Authored by Jon Wolfenberger via The Mises Institute,

Jay “The Inflation We Caused Is Transitory” Powell finally did it.

On Friday August 26th, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession.

Powell’s Speech Translated

Below we provide key quotes from Powell’s Jackson Hole speech, along with our honest translations:

The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.

“Overarching focus” means that stock prices, housing prices, employment, and economic growth are minor concerns for the Fed compared to their goal of trying to bring inflation down from the recent +8.5 percent level to their arbitrary +2 percent level (which cuts the dollar’s value by 50 percent in thirty-four years). The dangers of inflation that Powell highlights are very real.

Other dangers he didn’t mention include how the inflation the Fed creates also causes the boom-and-bust business cycle, destroys scarce capital resources, lowers overall living standards, and increases the size and power of the government. But we can only expect so much clarity from the Fed, of course:

Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

“Sustained period of below-trend growth” means recession. “Softening of labor market conditions” means rising unemployment. “Some pain” means lower stock prices, lower housing prices, less wealth, more joblessness, lower living standards, more bankruptcy, more poverty, and more misery. It’s highly unusual for a politician or bureaucrat to admit they intend to cause pain, so Powell’s message should not be taken lightly.

The US economy is clearly slowing from the historically high growth rates of 2021, which reflected the reopening of the economy following the pandemic recession.

It also reflected the Fed’s incredibly irresponsible and aggressive policy in response to covid, when it increased the monetary base by 60 percent, which helped increase the money supply by 40 percent. This caused the high and persistent inflation we have now. While the Fed likes to blame supply chain disruptions on covid policies and the Russia-Ukraine war, there can be no widespread price inflation without an increase in the money supply.

For example, if only oil rose in price due to oil supply disruptions, but the money supply didn’t change, then other prices would fall as people lowered their spending in other areas. Overall prices would remain roughly the same. That is why the Fed is to blame for the highest inflation rates in forty years. As Powell himself explained:

The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, “Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.”

Price inflation is driven first by aggressive money creation by the Fed and banks. That is what has driven the inflation we have now. But then, as high inflation drags on, people start to reduce their demand for money as they seek value in tangible goods. That is what can ultimately lead to hyperinflation and the destruction of the currency, as has happened many times in the past, including in Germany in the 1920s. At least the Fed understands they should try to prevent that!

That brings me to the third lesson, which is that we must keep at it until the job is done. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

It would be hard for Powell to be clearer that they will not ease monetary policy just because of declining asset prices, rising unemployment, or a recession. Until inflation slows materially, the Fed intends to keep monetary policy tight.

Top Five Signs of an Impending Recession

The Fed continues to say they do not expect their policies to cause a recession. But remember, they recently thought inflation was “transitory.” The Fed has a terrible track record of not only “managing” the economy, but also forecasting the economy.

Unfortunately, a recession is likely unavoidable at this point, even if the Fed started cutting interest rates right now. Keep in mind, the Fed cut interest rates all throughout the recessions of the early 2000s and 2008–09, and they were unable to prevent them.

For the Fed and others who do not understand what is happening to the economy right now, here are the top five signs that a recession is coming soon.

1. Declining Monetary Base

The boom-and-bust business cycle is caused by the Fed and banks creating money out of thin air, which artificially lowers interest rates and leads to an economic boom. Eventually, money supply growth slows, and interest rates rise. That leads to an economic bust.

As economist Ludwig von Mises summarized in his treatise Human Action:

The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion.

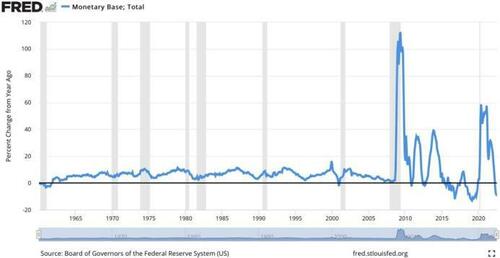

Money supply growth has slowed from 40 percent last year to 4.9 percent in July. The Fed’s monetary base (currency plus bank deposits at the Fed) is currently down 9.7 percent from last year, as shown below. The monetary base will decline further as their pace of quantitative tightening doubles starting in September.

2. Inverted Yield Curve

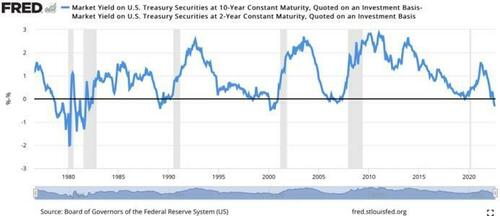

Short-term interest rates continue to rise. As a result, the yield curve spread between the ten-year and two-year Treasury rates is the most negative (or “inverted”) it has been in twenty-two years at –0.33 percent. An inverted yield curve has preceded every recession in recent decades, as shown below (with recessionary periods shaded gray).

3. Tightening Bank Lending Standards

Banks have been tightening their lending standards, which will lead to lower loan and money supply growth. As shown below, the percentage of banks that have tightened lending standards has already risen to levels seen in prior recessions.

4. Housing Market Crash

Mortgage rates have doubled over the past year to 5.13 percent. Higher interest rates and rising prices have brought housing affordability back down to the very low levels of the housing bubble peak of 2006.

The National Association of Home Builders (NAHB) is expecting a housing recession. Their highly respected Housing Market Index recently fell for the eighth straight month, to 49, below the neutral 50 level. Housing starts are down 20 percent since April, and new home sales have fallen 30 percent over the past year.

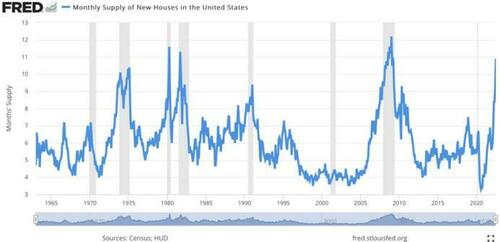

Housing supply is now at 10.9 months, the highest since early 2009. As shown below, every time housing supply rises above ten months, there has been a recession. One hundred percent of the time.

5. Declining Real Manufacturing and Trade Sales

Real manufacturing and trade sales are down 1.5 percent year-over-year. This broad measure of business sales only declines in recessions, as shown below.

Conclusion

The Fed is aggressively tightening monetary policy in the face of an impending recession for the first time in over forty years. The perfect storm of record-high stock market valuations and Fed tightening into a recession will likely lead to the worst stock bear market and recession since the Great Depression, when stocks fell nearly 90 percent. Now is the time to get prepared for the “pain” Powell plans to inflict.

Authored by Jon Wolfenberger via The Mises Institute,

Jay “The Inflation We Caused Is Transitory” Powell finally did it.

On Friday August 26th, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession.

Powell’s Speech Translated

Below we provide key quotes from Powell’s Jackson Hole speech, along with our honest translations:

The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.

“Overarching focus” means that stock prices, housing prices, employment, and economic growth are minor concerns for the Fed compared to their goal of trying to bring inflation down from the recent +8.5 percent level to their arbitrary +2 percent level (which cuts the dollar’s value by 50 percent in thirty-four years). The dangers of inflation that Powell highlights are very real.

Other dangers he didn’t mention include how the inflation the Fed creates also causes the boom-and-bust business cycle, destroys scarce capital resources, lowers overall living standards, and increases the size and power of the government. But we can only expect so much clarity from the Fed, of course:

Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

“Sustained period of below-trend growth” means recession. “Softening of labor market conditions” means rising unemployment. “Some pain” means lower stock prices, lower housing prices, less wealth, more joblessness, lower living standards, more bankruptcy, more poverty, and more misery. It’s highly unusual for a politician or bureaucrat to admit they intend to cause pain, so Powell’s message should not be taken lightly.

The US economy is clearly slowing from the historically high growth rates of 2021, which reflected the reopening of the economy following the pandemic recession.

It also reflected the Fed’s incredibly irresponsible and aggressive policy in response to covid, when it increased the monetary base by 60 percent, which helped increase the money supply by 40 percent. This caused the high and persistent inflation we have now. While the Fed likes to blame supply chain disruptions on covid policies and the Russia-Ukraine war, there can be no widespread price inflation without an increase in the money supply.

For example, if only oil rose in price due to oil supply disruptions, but the money supply didn’t change, then other prices would fall as people lowered their spending in other areas. Overall prices would remain roughly the same. That is why the Fed is to blame for the highest inflation rates in forty years. As Powell himself explained:

The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, “Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.”

Price inflation is driven first by aggressive money creation by the Fed and banks. That is what has driven the inflation we have now. But then, as high inflation drags on, people start to reduce their demand for money as they seek value in tangible goods. That is what can ultimately lead to hyperinflation and the destruction of the currency, as has happened many times in the past, including in Germany in the 1920s. At least the Fed understands they should try to prevent that!

That brings me to the third lesson, which is that we must keep at it until the job is done. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

It would be hard for Powell to be clearer that they will not ease monetary policy just because of declining asset prices, rising unemployment, or a recession. Until inflation slows materially, the Fed intends to keep monetary policy tight.

Top Five Signs of an Impending Recession

The Fed continues to say they do not expect their policies to cause a recession. But remember, they recently thought inflation was “transitory.” The Fed has a terrible track record of not only “managing” the economy, but also forecasting the economy.

Unfortunately, a recession is likely unavoidable at this point, even if the Fed started cutting interest rates right now. Keep in mind, the Fed cut interest rates all throughout the recessions of the early 2000s and 2008–09, and they were unable to prevent them.

For the Fed and others who do not understand what is happening to the economy right now, here are the top five signs that a recession is coming soon.

1. Declining Monetary Base

The boom-and-bust business cycle is caused by the Fed and banks creating money out of thin air, which artificially lowers interest rates and leads to an economic boom. Eventually, money supply growth slows, and interest rates rise. That leads to an economic bust.

As economist Ludwig von Mises summarized in his treatise Human Action:

The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion.

Money supply growth has slowed from 40 percent last year to 4.9 percent in July. The Fed’s monetary base (currency plus bank deposits at the Fed) is currently down 9.7 percent from last year, as shown below. The monetary base will decline further as their pace of quantitative tightening doubles starting in September.

2. Inverted Yield Curve

Short-term interest rates continue to rise. As a result, the yield curve spread between the ten-year and two-year Treasury rates is the most negative (or “inverted”) it has been in twenty-two years at –0.33 percent. An inverted yield curve has preceded every recession in recent decades, as shown below (with recessionary periods shaded gray).

3. Tightening Bank Lending Standards

Banks have been tightening their lending standards, which will lead to lower loan and money supply growth. As shown below, the percentage of banks that have tightened lending standards has already risen to levels seen in prior recessions.

4. Housing Market Crash

Mortgage rates have doubled over the past year to 5.13 percent. Higher interest rates and rising prices have brought housing affordability back down to the very low levels of the housing bubble peak of 2006.

The National Association of Home Builders (NAHB) is expecting a housing recession. Their highly respected Housing Market Index recently fell for the eighth straight month, to 49, below the neutral 50 level. Housing starts are down 20 percent since April, and new home sales have fallen 30 percent over the past year.

Housing supply is now at 10.9 months, the highest since early 2009. As shown below, every time housing supply rises above ten months, there has been a recession. One hundred percent of the time.

5. Declining Real Manufacturing and Trade Sales

Real manufacturing and trade sales are down 1.5 percent year-over-year. This broad measure of business sales only declines in recessions, as shown below.

Conclusion

The Fed is aggressively tightening monetary policy in the face of an impending recession for the first time in over forty years. The perfect storm of record-high stock market valuations and Fed tightening into a recession will likely lead to the worst stock bear market and recession since the Great Depression, when stocks fell nearly 90 percent. Now is the time to get prepared for the “pain” Powell plans to inflict.