Michael Burry may have built his reputation by taking the taking the other side of Goldman's mortgage CDOs that infamously blew up when the 2007 housing bubble burst and sparked the Global Financial Crisis, but for once "the Big Short" and Goldman are on the same side of the trade.

Overnight, Goldman strategist Peter Oppenheimer published a lengthy global strategy paper titled "Bear Repair; The Bumpy Road to Recovery" (link - available to pro subscribers), which - using a lot of words and charts - echoes what Bank of America said last week (far more simply in "6 Out Of 10 "Triggers" Say Market Bottom Not In Yet"), and concludes that we haven't hit a "market trough" yet.

In laying out the bank's surprisingly bearish thesis, Oppenheimer presents his argument in the following bullet points:

-

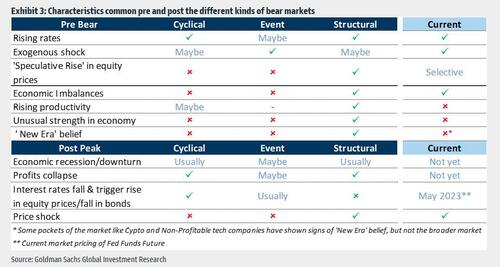

Bear markets can be split into three categories: Structural, Cyclical and Event-driven.

-

The initial transition from a bear market to a bull market tends to be strong and driven by valuation expansion, irrespective of the type of bear market.

-

But bear market rallies are common, making these transitions difficult to spot in real time.

-

Low valuations are a necessary, although not sufficient, condition for a market recovery. Getting close to the worst point in the economic cycle, reaching a peak in inflation and interest rates, and negative positioning are also important.

-

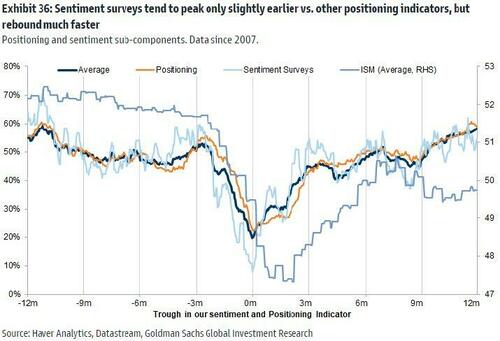

Our fundamentals-based Bull/Bear Indicator (GSBLBR) and our sentiment-based Risk Appetite Indicator (GSRAII) help identify potential inflection points. Combining these can provide powerful signals when they are both close to extremes.

The strategist concludes that "we have not yet met these conditions, suggesting further bumpy markets before a decisive trough is established" and just in case the punchline was not clear, Oppenheimer repeats that “we are not yet at levels consistent with a market trough."

In assessing the current precarious state, Goldman notes that "something has to give: either returns stay low and volatile for a long time or the market is likely to re-test its lows before a genuine trough is established." Then, looking ahead, Goldman expects the next bull market to be 'Fatter & Flatter' than the last; this 'Post-Modern Cycle' is also likely to be driven by some distinct themes with a greater focus on margin sustainability.

There is much more in the full note, but here is the a snapshot of the summary which is rather self-explanatory, and resets Goldman as a bank now expecting (much) lower S&P levels before we bottom.

Summary

Investors often see bear markets, and the recessions that follow them, as binary events; you are either in one or not. But in reality the scale and depth of bear markets vary quite a lot. The same can be said for bull markets – some are much stronger and longer than others, driven by powerful secular trends in growth and cost of capital.

Bear markets can be split into three categories: 'Structural', 'Cyclical' and 'Event-driven'. Each type of bear market is driven by a different set of conditions and has different profiles in terms of depth, length and time to recover.

Most bear markets ultimately tend to end with a similar powerful initial rebound (which we describe as the 'Hope' phase). However, in real time, it is often difficult to distinguish between a bear market rally and a genuine inflection into a new bull market as they can look and feel very similar, at least to begin with.

The difference between a bear market rally and a transition into a 'Hope' phase of a new bull market often depends on the drivers of the bear market itself, and a combination of other factors that tend to coincide with a genuine turning point. In this piece we describe and analyse these trigger points in an attempt to understand the likely path from here following the powerful equity rally since June.

Low valuations are a necessary, although not sufficient, condition for a market recovery. Getting close to the worst point in the economic cycle where the rate of deterioration slows, and reaching a peak in inflation and interest rates are also important triggers. Positioning can also play a significant role. Bull markets typically start during a recession, around 6-9 months before trough earnings and around 3-6 months before trough PMIs.

Our Bull/Bear Market indicator (GSBLBR) and our Risk Appetite indicator (GSRAII) attempt to capture the fundamental and sentiment factors that are important around inflection points. Combining these can provide a useful guide, particularly when they are both close to extremes. When GSBLBR is below 45% AND the GSRAII is below 1.5, the probability of achieving high returns over 12 months is very high. Current levels of these indicators would suggest that we are not yet at the market trough.

Something has to give: either returns stay low and volatile for a long time or the market is likely to re-test its lows before a genuine trough is established.

The bull market cycle that follows the initial ‘Hope’ phase can, like bear markets, vary quite a lot in terms of length and strength. Broadly we split bull markets into two types; those that are ‘Secular’ and during which valuations tend to rise, and those that are ‘Flatter’ – with lower aggregate price returns but with a greater focus on compounding returns. Sometimes these types of bull market exhibit a very wide trading range (‘Fat & Flat’), or are more stable with a narrow trading range (‘Skinny & Flat’). We expect the next bull market – what we call the Post-Modern Cycle – to be ‘Fatter & Flatter’ than the last, with some distinct secular drivers.

The last secular bull market (1982-2022) achieved high real returns powered by increased valuations. It was driven by:

- Disinflation - the collapse in inflation and interest rates.

- De-regulation - supply-side reforms and lower taxes.

- De-escalation - lower geopolitical risk premia (post the collapse of the Soviet Union and the emergence of US hegemony).

- Globalisation - the entry of India and China into the WTO.

- Digitisation - the emergence of the digital economy and lower physical capex spend.

- Monetisation - the emergence of zero interest rates and QE post the GFC.

The Post-Modern Cycle is likely to see a part reversal of a number of these drivers. We are likely to see a higher cost of capital together with more fiscal and government intervention, greater regionalisation, and higher spending on capex and infrastructure.

We expect:

- Lower aggregate returns; a Fat & Flat rather than a secular bull market.

- More focus on Alpha than Beta.

- A greater reward for diversification and buying at attractive valuations.

- Investment to increase corporate efficiency (energy efficiency and labour productivity).

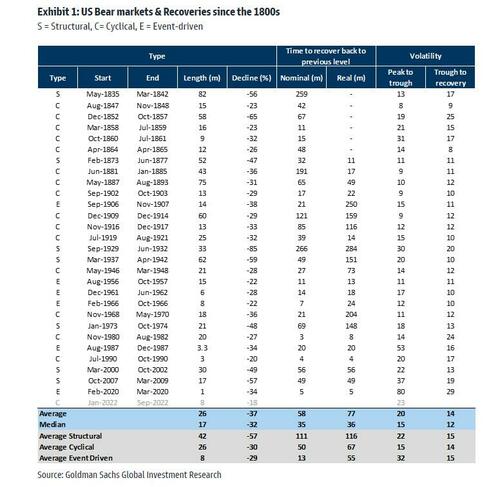

Below is Goldman's table showing historical bear markets and putting the current one in context:

Again, much more in the full Goldman note but the jist is clear.

What is notable is not only that this report represents a secular shift in Goldman's traditionally cheerful outlook (and in itself may indicate a market bottom of sorts has been reached), and we look forward to how David Kostin spins this report without dramatically slashing his year-end price target; What is especially remarkable is that Goldman actually agrees for once with Michael Burry, whose recent twitter commentary suggests he will get no satisfaction until the S&P hits 0 or thereabouts, and who earlier today agreed with BofA and Goldman, writing on Twitter that “we have not hit bottom yet.”

Burry referenced the recent closing of two exchange-traded funds that tracked special purpose acquisition companies, one of the artifacts of the massive bubble blown by the Fed in recent years. The two funds traded for less than two years before losing investors as their share prices plunged.

In another tweet Wednesday, he noted crashes in cryptocurrencies, meme stocks and SPACs, and seemingly linked market crashes in 2000 and 2008 to what he sees coming this year.

Of course, warnings from Burry about a coming market crash, hyperinflation and economic collapse have become rather common on Twitter in the past year, with the Scion Asset Management founder predicting consumer spending and silliness in markets will cause trouble for investors. Last month, we reported that his firm dumped all of its equity exposure except for one company.

Michael Burry may have built his reputation by taking the taking the other side of Goldman’s mortgage CDOs that infamously blew up when the 2007 housing bubble burst and sparked the Global Financial Crisis, but for once “the Big Short” and Goldman are on the same side of the trade.

Overnight, Goldman strategist Peter Oppenheimer published a lengthy global strategy paper titled “Bear Repair; The Bumpy Road to Recovery” (link – available to pro subscribers), which – using a lot of words and charts – echoes what Bank of America said last week (far more simply in “6 Out Of 10 “Triggers” Say Market Bottom Not In Yet“), and concludes that we haven’t hit a “market trough” yet.

In laying out the bank’s surprisingly bearish thesis, Oppenheimer presents his argument in the following bullet points:

-

Bear markets can be split into three categories: Structural, Cyclical and Event-driven.

-

The initial transition from a bear market to a bull market tends to be strong and driven by valuation expansion, irrespective of the type of bear market.

-

But bear market rallies are common, making these transitions difficult to spot in real time.

-

Low valuations are a necessary, although not sufficient, condition for a market recovery. Getting close to the worst point in the economic cycle, reaching a peak in inflation and interest rates, and negative positioning are also important.

-

Our fundamentals-based Bull/Bear Indicator (GSBLBR) and our sentiment-based Risk Appetite Indicator (GSRAII) help identify potential inflection points. Combining these can provide powerful signals when they are both close to extremes.

The strategist concludes that “we have not yet met these conditions, suggesting further bumpy markets before a decisive trough is established” and just in case the punchline was not clear, Oppenheimer repeats that “we are not yet at levels consistent with a market trough.”

In assessing the current precarious state, Goldman notes that “something has to give: either returns stay low and volatile for a long time or the market is likely to re-test its lows before a genuine trough is established.” Then, looking ahead, Goldman expects the next bull market to be ‘Fatter & Flatter’ than the last; this ‘Post-Modern Cycle’ is also likely to be driven by some distinct themes with a greater focus on margin sustainability.

There is much more in the full note, but here is the a snapshot of the summary which is rather self-explanatory, and resets Goldman as a bank now expecting (much) lower S&P levels before we bottom.

Summary

Investors often see bear markets, and the recessions that follow them, as binary events; you are either in one or not. But in reality the scale and depth of bear markets vary quite a lot. The same can be said for bull markets – some are much stronger and longer than others, driven by powerful secular trends in growth and cost of capital.

Bear markets can be split into three categories: ‘Structural’, ‘Cyclical’ and ‘Event-driven‘. Each type of bear market is driven by a different set of conditions and has different profiles in terms of depth, length and time to recover.

Most bear markets ultimately tend to end with a similar powerful initial rebound (which we describe as the ‘Hope’ phase). However, in real time, it is often difficult to distinguish between a bear market rally and a genuine inflection into a new bull market as they can look and feel very similar, at least to begin with.

The difference between a bear market rally and a transition into a ‘Hope’ phase of a new bull market often depends on the drivers of the bear market itself, and a combination of other factors that tend to coincide with a genuine turning point. In this piece we describe and analyse these trigger points in an attempt to understand the likely path from here following the powerful equity rally since June.

Low valuations are a necessary, although not sufficient, condition for a market recovery. Getting close to the worst point in the economic cycle where the rate of deterioration slows, and reaching a peak in inflation and interest rates are also important triggers. Positioning can also play a significant role. Bull markets typically start during a recession, around 6-9 months before trough earnings and around 3-6 months before trough PMIs.

Our Bull/Bear Market indicator (GSBLBR) and our Risk Appetite indicator (GSRAII) attempt to capture the fundamental and sentiment factors that are important around inflection points. Combining these can provide a useful guide, particularly when they are both close to extremes. When GSBLBR is below 45% AND the GSRAII is below 1.5, the probability of achieving high returns over 12 months is very high. Current levels of these indicators would suggest that we are not yet at the market trough.

Something has to give: either returns stay low and volatile for a long time or the market is likely to re-test its lows before a genuine trough is established.

The bull market cycle that follows the initial ‘Hope’ phase can, like bear markets, vary quite a lot in terms of length and strength. Broadly we split bull markets into two types; those that are ‘Secular’ and during which valuations tend to rise, and those that are ‘Flatter’ – with lower aggregate price returns but with a greater focus on compounding returns. Sometimes these types of bull market exhibit a very wide trading range (‘Fat & Flat’), or are more stable with a narrow trading range (‘Skinny & Flat’). We expect the next bull market – what we call the Post-Modern Cycle – to be ‘Fatter & Flatter’ than the last, with some distinct secular drivers.

The last secular bull market (1982-2022) achieved high real returns powered by increased valuations. It was driven by:

- Disinflation – the collapse in inflation and interest rates.

- De-regulation – supply-side reforms and lower taxes.

- De-escalation – lower geopolitical risk premia (post the collapse of the Soviet Union and the emergence of US hegemony).

- Globalisation – the entry of India and China into the WTO.

- Digitisation – the emergence of the digital economy and lower physical capex spend.

- Monetisation – the emergence of zero interest rates and QE post the GFC.

The Post-Modern Cycle is likely to see a part reversal of a number of these drivers. We are likely to see a higher cost of capital together with more fiscal and government intervention, greater regionalisation, and higher spending on capex and infrastructure.

We expect:

- Lower aggregate returns; a Fat & Flat rather than a secular bull market.

- More focus on Alpha than Beta.

- A greater reward for diversification and buying at attractive valuations.

- Investment to increase corporate efficiency (energy efficiency and labour productivity).

Below is Goldman’s table showing historical bear markets and putting the current one in context:

Again, much more in the full Goldman note but the jist is clear.

What is notable is not only that this report represents a secular shift in Goldman’s traditionally cheerful outlook (and in itself may indicate a market bottom of sorts has been reached), and we look forward to how David Kostin spins this report without dramatically slashing his year-end price target; What is especially remarkable is that Goldman actually agrees for once with Michael Burry, whose recent twitter commentary suggests he will get no satisfaction until the S&P hits 0 or thereabouts, and who earlier today agreed with BofA and Goldman, writing on Twitter that “we have not hit bottom yet.”

Burry referenced the recent closing of two exchange-traded funds that tracked special purpose acquisition companies, one of the artifacts of the massive bubble blown by the Fed in recent years. The two funds traded for less than two years before losing investors as their share prices plunged.

In another tweet Wednesday, he noted crashes in cryptocurrencies, meme stocks and SPACs, and seemingly linked market crashes in 2000 and 2008 to what he sees coming this year.

Of course, warnings from Burry about a coming market crash, hyperinflation and economic collapse have become rather common on Twitter in the past year, with the Scion Asset Management founder predicting consumer spending and silliness in markets will cause trouble for investors. Last month, we reported that his firm dumped all of its equity exposure except for one company.