As we previewed earlier, while expectations were still lofty, investor euphoria going into Nvidia's fourth quarter results was far more subdued than in 2023 and 2024 (with positioning a modest 7 out of 10) according to Goldman. Not only that, but the bank warned that investors were positioned bearish into the result, suggesting that the company would not need to beat by a whole lot to trigger a stock or gamma squeeze.

As Bloomberg notes, for Nvidia over the past two years consensus numbers have mattered less than they generally do because the company has regularly beaten average Wall Street estimates by more than 20%. Anything less than a blowout has been considered disappointing. Case in point: The highest estimate for first-quarter revenue is for more than $47 billion. Still sentiment is much more cautious than just a quarter or two prior: Nvidia shares are in an interesting place ahead of its earnings report. It’s the first time since 2022 that shares have declined since the company’s latest report, and the options-implied move of 9.9% in either direction is the biggest anticipated swing in roughly the same time frame. What’s more, shares are down year-to-date -- like most stocks in the Magnificent Seven -- and have not yet recouped all of the losses from the January rout set off by DeepSeek.

Still, Nvidia is almost certain to meet fiscal 4Q revenue guidance and raise 1Q’s outlook amid a significant ramp up in its Blackwell GPUs, having overcome supply-chain delays and concern about hyperscaler demand in the wake of DeepSeek, according to a note by Kunjan Sobhani, a Bloomberg Intelligence technology analyst.

“Increased capital spending guidance from Meta, Microsoft, Amazon Web Services and Google aids our confidence in near-term sales,” Sobhani said adding that “fundamentally the print and guidance should again be solid and most likely beat” analysts’ estimates. Key point of interest will be on whether 1H is likely to show strong growth or a pocket of slowdown between the Hopper and Blackwell transition.”

One number to keep an eye out for is the percentage of revenue that Nvidia gets from a small group of customers –- so-called hyperscalers – which includes Microsoft, Amazon and Alphabet Inc.’s Google. Last quarter, they accounted for more than half of of Nvidia’s data-center revenue, up from 45% in the prior period. Investors want that number to go down, to show that the use of AI is spreading across the economy.

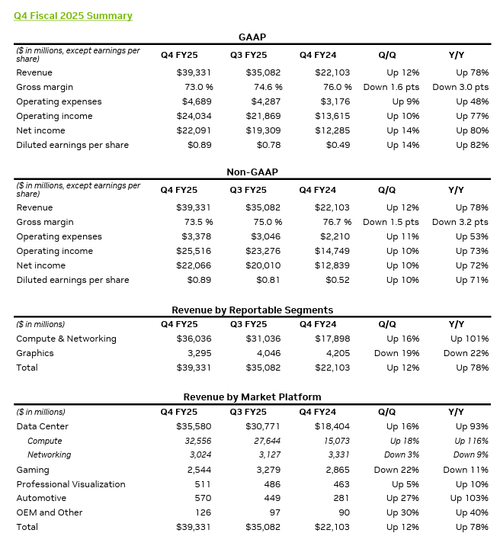

With all that in mind, here is what Nvidia just reported for Q4:

- Adjusted EPS 89c, beating estimate 84c

- Revenue $39.33 billion, +78% y/y, beating estimates $38.25 billion

- Data center revenue $35.6 billion, +93% y/y, beating estimates $34.09 billion

- Compute revenue $32.56 billion vs. $15.07 billion y/y, beating estimates $30.41 billion

- Networking revenue $3.02 billion, -9.2% y/y, missing estimate $3.51 billion

- Gaming revenue $2.5 billion, -14% y/y, missing estimate $3.02 billion

- Professional Visualization revenue $511 million, +10% y/y, beating estimate $507.6 million

- Automotive revenue $570 million vs. $281 million y/y, beating estimate $460.7 million

- Adjusted operating income $25.52 billion, +73% y/y, beating estimate $24.69 billion

- R&D expenses $3.71 billion, +51% y/y, below estimate $3.75 billion

- Adjusted operating expenses $3.38 billion, +53% y/y, below the estimate $3.4 billion

- Adjusted gross margin 73.5% vs. 76.7% y/y, in line with estimate 73.5%

- Free cash flow $15.52 billion, +38% y/y

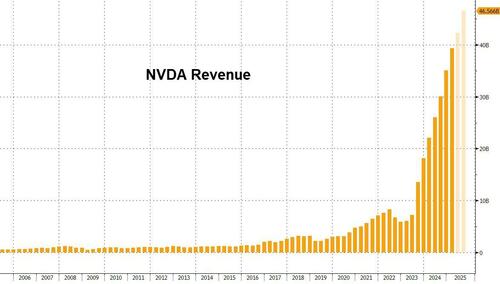

But the most important data point in the release, the guidance, came in sold as Nvidia sees Q1 Revenue of $43.0BN (plus or minus 2%), above the Wall Street consensus of $42.3BN but just light of the upside whisper number. As shown below, the revenue growth is clearly moderating.

One concerning point is that networking isn’t growing in lockstep with the rest of the business.

“Networking revenue was $3.0 billion, down 9% from a year ago and down 3% sequentially,” the company said in its CFO commentary. This hiccup is being caused by a transition to new products, Nvidia said.

company’s gross margin. The forecast calls for a further narrowing, something that analysts had expressed concern about.

Another potenial weakness is the company's non-adjusted gross margin. The forecast calls for a further narrowing, something that analysts had expressed concern about.

Nvidia has said that’s just the price of getting new products to market and they’ll widen again. For the current quarter, the company is predicting non-GAAP gross margin of 71%, about a point shy of consensus.

But it wasn't just the numbers that mattered: just as important was the qualitative description of ongoing events, where the company said it "delivered $11.0 billion of Blackwell architecture revenue in the fourth quarter of fiscal 2025, the fastest product ramp in our company’s history." Nvidia said that Blackwell sales were led by "large cloud service providers which represented approximately 50% of our Data Center revenue. Data Center compute revenue was $32.6 billion, up 116% from a year ago and up 18% sequentially, driven by demand for our Blackwell computing platform and sequential growth from our H200 offering."

Nvidia also said that it had "successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

The CFO commentary is full of details about getting the new chip range, Blackwell, to market successfully. That was a concern before the report, specifically that the added complexity might cause delays, and that there could be a “pause” as customers stopped ordering the old gear while they waited for the new to appear in significant volumes.

In short: number were blowout - perhaps a tad less blowout then recent quarter - but still impressive especially as the company transitions to an avalanche of Blackwell orders.

Remarkably, despite the (somewhat) blowout number with straddles pricing in a 10% move after hours, the stock has gone... nowhere.

As we previewed earlier, while expectations were still lofty, investor euphoria going into Nvidia’s fourth quarter results was far more subdued than in 2023 and 2024 (with positioning a modest 7 out of 10) according to Goldman. Not only that, but the bank warned that investors were positioned bearish into the result, suggesting that the company would not need to beat by a whole lot to trigger a stock or gamma squeeze.

As Bloomberg notes, for Nvidia over the past two years consensus numbers have mattered less than they generally do because the company has regularly beaten average Wall Street estimates by more than 20%. Anything less than a blowout has been considered disappointing. Case in point: The highest estimate for first-quarter revenue is for more than $47 billion. Still sentiment is much more cautious than just a quarter or two prior: Nvidia shares are in an interesting place ahead of its earnings report. It’s the first time since 2022 that shares have declined since the company’s latest report, and the options-implied move of 9.9% in either direction is the biggest anticipated swing in roughly the same time frame. What’s more, shares are down year-to-date — like most stocks in the Magnificent Seven — and have not yet recouped all of the losses from the January rout set off by DeepSeek.

Still, Nvidia is almost certain to meet fiscal 4Q revenue guidance and raise 1Q’s outlook amid a significant ramp up in its Blackwell GPUs, having overcome supply-chain delays and concern about hyperscaler demand in the wake of DeepSeek, according to a note by Kunjan Sobhani, a Bloomberg Intelligence technology analyst.

“Increased capital spending guidance from Meta, Microsoft, Amazon Web Services and Google aids our confidence in near-term sales,” Sobhani said adding that “fundamentally the print and guidance should again be solid and most likely beat” analysts’ estimates. Key point of interest will be on whether 1H is likely to show strong growth or a pocket of slowdown between the Hopper and Blackwell transition.”

One number to keep an eye out for is the percentage of revenue that Nvidia gets from a small group of customers –- so-called hyperscalers – which includes Microsoft, Amazon and Alphabet Inc.’s Google. Last quarter, they accounted for more than half of of Nvidia’s data-center revenue, up from 45% in the prior period. Investors want that number to go down, to show that the use of AI is spreading across the economy.

With all that in mind, here is what Nvidia just reported for Q4:

- Adjusted EPS 89c, beating estimate 84c

- Revenue $39.33 billion, +78% y/y, beating estimates $38.25 billion

- Data center revenue $35.6 billion, +93% y/y, beating estimates $34.09 billion

- Compute revenue $32.56 billion vs. $15.07 billion y/y, beating estimates $30.41 billion

- Networking revenue $3.02 billion, -9.2% y/y, missing estimate $3.51 billion

- Gaming revenue $2.5 billion, -14% y/y, missing estimate $3.02 billion

- Professional Visualization revenue $511 million, +10% y/y, beating estimate $507.6 million

- Automotive revenue $570 million vs. $281 million y/y, beating estimate $460.7 million

- Adjusted operating income $25.52 billion, +73% y/y, beating estimate $24.69 billion

- R&D expenses $3.71 billion, +51% y/y, below estimate $3.75 billion

- Adjusted operating expenses $3.38 billion, +53% y/y, below the estimate $3.4 billion

- Adjusted gross margin 73.5% vs. 76.7% y/y, in line with estimate 73.5%

- Free cash flow $15.52 billion, +38% y/y

But the most important data point in the release, the guidance, came in sold as Nvidia sees Q1 Revenue of $43.0BN (plus or minus 2%), above the Wall Street consensus of $42.3BN but just light of the upside whisper number. As shown below, the revenue growth is clearly moderating.

One concerning point is that networking isn’t growing in lockstep with the rest of the business.

“Networking revenue was $3.0 billion, down 9% from a year ago and down 3% sequentially,” the company said in its CFO commentary. This hiccup is being caused by a transition to new products, Nvidia said.

company’s gross margin. The forecast calls for a further narrowing, something that analysts had expressed concern about.

Another potenial weakness is the company’s non-adjusted gross margin. The forecast calls for a further narrowing, something that analysts had expressed concern about.

Nvidia has said that’s just the price of getting new products to market and they’ll widen again. For the current quarter, the company is predicting non-GAAP gross margin of 71%, about a point shy of consensus.

But it wasn’t just the numbers that mattered: just as important was the qualitative description of ongoing events, where the company said it “delivered $11.0 billion of Blackwell architecture revenue in the fourth quarter of fiscal 2025, the fastest product ramp in our company’s history.” Nvidia said that Blackwell sales were led by “large cloud service providers which represented approximately 50% of our Data Center revenue. Data Center compute revenue was $32.6 billion, up 116% from a year ago and up 18% sequentially, driven by demand for our Blackwell computing platform and sequential growth from our H200 offering.”

Nvidia also said that it had “successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

The CFO commentary is full of details about getting the new chip range, Blackwell, to market successfully. That was a concern before the report, specifically that the added complexity might cause delays, and that there could be a “pause” as customers stopped ordering the old gear while they waited for the new to appear in significant volumes.

In short: number were blowout – perhaps a tad less blowout then recent quarter – but still impressive especially as the company transitions to an avalanche of Blackwell orders.

Remarkably, despite the (somewhat) blowout number with straddles pricing in a 10% move after hours, the stock has gone… nowhere.

Loading…