–>

September 6, 2022

I know that I should be doing a proctological examination of Joe Biden’s “Soul of America” speech of September 1, 2022. But I think that Ron DeSantis and an army of highly qualified commentators are doing a much better job than I could ever do.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); }

Let’s talk instead about something much more fun: the current state of “Money Printer Go Brrr” operations at the Federal Reserve Board.

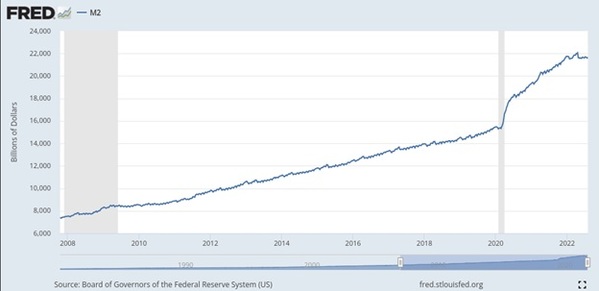

Here’s the M2 money supply since 1980 from the Federal Reserve Bank of St. Louis FRED database.

As you can see, M2 was flying along as unconcerned as a seagull until a little uptick around 2009, courtesy of the real-estate meltdown. Ever since it has increased rather faster than before the Great Recession. I can’t imagine why.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); }

But, right over at the end on the right, something seems to have gone wrong. Let’s take a closer look. I dare say that the MMT experts on AOC’s staff could tell us what it means.

As you can see, back in 2008 at the start of the Great Recession M2 money supply was about $7.5 trillion. By the end of the glorious reign of President Obama it had nearly doubled, to $13.3 trillion. By the Fall of 2019 M2 was about $15 trillion.

Then, with COVID, M2 money supply increased by about $3 trillion in the five months between March 1, 2020 and August 1, 2020. That’s an increase of about 22 percent. In less than half a year.

Was that really a good idea, noble rulers?

Then in the 15 months between August 1, 2020 and January 1, 2022, M2 money supply increased by another $3.5 trillion to $21.7 trillion. So, in the two years of COVID M2 money supply increased by 40 percent.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); } if (publir_show_ads) { document.write(“

Was that really a good idea, noble rulers?

Of course, it’s tremendous fun to be a central banker and watch the Money Printer Go Brrr. I dare say it’s almost as thrilling as watching internet porn — not that you or I would know anything about that.

But then the music stopped.

Since January 1, 2022, the M2 money supply has been basically flat, at $21.7 trillion, or so.

What? To switch from a reckless increase in money printing, increasing it by 20 percent a year, and then go to zero? In one month? Why would our revered central bankers do that, all of a sudden?

I will tell you why. All of a sudden, they woke up from their Money Printer Go Brrr Zoom meeting and realized: OMG, like, we are screwed.

Er no, you central banking experts. The American People, from ultra-MAGAs to devoted activists to aspiring rappers, are screwed. I’m sure you central bankers will do just fine.

By the way, President Biden and the Deep State and the Raiders of the Lost Crossfire Hurricane Docs at the FBI, suppose you had let President Trump win the 2020 election. Then the end of the Money Printer Go Brrr lark would be on Trump’s watch, and all you worthy guardians of the Soul of America would be tut-tutting and op-eding about the incompetence of the ultra-MAGA populists and you would be setting up for a midterm for the ages, maybe the biggest midterm for Democrats since gaining 74 seats in the 1922 midterms. Oh well.

Irregardless, in another ten years experts will agree that the Trump response to the COVID pandemic — because of course they will blame Trump — was the most incompetent moment in U.S. history. Fauci? Birx? Who they? The very idea of shutting down the economy with a lockdown and hosing it with Money Printer Go Brrr! Only a dumb populist would do that.

And then, the experts will agree, the pedal-to-the-metal spending and green energy transition made things worse. Of course, that was also the fault of Donald Trump. What else could it have been?

Meanwhile, the world wonders, what will be the consequence of suddenly stopping Money Printer Go Brrr and holding M2 constant? I’ll tell you what I think. I think we are in for an economic hurricane. Will it be inflation? Depression? Deflation? Financial Meltdown for the ages? Who knows, least of all the folks at the rapidly diversifying Federal Reserve Board.

No doubt that after the Republicans win Congress in the midterms we will get a recession in 2023. But the recession will be on Biden’s watch, so the voters will reject his Soul of America roundly in 2024.

I have a request for the new president and the new Congress in 2025. Please stop the spendarama and heal the economy so that ordinary people can earn ordinary money at ordinary jobs and have ordinary marriages and ordinary children and afford an ordinary house in the suburbs, as in the olden time.

Is that so much to ask, noble rulers?

Christopher Chantrill @chrischantrill runs the go-to site on US government finances, usgovernmentspending.com. Also get his American Manifesto and his Road to the Middle Class.

Images: Board of Governors of the Federal Reserve System

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>