US equity futures are flat, as European and Asian markets rise, as sentiment improves on the last day of the week. As of 8:10am ET, S&P futures were unchanged at 6,138 after Walmart’s forecast and concerns about consumer behavior led to a decline in stocks Thursday; Nasdaq futures gained 0.3% with the Mag 7 names are mostly higher led by META +0.6%. US-listed Chinese stocks rose in premarket trading on Alibaba's post-earnings euphoria and after Treasury Secretary Scott Bessent said he would hold an introductory phone call with his Chinese counterpart, though he didn’t specify who on the Chinese side he’d speak to. Bond yields are 1-2bps lower and the USD is higher. Commodities are mixed: oil fell -0.8% this morning, while base metals are higher. From the macro perspective, overnight headlines were largely quiet; earnings results since market-close were mixed; BKNG announced 10% dividend increase and additional buybacks. Today, key macro focus will be global PMIs: the Mfg PMI is expected to print 51.4 vs. 51.2 prior; the Services PMI should print 53.0 vs. 52.9 prior.

In premarket trading, the Mag7 was little changed (GOOGL +0.2%, AMZN +0.2%, AAPL -0.07%, MSFT +0.3%, META +0.6%, NVDA +0.06% and TSLA -0.3%). US-listed Chinese stocks rise after Alibaba’s earnings offered a fresh boost to the China tech sector.Baidu (BIDU) +3%, JD.com (JD) +1.6%). Data center providers gained as Alibaba pledged to increase capital spending to support its AI ambitions. Dow Jones heavyweight UnitedHealth plunged more than 10% after the WSJ reported that the DOJ has launched an investigation into the company’s Medicare billing practices in recent months. The report cited people familiar with the matter. The Financial Times reported a high-level Japanese group had drawn up plans for Tesla to invest in carmaker Nissan. Here are some more premarket movers:

- Akamai Technologies (AKAM) drops 9% after the infrastructure software company gave an outlook that is weaker than expected.

- Block (XYZ) falls 8% after the digital payments company gave a 2025 gross profit outlook slightly below what Wall Street expected, with Mizuho noting “no new upside.”

- Celsius Holdings (CELH) jumps 31% after the company said it would buy rival Alani Nutrition for $1.8 billion in cash and stock, including $150 million in tax assets.

- Dropbox (DBX) drops 9% after the document management software company reported fourth-quarter results. Analysts noted concerns over user trends and growth.

- Five9 (FIVN) rises 15% after the software company’s earnings beat estimates thanks to strong growth in subscription revenue.

- Floor & Decor Holdings Inc. (FND) climbs 9% after the retailer posted 4Q profit that beat estimates and same-store sales were better than expected.

- Grid Dynamics Holdings (GDYN) soars 22% after the information technology services company provided revenue forecasts for the 1Q and year that topped expectations.

- Innodata (INOD) jumps 11% after the data engineering company reported fourth-quarter revenue and earnings per share that beat the average analyst estimate.

- MercadoLibre (MELI) climbs 12% as Latin America’s most valuable company far surpassed net income estimates in the final quarter of 2024 while growing revenue at its commerce and fintech units at a faster pace than expected.

- Nubank (NU) falls 8% after the digital bank reported fourth-quarter net income that missed consensus estimates.

- RingCentral (RNG) declines 3% after the communications software company gave an outlook that is weaker than expected for EPS and revenues.

- Rivian (RIVN) slips 3% after the electric-vehicle maker issued a downbeat first-quarter vehicle delivery forecast that overshadowed its first-ever quarterly gross profit.

- Weave Communications (WEAV) slumps 15% after the infrastructure software company reported its fourth-quarter results and gave a forecast that is seen as conservative.

US equities have been lagging their European and Asian counterparts so far this year, and BofA CIO Michael Hartnett reiterated a preference for global stocks to US peers, seeing markets such as Germany, China, Japan and South Korea as more attractive at a time when business activity is improving. US companies’ profit outlooks for 2025 have also been relatively subdued, strategists at JPMorgan noted.

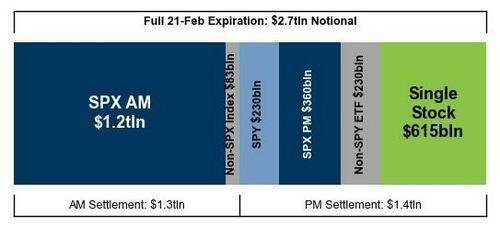

It is a quiet end to a turbulent week but we still have a huge, $2.7 trillion opex to go through. Goldman estimates that over $2.7 Trillion of notional options exposure will expire including $1.2 Trillion of SPX options and $615 Billion notional of single stock options, 9:30 AM Settlement: $1.3 Trillion ($1.2 Trillion is SPX AM), and $1.4 Trillion ($615 Billion single stocks).

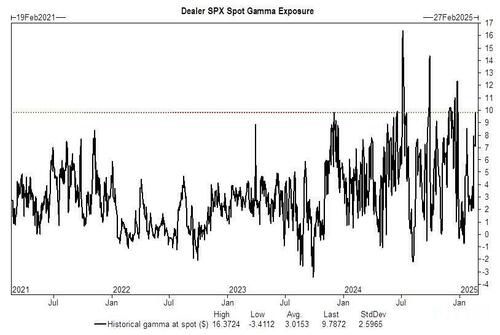

Dealers are long +$9.787 Billion of S&P 500 gamma at current spot, acting as a market buffer, supporting weakness and muting rallies. The Goldman index trading team estimates that 50% of this long gamma position rolls off tomorrow, and the market will have the ability to move more freely next week (read our full preview here).

Traders are now looking ahead to Germany’s weekend election and hoping the results will allow the Conservative front-runner to forge a coalition that can push through economic reforms and loosen borrowing rules. If Europe’s biggest economy can spend more on defense, it may help calm a market rattled by Washington’s efforts to boost ties with Russia, they said.

In Europe, the Stoxx 600 Index added 0.6%, heading for its ninth consecutive weekly gain on the back of resilient profits and optimism over peace talks in Ukraine; chemical names as Air Liquide shares surged with analysts enthusiastic about their higher margin guidance. Standard Chartered leads outperformance in banks after confirming plans to hand back $1.5 billion more to shareholders. The German DAX index rises 0.2% ahead of Sunday’s election. European stocks enjoyed about $4 billion in inflows in the week through Feb. 19, the most since February 2022, according to a Bank of America Corp. note that cited EPFR Global data. Here are some of the biggest movers on Friday:

- StanChart shares jump as much as 5.8% to hit a new 2014-high Friday after the bank’s fourth-quarter results, posting the best performance in the European banking sub-index.

- Kingspan shares gain as much as 12%, the most since July 2023, after the building materials company beat revenue and Ebitda estimates in its full-year results.

- UK retailers and grocery stocks are outperforming on Friday after sales grew more strongly than expected at the start of the year, as robust demand for food offsets weaker consumer confidence (JD Sports (+2.4%), Pets at Home (+1.5%), Frasers Group (+1,1%), Dunelm (+0.6%), B&M (+1.2%) and Currys (+1.2%); Primark-owner AB Foods, which is not in the sub-index, is up 1.5%)

- Ferrexpo shares rebound as much as 12% after saying it hasn’t been formally been notified by Ukraine about a possible seizure of a stake in its iron ore mine.

- Air Liquide shares rise as much as 3.8%, heading for a record close, with analysts enthusiastic about the French chemicals company’s higher margin guidance after full-year results were described as in line.

- Sika climbs as much as 4.1%, the most since September, after the Swiss construction and materials company reported full-year results that met market expectations and is set for continuing growth this year, according to Baader.

- ProSieben shares rise as much as 12% in Frankfurt after La Stampa said MFE-MediaForEurope — the broadcaster owned by Italy’s Berlusconi family — may consider making a takeover bid.

- Alten shares jump as much as 16%, their biggest one-day gain in nearly 17 years, after the French IT services firm released results and said that its business is stabilizing, even as there is no sign yet of a recovery.

- Diageo shares rise as much as 2.1%, extending a rebound into a second session, with analysts bullish on recovery prospects after management gave a presentation at the Consumer Analyst Group of New York (CAGNY).

- Elekta shares tumble as much as 11%, the most in more than 8 months, after the Swedish medical technology firm reported sales and earnings for the third quarter that missed estimates, while cutting its FY guidance for sales growth and Ebit margin.

Earlier in the session, stocks in Asia rose, buoyed by a rally in technology shares as Chinese e-commerce giant Alibaba’s stellar results boosted investor sentiment. The MSCI Asia Pacific Index climbed 0.7%, supported by Alibaba along with Tencent, TSMC and Xiaomi. The regional gauge marked a sixth-straight weekly advance, rising 1.2% for the period, the longest winning streak in almost a year. Equities in Hong Kong and mainland China led gains around the region Friday. Alibaba shares jumped the most in nearly three years after it reported sales that beat estimates. The results were seen as a good sign for a continuation of the DeepSeek-driven rally in everything related to China’s AI sector, which helped push the Hang Seng Tech Index into a bull market earlier this month. Chinese technology stocks surged to their highest level since 2022, lifted by a 14% jump in Alibaba. Elsewhere in the region, Japanese stocks closed 0.3% higher after Bank of Japan Governor Kazuo Ueda said he expects easy financial conditions to support the economy. Shares saw notable gains in Taiwan and the Philippines.

In rates, treasury futures drifted higher with the curve flatter, supported by a drop in oil and wider gains seen across bunds which jumped on a notably weak French service PMI print for February although gains were tempered by more encouraging readings from Germany. German 10-year yields fall 4 bps to 2.49%. Gilts were largely unmoved by a UK PMI which came in close to expectations. UK 10-year borrowing costs are flat at 4.61%. Treasuries edge higher.

In FX, the Bloomberg Dollar Spot Index rose 0.2%, rebounding from 2025 lows with economists expecting the composite reading at 53.2, slightly below the January reading; the yen weakened 0.5% against the US dollar after BOJ Governor Ueda signaled a readiness to quell a surge in bond yields. The Japanese currency earlier touched a fresh 2025 high after inflation accelerated more than forecast. The euro falls 0.3% after purchasing manager data showed business activity in the region hardly grew in February, reinforcing fears that the bloc remains mired in stagnation.

In commodities, oil prices decline, with WTI falling 1% to $71.80 a barrel. Spot gold drops $8 to around $2,931/oz, but still headed for an eighth consecutive weekly advance as the geopolitical and trade tensions fueled demand for the precious metal.

The US economic data calendar includes February manufacturing PMI (9:45am), University of Michigan sentiment and January existing home sales (10am). Fed speaker slate includes Jefferson at 11:30am on central bank communication

Market Snapshot

- S&P 500 futures little changed at 6,136.25

- STOXX Europe 600 up 0.3% to 552.66

- MXAP up 0.8% to 190.21

- MXAPJ up 1.3% to 601.61

- Nikkei up 0.3% to 38,776.94

- Topix little changed at 2,736.53

- Hang Seng Index up 4.0% to 23,477.92

- Shanghai Composite up 0.8% to 3,379.11

- Sensex down 0.5% to 75,328.71

- Australia S&P/ASX 200 down 0.3% to 8,296.21

- Kospi little changed at 2,654.58

- German 10Y yield little changed at 2.50%

- Euro down 0.2% to $1.0475

- Brent Futures down 0.6% to $76.00/bbl

- Gold spot down 0.4% to $2,927.26

- US Dollar Index up 0.23% to 106.62

Top Overnight News

- Russia used the first round of talks with the US over ending the war in Ukraine to demand the withdrawal of Nato forces from the alliance’s eastern flank, triggering concern in Europe that the Trump administration could acquiesce to seal a peace deal. FT

- Wall Street is strategizing for more radical moves from Donald Trump amid talk he may force some of the US’s foreign creditors to swap their Treasuries into ultra long-term bonds to ease America’s debt burden. BBG

- The US and EU have discussed a potential deal to cut and ultimately scrap tariffs on car imports. EU officials insisted there was “positive momentum: towards a compromise between the two sides following talks in Washington this week. FT

- China Foreign Ministry says Vice Premier He Lifeng will speak with US Treasury Secretary Bessent, "will communicate important issues in the economic field between China and US over video call".

- Nissan shares jumped on an FT report that a high-level Japanese group may seek investment from Tesla to aid the carmaker. The proposal envisions a consortium of investors, with the EV maker as the largest backer, acquiring Nissan’s plants in the US. FT

- Fed's Kugler (voter) said she believes the Fed should hold the policy rate in place for some time and noted there is currently a lot of uncertainty about the potential effect of President Trump's tariffs, as well as noted they are looking at potential scenarios on tariff impacts and tariffs could put up price pressures, but the extent is less known: BBG

- Senate continues vote-a-rama through the night to develop budget framework for Trump agenda: Fox's Pergram.

- Senate GOP budget resolution passes with Rand Paul voting no: Punchbowl

- Japan’s national CPI for Dec was mostly inline, including on headline (+4% vs. the Street +4% and vs. +3.6% in Dec) and core (+2.5% vs. the Street +2.5% and vs. +2.4% in Dec). BBG

- BOJ Governor Kazuo Ueda issued a mild warning on Friday that it could increase bond buying if "abnormal" market moves trigger a sharp rise in yields, but he was reiterating the bank's pledge made when it began tapering bond purchases in July last year. RTRS

- The PBOC added a net $11.6 billion into the financial system, it’s largest single-day infusion this month, to try to ease a cash crunch. BBG

- UK retail sales come in solidly ahead of expectations at +2.1% M/M (vs. the Street +0.9%). RTRS… Eurozone flash PMIs are mixed for Feb, with manufacturing ticking up to 47.3 (vs. 46.6 in Jan and slightly above the Street’s 47 forecast) while services fell to 50.7 (down from 51.3 in Jan and below the Street’s 51.5 consensus), and underlying inflation trends worsened (input and output costs both jumped in Feb). S&P

- European stocks attracted the most inflows since war broke out Ukraine three years ago, according to BofA, citing EPFR Global data. About $4 billion flowed into European funds, underpinned by optimism on peace negotiations. BBG

A more detailed look at overnight markets courtesy of Newsquawk

APAC stocks traded mostly higher albeit with mixed price action seen following the subdued handover from Wall St where stocks declined amid geopolitical uncertainty, disappointing data and weak Walmart guidance, while participants in the region digested earnings releases and central bank commentary. ASX 200 marginally declined amid a deluge of earnings releases and after Australia's flash manufacturing PMI improved but remained in contraction territory, while RBA Governor Bullock reiterated a cautious approach to further rate cuts. Nikkei 225 swung between gains and losses with initial pressure owing to recent currency strength and after mostly firmer-than-expected CPI data, although the index then rebounded and the yen weakened amid comments from BoJ Governor Ueda who said if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations. Hang Seng and Shanghai Comp are positive with notable outperformance in the Hong Kong benchmark which was led by a tech surge as Alibaba shares climbed by a double-digit percentage post-earnings, while the PBoC and Chinese Premier Li recently pledged efforts to smooth financing and stimulate consumption, respectively.

Top Asian News

- BoJ Governor Ueda said BoJ's massive monetary easing including YCC was a necessary process towards achieving the price target and they acknowledged the BoJ's massive stimulus caused various side effects, Ueda said they expect long-term interest rates to fluctuate to some extent depending on the market's view on the economic outlook and if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations, to smooth market moves. Ueda said he won't comment on where long-term interest rates could eventually converge and cannot say specifically when exactly the BoJ could conduct emergency market operations to soothe yield moves. Furthermore, he said there could be more side effects from monetary easing and that more interest rate hikes could come into sight if the price outlook continues to improve, and there might be some unpredictable impact on the economy, while he reiterated the accommodative environment continues and BoJ will adjust monetary policy if underlying prices rise.

- RBA Governor Bullock said the board is committed to being guided by incoming data and evolving risk assessments, while she added there is no pre-commitment to any specific course of action on interest rates and the board remains cautious about further policy easing.

European bourses (STOXX 600 +0.3%) opened with a modest positive bias, but sentiment slipped a touch, to display a more mixed picture. Thereafter, sentiment in Europe was hit following the release of the French PMI metrics, but the downside largely stabilised after the German and EZ figures. European sectors hold a positive bias, but with the breadth of the market fairly narrow aside from the day’s leader. Chemicals tops the pile, lifted by post-earning strength in Air Liquide (+2.9%). Energy resides at the foot of the pile, given the weakness in oil prices in today’s session.

Top European News

- UK reportedly lines up a new ambassador to help rebuild China ties, according to Reuters.

FX

- DXY is attempting to recoup some lost ground after printing a YTD trough overnight at 106.35. Downside in the prior session stems from the opening up the prospect of a US-China trade deal, softer-than-expected US data and the US curve flattening on the back of Treasury Secretary Bessent's recent comments. If upside for the DXY extends, the next target comes via the 107 mark with yesterday's peak just above at 107.15.

- EUR was knocked lower in early trade following a dismal outturn for French flash PMI data which saw the services metric print below the lower end of expectations, dragging the composite metrics further into negative territory and to its lowest reading since 2023. EUR/USD printed a session low at 1.0469 before recouping some ground after a beat on German manufacturing PMI was able to move the composite metric further into expansionary territory. Attention now turns to Sunday's German election with focus on what the outcome will mean for the nation's fiscal agenda. ECB's Lane due to speak at 14:30GMT.

- JPY is the clear laggard across the majors with a firmer-than-expected outturn for Japanese national CPI overshadowed by comments from BoJ Governor Ueda. Ueda declared that the Bank will respond to any abnormal upside in long-term interest rates with purchases of government bonds. As such, after initially printing a fresh YTD trough overnight at 149.29, the pair has returned to a 150 handle.

- Cable printed a fresh YTD peak in early European trade following a solid retail sales report for January with the headline print coming in above the top end of estimates. On the data slate, flash PMIs for January were a mixed bag with a beat on services offset by a miss in manufacturing, leaving the composite in-line with estimates at 50.5.

- Antipodeans are both marginally softer vs. the stronger USD. AUD/USD was able to print another fresh YTD peak and breach the 0.64 threshold (0.6408 peak) before succumbing to the strength in the greenback.

Fixed Income

- USTs are marginally firmer but only posting gains of a handful of ticks in rangebound/choppy trade with US-specifics so far somewhat lighter than has been the case in recent sessions. Overnight, USTs caught a bid alongside the discussed move in JGBs. Specifically, at the upper-end of a 109-03+ to 109-11+ band, eyeing the 109-15 peak from Monday. Ahead, while we await updates to the tariff and geopolitical narratives we get data via US Flash PMIs and then an appearance from Fed’s Jefferson (Voter) on Fed Communication, from this we expect both a text release and a Q&A.

- Bunds are firmer, leading the EGB space. At the upper-end of a 131.56 to 132.20 band which has eclipsed Tuesday’s best but yet to approach Monday’s 132.58 WTD peak. Into the morning’s data Bunds were around 15 ticks off the above base and in the red. The French numbers hit first and came in softer than expected with the Composite at its lowest since 2023 and particular concern around the Services figures. A release which lifted Bunds to the session high, but soon faded into the German figures which were mixed but far better than the French metrics earlier. The pan-EZ figure came in mixed vs consensus and spurred no real reaction.

- Gilts are moving with the above but with magnitudes more contained into its own data. A release which didn’t really spark much of a reaction given it was quite mixed. Services came in marginally better than expected while Manufacturing missed and printed outside the forecast range leaving Composite in-line with consensus and only incrementally down from the prior. Prior to the Flash PMIs, UK Retail metrics came in stronger than expected though the PNSB figures, while at a record surplus, actually posted a smaller surplus than the OBR forecast at the time of the October Budget; a ‘surplus’ which, given the OBR compare, isn’t as much of a welcome indicator for the Chancellor as it may appear on face value.

- JGBs were supported overnight by BoJ Governor Ueda, remarks which more than offset any pressure from hotter-than-expected Japanese CPI. Ueda said that the BoJ stands ready to respond nimbly such as through market operations if markets make abnormal moves.

- Orders for the 8yr BTP Plus have hit EUR 14bln across the offer period

Commodities

- Subdued price action across the crude complex, with prices weakening as the European session went underway and the dollar trending higher. Sentiment for the complex could also be subdued by the downbeat commentary from the EZ flash PMIs, which suggested "Economic output in the eurozone is barely moving at all." Brent sits in a USD 75.89-76.75/bbl.

- Lower trade across precious metals as the Dollar attempts a recovery from its recent tumble and in turn prompting downside across metals. It was also reported that record gold prices have dampened demand at top Asian hubs, with buyers in India and China reportedly "sitting back" and waiting for a drop in prices. Spot gold resides in a USD 2,916.82-2,949.93/oz range.

- Base metals are lower across the board amid the aforementioned recovery in the Dollar coupled with flimsy risk sentiment, albeit in the absence of macro newsflow. 3M LME copper trades with mild losses between a USD 9,455.95-9,570.80/t range.

- EU's Energy Commissioner said the EU is looking for more gas, including from the likes of the US, to replace Russian supplies, via Reuters; the draft shows that the EU is aiming for long-term LNG contracts to stabilise prices. The EU is also looking for renewable energy to cut its overall reliance on fuel.

- Oil flows from Tengiz field via Caspian Pipeline Consortium are uninterrupted, according to Ifax citing Tengizchevroil.

Geopolitics: Middle East

- Israeli police received reports of two explosions in Bat Yam and one in Holon on Thursday night, while four explosive devices were found in buses in Bat Yam and Holon. Israeli PM's office said there was an attempt to carry out a series of attacks on buses and Israeli PM Netanyahu has instructed the military to carry out an intense operation in the West Bank against "terror" hubs.

- Israel military said two bodies released by Hamas on Thursday were identified as Israeli hostages Kfir and Ariel Bibas, while it demanded for Hamas to return Shiri Bilbas along with all hostages. It was separately reported that the IDF said the exchange with Hamas on Saturday will continue as planned, according to Asharq News.

Geopolitics: Ukraine

- "AFP quoting Ukrainian source: Kiev and Washington continue negotiations on strategic minerals", according to Sky News Arabia.

- Russia Security Council says threats to Russian port infrastructure from NATO have intensified, according to RIA. Adds, NATO considers maritime transport and major oil terminals as targets for attacks.

- US Secretary of State Rubio said the meeting between US President Trump and Russian President Putin will largely depend on whether progress can be made on ending the war in Ukraine.

- US opposes language on 'Russian aggression' in G7 statement on Ukraine, according to FT

- Polish PM Tusk called for financing aid for Ukraine from frozen Russian assets and urged stronger defences along EU borders with Russia.

- China's Foreign Minister Wang Yi said China supports all efforts conducive to peace in Ukraine including the recent consensus reached by the US and Russia, while he added that China is willing to continue playing a constructive role in political resolution of the crisis.

- "German Chancellor: Ceasefire in Ukraine is still elusive", according to Sky News Arabia.

- Russian Kremlin says there is an understanding for a Trump-Putin meeting; no concrete details yet. Special military operation is continuing and goals will be achieved. Have goals related to security and ready to achieve this via negotiations.

Geopolitics: Other

- China’s military warned and drove away three Philippine aircraft that ‘illegally intruded’ into the airspace near the Spratly Islands and reefs on Thursday.

- There has been a new cable break in the Baltic Sea, according to information to TV4 News, The Armed Forces confirm that they are aware of the information.

- Sweden's PM says they are looking into a breach of an undersea cable within the Baltic Sea; Coast Guard adds that the suspected breach occurred in Sweden's EEZ.

- European Commission is to propose a new surveillance mechanism for submarine cables, according to a document cited by Reuters.

US Event Calendar

- 09:45: Feb. S&P Global US Manufacturing PM, est. 51.4, prior 51.2

- Feb. S&P Global US Services PMI, est. 53.0, prior 52.9

- Feb. S&P Global US Composite PMI, est. 53.2, prior 52.7

- 10:00: Feb. U. of Mich. Sentiment, est. 67.8, prior 67.8

- Feb. U. of Mich. Current Conditions, est. 68.5, prior 68.7

- Feb. U. of Mich. Expectations, est. 67.4, prior 67.3

- Feb. U. of Mich. 1 Yr Inflation, est. 4.3%, prior 4.3%

- Feb. U. of Mich. 5-10 Yr Inflation, est. 3.3%, prior 3.3%

- 10:00: Jan. Existing Home Sales MoM, est. -2.6%, prior 2.2%

Central Bank Speakers

- 11:30: Fed’s Jefferson Speaks on Central Bank Communication

DB's Jim Reid concludes the overnight wrap

Five years ago today we all went home on the Friday night blissfully unaware of the way our lives would change by Monday, and then subsequently over the next couple of years. This weekend coming was when Covid cases started to rise exponentially in Italy and by Sunday night 11 Italian towns were in lockdown. The rest as they say is history. I'll do a CoTD today on global asset price performance since this point. So watch out for that. I wonder if in five years time we'll look back on this coming weekend as a pivotal moment in Europe (good or bad) given the German election.

We'll have a full preview of that below but a brief review of the last 24 hours first. We saw a moderate risk-off move yesterday, with the S&P 500 (-0.43%) falling back from its all-time high, whilst gold prices closed at a record $2,939/oz. This morning Chinese risk is doing well on the back of Alibaba'a earnings. The main story in the US was a weaker-than-expected forecast from Walmart, which added to nerves about the health of the consumer right now, especially after a soft retail sales print last week. So that dented confidence, but some nervousness is also setting in ahead of a pivotal German election this Sunday, which could have significant implications for European markets and geopolitics for years to come.

The election comes against a difficult backdrop for Germany right now, as their economy has just experienced two consecutive annual contractions over 2023 and 2024. Indeed its economy hasn't grown over the last 5 years which for one of the strongest nations in the world, is a major disappointment and big cause for concern.

Moreover, the vote itself is taking place several months earlier than planned, as it was called after the three-way coalition of the SPD, Greens and FDP collapsed late last year. There’s a big debate about what Germany needs to do to boost growth, and a large part of that has centred around whether the new government should pursue a more expansionary fiscal policy, and even reform the constitutional debt brake to allow for more spending.

As it stands, Politico’s polling average has the conservative CDU/CSU bloc in the lead on 30%, who are currently led by Friedrich Merz. They’re followed by the far-right AfD on 21%, Chancellor Scholz’s centre-left SPD on 16%, and the Greens on 13%. Then you’ve got several parties on the cusp of the 5% threshold to enter Parliament, including the Left who’ve seen a late surge up to 7%, with the far-left BSW and the free-market FDP both on 5% (other polling aggregates suggest a rounding down to slightly below 5% for BSW and FDP). It’s important to keep an eye on those parties around the 5% threshold, as small changes in vote share could have a big impact on coalition formation and how fragmented the new Bundestag will be. So here the outcomes become non-linear between 4.9% of the vote and 5.1%. Put simply if one of the fringe parties enters parliament it‘s likely that the centrist parties will still have a two-thirds majority that could allow them to change the debt break if they agree to. If two enter they are unlikely to have a two-thirds majority and the subsequent horse trading could prevent meaningful reform. See my CoTD from Wednesday here for more on this and page 14 of our German economics primer on the election here.

In terms of when we’ll get the result, the first exit polls will be at 6pm CET, but those still come with some margin of error (0.5pts in 2021). But projections based on actual votes will be released from 6:30pm and updated throughout the evening. So by 8pm, it’s likely that the projections will be firm enough to have a clear view on coalition options and whether the two-third centrist parliamentary majority is achieved.

After the vote, the question will then turn to coalition negotiations, but these can take anything from a few weeks to several months based on prior experience. Indeed, after the 2017 election, it took almost 6 months before a new government was formed, as the initial three-way talks between the CDU/CSU, the Greens and the FDP broke down, so another grand coalition was eventually agreed between the CDU/CSU and the SPD. But last time, it was a shorter 8 weeks between the election day and reaching an agreement.

In terms of what it means for policy, clearly that will depend on the sort of government that’s formed. But our economists think it’s plausible to assume a net fiscal easing of around 0.5% of GDP by 2026. Much of that’s likely to be from higher defence spending. And beyond that, they see an easing of the debt brake at the state level as likely, which could unlock substantial public investment and consumption with high multipliers.

Away from the German election, the main story of the last 24 hours, as discussed at the top, was a pullback in US equities, though this decline did ease somewhat as the session went on. By the close, the S&P 500 was down -0.43%, having been -0.97% lower early on. The decline followed a weaker-than-expected profit forecast from Walmart (-6.53%), who were the worst performer in the Dow Jones (-1.01%) as a result. Moreover, that followed a worse-than-expected US retail sales number last week, which showed the biggest monthly contraction (-0.9%) since March 2023. So putting all that together, it added to fears that growth might be losing momentum into the new year. With this backdrop, bank stocks were the biggest decliners within the S&P 500 (-2.97%), giving up some of the outperformance that had propelled the sector to a +11.7% YTD gain prior to yesterday’s decline. Elsewhere in Europe, the STOXX 600 (-0.20%) also lost further ground, leaving the index on course to post its first weekly decline of 2025 so far.

On the rates side, the risk-off tone pushed yields lower on both sides of the Atlantic. But the main headlines came from US Treasury Secretary Scott Bessent, who said that moves to increase longer-term debt sales were “a long way off”. So that helped to push down longer-dated Treasury yields, with the 10yr Treasury yield down -2.8bps on the day to 4.51% and overnight trading at 4.49% (-1.95bps) . By contrast, the 2yr yield was little changed (+0.1bps to 4.27%), in part amid hawkish-leaning Fedspeak, as St Louis President Musalem said that policy should stay “modestly restrictive until inflation convergence is assured” He further added that “Around this baseline scenario, the risks of inflation stalling above 2% or moving higher seem skewed to the upside”.

Over in Europe bond yields saw similar declines, with yields on 10yr bunds (-2.4bps), OATs (-2.3bps) and BTPs (-2.5bps) all falling back. And with the risk-off mood driven more by the US economic outlook than policy headlines, the euro closed above 1.05 against the dollar for the first time since mid-December as the broad dollar index (-0.75%) lost substantial ground.

Asian equity markets are mostly rising this morning with the Hang Seng (+3.21%) seeing a renewed rally after Alibaba has jumped +13.2% on the back of strong earnings, thus helping the index notch its longest winning run since January 2023. On the mainland, the Shanghai Composite (+0.77%) is also trading noticeably higher as Alibaba’s stellar earnings renewed confidence in China’s major tech stocks. Elsewhere, the Nikkei (+0.18%) is also trading slightly higher while the KOSPI is flat. S&P 500 (-0.08%) and NASDAQ 100 (-0.09%) futures are a little softer.

Early morning data showed that Japan’s inflation accelerated to hit a 2yr high, rising +4.0% y/y in January from +3.6% in the prior month. Core CPI also rose more than expected, reaching 3.2% y/y, a one-and-a-half-year high and a tenth above consensus but with core-core in-line. The latest readings ties further into the BOJ’s projections of higher inflation, which is expected to elicit more rate hikes from the central bank this year.

Earlier today, the BOJ Governor Kazuo Ueda signalled that the central bank stands ready to increase government bond buying if long-term interest rates rise sharply, reiterating the BOJ’s long-standing commitment to supporting stable markets. Following the statement, yields on the 10yr JGBs fell -2.0bps to settle at 1.42% after briefly touching a fresh 15-year high of 1.459% while the Japanese yen (-0.33%) fell below the 150 level against the US per dollar, retreating from 11-weeks high. Meanwhile, markets are pricing in a roughly 84% chance of a 25bps hike at the July meeting, up from a 70% chance at the start of the month.

Looking at yesterday’s other data, the US weekly initial jobless claims ticked up to 219k (vs. 215k expected) in the week ending February 15. In addition, the continuing claims for the previous week moved up to 1.869m (vs. 1.868m expected). Meanwhile in the Euro Area, the European Commission’s consumer confidence indicator moved up to -13.6 in February (vs. -14.0 expected), which is its highest level since October.

To the day ahead now, and data releases include the flash PMIs for February, UK retail sales for January, and in the US there’s existing home sales for January, along with the University of Michigan’s final consumer sentiment index for February. From central banks, we’ll hear from Fed Vice Chair Jefferson, the ECB’s Lane, and Bank of Canada Governor Macklem.

US equity futures are flat, as European and Asian markets rise, as sentiment improves on the last day of the week. As of 8:10am ET, S&P futures were unchanged at 6,138 after Walmart’s forecast and concerns about consumer behavior led to a decline in stocks Thursday; Nasdaq futures gained 0.3% with the Mag 7 names are mostly higher led by META +0.6%. US-listed Chinese stocks rose in premarket trading on Alibaba’s post-earnings euphoria and after Treasury Secretary Scott Bessent said he would hold an introductory phone call with his Chinese counterpart, though he didn’t specify who on the Chinese side he’d speak to. Bond yields are 1-2bps lower and the USD is higher. Commodities are mixed: oil fell -0.8% this morning, while base metals are higher. From the macro perspective, overnight headlines were largely quiet; earnings results since market-close were mixed; BKNG announced 10% dividend increase and additional buybacks. Today, key macro focus will be global PMIs: the Mfg PMI is expected to print 51.4 vs. 51.2 prior; the Services PMI should print 53.0 vs. 52.9 prior.

In premarket trading, the Mag7 was little changed (GOOGL +0.2%, AMZN +0.2%, AAPL -0.07%, MSFT +0.3%, META +0.6%, NVDA +0.06% and TSLA -0.3%). US-listed Chinese stocks rise after Alibaba’s earnings offered a fresh boost to the China tech sector.Baidu (BIDU) +3%, JD.com (JD) +1.6%). Data center providers gained as Alibaba pledged to increase capital spending to support its AI ambitions. Dow Jones heavyweight UnitedHealth plunged more than 10% after the WSJ reported that the DOJ has launched an investigation into the company’s Medicare billing practices in recent months. The report cited people familiar with the matter. The Financial Times reported a high-level Japanese group had drawn up plans for Tesla to invest in carmaker Nissan. Here are some more premarket movers:

- Akamai Technologies (AKAM) drops 9% after the infrastructure software company gave an outlook that is weaker than expected.

- Block (XYZ) falls 8% after the digital payments company gave a 2025 gross profit outlook slightly below what Wall Street expected, with Mizuho noting “no new upside.”

- Celsius Holdings (CELH) jumps 31% after the company said it would buy rival Alani Nutrition for $1.8 billion in cash and stock, including $150 million in tax assets.

- Dropbox (DBX) drops 9% after the document management software company reported fourth-quarter results. Analysts noted concerns over user trends and growth.

- Five9 (FIVN) rises 15% after the software company’s earnings beat estimates thanks to strong growth in subscription revenue.

- Floor & Decor Holdings Inc. (FND) climbs 9% after the retailer posted 4Q profit that beat estimates and same-store sales were better than expected.

- Grid Dynamics Holdings (GDYN) soars 22% after the information technology services company provided revenue forecasts for the 1Q and year that topped expectations.

- Innodata (INOD) jumps 11% after the data engineering company reported fourth-quarter revenue and earnings per share that beat the average analyst estimate.

- MercadoLibre (MELI) climbs 12% as Latin America’s most valuable company far surpassed net income estimates in the final quarter of 2024 while growing revenue at its commerce and fintech units at a faster pace than expected.

- Nubank (NU) falls 8% after the digital bank reported fourth-quarter net income that missed consensus estimates.

- RingCentral (RNG) declines 3% after the communications software company gave an outlook that is weaker than expected for EPS and revenues.

- Rivian (RIVN) slips 3% after the electric-vehicle maker issued a downbeat first-quarter vehicle delivery forecast that overshadowed its first-ever quarterly gross profit.

- Weave Communications (WEAV) slumps 15% after the infrastructure software company reported its fourth-quarter results and gave a forecast that is seen as conservative.

US equities have been lagging their European and Asian counterparts so far this year, and BofA CIO Michael Hartnett reiterated a preference for global stocks to US peers, seeing markets such as Germany, China, Japan and South Korea as more attractive at a time when business activity is improving. US companies’ profit outlooks for 2025 have also been relatively subdued, strategists at JPMorgan noted.

It is a quiet end to a turbulent week but we still have a huge, $2.7 trillion opex to go through. Goldman estimates that over $2.7 Trillion of notional options exposure will expire including $1.2 Trillion of SPX options and $615 Billion notional of single stock options, 9:30 AM Settlement: $1.3 Trillion ($1.2 Trillion is SPX AM), and $1.4 Trillion ($615 Billion single stocks).

Dealers are long +$9.787 Billion of S&P 500 gamma at current spot, acting as a market buffer, supporting weakness and muting rallies. The Goldman index trading team estimates that 50% of this long gamma position rolls off tomorrow, and the market will have the ability to move more freely next week (read our full preview here).

Traders are now looking ahead to Germany’s weekend election and hoping the results will allow the Conservative front-runner to forge a coalition that can push through economic reforms and loosen borrowing rules. If Europe’s biggest economy can spend more on defense, it may help calm a market rattled by Washington’s efforts to boost ties with Russia, they said.

In Europe, the Stoxx 600 Index added 0.6%, heading for its ninth consecutive weekly gain on the back of resilient profits and optimism over peace talks in Ukraine; chemical names as Air Liquide shares surged with analysts enthusiastic about their higher margin guidance. Standard Chartered leads outperformance in banks after confirming plans to hand back $1.5 billion more to shareholders. The German DAX index rises 0.2% ahead of Sunday’s election. European stocks enjoyed about $4 billion in inflows in the week through Feb. 19, the most since February 2022, according to a Bank of America Corp. note that cited EPFR Global data. Here are some of the biggest movers on Friday:

- StanChart shares jump as much as 5.8% to hit a new 2014-high Friday after the bank’s fourth-quarter results, posting the best performance in the European banking sub-index.

- Kingspan shares gain as much as 12%, the most since July 2023, after the building materials company beat revenue and Ebitda estimates in its full-year results.

- UK retailers and grocery stocks are outperforming on Friday after sales grew more strongly than expected at the start of the year, as robust demand for food offsets weaker consumer confidence (JD Sports (+2.4%), Pets at Home (+1.5%), Frasers Group (+1,1%), Dunelm (+0.6%), B&M (+1.2%) and Currys (+1.2%); Primark-owner AB Foods, which is not in the sub-index, is up 1.5%)

- Ferrexpo shares rebound as much as 12% after saying it hasn’t been formally been notified by Ukraine about a possible seizure of a stake in its iron ore mine.

- Air Liquide shares rise as much as 3.8%, heading for a record close, with analysts enthusiastic about the French chemicals company’s higher margin guidance after full-year results were described as in line.

- Sika climbs as much as 4.1%, the most since September, after the Swiss construction and materials company reported full-year results that met market expectations and is set for continuing growth this year, according to Baader.

- ProSieben shares rise as much as 12% in Frankfurt after La Stampa said MFE-MediaForEurope — the broadcaster owned by Italy’s Berlusconi family — may consider making a takeover bid.

- Alten shares jump as much as 16%, their biggest one-day gain in nearly 17 years, after the French IT services firm released results and said that its business is stabilizing, even as there is no sign yet of a recovery.

- Diageo shares rise as much as 2.1%, extending a rebound into a second session, with analysts bullish on recovery prospects after management gave a presentation at the Consumer Analyst Group of New York (CAGNY).

- Elekta shares tumble as much as 11%, the most in more than 8 months, after the Swedish medical technology firm reported sales and earnings for the third quarter that missed estimates, while cutting its FY guidance for sales growth and Ebit margin.

Earlier in the session, stocks in Asia rose, buoyed by a rally in technology shares as Chinese e-commerce giant Alibaba’s stellar results boosted investor sentiment. The MSCI Asia Pacific Index climbed 0.7%, supported by Alibaba along with Tencent, TSMC and Xiaomi. The regional gauge marked a sixth-straight weekly advance, rising 1.2% for the period, the longest winning streak in almost a year. Equities in Hong Kong and mainland China led gains around the region Friday. Alibaba shares jumped the most in nearly three years after it reported sales that beat estimates. The results were seen as a good sign for a continuation of the DeepSeek-driven rally in everything related to China’s AI sector, which helped push the Hang Seng Tech Index into a bull market earlier this month. Chinese technology stocks surged to their highest level since 2022, lifted by a 14% jump in Alibaba. Elsewhere in the region, Japanese stocks closed 0.3% higher after Bank of Japan Governor Kazuo Ueda said he expects easy financial conditions to support the economy. Shares saw notable gains in Taiwan and the Philippines.

In rates, treasury futures drifted higher with the curve flatter, supported by a drop in oil and wider gains seen across bunds which jumped on a notably weak French service PMI print for February although gains were tempered by more encouraging readings from Germany. German 10-year yields fall 4 bps to 2.49%. Gilts were largely unmoved by a UK PMI which came in close to expectations. UK 10-year borrowing costs are flat at 4.61%. Treasuries edge higher.

In FX, the Bloomberg Dollar Spot Index rose 0.2%, rebounding from 2025 lows with economists expecting the composite reading at 53.2, slightly below the January reading; the yen weakened 0.5% against the US dollar after BOJ Governor Ueda signaled a readiness to quell a surge in bond yields. The Japanese currency earlier touched a fresh 2025 high after inflation accelerated more than forecast. The euro falls 0.3% after purchasing manager data showed business activity in the region hardly grew in February, reinforcing fears that the bloc remains mired in stagnation.

In commodities, oil prices decline, with WTI falling 1% to $71.80 a barrel. Spot gold drops $8 to around $2,931/oz, but still headed for an eighth consecutive weekly advance as the geopolitical and trade tensions fueled demand for the precious metal.

The US economic data calendar includes February manufacturing PMI (9:45am), University of Michigan sentiment and January existing home sales (10am). Fed speaker slate includes Jefferson at 11:30am on central bank communication

Market Snapshot

- S&P 500 futures little changed at 6,136.25

- STOXX Europe 600 up 0.3% to 552.66

- MXAP up 0.8% to 190.21

- MXAPJ up 1.3% to 601.61

- Nikkei up 0.3% to 38,776.94

- Topix little changed at 2,736.53

- Hang Seng Index up 4.0% to 23,477.92

- Shanghai Composite up 0.8% to 3,379.11

- Sensex down 0.5% to 75,328.71

- Australia S&P/ASX 200 down 0.3% to 8,296.21

- Kospi little changed at 2,654.58

- German 10Y yield little changed at 2.50%

- Euro down 0.2% to $1.0475

- Brent Futures down 0.6% to $76.00/bbl

- Gold spot down 0.4% to $2,927.26

- US Dollar Index up 0.23% to 106.62

Top Overnight News

- Russia used the first round of talks with the US over ending the war in Ukraine to demand the withdrawal of Nato forces from the alliance’s eastern flank, triggering concern in Europe that the Trump administration could acquiesce to seal a peace deal. FT

- Wall Street is strategizing for more radical moves from Donald Trump amid talk he may force some of the US’s foreign creditors to swap their Treasuries into ultra long-term bonds to ease America’s debt burden. BBG

- The US and EU have discussed a potential deal to cut and ultimately scrap tariffs on car imports. EU officials insisted there was “positive momentum: towards a compromise between the two sides following talks in Washington this week. FT

- China Foreign Ministry says Vice Premier He Lifeng will speak with US Treasury Secretary Bessent, “will communicate important issues in the economic field between China and US over video call”.

- Nissan shares jumped on an FT report that a high-level Japanese group may seek investment from Tesla to aid the carmaker. The proposal envisions a consortium of investors, with the EV maker as the largest backer, acquiring Nissan’s plants in the US. FT

- Fed’s Kugler (voter) said she believes the Fed should hold the policy rate in place for some time and noted there is currently a lot of uncertainty about the potential effect of President Trump’s tariffs, as well as noted they are looking at potential scenarios on tariff impacts and tariffs could put up price pressures, but the extent is less known: BBG

- Senate continues vote-a-rama through the night to develop budget framework for Trump agenda: Fox’s Pergram.

- Senate GOP budget resolution passes with Rand Paul voting no: Punchbowl

- Japan’s national CPI for Dec was mostly inline, including on headline (+4% vs. the Street +4% and vs. +3.6% in Dec) and core (+2.5% vs. the Street +2.5% and vs. +2.4% in Dec). BBG

- BOJ Governor Kazuo Ueda issued a mild warning on Friday that it could increase bond buying if “abnormal” market moves trigger a sharp rise in yields, but he was reiterating the bank’s pledge made when it began tapering bond purchases in July last year. RTRS

- The PBOC added a net $11.6 billion into the financial system, it’s largest single-day infusion this month, to try to ease a cash crunch. BBG

- UK retail sales come in solidly ahead of expectations at +2.1% M/M (vs. the Street +0.9%). RTRS… Eurozone flash PMIs are mixed for Feb, with manufacturing ticking up to 47.3 (vs. 46.6 in Jan and slightly above the Street’s 47 forecast) while services fell to 50.7 (down from 51.3 in Jan and below the Street’s 51.5 consensus), and underlying inflation trends worsened (input and output costs both jumped in Feb). S&P

- European stocks attracted the most inflows since war broke out Ukraine three years ago, according to BofA, citing EPFR Global data. About $4 billion flowed into European funds, underpinned by optimism on peace negotiations. BBG

A more detailed look at overnight markets courtesy of Newsquawk

APAC stocks traded mostly higher albeit with mixed price action seen following the subdued handover from Wall St where stocks declined amid geopolitical uncertainty, disappointing data and weak Walmart guidance, while participants in the region digested earnings releases and central bank commentary. ASX 200 marginally declined amid a deluge of earnings releases and after Australia’s flash manufacturing PMI improved but remained in contraction territory, while RBA Governor Bullock reiterated a cautious approach to further rate cuts. Nikkei 225 swung between gains and losses with initial pressure owing to recent currency strength and after mostly firmer-than-expected CPI data, although the index then rebounded and the yen weakened amid comments from BoJ Governor Ueda who said if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations. Hang Seng and Shanghai Comp are positive with notable outperformance in the Hong Kong benchmark which was led by a tech surge as Alibaba shares climbed by a double-digit percentage post-earnings, while the PBoC and Chinese Premier Li recently pledged efforts to smooth financing and stimulate consumption, respectively.

Top Asian News

- BoJ Governor Ueda said BoJ’s massive monetary easing including YCC was a necessary process towards achieving the price target and they acknowledged the BoJ’s massive stimulus caused various side effects, Ueda said they expect long-term interest rates to fluctuate to some extent depending on the market’s view on the economic outlook and if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations, to smooth market moves. Ueda said he won’t comment on where long-term interest rates could eventually converge and cannot say specifically when exactly the BoJ could conduct emergency market operations to soothe yield moves. Furthermore, he said there could be more side effects from monetary easing and that more interest rate hikes could come into sight if the price outlook continues to improve, and there might be some unpredictable impact on the economy, while he reiterated the accommodative environment continues and BoJ will adjust monetary policy if underlying prices rise.

- RBA Governor Bullock said the board is committed to being guided by incoming data and evolving risk assessments, while she added there is no pre-commitment to any specific course of action on interest rates and the board remains cautious about further policy easing.

European bourses (STOXX 600 +0.3%) opened with a modest positive bias, but sentiment slipped a touch, to display a more mixed picture. Thereafter, sentiment in Europe was hit following the release of the French PMI metrics, but the downside largely stabilised after the German and EZ figures. European sectors hold a positive bias, but with the breadth of the market fairly narrow aside from the day’s leader. Chemicals tops the pile, lifted by post-earning strength in Air Liquide (+2.9%). Energy resides at the foot of the pile, given the weakness in oil prices in today’s session.

Top European News

- UK reportedly lines up a new ambassador to help rebuild China ties, according to Reuters.

FX

- DXY is attempting to recoup some lost ground after printing a YTD trough overnight at 106.35. Downside in the prior session stems from the opening up the prospect of a US-China trade deal, softer-than-expected US data and the US curve flattening on the back of Treasury Secretary Bessent’s recent comments. If upside for the DXY extends, the next target comes via the 107 mark with yesterday’s peak just above at 107.15.

- EUR was knocked lower in early trade following a dismal outturn for French flash PMI data which saw the services metric print below the lower end of expectations, dragging the composite metrics further into negative territory and to its lowest reading since 2023. EUR/USD printed a session low at 1.0469 before recouping some ground after a beat on German manufacturing PMI was able to move the composite metric further into expansionary territory. Attention now turns to Sunday’s German election with focus on what the outcome will mean for the nation’s fiscal agenda. ECB’s Lane due to speak at 14:30GMT.

- JPY is the clear laggard across the majors with a firmer-than-expected outturn for Japanese national CPI overshadowed by comments from BoJ Governor Ueda. Ueda declared that the Bank will respond to any abnormal upside in long-term interest rates with purchases of government bonds. As such, after initially printing a fresh YTD trough overnight at 149.29, the pair has returned to a 150 handle.

- Cable printed a fresh YTD peak in early European trade following a solid retail sales report for January with the headline print coming in above the top end of estimates. On the data slate, flash PMIs for January were a mixed bag with a beat on services offset by a miss in manufacturing, leaving the composite in-line with estimates at 50.5.

- Antipodeans are both marginally softer vs. the stronger USD. AUD/USD was able to print another fresh YTD peak and breach the 0.64 threshold (0.6408 peak) before succumbing to the strength in the greenback.

Fixed Income

- USTs are marginally firmer but only posting gains of a handful of ticks in rangebound/choppy trade with US-specifics so far somewhat lighter than has been the case in recent sessions. Overnight, USTs caught a bid alongside the discussed move in JGBs. Specifically, at the upper-end of a 109-03+ to 109-11+ band, eyeing the 109-15 peak from Monday. Ahead, while we await updates to the tariff and geopolitical narratives we get data via US Flash PMIs and then an appearance from Fed’s Jefferson (Voter) on Fed Communication, from this we expect both a text release and a Q&A.

- Bunds are firmer, leading the EGB space. At the upper-end of a 131.56 to 132.20 band which has eclipsed Tuesday’s best but yet to approach Monday’s 132.58 WTD peak. Into the morning’s data Bunds were around 15 ticks off the above base and in the red. The French numbers hit first and came in softer than expected with the Composite at its lowest since 2023 and particular concern around the Services figures. A release which lifted Bunds to the session high, but soon faded into the German figures which were mixed but far better than the French metrics earlier. The pan-EZ figure came in mixed vs consensus and spurred no real reaction.

- Gilts are moving with the above but with magnitudes more contained into its own data. A release which didn’t really spark much of a reaction given it was quite mixed. Services came in marginally better than expected while Manufacturing missed and printed outside the forecast range leaving Composite in-line with consensus and only incrementally down from the prior. Prior to the Flash PMIs, UK Retail metrics came in stronger than expected though the PNSB figures, while at a record surplus, actually posted a smaller surplus than the OBR forecast at the time of the October Budget; a ‘surplus’ which, given the OBR compare, isn’t as much of a welcome indicator for the Chancellor as it may appear on face value.

- JGBs were supported overnight by BoJ Governor Ueda, remarks which more than offset any pressure from hotter-than-expected Japanese CPI. Ueda said that the BoJ stands ready to respond nimbly such as through market operations if markets make abnormal moves.

- Orders for the 8yr BTP Plus have hit EUR 14bln across the offer period

Commodities

- Subdued price action across the crude complex, with prices weakening as the European session went underway and the dollar trending higher. Sentiment for the complex could also be subdued by the downbeat commentary from the EZ flash PMIs, which suggested “Economic output in the eurozone is barely moving at all.” Brent sits in a USD 75.89-76.75/bbl.

- Lower trade across precious metals as the Dollar attempts a recovery from its recent tumble and in turn prompting downside across metals. It was also reported that record gold prices have dampened demand at top Asian hubs, with buyers in India and China reportedly “sitting back” and waiting for a drop in prices. Spot gold resides in a USD 2,916.82-2,949.93/oz range.

- Base metals are lower across the board amid the aforementioned recovery in the Dollar coupled with flimsy risk sentiment, albeit in the absence of macro newsflow. 3M LME copper trades with mild losses between a USD 9,455.95-9,570.80/t range.

- EU’s Energy Commissioner said the EU is looking for more gas, including from the likes of the US, to replace Russian supplies, via Reuters; the draft shows that the EU is aiming for long-term LNG contracts to stabilise prices. The EU is also looking for renewable energy to cut its overall reliance on fuel.

- Oil flows from Tengiz field via Caspian Pipeline Consortium are uninterrupted, according to Ifax citing Tengizchevroil.

Geopolitics: Middle East

- Israeli police received reports of two explosions in Bat Yam and one in Holon on Thursday night, while four explosive devices were found in buses in Bat Yam and Holon. Israeli PM’s office said there was an attempt to carry out a series of attacks on buses and Israeli PM Netanyahu has instructed the military to carry out an intense operation in the West Bank against “terror” hubs.

- Israel military said two bodies released by Hamas on Thursday were identified as Israeli hostages Kfir and Ariel Bibas, while it demanded for Hamas to return Shiri Bilbas along with all hostages. It was separately reported that the IDF said the exchange with Hamas on Saturday will continue as planned, according to Asharq News.

Geopolitics: Ukraine

- “AFP quoting Ukrainian source: Kiev and Washington continue negotiations on strategic minerals”, according to Sky News Arabia.

- Russia Security Council says threats to Russian port infrastructure from NATO have intensified, according to RIA. Adds, NATO considers maritime transport and major oil terminals as targets for attacks.

- US Secretary of State Rubio said the meeting between US President Trump and Russian President Putin will largely depend on whether progress can be made on ending the war in Ukraine.

- US opposes language on ‘Russian aggression’ in G7 statement on Ukraine, according to FT

- Polish PM Tusk called for financing aid for Ukraine from frozen Russian assets and urged stronger defences along EU borders with Russia.

- China’s Foreign Minister Wang Yi said China supports all efforts conducive to peace in Ukraine including the recent consensus reached by the US and Russia, while he added that China is willing to continue playing a constructive role in political resolution of the crisis.

- “German Chancellor: Ceasefire in Ukraine is still elusive”, according to Sky News Arabia.

- Russian Kremlin says there is an understanding for a Trump-Putin meeting; no concrete details yet. Special military operation is continuing and goals will be achieved. Have goals related to security and ready to achieve this via negotiations.

Geopolitics: Other

- China’s military warned and drove away three Philippine aircraft that ‘illegally intruded’ into the airspace near the Spratly Islands and reefs on Thursday.

- There has been a new cable break in the Baltic Sea, according to information to TV4 News, The Armed Forces confirm that they are aware of the information.

- Sweden’s PM says they are looking into a breach of an undersea cable within the Baltic Sea; Coast Guard adds that the suspected breach occurred in Sweden’s EEZ.

- European Commission is to propose a new surveillance mechanism for submarine cables, according to a document cited by Reuters.

US Event Calendar

- 09:45: Feb. S&P Global US Manufacturing PM, est. 51.4, prior 51.2

- Feb. S&P Global US Services PMI, est. 53.0, prior 52.9

- Feb. S&P Global US Composite PMI, est. 53.2, prior 52.7

- 10:00: Feb. U. of Mich. Sentiment, est. 67.8, prior 67.8

- Feb. U. of Mich. Current Conditions, est. 68.5, prior 68.7

- Feb. U. of Mich. Expectations, est. 67.4, prior 67.3

- Feb. U. of Mich. 1 Yr Inflation, est. 4.3%, prior 4.3%

- Feb. U. of Mich. 5-10 Yr Inflation, est. 3.3%, prior 3.3%

- 10:00: Jan. Existing Home Sales MoM, est. -2.6%, prior 2.2%

Central Bank Speakers

- 11:30: Fed’s Jefferson Speaks on Central Bank Communication

DB’s Jim Reid concludes the overnight wrap

Five years ago today we all went home on the Friday night blissfully unaware of the way our lives would change by Monday, and then subsequently over the next couple of years. This weekend coming was when Covid cases started to rise exponentially in Italy and by Sunday night 11 Italian towns were in lockdown. The rest as they say is history. I’ll do a CoTD today on global asset price performance since this point. So watch out for that. I wonder if in five years time we’ll look back on this coming weekend as a pivotal moment in Europe (good or bad) given the German election.

We’ll have a full preview of that below but a brief review of the last 24 hours first. We saw a moderate risk-off move yesterday, with the S&P 500 (-0.43%) falling back from its all-time high, whilst gold prices closed at a record $2,939/oz. This morning Chinese risk is doing well on the back of Alibaba’a earnings. The main story in the US was a weaker-than-expected forecast from Walmart, which added to nerves about the health of the consumer right now, especially after a soft retail sales print last week. So that dented confidence, but some nervousness is also setting in ahead of a pivotal German election this Sunday, which could have significant implications for European markets and geopolitics for years to come.

The election comes against a difficult backdrop for Germany right now, as their economy has just experienced two consecutive annual contractions over 2023 and 2024. Indeed its economy hasn’t grown over the last 5 years which for one of the strongest nations in the world, is a major disappointment and big cause for concern.

Moreover, the vote itself is taking place several months earlier than planned, as it was called after the three-way coalition of the SPD, Greens and FDP collapsed late last year. There’s a big debate about what Germany needs to do to boost growth, and a large part of that has centred around whether the new government should pursue a more expansionary fiscal policy, and even reform the constitutional debt brake to allow for more spending.

As it stands, Politico’s polling average has the conservative CDU/CSU bloc in the lead on 30%, who are currently led by Friedrich Merz. They’re followed by the far-right AfD on 21%, Chancellor Scholz’s centre-left SPD on 16%, and the Greens on 13%. Then you’ve got several parties on the cusp of the 5% threshold to enter Parliament, including the Left who’ve seen a late surge up to 7%, with the far-left BSW and the free-market FDP both on 5% (other polling aggregates suggest a rounding down to slightly below 5% for BSW and FDP). It’s important to keep an eye on those parties around the 5% threshold, as small changes in vote share could have a big impact on coalition formation and how fragmented the new Bundestag will be. So here the outcomes become non-linear between 4.9% of the vote and 5.1%. Put simply if one of the fringe parties enters parliament it‘s likely that the centrist parties will still have a two-thirds majority that could allow them to change the debt break if they agree to. If two enter they are unlikely to have a two-thirds majority and the subsequent horse trading could prevent meaningful reform. See my CoTD from Wednesday here for more on this and page 14 of our German economics primer on the election here.

In terms of when we’ll get the result, the first exit polls will be at 6pm CET, but those still come with some margin of error (0.5pts in 2021). But projections based on actual votes will be released from 6:30pm and updated throughout the evening. So by 8pm, it’s likely that the projections will be firm enough to have a clear view on coalition options and whether the two-third centrist parliamentary majority is achieved.

After the vote, the question will then turn to coalition negotiations, but these can take anything from a few weeks to several months based on prior experience. Indeed, after the 2017 election, it took almost 6 months before a new government was formed, as the initial three-way talks between the CDU/CSU, the Greens and the FDP broke down, so another grand coalition was eventually agreed between the CDU/CSU and the SPD. But last time, it was a shorter 8 weeks between the election day and reaching an agreement.

In terms of what it means for policy, clearly that will depend on the sort of government that’s formed. But our economists think it’s plausible to assume a net fiscal easing of around 0.5% of GDP by 2026. Much of that’s likely to be from higher defence spending. And beyond that, they see an easing of the debt brake at the state level as likely, which could unlock substantial public investment and consumption with high multipliers.

Away from the German election, the main story of the last 24 hours, as discussed at the top, was a pullback in US equities, though this decline did ease somewhat as the session went on. By the close, the S&P 500 was down -0.43%, having been -0.97% lower early on. The decline followed a weaker-than-expected profit forecast from Walmart (-6.53%), who were the worst performer in the Dow Jones (-1.01%) as a result. Moreover, that followed a worse-than-expected US retail sales number last week, which showed the biggest monthly contraction (-0.9%) since March 2023. So putting all that together, it added to fears that growth might be losing momentum into the new year. With this backdrop, bank stocks were the biggest decliners within the S&P 500 (-2.97%), giving up some of the outperformance that had propelled the sector to a +11.7% YTD gain prior to yesterday’s decline. Elsewhere in Europe, the STOXX 600 (-0.20%) also lost further ground, leaving the index on course to post its first weekly decline of 2025 so far.

On the rates side, the risk-off tone pushed yields lower on both sides of the Atlantic. But the main headlines came from US Treasury Secretary Scott Bessent, who said that moves to increase longer-term debt sales were “a long way off”. So that helped to push down longer-dated Treasury yields, with the 10yr Treasury yield down -2.8bps on the day to 4.51% and overnight trading at 4.49% (-1.95bps) . By contrast, the 2yr yield was little changed (+0.1bps to 4.27%), in part amid hawkish-leaning Fedspeak, as St Louis President Musalem said that policy should stay “modestly restrictive until inflation convergence is assured” He further added that “Around this baseline scenario, the risks of inflation stalling above 2% or moving higher seem skewed to the upside”.

Over in Europe bond yields saw similar declines, with yields on 10yr bunds (-2.4bps), OATs (-2.3bps) and BTPs (-2.5bps) all falling back. And with the risk-off mood driven more by the US economic outlook than policy headlines, the euro closed above 1.05 against the dollar for the first time since mid-December as the broad dollar index (-0.75%) lost substantial ground.

Asian equity markets are mostly rising this morning with the Hang Seng (+3.21%) seeing a renewed rally after Alibaba has jumped +13.2% on the back of strong earnings, thus helping the index notch its longest winning run since January 2023. On the mainland, the Shanghai Composite (+0.77%) is also trading noticeably higher as Alibaba’s stellar earnings renewed confidence in China’s major tech stocks. Elsewhere, the Nikkei (+0.18%) is also trading slightly higher while the KOSPI is flat. S&P 500 (-0.08%) and NASDAQ 100 (-0.09%) futures are a little softer.

Early morning data showed that Japan’s inflation accelerated to hit a 2yr high, rising +4.0% y/y in January from +3.6% in the prior month. Core CPI also rose more than expected, reaching 3.2% y/y, a one-and-a-half-year high and a tenth above consensus but with core-core in-line. The latest readings ties further into the BOJ’s projections of higher inflation, which is expected to elicit more rate hikes from the central bank this year.

Earlier today, the BOJ Governor Kazuo Ueda signalled that the central bank stands ready to increase government bond buying if long-term interest rates rise sharply, reiterating the BOJ’s long-standing commitment to supporting stable markets. Following the statement, yields on the 10yr JGBs fell -2.0bps to settle at 1.42% after briefly touching a fresh 15-year high of 1.459% while the Japanese yen (-0.33%) fell below the 150 level against the US per dollar, retreating from 11-weeks high. Meanwhile, markets are pricing in a roughly 84% chance of a 25bps hike at the July meeting, up from a 70% chance at the start of the month.

Looking at yesterday’s other data, the US weekly initial jobless claims ticked up to 219k (vs. 215k expected) in the week ending February 15. In addition, the continuing claims for the previous week moved up to 1.869m (vs. 1.868m expected). Meanwhile in the Euro Area, the European Commission’s consumer confidence indicator moved up to -13.6 in February (vs. -14.0 expected), which is its highest level since October.

To the day ahead now, and data releases include the flash PMIs for February, UK retail sales for January, and in the US there’s existing home sales for January, along with the University of Michigan’s final consumer sentiment index for February. From central banks, we’ll hear from Fed Vice Chair Jefferson, the ECB’s Lane, and Bank of Canada Governor Macklem.

Loading…