By Ye Xie and Amy Li, Bloomberg Markets Live reporters and analysts

The meltdown that engulfed Chinese stocks Monday is a clear sign investors are worried that President Xi Jinping’s tightening grip on power will exact a heavy toll on free enterprise and economic growth. But some Wall Street banks haven’t given up on China just yet. JPMorgan’s strategist Marko Kolanovic, for one, is urging investors to buy the dip (ZH: as he always does with everything).

While the quant guru’s bullish call on the nation’s assets has misfired this year, history shows a market rebound after a rout of this scale is more than likely.

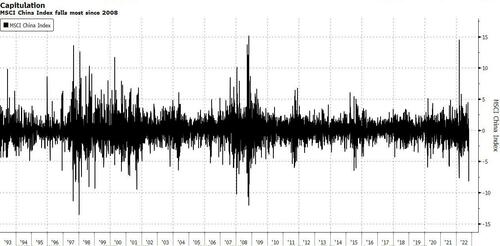

Monday’s selloff in Chinese assets was savage with few precedents outside economic crises.

Following the Party Congress where Xi stuff the Politburo Standing Committee with his allies, the Nasdaq Golden Dragon China Index of 65 Chinese stocks sank as much as 21%. The MSCI China Index fell more than 8%, the most since 2008. Foreign investors took out a record 18 billion yuan ($2.5 billion) from the mainland’s stock market via the connect programs -- more than wiping out the inflows this year.

Markets are clearly worried that Xi’s consolidation of power means a likely continuation of recent economically damaging policies, including Covid Zero and the campaign to rein in private-sector enterprises. “The market got the feeling of a continuous lack of focus on the state of the Chinese economy,” said Giuliano Gasparet, head of equity at Generali Insurance Asset Management.

For some investors, though, the selloff may be overdone. “We believe this is a good opportunity to add given an expected growth recovery, gradual COVID reopening, and monetary and fiscal stimulus,” JPMorgan’s Kolanovic wrote in a note Monday.

The widely followed strategist has been one of the most vocal China bulls throughout the year, even as his colleague at one point controversially labeled Chinese stocks as “uninvestable.” (The word was never meant to see the light of day, Bloomberg later reported.)

Kolanovic’s thesis has been that China’s economic stimulus would lead to a recovery. Yet the call has floundered as continued Covid restrictions severely hampered the economy.

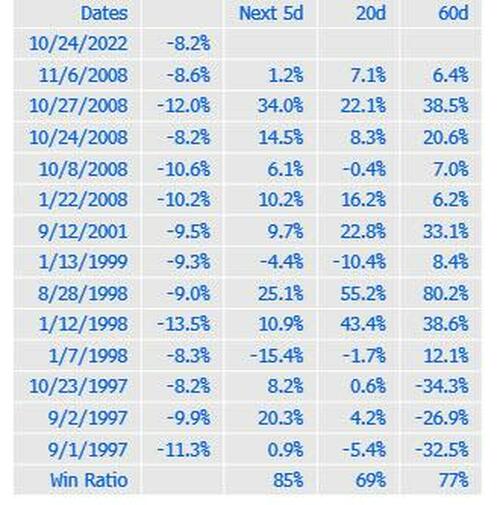

Still, he may be on to something this time. Prior to Monday, there have been only 13 times when the MSCI China Index tumbled at least 8% over the past three decades. The index rebounded in 11 out of those 13 occasions in the the next five days, and advanced 10 times in the following 60 days. In fact, since 1998, the hit ratio for the next 60 days is 100%.

These historic stats looks encouraging. But for the markets to have a sustained recovery, Beijing needs to retool its Covid policies and rebuild investor confidence. As Yan Wang, China strategist at Alpine Macro, puts it, “market volatility will remain high until investors get better clarity on how Xi Jinping will manage the country going forward.”

By Ye Xie and Amy Li, Bloomberg Markets Live reporters and analysts

The meltdown that engulfed Chinese stocks Monday is a clear sign investors are worried that President Xi Jinping’s tightening grip on power will exact a heavy toll on free enterprise and economic growth. But some Wall Street banks haven’t given up on China just yet. JPMorgan’s strategist Marko Kolanovic, for one, is urging investors to buy the dip (ZH: as he always does with everything).

While the quant guru’s bullish call on the nation’s assets has misfired this year, history shows a market rebound after a rout of this scale is more than likely.

Monday’s selloff in Chinese assets was savage with few precedents outside economic crises.

Following the Party Congress where Xi stuff the Politburo Standing Committee with his allies, the Nasdaq Golden Dragon China Index of 65 Chinese stocks sank as much as 21%. The MSCI China Index fell more than 8%, the most since 2008. Foreign investors took out a record 18 billion yuan ($2.5 billion) from the mainland’s stock market via the connect programs — more than wiping out the inflows this year.

Markets are clearly worried that Xi’s consolidation of power means a likely continuation of recent economically damaging policies, including Covid Zero and the campaign to rein in private-sector enterprises. “The market got the feeling of a continuous lack of focus on the state of the Chinese economy,” said Giuliano Gasparet, head of equity at Generali Insurance Asset Management.

For some investors, though, the selloff may be overdone. “We believe this is a good opportunity to add given an expected growth recovery, gradual COVID reopening, and monetary and fiscal stimulus,” JPMorgan’s Kolanovic wrote in a note Monday.

The widely followed strategist has been one of the most vocal China bulls throughout the year, even as his colleague at one point controversially labeled Chinese stocks as “uninvestable.” (The word was never meant to see the light of day, Bloomberg later reported.)

Kolanovic’s thesis has been that China’s economic stimulus would lead to a recovery. Yet the call has floundered as continued Covid restrictions severely hampered the economy.

Still, he may be on to something this time. Prior to Monday, there have been only 13 times when the MSCI China Index tumbled at least 8% over the past three decades. The index rebounded in 11 out of those 13 occasions in the the next five days, and advanced 10 times in the following 60 days. In fact, since 1998, the hit ratio for the next 60 days is 100%.

These historic stats looks encouraging. But for the markets to have a sustained recovery, Beijing needs to retool its Covid policies and rebuild investor confidence. As Yan Wang, China strategist at Alpine Macro, puts it, “market volatility will remain high until investors get better clarity on how Xi Jinping will manage the country going forward.”