Authored by Mark Jeftovic via BombThrower.com,

Outside of China, no major nation has anything else ready

Imagine if you will, persistent double-digit inflation, energy costs soaring, shortages causing blackouts across Europe, bond yields spiking uncontrollably, supply chains grinding to a halt while sovereign debt crises erupt the world over…

Then one Friday after the markets close, heading into a long weekend, an emergency broadcast occurs in which the President, the Chairman of the Federal Reserve and the Speaker of the House appear on national TV to announce that pursuant to the Statutory Bail-Ins provision of the 2010 Dodd-Frank Bill, a banking holiday would take place over the following week. During that holiday, certain bank liabilities would be converted into FedCoin (FED), an ERC-20 token on the Ethereum blockchain, at the rate of 10 FED per $1.

Every depositor would have an NFT issued to their Social Security Number – and that would give them access to their FedCoin via the Sign-On-With-Ethereum protocol. Depositors would have to “stake” their Ethereum to access the “full benefits” of FedCoin, however any sub-optimal social behaviours, (such as being behind on current vaccinations, or running your air conditioner too cool) could result in “slashing” – having a portion of their staked assets “burned”.

Similar announcements are being made elsewhere: in Canada Prime Minister Freeland and her Finance Minister Steven Guilbeault announce the creation of LOONCoin, invoking the The Bank Recapitalization (Bail-in) Conversion Regulations from 2018 while in Australia they refer to Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill of 2017.

Across the G-20, each leader is calling their national initiative part of The Great Restructuring…

We’re into the Endgame for Late Stage Globalism and things are moving fast. Decades of increasingly centralized, fiat-based plunder are now coming to a head and the system is unraveling quickly:

-

Energy costs are skyrocketing thanks to ESG-inspired shortages.

-

Inflation rates exceeding the stagflationary 70’s are hitting across the board and in some areas (Turkey, Argentina, Sri Lanka, Lebanon) verge on hyper-inflation .

-

The global bond markets could come unglued at any moment as trapped Central Banks are trying to hike into a global recession.

-

Geo-political tensions (even amongst NATO allies) eerily reminiscent of the months leading up to 1914, when the world “sleepwalked” into the first industrial scale global war.

-

Political and cultural elites the world over have never been more unhinged and detached from reality.

Many commentators are positing a monetary end-game scenario in which the Fed and other central banks really do lose control of the bond market, the 150 to 300 trillion (depending on what you include) global debt implodes, and the financial system itself enters the collapse that has been serially postponed since the dotCom bust….

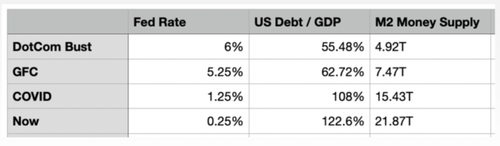

Two decades of kicking the can: The starting Fed Rate, Debt / GDP, and M2 money supply going into the last four financial crises…

The mini-parable in the opening paragraphs outlines the situation many of us who are skeptical of the current system anticipate: that there will be an inevitable move toward Central Bank Digital Currencies (CBDCs). It will be seen as a way to extend the lifespan of fiat-based financial system by a few critical decades while presenting an irresistible mechanism for asserting China-style social control in a way previous authoritarians could only dream of.

There have been plenty of government white papers issued (which we diligently cover in The Crypto Capitalist Letter), which uniformly outline the aspirations of CBDCs, namely:

-

Expiry dates on “cash”.

-

Negative interest rates on savings.

-

Programmability over where, when, who and why money gets spent

-

Transaction level reporting, tracking and taxation

-

Quotas, limits and restrictions

-

Ability to add or remove funds remotely by central authorities

There’s only one problem…

No nation or central bank outside of China is anywhere close to actually deploying a national Central Bank Digital Currency that is capable of doing these things.

For awhile it looked like maybe Facebook’s Diem would be at least a temporary FedCoin, until Facebook scrapped the project (they’ve since sold the intellectual property to Silvergate Bank).

But in practical terms, nobody is ready. The countries that have deployed a home-rolled CBDC have flopped (i.e, Nigeria, Venezuela,) even China’s Digital Yuan debuted during the Olympics to ho-hum reviews.

A national CBDC would be impossible to develop in secret and then spring on a population out of nowhere. Whatever gets adapted to be the rails for globally inter-connected CBDCs will leave footprints, big ones. People who pay close attention to Bitcoin, crypto-currencies, digital assets and blockchain would hear about it and see it coming from a long way off, and nothing that’s known to be in development (like Canada’s Project Jasper) is ready (or stalled).

However, the financial system is now coming unglued so quickly that there probably isn’t time to develop national CBDCs from scratch anyway, at least not for an advanced G-20 economy.

The solution may be to co-opt an existing crypto-currency that is already deployed, already has market share and a brand, and is more or less signalling an amenability to the notion.

Enter Ethereum: The Preferred Crypto-Currency of Central Banks (and The WEF)

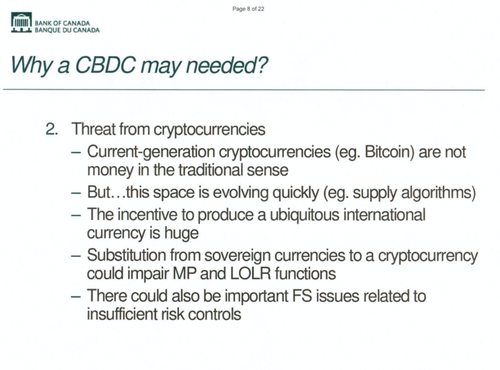

The advent of Bitcoin was a shot across the bow of all central banks and fiat money. We see, for example, a near visceral reactions toward the threat posed in various Bank of Canada documents (obtained via an ATIA request):

From BoC slide deck ‘Central Bank Money: The Next Generation, Maintaining Trust in the Digital Age’, Sept 19. 2018

At the supra-national and NGO level, everybody from the World Bank, to the IMF to the World Economic Forum is somewhat hostile toward Bitcoin. WEF articles about Bitcoin typically end with “problems” associated with it and what the alternatives are , going so far to declare in 2017 that by 2020 “Bitcoin would consume more power than the entire world does”.)

Fact check: #Bitcoin did not consume more power in 2020 than the entire world did in 2017. @wef pic.twitter.com/1nTwi99Xgp

— Mark Jeftovic, The C̶r̶y̶p̶t̶o̶ ₿itcoin Capitalist (@StuntPope) September 5, 2022

So it is interesting to notice a crypto-currency that these international bodies and central banks are not openly hostile to, and that has always been Ethereum.

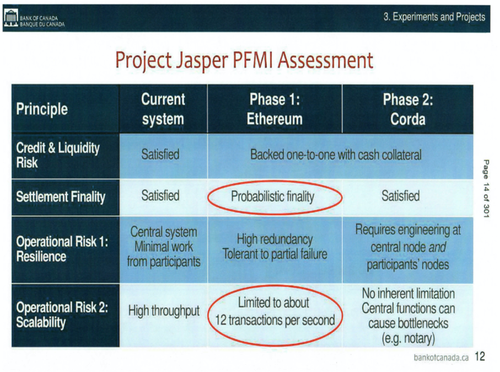

The main thrust of Canada’s CBDC development has been (thus far) “Project Jasper”, a partnership between the Bank of Canada, Payments Canada, R3 and the big banks, and note that Phase 1 was built atop Ethereum:

From ‘Distributed Ledger Technology, A Central Banker’s Perspective’, 2017

(Phase 2 was to be built on Corda “a leading Distributed Ledger System for regulated industries”).

So far Norway and Israel have started their CBDC development using Ethereum. In 2021 a Chinese banking official made the case for deploying a CBDC on Ethereum, and in at the WEF meeting in 2020, one of the Ethereum co-founders and Consensys CEO Joseph Lubin presented a white paper making the case for Ethereum to be the rails for CBDCs.

“As the World Economic Forum meets in Davos for the 50th time, it does so against the backdrop of a sea change in the mechanics of money

Below we provide both an overview of CBDC and a concrete example of how a CBDC might be implemented on the Ethereum blockchain. We believe that Ethereum is the best-suited blockchain network for the kind of maximally secure, global-scale, interoperable settlement platforms that CBDCs require. But we are well aware that there are many other possibilities”

To be clear, I am not one of those people who thinks the WEF is some all-powerful cabal that Controls Everything™, because the reality is that the world is inherently uncontrollable at a macro level (we live in an out-of-control world, and for many, the prospect of that is more terrifying than dystopia).

But what happens in Davos doesn’t stay in Davos. The WEF agenda truly does exert outsized influence (at least for now), and they do set tone for what is fashionable among technocrats, authoritarians and the sundry Malthusians that permeate elite circles.

Ethereum (or maybe “CBDETH”) is well suited for the use case of global CBDCs: different ERC-20 tokens can be issued for multiple uses: stablecoins, UBI, food stamps, carbon quotas, social credit – all underpinned by Ethereum on the base layer. One that has a proven track record of being willing to switch monetary policy on-the-fly, and isn’t afraid to hard-fork itself out of a jam.

For the push into Digital-IDs, ERC-721 style NFTs are well suited. Your Bored Ape not only telegraphs how cool you are, it can signal if your COVID boosters are up-to-date, for all to see, on the blockchain.

At first glance this runs counter to what I’ve been saying in The Crypto Capitalist (our premium letter) for over a year. My theory was that in the future, the way you would be able to differentiate between a decentralized, digital bearer asset and a CBDC would be whether it would be possible to self-custody your private keys or not.

Maybe I was wrong about that, since anybody can hold their own wallets for Ethereum.

However, we should expect that the plebes would be incentivized to custody their private keys with banking partners of the CBDETH system (“safely and effectively”). There might even be incentives for doing that, like extra meat allowances, or permission to take an additional flight each year.

The Ethereum ecosystem is already telegraphing a willingness to comply with central state dictums: embracing OFAC compliance with a hamfisted stab at protocol level transaction censorship, rather than arguing about it too much. The coming move to PoS is flat out ESG-inspired (this is not the place to argue the energy policy of PoW other than to say that the alarmism around it is based on pure ignorance and FUD; but at a minimum I would recommend Alex Gladstein’s “Hidden Costs of the Petrodollar” and Nic Carter’s “Last Word on Bitcoin’s Energy Consumption“)

After The Merge (a.k.a Ethereum’s Great Leap Forward), if we can envision a scenario where most of the ETH is locked up in centrally operated validators, and a huge chunk of the system having already enacted protocol level transaction censorship, it would be perfect. Outwardly it could be the branded as a decentralized, inclusive digital money while in reality being highly concentrated and censored at the transaction level.

Similar to how the WEF brags they’ve “penetrated the cabinets” of many world governments, the Venn diagram of WEF and upper echelons of the Ethereum Foundation already intersect in a few places. In addition to the aforementioned pitch by Ethereum co-founder Joseph Lubin, the Ethereum Foundation’s Executive Director is “an agenda contributor” to the WEF.

The there’s the Enterprise Ethereum Alliance is a who’s who of big tech, Wall St and corporate big wigs, including JP Morgan, Microsoft, Accenture, Bank of New York Mellon, Ernst & Young and even Fedex Corporate Services Inc.

Contrasting Ethereum with Bitcoin

With EIP 1559, Ethereum ostensibly adopted a “ultra-sound” monetary policy where the supply of ETH would actually plateau and then begin to decline as more ETH gets “burned” than minted. However even this update, combined with the looming switch from Proof-of-Work to PoS shows: The Ethereum core devs have no issues radically restructuring its underlying fundamentals to suit the winds and the whims of it’s circumstances.

From its initial ICO to insiders, launching with an unlimited supply, to bailing themselves out after their DAO was hacked, Ethereum has a “whatever it takes” approach that is the opposite of an immutable, hard asset with a finite supply like Bitcoin.

If circumstances arise where an infinitely expandable money supply is desired or required, they can just change the system again. And again.

Contrast with Bitcoin, which is truly decentralized, with an immutable hard cap that cannot be changed. If there are dissident factions, like during the Blocksize Wars, for example, it gets settled with a hard fork where users choose which way to go and market forces settle the rest.

On that note there is even already a Proof-of-Stake version of Bitcoin.

So if we truly value democracy over coercion, and if Proof-of-Stake is demonstrably better than Bitcoin core’s Proof-of-Work, then we should see “Bitcoin-2” flippen Bitcoin in due course (similarly, and this is my main beef with The Merge, the more democratic way to undertake it would be with a user-selected hard fork, leaving both chains and options available afterward).

Of course, nobody seriously expects Bitcoin2 to do that. But we can expect Bitcoin to be the one, immutable digital bearer asset in the coming era of Central Bank Digital Currencies.

Conclusion

In The Crypto Capitalist Manifesto, I built on my previous work around The Great Bifurcation and theorized a coming two-tier society. I posited that UBI would be inevitable and the rails would be a CBDC that doubled as a China-style social credit system. Everything that’s unfolded since then has reinforced that belief.

What I may have not foreseen was what the rails for CBDCs could very well be Ethereum, or a co-opted version of it. Beacon Chain (the post-merge chain) may be that version.

It’s too early to say how to feel about that. I’ve always had a soft spot for Ethereum, and admired what they’ve done in decentralized naming with ENS. My main business has been involved with that effort for some time. I guess watching it position for mainstream / corporate / government acceptance is somewhat disorienting.

(Maybe it’s a good thing that the fiat-era’s last ditch iteration of state-sponsored money will have to be, out of necessity, built on something beyond their absolute control… another marker of the decentralized revolution?)

However, where Bitcoin reached escape velocity and broke the “here to stay” barrier through sheer honey-badger belligerence, Ethereum seems to be getting there by “playing the game”.

That’s also not to say that with our investor hats on, there aren’t going to be huge gains to be made within the Ethereum ecosystem even if it goes that way. If Ethereum becomes the rails for global CBDCs (CBDETH), owning the infrastructure components of it (oracles, validators, exchanges, dapps, naming platforms) would be the analogous to owning a small slice of the Federal Reserve, or the global ACH payments system.

But I stopped thinking of Ethereum as immutable some time ago, and certainly not as a digital hard asset, the way I do Bitcoin.

* * *

Mark E. Jeftovic is the CEO of easyDNS, co-founder of Bombthrower Media, author and investor. Sign up for The Bombthrower mailing list to get updates straight into your inbox and get a free copy of The Crypto Capitalist Manifesto while you’re at it.

Follow me on Gettr, Telegram or if you haven’t been kicked off Twitter yet, there

Authored by Mark Jeftovic via BombThrower.com,

Outside of China, no major nation has anything else ready

Imagine if you will, persistent double-digit inflation, energy costs soaring, shortages causing blackouts across Europe, bond yields spiking uncontrollably, supply chains grinding to a halt while sovereign debt crises erupt the world over…

Then one Friday after the markets close, heading into a long weekend, an emergency broadcast occurs in which the President, the Chairman of the Federal Reserve and the Speaker of the House appear on national TV to announce that pursuant to the Statutory Bail-Ins provision of the 2010 Dodd-Frank Bill, a banking holiday would take place over the following week. During that holiday, certain bank liabilities would be converted into FedCoin (FED), an ERC-20 token on the Ethereum blockchain, at the rate of 10 FED per $1.

Every depositor would have an NFT issued to their Social Security Number – and that would give them access to their FedCoin via the Sign-On-With-Ethereum protocol. Depositors would have to “stake” their Ethereum to access the “full benefits” of FedCoin, however any sub-optimal social behaviours, (such as being behind on current vaccinations, or running your air conditioner too cool) could result in “slashing” – having a portion of their staked assets “burned”.

Similar announcements are being made elsewhere: in Canada Prime Minister Freeland and her Finance Minister Steven Guilbeault announce the creation of LOONCoin, invoking the The Bank Recapitalization (Bail-in) Conversion Regulations from 2018 while in Australia they refer to Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill of 2017.

Across the G-20, each leader is calling their national initiative part of The Great Restructuring…

We’re into the Endgame for Late Stage Globalism and things are moving fast. Decades of increasingly centralized, fiat-based plunder are now coming to a head and the system is unraveling quickly:

-

Energy costs are skyrocketing thanks to ESG-inspired shortages.

-

Inflation rates exceeding the stagflationary 70’s are hitting across the board and in some areas (Turkey, Argentina, Sri Lanka, Lebanon) verge on hyper-inflation .

-

The global bond markets could come unglued at any moment as trapped Central Banks are trying to hike into a global recession.

-

Geo-political tensions (even amongst NATO allies) eerily reminiscent of the months leading up to 1914, when the world “sleepwalked” into the first industrial scale global war.

-

Political and cultural elites the world over have never been more unhinged and detached from reality.

Many commentators are positing a monetary end-game scenario in which the Fed and other central banks really do lose control of the bond market, the 150 to 300 trillion (depending on what you include) global debt implodes, and the financial system itself enters the collapse that has been serially postponed since the dotCom bust….

Two decades of kicking the can: The starting Fed Rate, Debt / GDP, and M2 money supply going into the last four financial crises…

The mini-parable in the opening paragraphs outlines the situation many of us who are skeptical of the current system anticipate: that there will be an inevitable move toward Central Bank Digital Currencies (CBDCs). It will be seen as a way to extend the lifespan of fiat-based financial system by a few critical decades while presenting an irresistible mechanism for asserting China-style social control in a way previous authoritarians could only dream of.

There have been plenty of government white papers issued (which we diligently cover in The Crypto Capitalist Letter), which uniformly outline the aspirations of CBDCs, namely:

-

Expiry dates on “cash”.

-

Negative interest rates on savings.

-

Programmability over where, when, who and why money gets spent

-

Transaction level reporting, tracking and taxation

-

Quotas, limits and restrictions

-

Ability to add or remove funds remotely by central authorities

There’s only one problem…

No nation or central bank outside of China is anywhere close to actually deploying a national Central Bank Digital Currency that is capable of doing these things.

For awhile it looked like maybe Facebook’s Diem would be at least a temporary FedCoin, until Facebook scrapped the project (they’ve since sold the intellectual property to Silvergate Bank).

But in practical terms, nobody is ready. The countries that have deployed a home-rolled CBDC have flopped (i.e, Nigeria, Venezuela,) even China’s Digital Yuan debuted during the Olympics to ho-hum reviews.

A national CBDC would be impossible to develop in secret and then spring on a population out of nowhere. Whatever gets adapted to be the rails for globally inter-connected CBDCs will leave footprints, big ones. People who pay close attention to Bitcoin, crypto-currencies, digital assets and blockchain would hear about it and see it coming from a long way off, and nothing that’s known to be in development (like Canada’s Project Jasper) is ready (or stalled).

However, the financial system is now coming unglued so quickly that there probably isn’t time to develop national CBDCs from scratch anyway, at least not for an advanced G-20 economy.

The solution may be to co-opt an existing crypto-currency that is already deployed, already has market share and a brand, and is more or less signalling an amenability to the notion.

Enter Ethereum: The Preferred Crypto-Currency of Central Banks (and The WEF)

The advent of Bitcoin was a shot across the bow of all central banks and fiat money. We see, for example, a near visceral reactions toward the threat posed in various Bank of Canada documents (obtained via an ATIA request):

From BoC slide deck ‘Central Bank Money: The Next Generation, Maintaining Trust in the Digital Age’, Sept 19. 2018

At the supra-national and NGO level, everybody from the World Bank, to the IMF to the World Economic Forum is somewhat hostile toward Bitcoin. WEF articles about Bitcoin typically end with “problems” associated with it and what the alternatives are , going so far to declare in 2017 that by 2020 “Bitcoin would consume more power than the entire world does”.)

Fact check: #Bitcoin did not consume more power in 2020 than the entire world did in 2017. @wef pic.twitter.com/1nTwi99Xgp

— Mark Jeftovic, The C̶r̶y̶p̶t̶o̶ ₿itcoin Capitalist (@StuntPope) September 5, 2022

So it is interesting to notice a crypto-currency that these international bodies and central banks are not openly hostile to, and that has always been Ethereum.

The main thrust of Canada’s CBDC development has been (thus far) “Project Jasper”, a partnership between the Bank of Canada, Payments Canada, R3 and the big banks, and note that Phase 1 was built atop Ethereum:

From ‘Distributed Ledger Technology, A Central Banker’s Perspective’, 2017

(Phase 2 was to be built on Corda “a leading Distributed Ledger System for regulated industries”).

So far Norway and Israel have started their CBDC development using Ethereum. In 2021 a Chinese banking official made the case for deploying a CBDC on Ethereum, and in at the WEF meeting in 2020, one of the Ethereum co-founders and Consensys CEO Joseph Lubin presented a white paper making the case for Ethereum to be the rails for CBDCs.

“As the World Economic Forum meets in Davos for the 50th time, it does so against the backdrop of a sea change in the mechanics of money

Below we provide both an overview of CBDC and a concrete example of how a CBDC might be implemented on the Ethereum blockchain. We believe that Ethereum is the best-suited blockchain network for the kind of maximally secure, global-scale, interoperable settlement platforms that CBDCs require. But we are well aware that there are many other possibilities”

To be clear, I am not one of those people who thinks the WEF is some all-powerful cabal that Controls Everything™, because the reality is that the world is inherently uncontrollable at a macro level (we live in an out-of-control world, and for many, the prospect of that is more terrifying than dystopia).

But what happens in Davos doesn’t stay in Davos. The WEF agenda truly does exert outsized influence (at least for now), and they do set tone for what is fashionable among technocrats, authoritarians and the sundry Malthusians that permeate elite circles.

Ethereum (or maybe “CBDETH”) is well suited for the use case of global CBDCs: different ERC-20 tokens can be issued for multiple uses: stablecoins, UBI, food stamps, carbon quotas, social credit – all underpinned by Ethereum on the base layer. One that has a proven track record of being willing to switch monetary policy on-the-fly, and isn’t afraid to hard-fork itself out of a jam.

For the push into Digital-IDs, ERC-721 style NFTs are well suited. Your Bored Ape not only telegraphs how cool you are, it can signal if your COVID boosters are up-to-date, for all to see, on the blockchain.

At first glance this runs counter to what I’ve been saying in The Crypto Capitalist (our premium letter) for over a year. My theory was that in the future, the way you would be able to differentiate between a decentralized, digital bearer asset and a CBDC would be whether it would be possible to self-custody your private keys or not.

Maybe I was wrong about that, since anybody can hold their own wallets for Ethereum.

However, we should expect that the plebes would be incentivized to custody their private keys with banking partners of the CBDETH system (“safely and effectively”). There might even be incentives for doing that, like extra meat allowances, or permission to take an additional flight each year.

The Ethereum ecosystem is already telegraphing a willingness to comply with central state dictums: embracing OFAC compliance with a hamfisted stab at protocol level transaction censorship, rather than arguing about it too much. The coming move to PoS is flat out ESG-inspired (this is not the place to argue the energy policy of PoW other than to say that the alarmism around it is based on pure ignorance and FUD; but at a minimum I would recommend Alex Gladstein’s “Hidden Costs of the Petrodollar” and Nic Carter’s “Last Word on Bitcoin’s Energy Consumption“)

After The Merge (a.k.a Ethereum’s Great Leap Forward), if we can envision a scenario where most of the ETH is locked up in centrally operated validators, and a huge chunk of the system having already enacted protocol level transaction censorship, it would be perfect. Outwardly it could be the branded as a decentralized, inclusive digital money while in reality being highly concentrated and censored at the transaction level.

Similar to how the WEF brags they’ve “penetrated the cabinets” of many world governments, the Venn diagram of WEF and upper echelons of the Ethereum Foundation already intersect in a few places. In addition to the aforementioned pitch by Ethereum co-founder Joseph Lubin, the Ethereum Foundation’s Executive Director is “an agenda contributor” to the WEF.

The there’s the Enterprise Ethereum Alliance is a who’s who of big tech, Wall St and corporate big wigs, including JP Morgan, Microsoft, Accenture, Bank of New York Mellon, Ernst & Young and even Fedex Corporate Services Inc.

Contrasting Ethereum with Bitcoin

With EIP 1559, Ethereum ostensibly adopted a “ultra-sound” monetary policy where the supply of ETH would actually plateau and then begin to decline as more ETH gets “burned” than minted. However even this update, combined with the looming switch from Proof-of-Work to PoS shows: The Ethereum core devs have no issues radically restructuring its underlying fundamentals to suit the winds and the whims of it’s circumstances.

From its initial ICO to insiders, launching with an unlimited supply, to bailing themselves out after their DAO was hacked, Ethereum has a “whatever it takes” approach that is the opposite of an immutable, hard asset with a finite supply like Bitcoin.

If circumstances arise where an infinitely expandable money supply is desired or required, they can just change the system again. And again.

Contrast with Bitcoin, which is truly decentralized, with an immutable hard cap that cannot be changed. If there are dissident factions, like during the Blocksize Wars, for example, it gets settled with a hard fork where users choose which way to go and market forces settle the rest.

On that note there is even already a Proof-of-Stake version of Bitcoin.

So if we truly value democracy over coercion, and if Proof-of-Stake is demonstrably better than Bitcoin core’s Proof-of-Work, then we should see “Bitcoin-2” flippen Bitcoin in due course (similarly, and this is my main beef with The Merge, the more democratic way to undertake it would be with a user-selected hard fork, leaving both chains and options available afterward).

Of course, nobody seriously expects Bitcoin2 to do that. But we can expect Bitcoin to be the one, immutable digital bearer asset in the coming era of Central Bank Digital Currencies.

Conclusion

In The Crypto Capitalist Manifesto, I built on my previous work around The Great Bifurcation and theorized a coming two-tier society. I posited that UBI would be inevitable and the rails would be a CBDC that doubled as a China-style social credit system. Everything that’s unfolded since then has reinforced that belief.

What I may have not foreseen was what the rails for CBDCs could very well be Ethereum, or a co-opted version of it. Beacon Chain (the post-merge chain) may be that version.

It’s too early to say how to feel about that. I’ve always had a soft spot for Ethereum, and admired what they’ve done in decentralized naming with ENS. My main business has been involved with that effort for some time. I guess watching it position for mainstream / corporate / government acceptance is somewhat disorienting.

(Maybe it’s a good thing that the fiat-era’s last ditch iteration of state-sponsored money will have to be, out of necessity, built on something beyond their absolute control… another marker of the decentralized revolution?)

However, where Bitcoin reached escape velocity and broke the “here to stay” barrier through sheer honey-badger belligerence, Ethereum seems to be getting there by “playing the game”.

That’s also not to say that with our investor hats on, there aren’t going to be huge gains to be made within the Ethereum ecosystem even if it goes that way. If Ethereum becomes the rails for global CBDCs (CBDETH), owning the infrastructure components of it (oracles, validators, exchanges, dapps, naming platforms) would be the analogous to owning a small slice of the Federal Reserve, or the global ACH payments system.

But I stopped thinking of Ethereum as immutable some time ago, and certainly not as a digital hard asset, the way I do Bitcoin.

* * *

Mark E. Jeftovic is the CEO of easyDNS, co-founder of Bombthrower Media, author and investor. Sign up for The Bombthrower mailing list to get updates straight into your inbox and get a free copy of The Crypto Capitalist Manifesto while you’re at it.

Follow me on Gettr, Telegram or if you haven’t been kicked off Twitter yet, there