The ECB policy announcement is due at 13:15BST/08:15EDT, with the follow up press conference starting at 13:45BST/08:45EDT; both consensus and market pricing look for a 75bps hike, taking the deposit rate to 1.5%, and according to Newsquawk, markets will also be focusing on discussions around the balance sheet and measures to address excess liquidity.

OVERVIEW: With headline Y/Y HICP in September advancing to 9.9% from 9.1%, policymakers are set to deliver another outsized rate hike following a 75bps increase in September. In terms of market pricing, a 75bps hike is priced at around 80% and a 50bps increase at 20%. Beyond inflationary developments, growth concerns are continuing to mount in the Eurozone with the composite PMI metric declining to 47.1 in October from 48.1 in September. Nonetheless, with the ECB’s 5y5y inflation expectations measure rising to around 2.3% from circa 2.2% at the time of the prior meeting, policymakers will be forced to raise rates again this month. In terms of other measures to be mindful of, source reporting on 13th October suggested that the GC discussed the timeline for the balance sheet reduction at the Cyprus meeting earlier this month. The report noted that the language regarding reinvestments could be tweaked at the October meeting, before outlining plans for a balance sheet reduction in December or February and then commencing QT sometime in Q2 2023. Elsewhere, the upcoming meeting could see policymakers alter the terms of its TLTROs given that banks can currently park cash from operations at the ECB and earn a risk-free profit following recent rate hikes.

PRIOR MEETING: In-fitting with market pricing and against a split consensus amongst analysts, the ECB opted to pull the trigger on a 75bps hike, taking the deposit rate to 0.75%. The statement noted that the GC expects to raise rates further over the next "several" meetings, whilst taking a data-dependent and meeting-by-meeting approach. The ECB opted to continue with its current reinvestment policy whilst suspending its two-tier system by setting the multiplier to zero. The accompanying staff forecasts saw 2022, 2023 and 2024 inflation projections revised higher with the 2024 forecast of 2.3% indicating that further policy tightening is required. On the growth front, 2022 GDP was revised a touch higher, however, 2023 was slashed to 0.9% from 2.1% with the downside scenario touting the possibility of negative growth. With regards to the magnitude of hikes going forward, Lagarde noted that 75bps increments are not the norm, but moves will not necessarily get smaller as the ECB heads towards the terminal rate. Despite guidance that the GC will be following a meeting-by-meeting approach, Lagarde stated that hikes will probably take place at more than two meetings, but fewer than five, so markets will be looking to see if such a viewpoint was alluded to in the account of the meeting.

RECENT ECONOMIC DEVELOPMENTS: Y/Y HICP in September advanced to 9.9% from 9.1% and the core metric rose to 6.0% from 5.5%, with the headline boosted by the ongoing surge in energy and food prices as well as Germany unwinding its discounted transport ticket scheme. In terms of market gauges of inflation, the ECB’s preferred 5y5y expectations measure has risen to around 2.3% from circa 2.2% at the time of the prior meeting. On the growth front, the flash estimate of Q3 GDP is not due until October 31st. That said, the October composite PMI declined to 47.1 from 48.1 in September. Accordingly, S&P Global noted that "The eurozone economy looks set to contract in the fourth quarter given the steepening loss of output and deteriorating demand picture seen in October, adding to speculation that a recession is looking increasingly inevitable." The Unemployment rate in August held steady at 6.6%, however, concerns about the employment outlook have triggered talks within the EU about the potential revival of the SURE scheme (aimed at mitigating unemployment risks in an emergency).

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde (14th Oct) said that inflation in the Eurozone is likely to stay above the ECB's target for an extended period of time and the governing council expects to raise rates further over the next several meetings. Germany's thought-leader Schnabel (30th Sept) said a robust approach to monetary policy is required given the uncertainty about the persistence of inflation. Chief Economist Lane (29th Sept) said the central bank is still trying to reach neutral, but is not yet taking a stand on whether that will be enough. He added that the exchange rate channel is not significant enough to influence monetary policy. France's Villeroy (11th Oct) remarked that the ECB should reach the neutral rate of close to 2% by the end of the year, adding that the Bank could move more slowly after reaching a neutral rate. Elsewhere, Slovenia's Vasle is of the view that the ECB should hike by 75bps at the next two meetings and then could start shrinking the balance sheet in 2023.

RATES: Expectations are for the ECB to hike its key three interest rates by 75bps each, taking the deposit rate to 1.5%, main refinancing rate to 2% and marginal lending to 2.25%. According to a Reuters survey, 27/36 expect the Deposit Rate to be raised by 75bps to 1.5%, 7/36 look for 50bps and just 2/36 forecast 25bps. In terms of market pricing, a 75bps hike is priced at around 80% and a 50bps increase at 20%. The decision to carry on with interest rate hikes follows on from headline Y/Y HICP in September advancing to 9.9% from 9.1% and the core metric rising to 6.0% from 5.5%. Furthermore, since the prior meeting there hasn't been much in the way of guidance from policymakers to suggest that the Bank will be stepping up or stepping down the magnitude of rate hikes. As a reminder, at the September press conference, Lagarde stated that hikes will probably take place at more than two meetings, but fewer than five. Looking beyond this week, markets fully price in another 50bps move in December, with the deposit rate expected to peak at just below 3% around Q3 next year. In terms of guidance from policymakers, Slovenia's Vasle believes the ECB should hike by 75bps at the next two meetings, whilst France's Villeroy remarked the ECB should reach the neutral rate of close to 2% by the end of the year. Note, recent reporting suggesting that an ECB staff model puts the target-consistent terminal rate at 2.25%. That said, the report noted that policymakers were sceptical over the accuracy of the model.

QT: In terms of other measures to be mindful of, source reporting on 13th October suggested that the GC discussed the timeline for the balance sheet reduction at the Cyprus meeting earlier this month. The report noted that the language regarding reinvestments could be tweaked at the October meeting, before outlining plans for a balance sheet reduction in December or February and then commencing QT sometime in Q2 2023. ING takes a more cautious stance, suggesting that markets "have got ahead of themselves", noting that "even if the discussion might have started at the ECB, with current financial stability risks, the recent UK experience and a very uncertain macro outlook, QT is still some way out". Furthermore, guidance from President Lagarde has stated that rates would need to be taken to neutral (estimated to be around 2%, according to Villeroy) before QT could begin. In terms of a potential course of action, ING suggests that a beginning of QT would entail ending reinvestments rather than active selling of bonds, something which, under APP could start in Spring 2023 at the earliest. As such, any talk around QT at this stage is likely to be vague. SGH Macro expects that details will not be announced until February.

TLTRO: Elsewhere, the upcoming meeting could see policymakers alter the terms of its TLTROs given that banks can currently park cash from operations at the ECB and earn a risk-free profit following recent rate hikes. Source reporting via Reuters suggested that a decision on what to do about this could come as soon as the upcoming meeting. In terms of the options available, SGH Macro says the ECB could:

- Reset the terms of the original TLTRO loans.

- Adjusting the rates paid specifically on TLTRO-related deposits.

- Instituting a blanket threshold on excess reserves above which the ECB and national central banks will not pay interest.

SGH Macro leans towards the third option by implementing a "reverse tiering" system as per the SNB. ING is also of the view that this would be the easiest system to implement as opposed to resetting TLTRO terms as this would hamper the Bank's credibility "and would lead to reluctance of banks to ever make use of the TLTROs in the future again". Alternatively, Rabobank suggests that "reverse tiering would impair the efficacy of the interest rate instrument". Instead, Rabo believes "lowering the remuneration on banks’ excess reserves equal to their TLTRO use is the most feasible", albeit it has a low conviction on this call

* * *

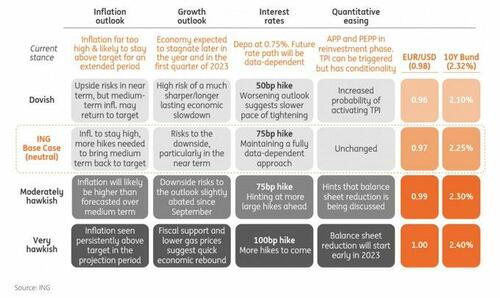

In its ECB preview, ING Economics writes that since nearly everyone's expecting another 75bp hike, the market reaction will depend on

- Stance on further rate rises

- Changes in inflation and growth outlook

- Discussion over quantitative tightening

And here is the bank's popular reaction matrix:

* * *

Finally, courtesy of Bloomberg's Ven Ram, here three things traders will be watching, and some of the key elements of what may be expected from the European Central Bank today and how markets may react.

Size of hike & signaling: ECB officials have been more or less consistent in telegraphing a 75-basis point increase at today’s meeting. With President Christine Lagarde herself having commented that rate hikes need to be more emphatic the further the benchmark is away from neutral, markets are well positioned for another big hike. While there is a remarkable scatter of opinion within the ECB as to what constitutes a neutral rate, few in the Governing Council seem to be thinking it would be a number less than 2%. Lagarde may stay noncommittal as to her personal opinion on the matter during the press conference, but if she hints that the ECB may no longer need 75-basis point increases, euro-area rates could find a bid tone.

TLTRO & tiering: A crucial point of discussion at the meeting will be cheap long-term loans to banks, or targeted longer-term refinancing operations (TLTROs). With the ECB having gone from a regime of extreme accommodation to one of express hawkishness to contain inflation, how the central bank remunerates the excess reserves that lenders park with it is at once a challenging and contentious issue.

The ECB may decide to opt for one or a combination of the following measures:

- Alter the terms governing TLTROs to the effect that reserves parked with it aren’t remunerated at the deposit rate, especially in a context where the latter is likely to climb well above 2%;

- Treat cash parked with it on a par with mandatory reserves that lenders set aside; or

- Introduce tiering, with different rates applying at different thresholds. Bloomberg Economics estimates that a tiering multiplier of six would exempt about 20% of excess liquidity from remuneration altogether

Euro-area lenders will feel the pinch of the moves, so bank stocks may come under a glare after any such announcement.

Quantitative tightening: Another topic du jour will be when the central bank should start shrinking its mammoth balance sheet. While the ECB may discuss the matter, it is unlikely to get going before it is done hiking for the current cycle. Lagarde remarked after last month’s review that the ECB has “probably less than five interest-rate increases” left, suggesting that it may decide to pause in February or March if all goes to plan. (In a situation where inflation is still ebullient, it may be compelled to keep going, though that’s a discussion for another day). That means, perforce, that quantitative tightening will have to wait until then at least.

* * *

All told, euro-area bonds will take their cue from how hawkish the ECB sounds, but the euro -- which has been exposed this year against the dollar by deeply negative inflation-adjusted interest-rate differentials -- won’t find any quick resolution despite any short-term hullabaloo.

The ECB policy announcement is due at 13:15BST/08:15EDT, with the follow up press conference starting at 13:45BST/08:45EDT; both consensus and market pricing look for a 75bps hike, taking the deposit rate to 1.5%, and according to Newsquawk, markets will also be focusing on discussions around the balance sheet and measures to address excess liquidity.

OVERVIEW: With headline Y/Y HICP in September advancing to 9.9% from 9.1%, policymakers are set to deliver another outsized rate hike following a 75bps increase in September. In terms of market pricing, a 75bps hike is priced at around 80% and a 50bps increase at 20%. Beyond inflationary developments, growth concerns are continuing to mount in the Eurozone with the composite PMI metric declining to 47.1 in October from 48.1 in September. Nonetheless, with the ECB’s 5y5y inflation expectations measure rising to around 2.3% from circa 2.2% at the time of the prior meeting, policymakers will be forced to raise rates again this month. In terms of other measures to be mindful of, source reporting on 13th October suggested that the GC discussed the timeline for the balance sheet reduction at the Cyprus meeting earlier this month. The report noted that the language regarding reinvestments could be tweaked at the October meeting, before outlining plans for a balance sheet reduction in December or February and then commencing QT sometime in Q2 2023. Elsewhere, the upcoming meeting could see policymakers alter the terms of its TLTROs given that banks can currently park cash from operations at the ECB and earn a risk-free profit following recent rate hikes.

PRIOR MEETING: In-fitting with market pricing and against a split consensus amongst analysts, the ECB opted to pull the trigger on a 75bps hike, taking the deposit rate to 0.75%. The statement noted that the GC expects to raise rates further over the next “several” meetings, whilst taking a data-dependent and meeting-by-meeting approach. The ECB opted to continue with its current reinvestment policy whilst suspending its two-tier system by setting the multiplier to zero. The accompanying staff forecasts saw 2022, 2023 and 2024 inflation projections revised higher with the 2024 forecast of 2.3% indicating that further policy tightening is required. On the growth front, 2022 GDP was revised a touch higher, however, 2023 was slashed to 0.9% from 2.1% with the downside scenario touting the possibility of negative growth. With regards to the magnitude of hikes going forward, Lagarde noted that 75bps increments are not the norm, but moves will not necessarily get smaller as the ECB heads towards the terminal rate. Despite guidance that the GC will be following a meeting-by-meeting approach, Lagarde stated that hikes will probably take place at more than two meetings, but fewer than five, so markets will be looking to see if such a viewpoint was alluded to in the account of the meeting.

RECENT ECONOMIC DEVELOPMENTS: Y/Y HICP in September advanced to 9.9% from 9.1% and the core metric rose to 6.0% from 5.5%, with the headline boosted by the ongoing surge in energy and food prices as well as Germany unwinding its discounted transport ticket scheme. In terms of market gauges of inflation, the ECB’s preferred 5y5y expectations measure has risen to around 2.3% from circa 2.2% at the time of the prior meeting. On the growth front, the flash estimate of Q3 GDP is not due until October 31st. That said, the October composite PMI declined to 47.1 from 48.1 in September. Accordingly, S&P Global noted that “The eurozone economy looks set to contract in the fourth quarter given the steepening loss of output and deteriorating demand picture seen in October, adding to speculation that a recession is looking increasingly inevitable.” The Unemployment rate in August held steady at 6.6%, however, concerns about the employment outlook have triggered talks within the EU about the potential revival of the SURE scheme (aimed at mitigating unemployment risks in an emergency).

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde (14th Oct) said that inflation in the Eurozone is likely to stay above the ECB’s target for an extended period of time and the governing council expects to raise rates further over the next several meetings. Germany’s thought-leader Schnabel (30th Sept) said a robust approach to monetary policy is required given the uncertainty about the persistence of inflation. Chief Economist Lane (29th Sept) said the central bank is still trying to reach neutral, but is not yet taking a stand on whether that will be enough. He added that the exchange rate channel is not significant enough to influence monetary policy. France’s Villeroy (11th Oct) remarked that the ECB should reach the neutral rate of close to 2% by the end of the year, adding that the Bank could move more slowly after reaching a neutral rate. Elsewhere, Slovenia’s Vasle is of the view that the ECB should hike by 75bps at the next two meetings and then could start shrinking the balance sheet in 2023.

RATES: Expectations are for the ECB to hike its key three interest rates by 75bps each, taking the deposit rate to 1.5%, main refinancing rate to 2% and marginal lending to 2.25%. According to a Reuters survey, 27/36 expect the Deposit Rate to be raised by 75bps to 1.5%, 7/36 look for 50bps and just 2/36 forecast 25bps. In terms of market pricing, a 75bps hike is priced at around 80% and a 50bps increase at 20%. The decision to carry on with interest rate hikes follows on from headline Y/Y HICP in September advancing to 9.9% from 9.1% and the core metric rising to 6.0% from 5.5%. Furthermore, since the prior meeting there hasn’t been much in the way of guidance from policymakers to suggest that the Bank will be stepping up or stepping down the magnitude of rate hikes. As a reminder, at the September press conference, Lagarde stated that hikes will probably take place at more than two meetings, but fewer than five. Looking beyond this week, markets fully price in another 50bps move in December, with the deposit rate expected to peak at just below 3% around Q3 next year. In terms of guidance from policymakers, Slovenia’s Vasle believes the ECB should hike by 75bps at the next two meetings, whilst France’s Villeroy remarked the ECB should reach the neutral rate of close to 2% by the end of the year. Note, recent reporting suggesting that an ECB staff model puts the target-consistent terminal rate at 2.25%. That said, the report noted that policymakers were sceptical over the accuracy of the model.

QT: In terms of other measures to be mindful of, source reporting on 13th October suggested that the GC discussed the timeline for the balance sheet reduction at the Cyprus meeting earlier this month. The report noted that the language regarding reinvestments could be tweaked at the October meeting, before outlining plans for a balance sheet reduction in December or February and then commencing QT sometime in Q2 2023. ING takes a more cautious stance, suggesting that markets “have got ahead of themselves”, noting that “even if the discussion might have started at the ECB, with current financial stability risks, the recent UK experience and a very uncertain macro outlook, QT is still some way out”. Furthermore, guidance from President Lagarde has stated that rates would need to be taken to neutral (estimated to be around 2%, according to Villeroy) before QT could begin. In terms of a potential course of action, ING suggests that a beginning of QT would entail ending reinvestments rather than active selling of bonds, something which, under APP could start in Spring 2023 at the earliest. As such, any talk around QT at this stage is likely to be vague. SGH Macro expects that details will not be announced until February.

TLTRO: Elsewhere, the upcoming meeting could see policymakers alter the terms of its TLTROs given that banks can currently park cash from operations at the ECB and earn a risk-free profit following recent rate hikes. Source reporting via Reuters suggested that a decision on what to do about this could come as soon as the upcoming meeting. In terms of the options available, SGH Macro says the ECB could:

- Reset the terms of the original TLTRO loans.

- Adjusting the rates paid specifically on TLTRO-related deposits.

- Instituting a blanket threshold on excess reserves above which the ECB and national central banks will not pay interest.

SGH Macro leans towards the third option by implementing a “reverse tiering” system as per the SNB. ING is also of the view that this would be the easiest system to implement as opposed to resetting TLTRO terms as this would hamper the Bank’s credibility “and would lead to reluctance of banks to ever make use of the TLTROs in the future again”. Alternatively, Rabobank suggests that “reverse tiering would impair the efficacy of the interest rate instrument”. Instead, Rabo believes “lowering the remuneration on banks’ excess reserves equal to their TLTRO use is the most feasible”, albeit it has a low conviction on this call

* * *

In its ECB preview, ING Economics writes that since nearly everyone’s expecting another 75bp hike, the market reaction will depend on

- Stance on further rate rises

- Changes in inflation and growth outlook

- Discussion over quantitative tightening

And here is the bank’s popular reaction matrix:

* * *

Finally, courtesy of Bloomberg’s Ven Ram, here three things traders will be watching, and some of the key elements of what may be expected from the European Central Bank today and how markets may react.

Size of hike & signaling: ECB officials have been more or less consistent in telegraphing a 75-basis point increase at today’s meeting. With President Christine Lagarde herself having commented that rate hikes need to be more emphatic the further the benchmark is away from neutral, markets are well positioned for another big hike. While there is a remarkable scatter of opinion within the ECB as to what constitutes a neutral rate, few in the Governing Council seem to be thinking it would be a number less than 2%. Lagarde may stay noncommittal as to her personal opinion on the matter during the press conference, but if she hints that the ECB may no longer need 75-basis point increases, euro-area rates could find a bid tone.

TLTRO & tiering: A crucial point of discussion at the meeting will be cheap long-term loans to banks, or targeted longer-term refinancing operations (TLTROs). With the ECB having gone from a regime of extreme accommodation to one of express hawkishness to contain inflation, how the central bank remunerates the excess reserves that lenders park with it is at once a challenging and contentious issue.

The ECB may decide to opt for one or a combination of the following measures:

- Alter the terms governing TLTROs to the effect that reserves parked with it aren’t remunerated at the deposit rate, especially in a context where the latter is likely to climb well above 2%;

- Treat cash parked with it on a par with mandatory reserves that lenders set aside; or

- Introduce tiering, with different rates applying at different thresholds. Bloomberg Economics estimates that a tiering multiplier of six would exempt about 20% of excess liquidity from remuneration altogether

Euro-area lenders will feel the pinch of the moves, so bank stocks may come under a glare after any such announcement.

Quantitative tightening: Another topic du jour will be when the central bank should start shrinking its mammoth balance sheet. While the ECB may discuss the matter, it is unlikely to get going before it is done hiking for the current cycle. Lagarde remarked after last month’s review that the ECB has “probably less than five interest-rate increases” left, suggesting that it may decide to pause in February or March if all goes to plan. (In a situation where inflation is still ebullient, it may be compelled to keep going, though that’s a discussion for another day). That means, perforce, that quantitative tightening will have to wait until then at least.

* * *

All told, euro-area bonds will take their cue from how hawkish the ECB sounds, but the euro — which has been exposed this year against the dollar by deeply negative inflation-adjusted interest-rate differentials — won’t find any quick resolution despite any short-term hullabaloo.