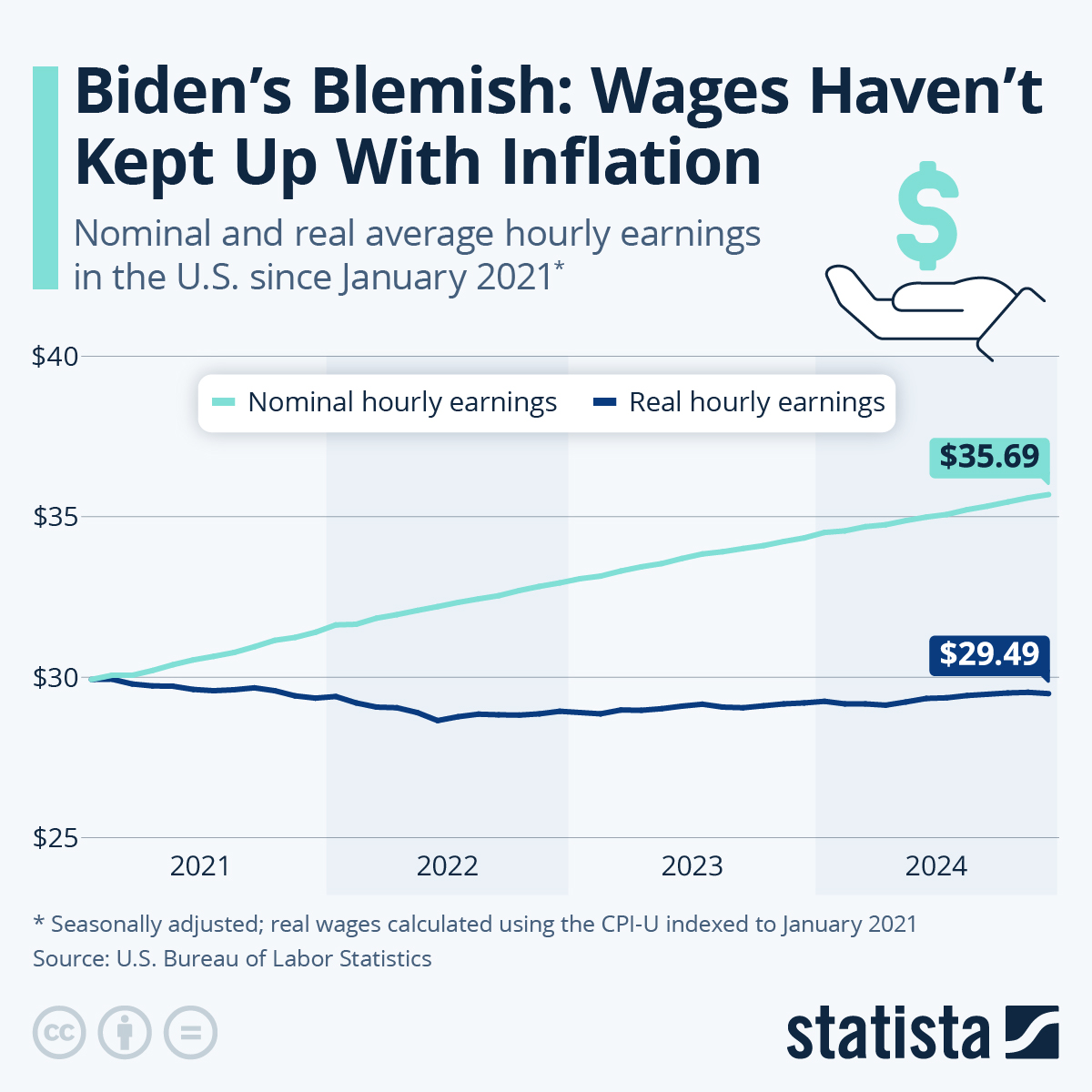

While (moderately) rising prices are no problem per se and actually wanted in a functioning economy, hence the Fed’s 2-percent inflation target, inflation becomes a problem if it outpaces wage growth for a protracted period of time. As Statista's Felix Richter shows in the chart below, according to data from the U.S. Bureau of Labor Statistics, this has been the case in the U.S. from April 2021 to April 2023, when prices increased faster than nominal wages did for 25 consecutive months, at least on a year-over-year basis.

You will find more infographics at Statista

That resulted in an actual decline in real wages as nominal wage growth still hadn’t fully caught up with price increases by December 2024.

As the chart shows, nominal average hourly earnings grew from $29.93 in January 2021 to $35.69 in December 2024 – a 19.2 percent increase.

During the same period, prices, as measured here by the Consumer Price Index for all Urban Consumers (CPI-U) climbed 21.0 percent, leading to a 1.5 percent decline in real wages.

That means adjusted for price increases, people went from $29.93 an hour to $29.49 an hour during the Biden years.

Considering that these are average earnings, it’s fair to assume that many people suffered considerably larger and actually noticeable declines in real wages, leading to the widespread frustration with the Biden economy.

The largest blemish on Joe Biden’s economic legacy is the fact that, despite robust growth, low unemployment and a roaring stock market, many Americans felt worse off during his presidency than they did before. One of the reasons behind this seeming disconnect is simple and it has to do with inflation, disinflation and wage growth, or the lack thereof.

Shortly after Biden took office in January 2021, inflation began to surge. The Covid-19 pandemic and the supply-chain crisis that followed, combined with generous stimulus spending and Russia’s invasion of Ukraine in early 2022 had created a perfect storm of inflationary pressures that resulted in prices climbing faster than they had since the early 1980s. And despite inflation coming down notably from its mid-2022 highs, prices have not come down – at least on the aggregate.

That’s because bringing down inflation, i.e. disinflation, is not to be mistaken for falling prices, which would be deflation.

While (moderately) rising prices are no problem per se and actually wanted in a functioning economy, hence the Fed’s 2-percent inflation target, inflation becomes a problem if it outpaces wage growth for a protracted period of time. As Statista’s Felix Richter shows in the chart below, according to data from the U.S. Bureau of Labor Statistics, this has been the case in the U.S. from April 2021 to April 2023, when prices increased faster than nominal wages did for 25 consecutive months, at least on a year-over-year basis.

You will find more infographics at Statista

That resulted in an actual decline in real wages as nominal wage growth still hadn’t fully caught up with price increases by December 2024.

As the chart shows, nominal average hourly earnings grew from $29.93 in January 2021 to $35.69 in December 2024 – a 19.2 percent increase.

During the same period, prices, as measured here by the Consumer Price Index for all Urban Consumers (CPI-U) climbed 21.0 percent, leading to a 1.5 percent decline in real wages.

That means adjusted for price increases, people went from $29.93 an hour to $29.49 an hour during the Biden years.

Considering that these are average earnings, it’s fair to assume that many people suffered considerably larger and actually noticeable declines in real wages, leading to the widespread frustration with the Biden economy.

Loading…