Tuesday's stock market plunge was sparked by August's hotter-than-expected consumer inflation print, which led to a massive unwind in bullish bets across all sectors that were placed on the back of expectations the Federal Reserve would quickly pivot and that peak inflation was locked in.

But one investor went against the herd's 'pukefest' and did the one thing she only knows how: 'buy the dip' in profitless tech. Of course, we're talking about everyone's favorite Ark Investment Management's Cathie Wood.

Wood's investing style is no different than the self-described apes and degenerates that use Reddit's Wall Street Bet. Their strategy is to endlessly buy the dip of profitless tech companies and hope for the Fed to rescue them -- and why not? It has worked over the last decade...

But this time, the Fed has an inflation problem and can't quickly pivot (well, maybe not yet). Perhaps Wood had blinders on this year as she has endlessly bought dips as overall main equity indexes slid into bear markets.

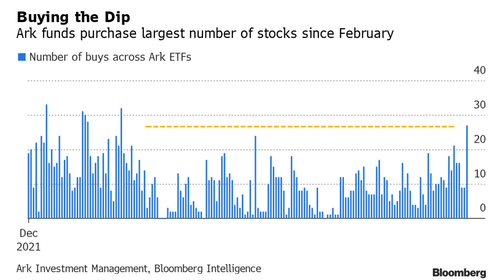

On Tuesday, when the technology-heavy Nasdaq 100 recorded the steepest one-day plunge in two years, Wood went on the most significant buying spree since February.

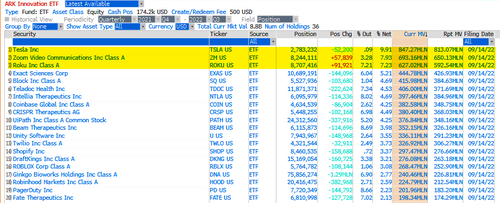

Bloomberg data shows Ark bought 27 stocks across its eight exchange-traded funds. The largest buy was Roku under the flagship ARK Innovation ETF (ARKK). It's now the third largest holding. Tesla is the first, and Zoom Video Communications is the second.

"Her buys have gone down quite a bit after January but are starting moving up last few days. It just seems like her conviction is higher now," Bloomberg's Athanasios Psarofagis said.

ARKK Bubble Implosion

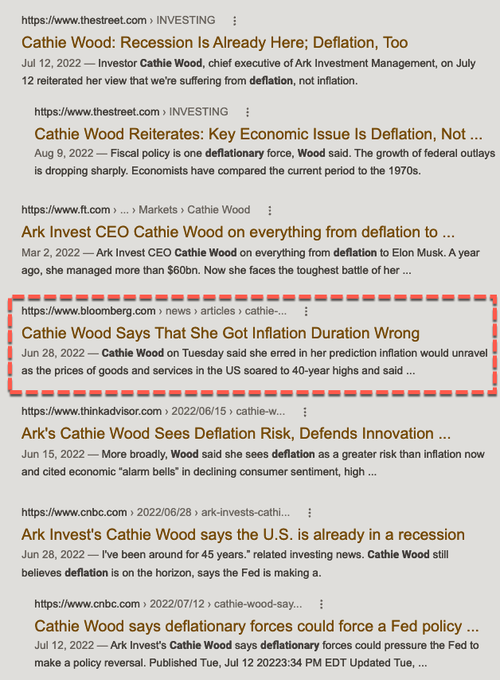

Wood has been calling for recession and deflation for most of the year as inflation spiked. She has doubled and tripled down on stocks, similar to the apes on Reddit's WSB.

After admitting she was wrong about the macro environment over the summer. She's at it again...

Wood will be right at some point as the Fed could quickly pivot after a series of oversized rate hikes this fall (but not yet).

Deflation in the pipeline, heading for the PPI, CPI, PCE Deflator: from post-COVID price peaks, lumber -60%, copper -35%, oil -35%, iron ore -60%, DRAM -46%, corn -17%, Baltic freight rates -79%, gold -17%, and silver -39%. https://t.co/nVpU1cdf1L

— Cathie Wood (@CathieDWood) September 12, 2022

While Wood was buying the dip yesterday, Goldman's Prime Services group said hedge funds were also buying beaten-down tech (into another sell-off).

Tuesday’s stock market plunge was sparked by August’s hotter-than-expected consumer inflation print, which led to a massive unwind in bullish bets across all sectors that were placed on the back of expectations the Federal Reserve would quickly pivot and that peak inflation was locked in.

But one investor went against the herd’s ‘pukefest’ and did the one thing she only knows how: ‘buy the dip’ in profitless tech. Of course, we’re talking about everyone’s favorite Ark Investment Management’s Cathie Wood.

Wood’s investing style is no different than the self-described apes and degenerates that use Reddit’s Wall Street Bet. Their strategy is to endlessly buy the dip of profitless tech companies and hope for the Fed to rescue them — and why not? It has worked over the last decade…

But this time, the Fed has an inflation problem and can’t quickly pivot (well, maybe not yet). Perhaps Wood had blinders on this year as she has endlessly bought dips as overall main equity indexes slid into bear markets.

On Tuesday, when the technology-heavy Nasdaq 100 recorded the steepest one-day plunge in two years, Wood went on the most significant buying spree since February.

Bloomberg data shows Ark bought 27 stocks across its eight exchange-traded funds. The largest buy was Roku under the flagship ARK Innovation ETF (ARKK). It’s now the third largest holding. Tesla is the first, and Zoom Video Communications is the second.

“Her buys have gone down quite a bit after January but are starting moving up last few days. It just seems like her conviction is higher now,” Bloomberg’s Athanasios Psarofagis said.

ARKK Bubble Implosion

Wood has been calling for recession and deflation for most of the year as inflation spiked. She has doubled and tripled down on stocks, similar to the apes on Reddit’s WSB.

After admitting she was wrong about the macro environment over the summer. She’s at it again…

Wood will be right at some point as the Fed could quickly pivot after a series of oversized rate hikes this fall (but not yet).

Deflation in the pipeline, heading for the PPI, CPI, PCE Deflator: from post-COVID price peaks, lumber -60%, copper -35%, oil -35%, iron ore -60%, DRAM -46%, corn -17%, Baltic freight rates -79%, gold -17%, and silver -39%. https://t.co/nVpU1cdf1L

— Cathie Wood (@CathieDWood) September 12, 2022

While Wood was buying the dip yesterday, Goldman’s Prime Services group said hedge funds were also buying beaten-down tech (into another sell-off).