McDonald's global same-store sales increased by .4% in the fourth quarter (this snapped two consecutive negative quarters), offsetting a 1.4% decline in the US, where cash-strapped consumers and an E. coli outbreak weighed on Big Mac demand. Shares in New York jumped on Monday as executives forecasted an improving sales trend for 2025.

Here's a summary of the quick-service restaurant's fourth-quarter earnings, as reported by Goldman's Christine Cho, Teddy Farley, and Samantha Chiang:

MCD reported global SSSG of +0.4% that beat GS/Visible Alpha Consensus Data estimates of +0.0%/-0.4% driven by a beat in the IOM and IDLM segments, partially offset by weaker performance in the US segment. US SSSG of -1.4% was below both GS/VA (+0.5%/-0.2%) driven by a decline in average check, partly offset by slightly positive comparable guest counts.

More color on fourth-quarter earnings:

-

IOM SSSG of +0.1% came in ahead of GS/VA estimates of -0.5%/-0.8% driven by mixed results across markets, including negative comparable sales in the UK. IDLM SSSG of +4.1% beat GS/VA of +0.0%/-0.3% as the Middle East and Japan posted positive comparable sales.

-

Total revenues of $6.39bn came in 1.4%/1.3% behind GS/VA of $6.48bn/$6.47bn, with the miss driven primarily by US total revenues that fell short of GS/VA by -3.3%/-2.7% and IDLM total revenues that fell short of GS/VA by -2.3%/-4.8%, while IOM was roughly in line with consensus. Company restaurant margins of 14.4% were below GS/VA (16%) due to the top line pressures in the US and IOM segments.

-

Adj. EPS of $2.83 missed GS/VA estimates of $2.88/$2.87, driven primarily by the top line miss, as well as elevated other operating expense (note that adj. EPS excludes $74mn in pre-tax restructuring charges and $71mn in pre-tax property sale gains from the sale of the South Korea business).

MCD's earnings call provided more color on cash-strapped customers weighing down sales in the US (courtesy of Bloomberg):

The low-income consumer in the US was still down double-digits in Q4, and this segment is overweighted in the industry relative to the US in total.

Bernstein analyst Danilo Gargiulo told clients that MCD's results showed the recovery might be faster than anticipated for international markets, especially in emerging licensed markets pressured by months of Middle East-related boycotts over Gaza.

Gargiulo noted, "The persistence of negative same-store sales growth in the US is worrisome."

Citi and Wall Street expectations see "encouraging signs" in MCD's full-year forecast (courtesy of Bloomberg):

-

Sees net restaurant unit expansion contributing slightly over 2% to systemwide sales growth, in constant currencies

-

Sees operating margin percent in the mid-to-high 40% range

-

Sees capital expenditures $3.0 billion to $3.2 billion, estimate $2.8 billion

-

Sees the effective income tax rate between 20% and 22%

-

Sees nearly 1,800 net restaurant additions

-

Sees free cash flow conversion rate in the low-to-mid 80% range

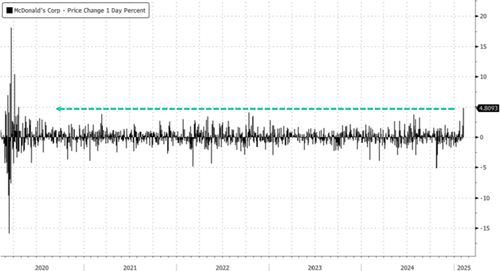

The improving outlook sent shares in New York up 5% - the largest intra-day advancement in five years.

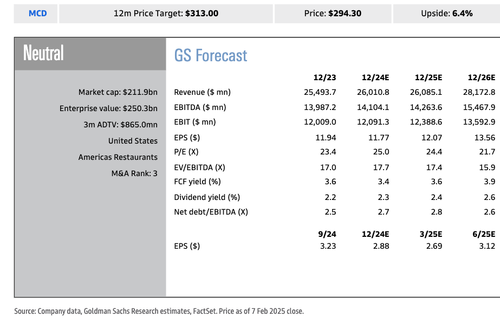

Goldman has a "Neutral" rating on MCD with a $313 12-month price target.

While global sales helped offset weakness in the US, low-income consumers—who make up a large portion of the QSR's customer base—remain under pressure. This suggests these US customers are not as responsive to meal deals amid a multi-year inflation storm.

McDonald’s global same-store sales increased by .4% in the fourth quarter (this snapped two consecutive negative quarters), offsetting a 1.4% decline in the US, where cash-strapped consumers and an E. coli outbreak weighed on Big Mac demand. Shares in New York jumped on Monday as executives forecasted an improving sales trend for 2025.

Here’s a summary of the quick-service restaurant’s fourth-quarter earnings, as reported by Goldman’s Christine Cho, Teddy Farley, and Samantha Chiang:

MCD reported global SSSG of +0.4% that beat GS/Visible Alpha Consensus Data estimates of +0.0%/-0.4% driven by a beat in the IOM and IDLM segments, partially offset by weaker performance in the US segment. US SSSG of -1.4% was below both GS/VA (+0.5%/-0.2%) driven by a decline in average check, partly offset by slightly positive comparable guest counts.

More color on fourth-quarter earnings:

-

IOM SSSG of +0.1% came in ahead of GS/VA estimates of -0.5%/-0.8% driven by mixed results across markets, including negative comparable sales in the UK. IDLM SSSG of +4.1% beat GS/VA of +0.0%/-0.3% as the Middle East and Japan posted positive comparable sales.

-

Total revenues of $6.39bn came in 1.4%/1.3% behind GS/VA of $6.48bn/$6.47bn, with the miss driven primarily by US total revenues that fell short of GS/VA by -3.3%/-2.7% and IDLM total revenues that fell short of GS/VA by -2.3%/-4.8%, while IOM was roughly in line with consensus. Company restaurant margins of 14.4% were below GS/VA (16%) due to the top line pressures in the US and IOM segments.

-

Adj. EPS of $2.83 missed GS/VA estimates of $2.88/$2.87, driven primarily by the top line miss, as well as elevated other operating expense (note that adj. EPS excludes $74mn in pre-tax restructuring charges and $71mn in pre-tax property sale gains from the sale of the South Korea business).

MCD’s earnings call provided more color on cash-strapped customers weighing down sales in the US (courtesy of Bloomberg):

The low-income consumer in the US was still down double-digits in Q4, and this segment is overweighted in the industry relative to the US in total.

Bernstein analyst Danilo Gargiulo told clients that MCD’s results showed the recovery might be faster than anticipated for international markets, especially in emerging licensed markets pressured by months of Middle East-related boycotts over Gaza.

Gargiulo noted, “The persistence of negative same-store sales growth in the US is worrisome.”

Citi and Wall Street expectations see “encouraging signs” in MCD’s full-year forecast (courtesy of Bloomberg):

-

Sees net restaurant unit expansion contributing slightly over 2% to systemwide sales growth, in constant currencies

-

Sees operating margin percent in the mid-to-high 40% range

-

Sees capital expenditures $3.0 billion to $3.2 billion, estimate $2.8 billion

-

Sees the effective income tax rate between 20% and 22%

-

Sees nearly 1,800 net restaurant additions

-

Sees free cash flow conversion rate in the low-to-mid 80% range

The improving outlook sent shares in New York up 5% – the largest intra-day advancement in five years.

Goldman has a “Neutral” rating on MCD with a $313 12-month price target.

While global sales helped offset weakness in the US, low-income consumers—who make up a large portion of the QSR’s customer base—remain under pressure. This suggests these US customers are not as responsive to meal deals amid a multi-year inflation storm.

Loading…