No trades (none!) were reported overnight in the benchmark 10Y Japanese Government Bond (JGB) for the second straight day.

This is the first such occurrence since 1999.

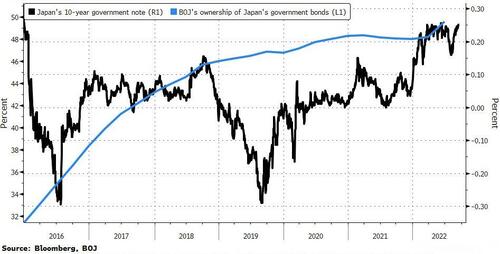

As Bloomberg reports, trading volumes in JGBs have dried up over the years as the BOJ scooped up sizable chunks of the debt to keep a cap on yields.

“The BOJ’s fixed-rate operations have become the JGB trading floor,” said Katsutoshi Inadome, a strategist at Mitsubishi UFJ in Tokyo.

“Players are guaranteed to find a solid buyer who also buys large lots."

Traders also lack the incentive to trade benchmark 10-year notes because they expect yields to rise as the Fed aggressively tightens monetary policy, according to Mitsubishi UFJ Morgan Stanley Securities.

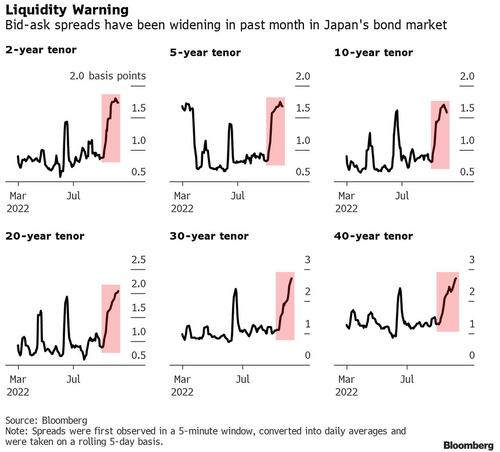

Bid-ask spreads for JGBs have exploded since March as inflation fears ripped through global bond markets (but BoJ remains stuck in its easing policy framework)...

The irony of all this is that at the same time as liquidity in the JGB market has disappeared, The Bank of Japan bought 1.26 trillion yen ($8.8 billion) of government bonds, the largest daily amount since June as it aggressively defended the upper bound of its yield curve control band...

Pressure is building on the BOJ to defend its yield-curve-control policy tonight after The Fed hikes (75bps is consensus) today. Widening yield differentials between the US and Japan have resulted in the yen sliding to a 24-year low.

Finally, we note that the issue of diminishing liquidity isn’t limited to Japanese bonds.

Bank of America analysts warned in a note this month that shrinking trading volumes in the US Treasury market may be one of the greatest threats to global financial stability.

No trades (none!) were reported overnight in the benchmark 10Y Japanese Government Bond (JGB) for the second straight day.

This is the first such occurrence since 1999.

As Bloomberg reports, trading volumes in JGBs have dried up over the years as the BOJ scooped up sizable chunks of the debt to keep a cap on yields.

“The BOJ’s fixed-rate operations have become the JGB trading floor,” said Katsutoshi Inadome, a strategist at Mitsubishi UFJ in Tokyo.

“Players are guaranteed to find a solid buyer who also buys large lots.”

Traders also lack the incentive to trade benchmark 10-year notes because they expect yields to rise as the Fed aggressively tightens monetary policy, according to Mitsubishi UFJ Morgan Stanley Securities.

Bid-ask spreads for JGBs have exploded since March as inflation fears ripped through global bond markets (but BoJ remains stuck in its easing policy framework)…

The irony of all this is that at the same time as liquidity in the JGB market has disappeared, The Bank of Japan bought 1.26 trillion yen ($8.8 billion) of government bonds, the largest daily amount since June as it aggressively defended the upper bound of its yield curve control band…

Pressure is building on the BOJ to defend its yield-curve-control policy tonight after The Fed hikes (75bps is consensus) today. Widening yield differentials between the US and Japan have resulted in the yen sliding to a 24-year low.

Finally, we note that the issue of diminishing liquidity isn’t limited to Japanese bonds.

Bank of America analysts warned in a note this month that shrinking trading volumes in the US Treasury market may be one of the greatest threats to global financial stability.