Having abandoned its model in May - after months of optically systemically underpredicting the BLS payrolls print...

Source: Bloomberg

...ADP is ready to unveil its fresh new Employment Index 2.0 today “to provide a more robust, high-frequency view of the labor market and trajectory of economic growth.”

The revamped report, developed with the Stanford Digital Economy Lab, will include figures on both jobs and pay, ADP said in a statement. It will feature the monthly change in private employment as well as weekly payrolls data for the preceding month. Median annual pay growth by industry, company size, region, gender and age will also now be available each month.

“As the labor market evolves, methods for measuring employment dynamics also need to evolve,” Nela Richardson, ADP chief economist, said in the statement.

“Combining job and pay data in one report, coupled with high-frequency releases, will give us a clearer picture of the labor market.”

Instead of its previous model-based approach, the figure will now be constructed from ADP payroll data and weighted with an expansive, quarterly BLS dataset to make it more nationally representative.

So, what does the new data show?

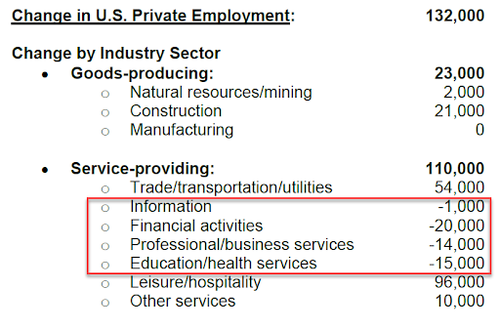

Analysts forecast ADP would report a 300k rise in employment in August (exactly in line with the BLS payrolls estimate due to be released on Friday) but instead it printed a drastically disappointing +132k jobs added.

Source: Bloomberg

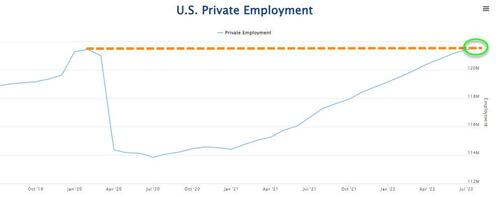

According to ADP data, US Private Employment levels are back at pre-pandemic highs...

Source: ADP

Goods-producing firms added just 23k jobs in August while Services added 110k, despite serveral Services sectors seeing job losses...

If it wasn't for Truck drivers, waiters, and bartenders we could be facing a negative print.

“Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy's conflicting signals,” said Nela Richardson, chief economist, ADP.

“We could be at an inflection point, from super-charged job gains to something more normal.”

The MidWest saw net job losses in August...

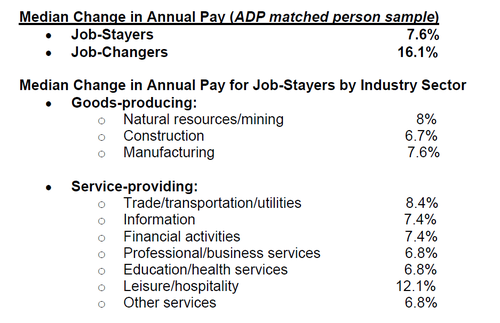

Perhaps most critically, wages are still soaring (especially for job-changers)...

Time to revise that model again?

Having abandoned its model in May – after months of optically systemically underpredicting the BLS payrolls print…

Source: Bloomberg

…ADP is ready to unveil its fresh new Employment Index 2.0 today “to provide a more robust, high-frequency view of the labor market and trajectory of economic growth.”

The revamped report, developed with the Stanford Digital Economy Lab, will include figures on both jobs and pay, ADP said in a statement. It will feature the monthly change in private employment as well as weekly payrolls data for the preceding month. Median annual pay growth by industry, company size, region, gender and age will also now be available each month.

“As the labor market evolves, methods for measuring employment dynamics also need to evolve,” Nela Richardson, ADP chief economist, said in the statement.

“Combining job and pay data in one report, coupled with high-frequency releases, will give us a clearer picture of the labor market.”

Instead of its previous model-based approach, the figure will now be constructed from ADP payroll data and weighted with an expansive, quarterly BLS dataset to make it more nationally representative.

So, what does the new data show?

Analysts forecast ADP would report a 300k rise in employment in August (exactly in line with the BLS payrolls estimate due to be released on Friday) but instead it printed a drastically disappointing +132k jobs added.

Source: Bloomberg

According to ADP data, US Private Employment levels are back at pre-pandemic highs…

Source: ADP

Goods-producing firms added just 23k jobs in August while Services added 110k, despite serveral Services sectors seeing job losses…

If it wasn’t for Truck drivers, waiters, and bartenders we could be facing a negative print.

“Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy’s conflicting signals,” said Nela Richardson, chief economist, ADP.

“We could be at an inflection point, from super-charged job gains to something more normal.”

The MidWest saw net job losses in August…

Perhaps most critically, wages are still soaring (especially for job-changers)…

Time to revise that model again?