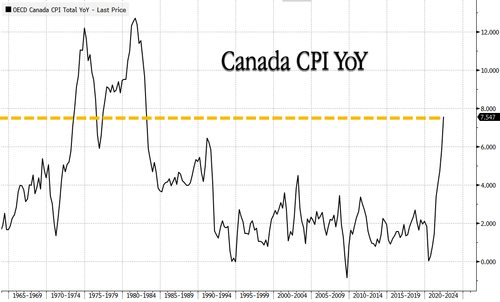

While the Bank of Canada is locked in a period of oversized interest rate increases to combat the highest inflation since the early 1980s, politicians who want to please their constituents are aiming for new rounds of fiscal support, which economists warn is a terrible idea.

"While there are times where fiscal largesse is just what the economy needs, these aren't such times," Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce, wrote in a note to clients.

"In a period of high inflation and excess demand, cutting taxes or handing out cheques can add fuel to the inflationary fire, and make the job of a central bank that's raising rates to cool demand all that more troublesome," Shenfeld said.

He continued:

What concerns us is that federal and provincial governments in Canada are feeling tempted to "do something" to help their constituents cope with high prices. While governments are feeling some inflation in their own costs, they've done even better on the revenue side, which creates the impression that they have the green light to put more money in voters' pockets. That issue is apparently at least up for discussion as the Liberals meet to plan their agenda for the upcoming parliament.

Provinces have already moved in that direction. Either through fee rebates or broad-based cheques, most residents of Ontario, Quebec, Saskatchewan and Manitoba have or will soon receive payments marketed as a helping hand to deal with inflation. Alberta's governing party is choosing a new leader, and it remains to be seen whether that will impact its apparent willingness to devote a huge $13 bn surplus this year to debt reduction.

The appeal of handouts to voters complaining about inflation is evident in the fact the provinces opting for them were generally about to face the electorate. But unless very narrowly targeted to only reach those in the most need of support to put food on the table, or even better, financed by offsetting spending cuts elsewhere, they add to the inflation pressure in the economy by increasing spending power.

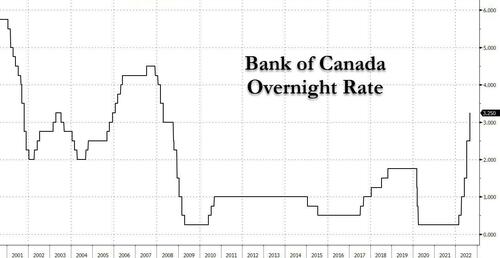

Last week, the BoC hiked rates by 75bps as expected, lifting the overnight rate to 3.25% - the highest policy rate among major advanced economies - with the fourth consecutive outsized (more than 25bps) rate hike, and warning that "given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further."

The problem with deploying additional rounds of stimulus checks in an inflationary environment while the BoC combats inflation is that it will make the central bank's job even more challenging, increasing the risks of a hard landing.

"We're not going to deny that there are households seriously in need of help right now in this inflationary environment," Robert Kavcic, senior economist at the Bank of Montreal, wrote in a separate note.

"But, from a policy perspective, we all know that sending out money as an inflation-support measure is inherently inflationary," Kavcic said.

The warning from economists is right about the dangers of additional rounds of cash handouts and how it could stoke even more inflation. Perhaps the politicians should wait to deploy stimmy checks when the next downturn arrives.

Isn't it ridiculous how politicians want to inject more money into the economy to 'fight inflation'...

While the Bank of Canada is locked in a period of oversized interest rate increases to combat the highest inflation since the early 1980s, politicians who want to please their constituents are aiming for new rounds of fiscal support, which economists warn is a terrible idea.

“While there are times where fiscal largesse is just what the economy needs, these aren’t such times,” Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce, wrote in a note to clients.

“In a period of high inflation and excess demand, cutting taxes or handing out cheques can add fuel to the inflationary fire, and make the job of a central bank that’s raising rates to cool demand all that more troublesome,” Shenfeld said.

He continued:

What concerns us is that federal and provincial governments in Canada are feeling tempted to “do something” to help their constituents cope with high prices. While governments are feeling some inflation in their own costs, they’ve done even better on the revenue side, which creates the impression that they have the green light to put more money in voters’ pockets. That issue is apparently at least up for discussion as the Liberals meet to plan their agenda for the upcoming parliament.

Provinces have already moved in that direction. Either through fee rebates or broad-based cheques, most residents of Ontario, Quebec, Saskatchewan and Manitoba have or will soon receive payments marketed as a helping hand to deal with inflation. Alberta’s governing party is choosing a new leader, and it remains to be seen whether that will impact its apparent willingness to devote a huge $13 bn surplus this year to debt reduction.

The appeal of handouts to voters complaining about inflation is evident in the fact the provinces opting for them were generally about to face the electorate. But unless very narrowly targeted to only reach those in the most need of support to put food on the table, or even better, financed by offsetting spending cuts elsewhere, they add to the inflation pressure in the economy by increasing spending power.

Last week, the BoC hiked rates by 75bps as expected, lifting the overnight rate to 3.25% – the highest policy rate among major advanced economies – with the fourth consecutive outsized (more than 25bps) rate hike, and warning that “given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further.”

The problem with deploying additional rounds of stimulus checks in an inflationary environment while the BoC combats inflation is that it will make the central bank’s job even more challenging, increasing the risks of a hard landing.

“We’re not going to deny that there are households seriously in need of help right now in this inflationary environment,” Robert Kavcic, senior economist at the Bank of Montreal, wrote in a separate note.

“But, from a policy perspective, we all know that sending out money as an inflation-support measure is inherently inflationary,” Kavcic said.

The warning from economists is right about the dangers of additional rounds of cash handouts and how it could stoke even more inflation. Perhaps the politicians should wait to deploy stimmy checks when the next downturn arrives.

Isn’t it ridiculous how politicians want to inject more money into the economy to ‘fight inflation’…