Oil prices have soared in the last few days (to 3-week highs) as the dollar weakened and OPEC+ hinted at greater and greater production cuts.

“The potential cut increasing from 1 million barrels a day to 2 million barrels implies a more aggressive approach,” said Stacey Morris, head of energy research at Alerian VettaFi.

“It may signal greater concern around demand and the health of the global economy.”

Additionally, Saudi Aramco’s chief executive officer warned Tuesday that the global oil market’s spare capacity is extremely low.

API

-

Crude -1.77mm

-

Cushing +925k

-

Gasoline -3.47mm

-

Distillates -4.05mm - biggest draw since Mar 2022

Crude stocks drew down for the second straight week, and products saw major draws (likely stockpiling ahead of Hurricane Ian)...

Source: Bloomberg

WTI was hovering just above $86 ahead of the API print and rallied after, back up towards post-OPEC+ headline highs of the day...

Rising crude and wholesale gasoline are starting to put renewed pressure on retail pump prices in the US...

Source: Bloomberg

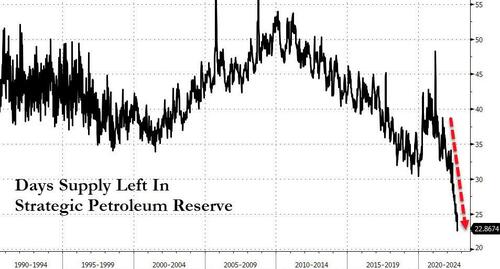

And finally bear in mind that Biden does not have much room to play in the SPR release into the Midterms...

Source: Bloomberg

That is a record low 2-day supply left for real 'emergencies'...

Oil prices have soared in the last few days (to 3-week highs) as the dollar weakened and OPEC+ hinted at greater and greater production cuts.

“The potential cut increasing from 1 million barrels a day to 2 million barrels implies a more aggressive approach,” said Stacey Morris, head of energy research at Alerian VettaFi.

“It may signal greater concern around demand and the health of the global economy.”

Additionally, Saudi Aramco’s chief executive officer warned Tuesday that the global oil market’s spare capacity is extremely low.

API

Crude stocks drew down for the second straight week, and products saw major draws (likely stockpiling ahead of Hurricane Ian)…

Source: Bloomberg

WTI was hovering just above $86 ahead of the API print and rallied after, back up towards post-OPEC+ headline highs of the day…

Rising crude and wholesale gasoline are starting to put renewed pressure on retail pump prices in the US…

Source: Bloomberg

And finally bear in mind that Biden does not have much room to play in the SPR release into the Midterms…

Source: Bloomberg

That is a record low 2-day supply left for real ’emergencies’…