Authored by Michael Maharrey via SchiffGold.com,

Given historically high inflation, why haven’t we seen a big rally in gold and silver?

There are a number of factors that have weighed on precious metals, but as the World Gold Council points out, it’s important to put gold and silver’s recent price movements in a broader perspective.

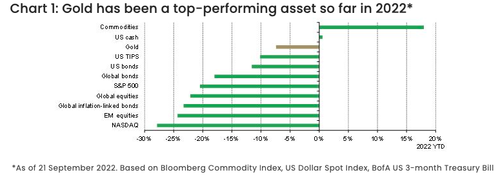

In fact, gold has been one of the better-performing asset classes in 2022.

Gold has outperformed US bonds, foreign bonds, the S&P 500, foreign stocks, the NASDAQ, and US Treasury Inflation-Protected Securities (TIPS). The only things that have outperformed gold are commodities, especially oil and agricultural goods, and the US dollar.

So, while gold has fallen more than 5% over the year, it has fallen far less than most other assets, and if you hold gold in your portfolio, it has helped hedge some of those other losses.

The Mighty Dollar

Dollar strength has been the story of 2022. As the World Gold Council put it, “Rising rates and a strong dollar have had a significant negative effect on gold’s performance despite support from geopolitics and inflation.”

We’ve seen the dollar index at 20-plus-year highs. This seems kind of crazy given the level of inflation. After all, high inflation means the dollar is devaluing, right?

Yes.

And it has.

Your purchasing power has decreased precipitously. In June, we reported that the average US household will spend about $5,200 more this year than they did last year on the same consumption basket. That breaks down to $433 extra in expenditures every single month. So, your dollar is worth considerably less.

But when we talk about dollar strength, we’re talking about the greenback compared to other fiat currencies. And over the last year, the dollar has been the cleanest dirty shirt in the laundry. Other fiat currencies have devalued even more. As Mike Maloney put it, “The US dollar has strengthened so much and so quickly this year that it has become a juggernaut, trampling pretty much every other asset.

The question is how long can this last?

In a nutshell, it will last as long as the mainstream thinks the Fed can win this inflation fight.

Peter Schiff recently said Jerome Powell still thinks he can pull off the impossible. A lot of people agree. You can see this in the bond market. Yields indicate investors think the Fed will do whatever is necessary to bring inflation down, it will do so effectively, and it won’t crash the economy. Peter said the markets are wrong on all counts.

They’re wrong about the economy and they’re wrong about the inflation. The economy is going to be much weaker than investors think. But at the same time, inflation is going to be much stronger than investors think.”

And Peter said once the Fed can no longer deny this reality, it will go back to loose monetary policy.

I think when Powell is really confronted with how ugly this is going to be, then we’re finally going to get that pivot. But this is a giant game of chicken, and I think Powell is going to keep up this pretense as long as he possibly can.”

In the meantime, other central banks are playing catch up. The ECB has gotten much more aggressive in its inflation fight. Other central banks are tightening. Japan is the only country still dragging its heels. The World Gold Council argues that this will begin to curb dollar strength.

The fact the other central banks are being more resolute in their policy decisions – partly to curb inflation, partly to defend their currencies – should weigh on the US dollar.”

Looking at the longer term, dollar dominance continues to erode. Some analysts think we are rapidly approaching a post-dollar world.

Gold’s Underlying Strength

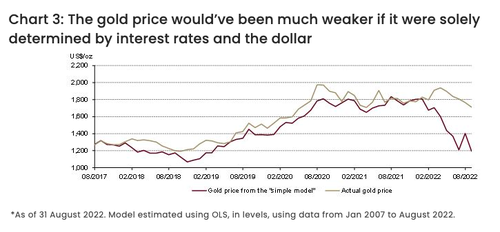

Despite the headwinds, gold has performed better than might be expected.

Based solely on interest rates and dollar strength, gold should have fallen about 30%, according to a WGC model.

Meanwhile, negative investor sentiment drove heavy gold ETF outflows and weak positioning in the futures market. This put additional pressure on gold. The World Gold Council argues that gold has held up remarkably well given these headwinds.

The fact that gold has performed as well as it has, all things considered, is a testament to its global appeal and more nuanced reaction to a wider set of variables.”

The World Gold Council highlights some of the underlying support for gold beyond a likely softening of the dollar in the near future.

Positioning in gold futures has turned net short again and this, historically, has not lasted long – often mean-reverting in subsequent weeks. At the same time, central bank demand for gold remains quite strong. Finally, as recessionary and geopolitical risks increase, investors may shift to more defensive strategies, looking for high-quality liquid assets such as gold to reduce portfolio losses.

Given these factors, the World Gold Council said it is optimistic that gold’s headwinds may start to subside, but that supportive factors will remain, “thus encouraging demand for gold as a long-term investment hedge.”

Authored by Michael Maharrey via SchiffGold.com,

Given historically high inflation, why haven’t we seen a big rally in gold and silver?

There are a number of factors that have weighed on precious metals, but as the World Gold Council points out, it’s important to put gold and silver’s recent price movements in a broader perspective.

In fact, gold has been one of the better-performing asset classes in 2022.

Gold has outperformed US bonds, foreign bonds, the S&P 500, foreign stocks, the NASDAQ, and US Treasury Inflation-Protected Securities (TIPS). The only things that have outperformed gold are commodities, especially oil and agricultural goods, and the US dollar.

So, while gold has fallen more than 5% over the year, it has fallen far less than most other assets, and if you hold gold in your portfolio, it has helped hedge some of those other losses.

The Mighty Dollar

Dollar strength has been the story of 2022. As the World Gold Council put it, “Rising rates and a strong dollar have had a significant negative effect on gold’s performance despite support from geopolitics and inflation.”

We’ve seen the dollar index at 20-plus-year highs. This seems kind of crazy given the level of inflation. After all, high inflation means the dollar is devaluing, right?

Yes.

And it has.

Your purchasing power has decreased precipitously. In June, we reported that the average US household will spend about $5,200 more this year than they did last year on the same consumption basket. That breaks down to $433 extra in expenditures every single month. So, your dollar is worth considerably less.

But when we talk about dollar strength, we’re talking about the greenback compared to other fiat currencies. And over the last year, the dollar has been the cleanest dirty shirt in the laundry. Other fiat currencies have devalued even more. As Mike Maloney put it, “The US dollar has strengthened so much and so quickly this year that it has become a juggernaut, trampling pretty much every other asset.

The question is how long can this last?

In a nutshell, it will last as long as the mainstream thinks the Fed can win this inflation fight.

Peter Schiff recently said Jerome Powell still thinks he can pull off the impossible. A lot of people agree. You can see this in the bond market. Yields indicate investors think the Fed will do whatever is necessary to bring inflation down, it will do so effectively, and it won’t crash the economy. Peter said the markets are wrong on all counts.

They’re wrong about the economy and they’re wrong about the inflation. The economy is going to be much weaker than investors think. But at the same time, inflation is going to be much stronger than investors think.”

And Peter said once the Fed can no longer deny this reality, it will go back to loose monetary policy.

I think when Powell is really confronted with how ugly this is going to be, then we’re finally going to get that pivot. But this is a giant game of chicken, and I think Powell is going to keep up this pretense as long as he possibly can.”

In the meantime, other central banks are playing catch up. The ECB has gotten much more aggressive in its inflation fight. Other central banks are tightening. Japan is the only country still dragging its heels. The World Gold Council argues that this will begin to curb dollar strength.

The fact the other central banks are being more resolute in their policy decisions – partly to curb inflation, partly to defend their currencies – should weigh on the US dollar.”

Looking at the longer term, dollar dominance continues to erode. Some analysts think we are rapidly approaching a post-dollar world.

Gold’s Underlying Strength

Despite the headwinds, gold has performed better than might be expected.

Based solely on interest rates and dollar strength, gold should have fallen about 30%, according to a WGC model.

Meanwhile, negative investor sentiment drove heavy gold ETF outflows and weak positioning in the futures market. This put additional pressure on gold. The World Gold Council argues that gold has held up remarkably well given these headwinds.

The fact that gold has performed as well as it has, all things considered, is a testament to its global appeal and more nuanced reaction to a wider set of variables.”

The World Gold Council highlights some of the underlying support for gold beyond a likely softening of the dollar in the near future.

Positioning in gold futures has turned net short again and this, historically, has not lasted long – often mean-reverting in subsequent weeks. At the same time, central bank demand for gold remains quite strong. Finally, as recessionary and geopolitical risks increase, investors may shift to more defensive strategies, looking for high-quality liquid assets such as gold to reduce portfolio losses.

Given these factors, the World Gold Council said it is optimistic that gold’s headwinds may start to subside, but that supportive factors will remain, “thus encouraging demand for gold as a long-term investment hedge.”