Back in early 2018, around the time the Fed was confident it could hike its way to around 4% without an accident, and with balance sheet QT on "autopilot", we first warned that every fed tightening cycle leads to a crisis.

Deutsche: "Every Fed Tightening Cycle Creates A Crisis" https://t.co/Lv2CM5gmEo

— zerohedge (@zerohedge) May 24, 2018

A few months later, in late December, this was confirmed when the Fed panicked and ended its tightening cycle very prematurely. Shortly after it started restarted (NOT) QE, which was then followed by the liquidity supernova that was the covid global lockdowns, and everyone knows the rest.

So fast forward to the start of 2022, when just as the Fed was setting off on its latest tightening campaign, we again reminded readers that "every Fed tightening cycle ends in disaster and then, much more Fed easing."

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

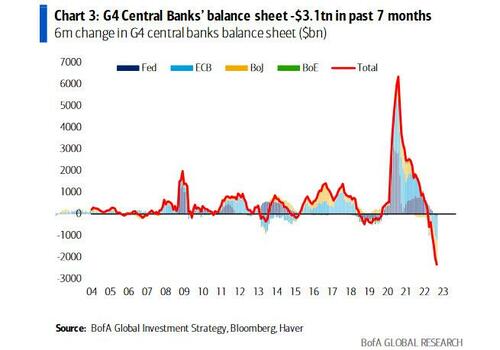

While this warning was (again) ignored for far too long, with global central banks hiking rates no less than 294 times since Aug 2021 (vs 1302 rate cuts since Lehman), last week the Bank of England confirmed that this time won't be different when it quickly ended its QT and restarted QE ("temporarily" of course) to avoid a brutal collapse of the UK pension system (which for some bizarre reason, had been allowed to use margin to hedge duration exposure). And while so far the Fed has shown it is confident it is immune to the crushing consequences of the biggest ever tightening cycle and reversal in global liquidity...

... recent events are starting to make some high-profile financial luminaries nervous, starting with Mohamed El-Erian, who openly agreed with us on Friday saying that an "economic accident" would precede any central bank pivot...

Mohamed El-Erian has a cautionary word for anyone anticipating an end to interest-rate increases https://t.co/WRysTFcfg3

— Bloomberg (@business) September 30, 2022

... an "accident" which Bank of America's credit strategists warned could be imminent when they said that "credit stress approaching critical levels, now is the time to put emphasis on risk management", and unless the Fed slows down its hiking pace, it is about to break the all-important corporate bond market, to wit:

With credit stress approaching critical levels, now is the time to put emphasis on risk management. This means slower pace of rate hikes at immediate upcoming meetings and a potential pause subsequently, to allow the economy to fully adjust to all the extreme tightening already implemented, but still working its way through the financial system’s plumbing. Failure to do so raises the risk of credit market dysfunction, which, if occurred, would be difficult to contain and fix.

Or maybe we are wrong and the Fed is finally becoming aware that it its actions are about to break the economy and market again. That's what Charlie Gasparino reported yesterady when he tweeted that, according to several big investors, "federal reserve officials getting increasingly worried about "financial stability" as opposed to inflation as higher rates begin to crush bonds." Gasparino continued that the Fed was growing "worried about possible "Lehman Moment" with a 4% FF rate as Bonds and derivatives tied to them crash, given the enormous debt issued in just the past 3 years at super low rates. A Fed watcher told me the UK intervention was not "a one off" and the same systemic risk could happen here, which might cause the Fed to pause."

(2/2) tied to them crash, given the enormous debt issued in just the past 3 years at super low rates. A Fed watcher told me the UK intervention was not "a one off" and the same systemic risk could happen here, which might cause the Fed to pause. More later on @FoxBusiness

— Charles Gasparino (@CGasparino) September 30, 2022

While that may sound like a lot of wishful thinking by the "big investors" it is becoming increasingly clear that Bank of America's warning is certainly starting to resonate with Fed officials. As a reminder, the BofA team warned that to avoid "credit market dysfunction", the Fed should slower "the pace of rate hikes at immediate upcoming meetings and a potential pause subsequently, to allow the economy to fully adjust to all the extreme tightening already implemented."

It now appears that they are doing just that, because according to Bloomberg, Federal Reserve officials "are starting to stake out different views on how fast to raise interest rates as they balance hot inflation against rising stress in financial markets." Translation: here come the cold feet.

As Bloomberg elaborates, "with Fed target range now at 3% to 3.25% and only a few moves from reaching their forecast peak, officials are starting to speak differently about the urgency with which they need to get there. Hawks like Cleveland Fed chief Loretta Mester say they must keep raising rates aggressively to win the battle against inflation even if that causes a recession." However, Vice Chair Lael Brainard has offered a slightly softer assessment while continuing to stress the need to tighten policy. Brainard’s speech Friday -- the first from Fed board leadership since officials met last week -- said policy will need be restrictive for some time and avoid the risk of prematurely pulling back.

But unlike her hawkish colleagues, "she injected a note of caution about how fast they need to go, while discussing a number of ways in which the global rate-hiking cycle could spill over on the US economy." San Francisco Fed president Mary Daly also highlighted the cost of doing too much -- as well as too little -- to cool prices.

As Bloomberg notes, their comments injected a slight variation into what has been a uniformed stream of insistence from regional Fed presidents declaring unflinching resolve to crush inflation.

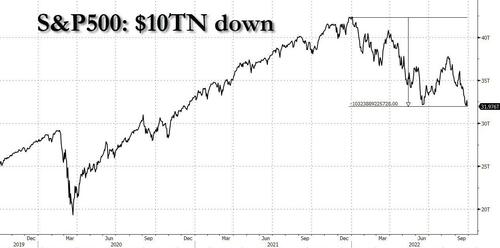

To be sure, the costs to the economy have already been telegraphed in the form of falling asset prices with the S&P 500 plunging 9.3% in September - the worst September since 2008 - as markets have now lost over $10 trillion from the all time high.

But it's the elusive economic collapse that is seen as the greenlight for any Fed pivot - just two days ago Loretta Mester went so far to say that not even a recession would stop the Fed from hiking further...

- *MESTER SAYS RECESSION WON'T STOP FED FROM RAISING RATES

... a view which seems dangerously naive and ignores the political fallout (for the Democratic party) that millions of lost jobs will lead to. Furthermore, while bond and stock values have cratered, for now the financial system - at least in the US - seems to be working just fine.

But if the BofA strategy team is correct, that's about to end with a bang. Indeed, even Bloomberg brings attention to what we reported last night, saying that "Bank of America Corp. says credit stress is at a “borderline critical level” beyond which dysfunction begins. That’s something the Fed wants to avoid because market breakdowns are difficult to control and can accelerate downturns."

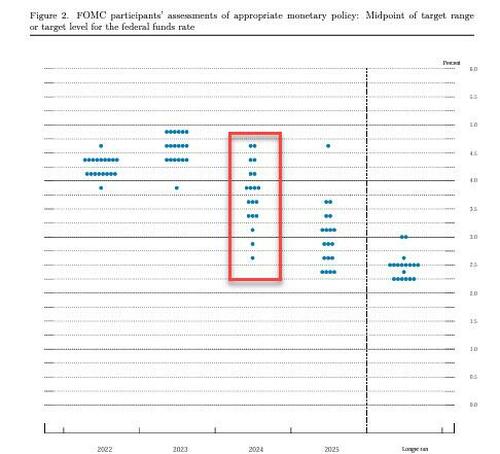

In any case, the growing divisions among officials showed up in their forecasts released Sept. 21 that showed 8 officials estimating they would finish the year with rates in a 4% to 4.25% range while nine were a quarter point higher. Their 2024 forecast was even more bizarre and clueless.

Another novel narrative to emerge in Brainard's speech, was her warning that it will take time for the full extent of tightening to bite down broadly across the economy, another way of arguing for some patience starting now.

“Uncertainty is currently high, and there are a range of estimates around the appropriate destination of the target range for the cycle,” she told a conference hosted at the New York Fed on financial stability. “Proceeding deliberately and in a data-dependent manner will enable us to learn how economic activity and inflation are adjusting to the cumulative tightening.”

That contrasts sharply with Fed hawks. In fact, Mester has argued aggressively against down-shifting into more deliberative policy, as officials have done in past tightening cycles when high uncertainty lead the central bank to inch rates up a quarter-point at a time. At a time when inflation is too high, and the direction of inflation expectations is hard forecast, overshooting is better than undershooting, Mester said:

“Some results in the literature suggest that when policymakers confront more uncertainty either in their data or in their models, they should be more cautious in acting, that is, be more inertial in their responses,” she said in a Sept. 26 speech. “Subsequent research has shown that this is not generally true.”

“It can be better for policymakers to act more aggressively because aggressive and pre-emptive action can prevent the worst-case outcomes from actually coming about,” she added.

Ironically, just as she read those words, the Bank of England capitulated and pivoted back to QE.

Yet while a fissure is finally emerging within the FOMC over how fast to hike to peak rates, so far not a single official is talking about easing rapidly once they get there. Labor markets are strong with forecasters estimating another 250,000 jobs added in September, while the latest inflation report was discouraging. But expect all that to change and soon, because as Bloomberg summarizes, "What ultimately determines the pace might be just whether markets remain orderly or not."

This matters because while the Fed's favorite economic indicators are backward looking and lag anywhere between 6 and 9 months, the market still anticipated key turning points and traders accordingly.

“They have made the decision they are going to tighten more rather than less, which guarantees they will over-tighten. How are we going to see it? You are going to see it in financial conditions,” said former Fed staffer, Julia Coronado, founding partner at MacroPolicy Perspectives.

“I don’t think they really understand” the risk of chaotic market breakdowns, she added. “When you say we are hellbent on being the fastest car on the road, that encourages a lot of positioning that is one way.”

And speaking of chaotic market breakdowns, it is not just the credit market that is on the edge: according to another former NY Fed staffer, and current rates strategist at Bank of America, Mark Cabana who on Friday wrote a must read note (available to pro subscribers), in which he warned that Treasury "market functioning breakdown is a growing risk & may see long-end duration sell-off + curve bear steepen. The Fed is unlikely to tolerate a UST market functioning breakdown for long; if the UST market doesn’t work, broader markets likely don’t work."

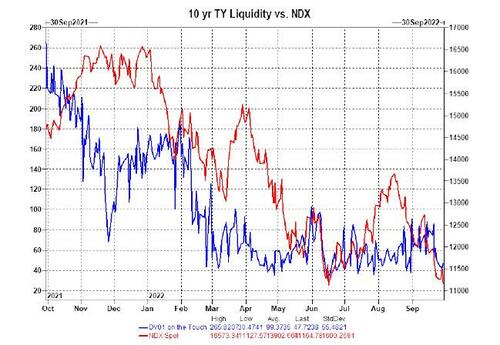

Here, one look at the record low liquidity...

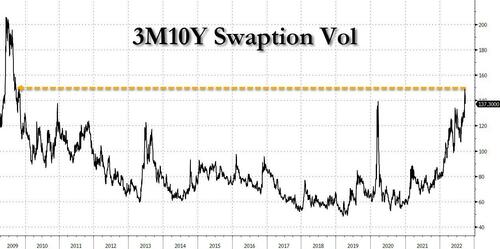

... and exploding volatility in the Treasury market which was already blown above the 2020 covid crash and is on the verge of surpassing Lehman levels...

... suggests that the Fed has already lost control of the Treasury market which is no longer functioning properly. How long until the Fed admits this, and how much additional pain it will tolerate before it capitulates, is a different question.

Back in early 2018, around the time the Fed was confident it could hike its way to around 4% without an accident, and with balance sheet QT on “autopilot”, we first warned that every fed tightening cycle leads to a crisis.

Deutsche: “Every Fed Tightening Cycle Creates A Crisis” https://t.co/Lv2CM5gmEo

— zerohedge (@zerohedge) May 24, 2018

A few months later, in late December, this was confirmed when the Fed panicked and ended its tightening cycle very prematurely. Shortly after it started restarted (NOT) QE, which was then followed by the liquidity supernova that was the covid global lockdowns, and everyone knows the rest.

So fast forward to the start of 2022, when just as the Fed was setting off on its latest tightening campaign, we again reminded readers that “every Fed tightening cycle ends in disaster and then, much more Fed easing.”

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

While this warning was (again) ignored for far too long, with global central banks hiking rates no less than 294 times since Aug 2021 (vs 1302 rate cuts since Lehman), last week the Bank of England confirmed that this time won’t be different when it quickly ended its QT and restarted QE (“temporarily” of course) to avoid a brutal collapse of the UK pension system (which for some bizarre reason, had been allowed to use margin to hedge duration exposure). And while so far the Fed has shown it is confident it is immune to the crushing consequences of the biggest ever tightening cycle and reversal in global liquidity…

… recent events are starting to make some high-profile financial luminaries nervous, starting with Mohamed El-Erian, who openly agreed with us on Friday saying that an “economic accident” would precede any central bank pivot…

Mohamed El-Erian has a cautionary word for anyone anticipating an end to interest-rate increases https://t.co/WRysTFcfg3

— Bloomberg (@business) September 30, 2022

… an “accident” which Bank of America’s credit strategists warned could be imminent when they said that “credit stress approaching critical levels, now is the time to put emphasis on risk management“, and unless the Fed slows down its hiking pace, it is about to break the all-important corporate bond market, to wit:

With credit stress approaching critical levels, now is the time to put emphasis on risk management. This means slower pace of rate hikes at immediate upcoming meetings and a potential pause subsequently, to allow the economy to fully adjust to all the extreme tightening already implemented, but still working its way through the financial system’s plumbing. Failure to do so raises the risk of credit market dysfunction, which, if occurred, would be difficult to contain and fix.

Or maybe we are wrong and the Fed is finally becoming aware that it its actions are about to break the economy and market again. That’s what Charlie Gasparino reported yesterady when he tweeted that, according to several big investors, “federal reserve officials getting increasingly worried about “financial stability” as opposed to inflation as higher rates begin to crush bonds.” Gasparino continued that the Fed was growing “worried about possible “Lehman Moment” with a 4% FF rate as Bonds and derivatives tied to them crash, given the enormous debt issued in just the past 3 years at super low rates. A Fed watcher told me the UK intervention was not “a one off” and the same systemic risk could happen here, which might cause the Fed to pause.“

(2/2) tied to them crash, given the enormous debt issued in just the past 3 years at super low rates. A Fed watcher told me the UK intervention was not “a one off” and the same systemic risk could happen here, which might cause the Fed to pause. More later on @FoxBusiness

— Charles Gasparino (@CGasparino) September 30, 2022

While that may sound like a lot of wishful thinking by the “big investors” it is becoming increasingly clear that Bank of America’s warning is certainly starting to resonate with Fed officials. As a reminder, the BofA team warned that to avoid “credit market dysfunction”, the Fed should slower “the pace of rate hikes at immediate upcoming meetings and a potential pause subsequently, to allow the economy to fully adjust to all the extreme tightening already implemented.”

It now appears that they are doing just that, because according to Bloomberg, Federal Reserve officials “are starting to stake out different views on how fast to raise interest rates as they balance hot inflation against rising stress in financial markets.” Translation: here come the cold feet.

As Bloomberg elaborates, “with Fed target range now at 3% to 3.25% and only a few moves from reaching their forecast peak, officials are starting to speak differently about the urgency with which they need to get there. Hawks like Cleveland Fed chief Loretta Mester say they must keep raising rates aggressively to win the battle against inflation even if that causes a recession.” However, Vice Chair Lael Brainard has offered a slightly softer assessment while continuing to stress the need to tighten policy. Brainard’s speech Friday — the first from Fed board leadership since officials met last week — said policy will need be restrictive for some time and avoid the risk of prematurely pulling back.

But unlike her hawkish colleagues, “she injected a note of caution about how fast they need to go, while discussing a number of ways in which the global rate-hiking cycle could spill over on the US economy.” San Francisco Fed president Mary Daly also highlighted the cost of doing too much — as well as too little — to cool prices.

As Bloomberg notes, their comments injected a slight variation into what has been a uniformed stream of insistence from regional Fed presidents declaring unflinching resolve to crush inflation.

To be sure, the costs to the economy have already been telegraphed in the form of falling asset prices with the S&P 500 plunging 9.3% in September – the worst September since 2008 – as markets have now lost over $10 trillion from the all time high.

But it’s the elusive economic collapse that is seen as the greenlight for any Fed pivot – just two days ago Loretta Mester went so far to say that not even a recession would stop the Fed from hiking further…

- *MESTER SAYS RECESSION WON’T STOP FED FROM RAISING RATES

… a view which seems dangerously naive and ignores the political fallout (for the Democratic party) that millions of lost jobs will lead to. Furthermore, while bond and stock values have cratered, for now the financial system – at least in the US – seems to be working just fine.

But if the BofA strategy team is correct, that’s about to end with a bang. Indeed, even Bloomberg brings attention to what we reported last night, saying that “Bank of America Corp. says credit stress is at a “borderline critical level” beyond which dysfunction begins. That’s something the Fed wants to avoid because market breakdowns are difficult to control and can accelerate downturns.”

In any case, the growing divisions among officials showed up in their forecasts released Sept. 21 that showed 8 officials estimating they would finish the year with rates in a 4% to 4.25% range while nine were a quarter point higher. Their 2024 forecast was even more bizarre and clueless.

Another novel narrative to emerge in Brainard’s speech, was her warning that it will take time for the full extent of tightening to bite down broadly across the economy, another way of arguing for some patience starting now.

“Uncertainty is currently high, and there are a range of estimates around the appropriate destination of the target range for the cycle,” she told a conference hosted at the New York Fed on financial stability. “Proceeding deliberately and in a data-dependent manner will enable us to learn how economic activity and inflation are adjusting to the cumulative tightening.”

That contrasts sharply with Fed hawks. In fact, Mester has argued aggressively against down-shifting into more deliberative policy, as officials have done in past tightening cycles when high uncertainty lead the central bank to inch rates up a quarter-point at a time. At a time when inflation is too high, and the direction of inflation expectations is hard forecast, overshooting is better than undershooting, Mester said:

“Some results in the literature suggest that when policymakers confront more uncertainty either in their data or in their models, they should be more cautious in acting, that is, be more inertial in their responses,” she said in a Sept. 26 speech. “Subsequent research has shown that this is not generally true.”

“It can be better for policymakers to act more aggressively because aggressive and pre-emptive action can prevent the worst-case outcomes from actually coming about,” she added.

Ironically, just as she read those words, the Bank of England capitulated and pivoted back to QE.

Yet while a fissure is finally emerging within the FOMC over how fast to hike to peak rates, so far not a single official is talking about easing rapidly once they get there. Labor markets are strong with forecasters estimating another 250,000 jobs added in September, while the latest inflation report was discouraging. But expect all that to change and soon, because as Bloomberg summarizes, “What ultimately determines the pace might be just whether markets remain orderly or not.“

This matters because while the Fed’s favorite economic indicators are backward looking and lag anywhere between 6 and 9 months, the market still anticipated key turning points and traders accordingly.

“They have made the decision they are going to tighten more rather than less, which guarantees they will over-tighten. How are we going to see it? You are going to see it in financial conditions,” said former Fed staffer, Julia Coronado, founding partner at MacroPolicy Perspectives.

“I don’t think they really understand” the risk of chaotic market breakdowns, she added. “When you say we are hellbent on being the fastest car on the road, that encourages a lot of positioning that is one way.”

And speaking of chaotic market breakdowns, it is not just the credit market that is on the edge: according to another former NY Fed staffer, and current rates strategist at Bank of America, Mark Cabana who on Friday wrote a must read note (available to pro subscribers), in which he warned that Treasury “market functioning breakdown is a growing risk & may see long-end duration sell-off + curve bear steepen. The Fed is unlikely to tolerate a UST market functioning breakdown for long; if the UST market doesn’t work, broader markets likely don’t work.“

Here, one look at the record low liquidity…

… and exploding volatility in the Treasury market which was already blown above the 2020 covid crash and is on the verge of surpassing Lehman levels…

… suggests that the Fed has already lost control of the Treasury market which is no longer functioning properly. How long until the Fed admits this, and how much additional pain it will tolerate before it capitulates, is a different question.