Despite bouncing from August's plunge, S&P Global's Services PMI printed below 50 (in contraction) for the 3rd month in a row (at 49.3). Of course, in keeping with the idiocy, ISM Services printed 56.7 (below 56.9 in August but well above the 56.0 expected)...

Source: Bloomberg

The pictures from ISM and PMI data remain mixed (as ever) with ISM data slowed in September while S&P Global rose...

Source: Bloomberg

Under the hood of ISM, Services Prices and New Orders slowed while employment improved...

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"With service sector activity declining for a third straight month in September, businesses have faced a tough third quarter. Economic growth has come under pressure from falling output in both the manufacturing and service sectors, though in both cases September has seen some encouraging signals that business conditions may be starting to improve.

"Driving this improvement is a cooling of inflationary pressures in manufacturing supply chains, which is in turn alleviating cost growth for goods and energy in both manufacturing and service sectors, helping stimulate demand and allaying some concerns about the economic outlook.

"The worry is that tightening financial conditions, and notably higher borrowing costs, are exerting increased cost pressures on households and businesses, as well as hitting growth in the vast financial services sector, which has seen the steepest downturns in both demand and business activity in recent months and saw yet another marked worsening of business conditions in September.

"Furthermore, despite easing, inflationary pressures in terms of firms' costs and average selling prices for goods and services remain elevated. With companies also reporting staffing issues and rising wages due to very tight labor market conditions, persistent inflation remains a concern at the same time that the economy appears to be struggling to regain momentum."

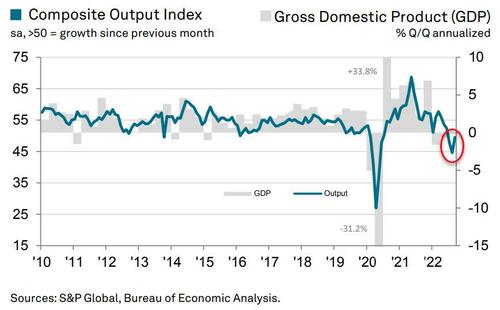

The S&P Global US Composite PMI Output Index posted 49.5 in September, notably up from 44.6 in August, but still in contraction overall as a further decline in output at service providers outweighed a slight expansion at manufacturers.

But, as S&P Global concludes, hopes of greater client demand, a peaking of inflation and investment in new products drove business expectations for the year-ahead to the highest for four months.

So we are back to 'hope'?

Despite bouncing from August’s plunge, S&P Global’s Services PMI printed below 50 (in contraction) for the 3rd month in a row (at 49.3). Of course, in keeping with the idiocy, ISM Services printed 56.7 (below 56.9 in August but well above the 56.0 expected)…

Source: Bloomberg

The pictures from ISM and PMI data remain mixed (as ever) with ISM data slowed in September while S&P Global rose…

Source: Bloomberg

Under the hood of ISM, Services Prices and New Orders slowed while employment improved…

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“With service sector activity declining for a third straight month in September, businesses have faced a tough third quarter. Economic growth has come under pressure from falling output in both the manufacturing and service sectors, though in both cases September has seen some encouraging signals that business conditions may be starting to improve.

“Driving this improvement is a cooling of inflationary pressures in manufacturing supply chains, which is in turn alleviating cost growth for goods and energy in both manufacturing and service sectors, helping stimulate demand and allaying some concerns about the economic outlook.

“The worry is that tightening financial conditions, and notably higher borrowing costs, are exerting increased cost pressures on households and businesses, as well as hitting growth in the vast financial services sector, which has seen the steepest downturns in both demand and business activity in recent months and saw yet another marked worsening of business conditions in September.

“Furthermore, despite easing, inflationary pressures in terms of firms’ costs and average selling prices for goods and services remain elevated. With companies also reporting staffing issues and rising wages due to very tight labor market conditions, persistent inflation remains a concern at the same time that the economy appears to be struggling to regain momentum.”

The S&P Global US Composite PMI Output Index posted 49.5 in September, notably up from 44.6 in August, but still in contraction overall as a further decline in output at service providers outweighed a slight expansion at manufacturers.

But, as S&P Global concludes, hopes of greater client demand, a peaking of inflation and investment in new products drove business expectations for the year-ahead to the highest for four months.

So we are back to ‘hope’?