The past year hasn't been kind to Snapshot. And by that we mean shareholders have gotten absolutely obliterated.

The implosion started exactly one year ago, when the company missed after missing on Revenue and ARPU (it quickly blamed Apple for this debacle), and the stock lost a third of its value, plunging from the mid-$70s to the low $50s.

It only got worse one quarter ago, when the company lost another quarter of its value, plunging to single digits, or as we put it "SNAP Craters 25% After Reporting Weakest-Ever Growth, Removes Q3 Guidance, Drags Down All "Socials"."

Well, it's deja vu time, because moments ago, drumroll, SNAP cratered 25%, after reporting its weakest-ever growth, saying that a decline in advertising spending on the platform continues to drag on results, removing Q4 guidance, and dragging down all socials.

Yup, it's the same exact disastrous quarter transposed to today.

Here is how the company did in yet another catastrophic quarter

- Revenue $1.13 billion,missing the estimate $1.14 billion and growing just +5.7% y/y (after 13% Y/Y in Q3), not only the lowest on record, but below the 8% figure Snap said in August it was seeing.

- North America revenue $811.6 million, +3.1% y/y, missing the estimate $820.6 million

- Europe revenue $161.4 million, +5.4% y/y, missing the estimate $164.4 million

- Rest of the world revenue $155.5 million, +22% y/y, beating the estimate $154.1 million

- Adjusted EPS 8.0c vs. 17c y/y, estimate loss/shr 2.2c

- Adjusted Ebitda $72.6 million, -58% y/y, estimate $24 million

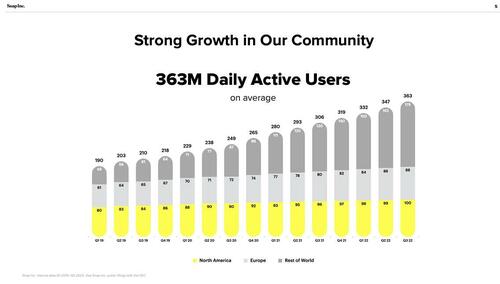

Like last quarter, there was some good news in the daily active users, which at 363 million, rose 19% y/y, and beat the estimate of 358.7 million.

- North America daily active users 100 million, +4.2% y/y, estimate 99.9 million

- Europe daily active users 88 million, +10% y/y, estimate 87.5 million

- Rest of world daily active users 175 million, +35% y/y, estimate 171.6 million

The problem is that judging by the actual earnings, none of this matters. Worse, Snap’s average revenue per user slid 11% to $3.11, missing the $3.19 average analyst projection.

Like last quarter, the company again refused to give a user forecast saying that:

Given uncertainties related to the operating environment, we are not providing our expectations for revenue or adjusted EBITDA for the fourth quarter of 2022

... but it said it had set “internal forecasts based on the assumption that year-over-year revenue growth will be approximately flat in 4Q.” In short, the growth is over!

The social media company spent the third quarter shrinking and refocusing its business, announcing in August that it was cutting 20% of its workforce and slashing projects that don’t contribute to user or revenue growth, or to the company’s augmented reality efforts. The changes were in response to plunging sales, which Snap attributed to a slowdown in marketer spending.

Alas, by cutting employees, the company apparently also cut its revenues, which not only grew by the slowest on record, but coming at single digits, the formerly highly-flying story stock is about to shrink!

More tragically, in a time when tech companies are firing everyone, SNAP still has the same colorblind in-house graphic designer.

In its prepared remarks for investors, Snapchat said that Revenue growth “continues to be impacted by a number of factors we have noted throughout the past year, including platform policy changes, macroeconomic headwinds, and increased competition." It added that "we are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.”

And as Alex Weprin notes "if Snapchat is social media's canary in the coal mine, here's an ominous stat from the Q3 investor letter: "total time spent watching content in the United States decreased 5% year-over-year..."

Almost as if people have to work again for a living instead of relying on their stimmies.

Tragically, all this is happening as the company prioritizes efforts to boost revenue. In the third quarter, Snap grew its nascent subscription service, Snapchat+, to 1.5 million users who pay for early access to exclusive or pre-release features, Snap said Thursday. The app maker has also been investing in improving measurement tools for ads on its platform.

Alas, none of this mattered at the end of the day.

And while Bloomberg noted that "investors will be watching Santa Monica, California-based Snap for clues on the performance of other advertising-dependent social media businesses" as next week "Meta Platforms Inc. and Alphabet Inc. report earnings" we already know: the results were so horrific, they dragged down shares of all social media companies. Among its closest peers, Facebook parent Meta Platforms -4.3% and Pinterest -9%; Google parent Alphabet, which also derives revenue from online advertising, is down 2.5%. And while Twitter, which is being acquired by Elon Musk, is little changed, had it not been for Musk's offer, TWTR stock would also be single digits now.

Following the dire report, SNAP stock is down another 25%, bringing its drop to -90% from Sept 24, 2021 highs, and down 77% in 2022 already.

The past year hasn’t been kind to Snapshot. And by that we mean shareholders have gotten absolutely obliterated.

The implosion started exactly one year ago, when the company missed after missing on Revenue and ARPU (it quickly blamed Apple for this debacle), and the stock lost a third of its value, plunging from the mid-$70s to the low $50s.

It only got worse one quarter ago, when the company lost another quarter of its value, plunging to single digits, or as we put it “SNAP Craters 25% After Reporting Weakest-Ever Growth, Removes Q3 Guidance, Drags Down All “Socials“.”

Well, it’s deja vu time, because moments ago, drumroll, SNAP cratered 25%, after reporting its weakest-ever growth, saying that a decline in advertising spending on the platform continues to drag on results, removing Q4 guidance, and dragging down all socials.

Yup, it’s the same exact disastrous quarter transposed to today.

Here is how the company did in yet another catastrophic quarter

- Revenue $1.13 billion,missing the estimate $1.14 billion and growing just +5.7% y/y (after 13% Y/Y in Q3), not only the lowest on record, but below the 8% figure Snap said in August it was seeing.

- North America revenue $811.6 million, +3.1% y/y, missing the estimate $820.6 million

- Europe revenue $161.4 million, +5.4% y/y, missing the estimate $164.4 million

- Rest of the world revenue $155.5 million, +22% y/y, beating the estimate $154.1 million

- Adjusted EPS 8.0c vs. 17c y/y, estimate loss/shr 2.2c

- Adjusted Ebitda $72.6 million, -58% y/y, estimate $24 million

Like last quarter, there was some good news in the daily active users, which at 363 million, rose 19% y/y, and beat the estimate of 358.7 million.

- North America daily active users 100 million, +4.2% y/y, estimate 99.9 million

- Europe daily active users 88 million, +10% y/y, estimate 87.5 million

- Rest of world daily active users 175 million, +35% y/y, estimate 171.6 million

The problem is that judging by the actual earnings, none of this matters. Worse, Snap’s average revenue per user slid 11% to $3.11, missing the $3.19 average analyst projection.

Like last quarter, the company again refused to give a user forecast saying that:

Given uncertainties related to the operating environment, we are not providing our expectations for revenue or adjusted EBITDA for the fourth quarter of 2022

… but it said it had set “internal forecasts based on the assumption that year-over-year revenue growth will be approximately flat in 4Q.” In short, the growth is over!

The social media company spent the third quarter shrinking and refocusing its business, announcing in August that it was cutting 20% of its workforce and slashing projects that don’t contribute to user or revenue growth, or to the company’s augmented reality efforts. The changes were in response to plunging sales, which Snap attributed to a slowdown in marketer spending.

Alas, by cutting employees, the company apparently also cut its revenues, which not only grew by the slowest on record, but coming at single digits, the formerly highly-flying story stock is about to shrink!

More tragically, in a time when tech companies are firing everyone, SNAP still has the same colorblind in-house graphic designer.

In its prepared remarks for investors, Snapchat said that Revenue growth “continues to be impacted by a number of factors we have noted throughout the past year, including platform policy changes, macroeconomic headwinds, and increased competition.” It added that “we are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.”

And as Alex Weprin notes “if Snapchat is social media’s canary in the coal mine, here’s an ominous stat from the Q3 investor letter: “total time spent watching content in the United States decreased 5% year-over-year…“

Almost as if people have to work again for a living instead of relying on their stimmies.

Tragically, all this is happening as the company prioritizes efforts to boost revenue. In the third quarter, Snap grew its nascent subscription service, Snapchat+, to 1.5 million users who pay for early access to exclusive or pre-release features, Snap said Thursday. The app maker has also been investing in improving measurement tools for ads on its platform.

Alas, none of this mattered at the end of the day.

And while Bloomberg noted that “investors will be watching Santa Monica, California-based Snap for clues on the performance of other advertising-dependent social media businesses” as next week “Meta Platforms Inc. and Alphabet Inc. report earnings” we already know: the results were so horrific, they dragged down shares of all social media companies. Among its closest peers, Facebook parent Meta Platforms -4.3% and Pinterest -9%; Google parent Alphabet, which also derives revenue from online advertising, is down 2.5%. And while Twitter, which is being acquired by Elon Musk, is little changed, had it not been for Musk’s offer, TWTR stock would also be single digits now.

Following the dire report, SNAP stock is down another 25%, bringing its drop to -90% from Sept 24, 2021 highs, and down 77% in 2022 already.