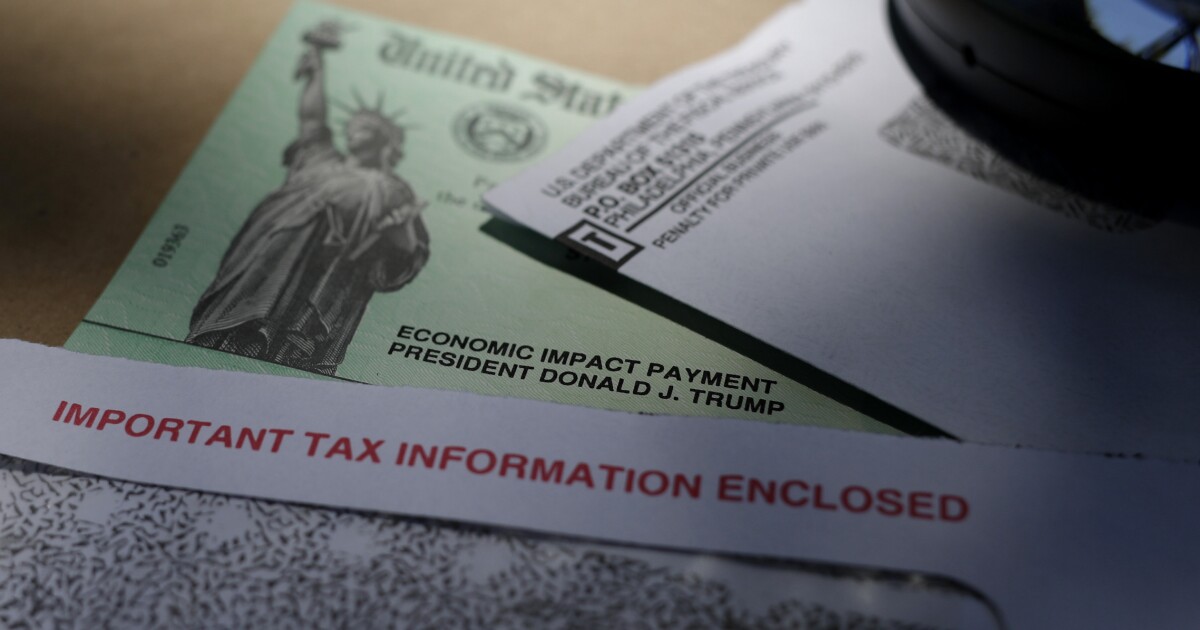

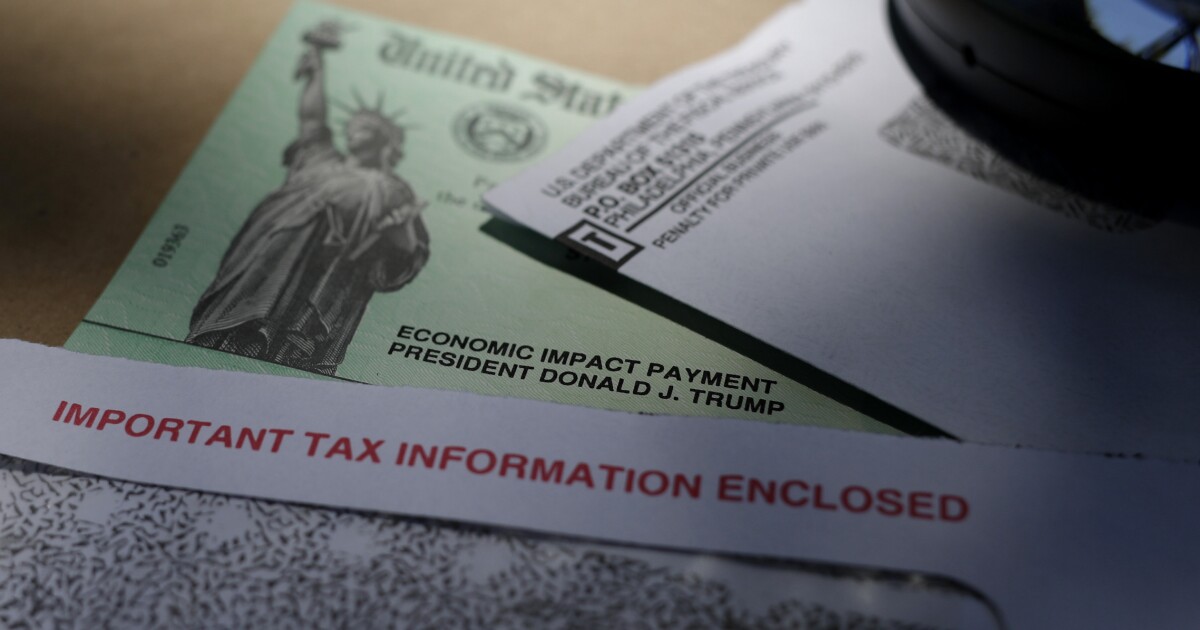

Illinois residents have just eight days left to claim up to $700 in tax rebates aimed to provide financial support amid increased living costs in the state.

The tax rebates are part of the state’s Family Relief Plan that was introduced in a bill backed by state Sen. Meg Loughran Cappel who passed the legislature earlier this year. The bill sets aside millions of dollars for those who filed their taxes in 2021 to help with increased costs caused by the pandemic and rising inflation.

STIMULUS UPDATE: DIRECT $487 PAYMENTS BEING SENT OUT FROM WEDNESDAY FOR MORE THAN 1 MILLION PEOPLE

“From pandemic losses to the increased cost of living, families across the state are facing financial distress,” Cappel said. “As a General Assembly, we recognized the daily struggles of hardworking people and passed a comprehensive plan to provide them with much-needed relief to help them get back on their feet.”

Eligible residents have until Oct. 17 to file last year’s taxes to receive the payment.

The amount each resident will receive varies depending on the taxes filed. For those who filed individually and make less than $200,000 annually, they will receive a $50 rebate, while joint filers making less than $400,000 a year will receive $100.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Filers can receive an additional $100 per dependent for a maximum of three dependents, according to the plan. Those who paid property taxes in 2021 on their primary residence and make less than $250,000 individually or $500,000 jointly will be awarded an additional $300.