A day after we reported that the Biden administration withdrew a record amount from the US Strategic Petroleum Reserve plunging it to its lowest since 1982, Bloomberg reports that, according to people familiar with the matter, the US may begin refilling its emergency oil reserve when crude prices fall to around $80 a barrel.

The sources said that Biden administration officials are weighing the timing of such a move, with an eye toward protecting US oil-production growth and preventing crude prices from plummeting (in an effort to reassure oil producers that the administration won’t let prices collapse).

The reaction in WTI was immediate with the front-month bid (well above $80)...

“It may not be a catalyst for $100 crude but does offer a buffer to the downside risk that the market is worrying about,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

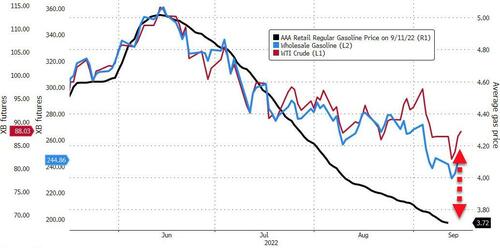

And as we have noted previously, while gas prices have dropped for 90 straight days now, they are already decoupled to the downside (thanks to the SPR releases) relative to crude and wholesale prices.

But, as we noted yesterday, this is likely to be problem for after the Midterms - so really, Biden doesn't care if it raises gas prices, it will be Republican House's problem?

So - to sum up - President Biden is fighting inflation by pre-announcing there is now a hard floor on oil prices, ensuring they never drop below it and gasoline surges now that OPEC has all the leverage.

This may well be the dumbest thing to ever come out of this administration https://t.co/7cwvoZI2x6

— zerohedge (@zerohedge) September 13, 2022

Trade accordingly.

A day after we reported that the Biden administration withdrew a record amount from the US Strategic Petroleum Reserve plunging it to its lowest since 1982, Bloomberg reports that, according to people familiar with the matter, the US may begin refilling its emergency oil reserve when crude prices fall to around $80 a barrel.

The sources said that Biden administration officials are weighing the timing of such a move, with an eye toward protecting US oil-production growth and preventing crude prices from plummeting (in an effort to reassure oil producers that the administration won’t let prices collapse).

The reaction in WTI was immediate with the front-month bid (well above $80)…

“It may not be a catalyst for $100 crude but does offer a buffer to the downside risk that the market is worrying about,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

And as we have noted previously, while gas prices have dropped for 90 straight days now, they are already decoupled to the downside (thanks to the SPR releases) relative to crude and wholesale prices.

But, as we noted yesterday, this is likely to be problem for after the Midterms – so really, Biden doesn’t care if it raises gas prices, it will be Republican House’s problem?

So – to sum up – President Biden is fighting inflation by pre-announcing there is now a hard floor on oil prices, ensuring they never drop below it and gasoline surges now that OPEC has all the leverage.

This may well be the dumbest thing to ever come out of this administration https://t.co/7cwvoZI2x6

— zerohedge (@zerohedge) September 13, 2022

Trade accordingly.