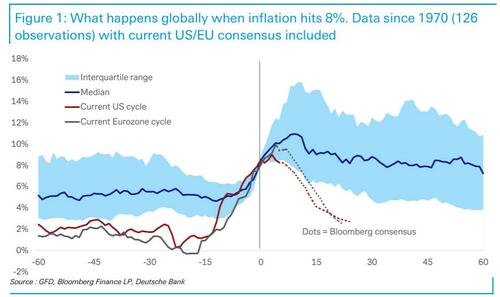

Last week, DB's Jim Reid published a note looking at what normally happens next, when inflation hits 8% through history using 50 DM and EM countries, around 320 unique observations, and covering up to a 100 years of data.

The reason for the study, which even grabbed the attention of Larry Summer who has repeatedly been warning in recent months the Powell Fed will never be Volcker 2.0 and instead will repeat Arthur Burns' mistakes and pivot sooner than it should...

Almost never does high inflation come down fast. Today's consensus view that inflation will come way down is, as this figure from Jim Reid at Deutsche illustrates, outside the range of normal historical experience. pic.twitter.com/Mbnb4yg3UV

— Lawrence H. Summers (@LHSummers) October 27, 2022

... was because as Reid put it, "with consensus being so bad at predicting inflation in this cycle we thought we'd look at what history says."

So what does history suggest? According to the DB strategist, and in keeping with the Fed's hawkish view, it would be unusual to see inflation now fall back as quickly as consensus believes over the next 2 years. In fact using data from the last 50 years (the fiat money era), current consensus forecasts would be in the most optimistic decile of observations over this period. As an aside, Reid notes that in most inflationary cycles rates don't normally only start rising after inflation hits 8% (as they did in this one) and fiscal policy doesn't normally loosen (e.g. across Europe given the gas crisis).

Needless to say, but Reid says it anyway, "whether consensus or the median observation through history is correct will have profound implications for assets over the next few months and years. So this is crucial to have a view on."

So if history suggest it will take a long time for inflation to normalize, is there a way to short-circuit the process?

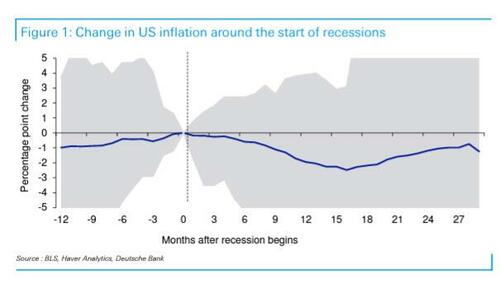

The answer is, of course, yes... but it's painful. Reid, who next looks at 100 years of US inflation around recessions, found that while there is a big range, on average inflation only starts declining when the recession starts.

To be sure, in this cycle headline US CPI has already declined from its peak in June - even without the US officially entering recession - and may continue to do so due to energy rolling over but maybe the all-important core print - which is the core pilled behind Fed monetary policy - will only see serious declines once a recession hits.

Indeed on this, DB economist Matt Luzzetti recently published a note (available to pro subs), suggesting that only in their base case of a recession and US unemployment hitting 5.5-6% next year will inflation get close to the Fed's objective by end-2024.

The implications are that Fed Funds will probably need to go to at least 5% to achieve this, which incidentally is what the market has been pricing in for the past month (although the recent dovish comments from Wikileaks and Mary Daly have seen a notable drop in the Fed's peak target rate)...

Last week, DB’s Jim Reid published a note looking at what normally happens next, when inflation hits 8% through history using 50 DM and EM countries, around 320 unique observations, and covering up to a 100 years of data.

The reason for the study, which even grabbed the attention of Larry Summer who has repeatedly been warning in recent months the Powell Fed will never be Volcker 2.0 and instead will repeat Arthur Burns’ mistakes and pivot sooner than it should…

Almost never does high inflation come down fast. Today’s consensus view that inflation will come way down is, as this figure from Jim Reid at Deutsche illustrates, outside the range of normal historical experience. pic.twitter.com/Mbnb4yg3UV

— Lawrence H. Summers (@LHSummers) October 27, 2022

… was because as Reid put it, “with consensus being so bad at predicting inflation in this cycle we thought we’d look at what history says.”

So what does history suggest? According to the DB strategist, and in keeping with the Fed’s hawkish view, it would be unusual to see inflation now fall back as quickly as consensus believes over the next 2 years. In fact using data from the last 50 years (the fiat money era), current consensus forecasts would be in the most optimistic decile of observations over this period. As an aside, Reid notes that in most inflationary cycles rates don’t normally only start rising after inflation hits 8% (as they did in this one) and fiscal policy doesn’t normally loosen (e.g. across Europe given the gas crisis).

Needless to say, but Reid says it anyway, “whether consensus or the median observation through history is correct will have profound implications for assets over the next few months and years. So this is crucial to have a view on.”

So if history suggest it will take a long time for inflation to normalize, is there a way to short-circuit the process?

The answer is, of course, yes… but it’s painful. Reid, who next looks at 100 years of US inflation around recessions, found that while there is a big range, on average inflation only starts declining when the recession starts.

To be sure, in this cycle headline US CPI has already declined from its peak in June – even without the US officially entering recession – and may continue to do so due to energy rolling over but maybe the all-important core print – which is the core pilled behind Fed monetary policy – will only see serious declines once a recession hits.

Indeed on this, DB economist Matt Luzzetti recently published a note (available to pro subs), suggesting that only in their base case of a recession and US unemployment hitting 5.5-6% next year will inflation get close to the Fed’s objective by end-2024.

The implications are that Fed Funds will probably need to go to at least 5% to achieve this, which incidentally is what the market has been pricing in for the past month (although the recent dovish comments from Wikileaks and Mary Daly have seen a notable drop in the Fed’s peak target rate)…