The US Energy Information Administration (EIA) published its Short-Term Energy Outlook (STEO) for February, which boosted its outlook for natural gas by 20% for 2025 after a polar vortex in January led to some of the largest withdraws from underground storage in years.

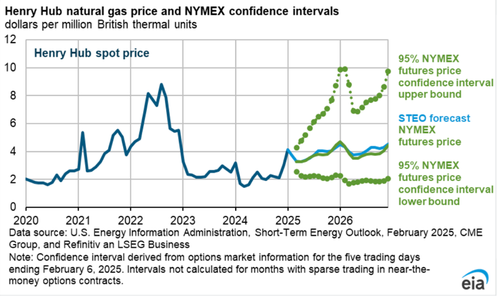

"The Henry Hub spot price averaged $4.13 per million British thermal units (MMBtu) in January and reached a daily high of $9.86/MMBtu on January 17 ahead of a cold snap that spread across the United States, leading to above-average inventory withdrawals," EIA wrote in the STEO report.

Here is EIA's outlook on NatGas prices, which was revised higher: "We expect the spot price to rise through 2026, averaging almost $3.80/MMBtu in 2025, up 65 cents from our January 2025 Short-Term Energy Outlook, and reaching nearly $4.20/MMBtu in 2026."

This revision follows a massive cold blast across the Lower 48 in January, significantly increasing energy consumption.

Some of our reporting on the cold blast last month:

-

Ski Weather At Vail Resorts "Solid" With Above-Average Snowfall At Northeast Slopes

-

Goldman: "Cold January" & "Record LNG Demand" Drive Upside Risk In Natty Prices

-

Incoming: "Big Dumps Of Cold Air. Reminiscent Of 2013/14 Winter"

-

Doesn't Fit MSM Narrative: Parts Of US Could Rival Coldest January Since 1977

-

Polar Vortex, Back-To-Back-To-Back Winter Storms Target Eastern Half Of US

-

Extreme Cold, Snow Places Texas Power Grid & Permian On Alert

-

Lower 48 Polar Blast Coldest "Since 1994" As Global Warming Alarmists Go Silent

Even a grid emergency was declared:

EIA explained in a separate report that last month's cold snap led to the fourth-largest withdrawal from underground NatGas storage.

Here's more from the report:

Colder-than-normal temperatures across much of the United States in mid-January increased natural gas consumption, resulting in the fourth-largest reported weekly withdrawal from natural gas storage in the Lower 48 states, according to our Weekly Natural Gas Storage Report (WNGSR). During the week ending January 24, 2025, stocks fell by 321 billion cubic feet (Bcf), which was nearly 70% more than the five-year (2020–24) average withdrawal for the same week in January. With withdrawals in January totaling nearly 1,000 Bcf, U.S. natural gas inventories are now 4% below their previous five-year average after being 6% above the five-year average at the start of the 2024–25 heating season, which began in November.

For the week ending January 24, the South-Central region of the United States, which accounted for approximately 35% of working gas in US storage, reported its fourth-largest withdrawal of 136 Bcf. In the East and Midwest, the regions with the next-largest storage inventories, stocks fell by 10% in the East and by 11% in the Midwest over the week. The East and Midwest are also the US regions with the most natural gas consumption in the winter to meet space heating demand.

The EIA's STEO report also estimated that residential electricity prices would only rise 2% this year—the smallest annual rise since 2020.

The US Energy Information Administration (EIA) published its Short-Term Energy Outlook (STEO) for February, which boosted its outlook for natural gas by 20% for 2025 after a polar vortex in January led to some of the largest withdraws from underground storage in years.

“The Henry Hub spot price averaged $4.13 per million British thermal units (MMBtu) in January and reached a daily high of $9.86/MMBtu on January 17 ahead of a cold snap that spread across the United States, leading to above-average inventory withdrawals,” EIA wrote in the STEO report.

Here is EIA’s outlook on NatGas prices, which was revised higher: “We expect the spot price to rise through 2026, averaging almost $3.80/MMBtu in 2025, up 65 cents from our January 2025 Short-Term Energy Outlook, and reaching nearly $4.20/MMBtu in 2026.”

This revision follows a massive cold blast across the Lower 48 in January, significantly increasing energy consumption.

Some of our reporting on the cold blast last month:

Even a grid emergency was declared:

EIA explained in a separate report that last month’s cold snap led to the fourth-largest withdrawal from underground NatGas storage.

Here’s more from the report:

Colder-than-normal temperatures across much of the United States in mid-January increased natural gas consumption, resulting in the fourth-largest reported weekly withdrawal from natural gas storage in the Lower 48 states, according to our Weekly Natural Gas Storage Report (WNGSR). During the week ending January 24, 2025, stocks fell by 321 billion cubic feet (Bcf), which was nearly 70% more than the five-year (2020–24) average withdrawal for the same week in January. With withdrawals in January totaling nearly 1,000 Bcf, U.S. natural gas inventories are now 4% below their previous five-year average after being 6% above the five-year average at the start of the 2024–25 heating season, which began in November.

For the week ending January 24, the South-Central region of the United States, which accounted for approximately 35% of working gas in US storage, reported its fourth-largest withdrawal of 136 Bcf. In the East and Midwest, the regions with the next-largest storage inventories, stocks fell by 10% in the East and by 11% in the Midwest over the week. The East and Midwest are also the US regions with the most natural gas consumption in the winter to meet space heating demand.

The EIA’s STEO report also estimated that residential electricity prices would only rise 2% this year—the smallest annual rise since 2020.

Loading…