US equity futures were unchanged after two days of declines in underlying gauges as investors brace for today's 2pm Fed interest-rate decision along with its monetary policy outlook (although a potentially more surprising treasury buyback announcement could come as soon as 830am when the Treasury publishes its quarterly refunding announcement). Contracts on the S&P 500 were little unchanged, while Nasdaq 100 futures advanced 0.2% as of 7:30 a.m. in New York. Stocks have stabilized after a drop in the S&P 500 on Tuesday that was triggered by a surprise surge in job openings. European stocks erased earlier gains while US-listed Chinese stocks rallied in premarket trading and the Hang Seng Index rose in a session cut short by a storm warning as growing speculation over China’s reopening spurred another rally in Asia. The US dollar dropped for the second day as the yen strengthened in a sign traders anticipate a muted impact of Fed tightening on the currency; 10Y yields traded unchanged around 4.04%.

All eyes will be on the Fed later, when the central bank is widely expected to raise rates by 75 basis points for a fourth time in a row; the question is what the Fed does in December and onward. Here is a summary of Fed rate-hike expectations from major banks for Sept and Dec:

- Bank of America: 75 bps, 50 bps

- Barclays: 75 bps, 75 bps

- Citigroup: 75 bps, 50 bps

- Deutsche Bank: 75 bps, 75 bps

- JPMorgan Chase: 75 bps, 50 bps

- Goldman Sachs: 75 bps, 50 bps

- Morgan Stanley: 75 bps, 50 bps

- Wells Fargo: 75 bps, 50 bps

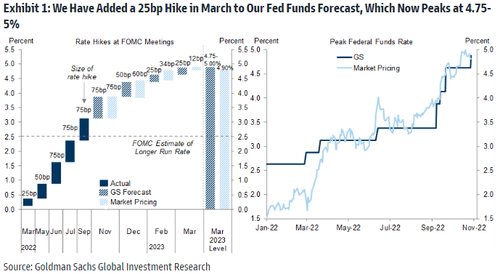

Goldman expects a more dovish 50bps Dec rate hike, but also a slower rise to peak as it has now added a 25bps rate hike in March which brings the Fed to 5.00%.

Chair Jerome Powell’s comments will be key, especially after a 7.8% rally in the S&P 500 since Oct. 12, triggered mostly by expectations of easing in the central bank’s hawkish narrative given risks to economic growth. Our full FOMC preview can be found here.

“It’s a matter of balance here -- the Fed doesn’t want to signal too much hawkishness, but also doesn’t want to sound too dovish as that would result in a huge leg up in share prices and too much of an easing in financial conditions,” said Shane Oliver, head of investment strategy at AMP Services. Oliver feels caution is still needed. “We may have seen the bottom in the share market and certainly sentiment has been very negative, but by the same token given recession risks and the yield curve continuing to invert in the US, that suggests risks are still high,” he said on Bloomberg TV.

“It’s a challenge for messaging because they don’t want to ease financial conditions significantly,” said Julia Coronado, the founder of MacroPolicy Perspectives LLC. “They need tight financial conditions to keep cooling the economy off. So he doesn’t want to sound dovish, but he may want to go slower.”

“Continuation of the year-end rally is contingent on the Fed delivering on the pivot narrative,” said Barclays Plc strategists led by Emmanuel Cau, who see current market optimism as misplaced. “It feels premature for the Fed to loosen financial conditions via equity and bond markets -- inflation is just too high.” Former Treasury Secretary Larry Summers also warned that expectations the central bank would pivot were “badly misguided,” saying the Fed should “stay on the current course.”

In premarket trading, US-listed Chinese stocks rallied for the second day and were set to extend Tuesday’s gains, after new unverified social media posts claimed the government is considering a slew of changes to its Covid Zero policy, including a shorter quarantine period for inbound travelers. Chipmaker Advanced Micro Devices rose after topping profit estimates, but Airbnb slumped after its bookings outlook for the fourth quarter fell short of expectations. Apple shares slipped after China ordered a seven-day lockdown of the area around Foxconn Technology Group’s main plant in Zhengzhou, a move that will severely curtail shipments in and out of the world’s largest iPhone factory. Here are all the notable premarket movers:

- AMD rose 4.9% after topping profit estimates as the semiconductor company’s expansion into the server processor market helped offset falling demand for chips used in PCs.

- Airbnb shares decline 6% after giving a downbeat outlook for 4Q bookings. While analysts applauded the firm’s robust 3Q results, they also highlighted the moderately weaker prospects for the alternative accommodation specialist amid FX headwinds.

- Arcturus Therapeutics shares surge 33% in US premarket trading after the biotech entered a collaboration and license agreement with a unit of CSL. The pact reduces execution risk, Cantor Fitzgerald says, prompting the broker to raise its price target.

- Bally’s cut to hold at Stifel, which says macro, regulatory and development risks in the near-term force the broker into “capitulation” and a move to the sidelines. Shares decline 1.8%

- Bandwidth shares jump 15% in US premarket trading after the company forecast fourth-quarter revenue above the average analyst estimate and raised its full-year outlook.

- Benefitfocus shares rise 48% to $10.35 in US premarket trading, after Voya Financial agreed to buy the company at $10.50 a share in cash.

- Canada Goose cut its non-IFRS adjusted earnings per share guidance for the full year; the guidance missed the average analyst estimate. Shares declined as much as 3.6%.

- Coty and L’Oreal declined after peer Estee Lauder’s second-quarter and full-year forecasts trailed consensus estimates, sinking the stock as much as 13% in premarket trading. Coty shares decline 2.8% and L’Oreal shares fell 1.7%.

- Chegg jumps as much as 17.5% after the education-focused company reported better-than-expected third- quarter earnings and boosted its full-year outlook for revenue and adjusted Ebitda.

- Match Group surges as much as 14.7% after the owner of dating apps including Tinder and OkCupid reported third-quarter revenue that beat the average analyst estimate and pledged to control costs. Analysts said that while 4Q and initial 2023 guidance were below expectations, they look achievable based on the current macro environment.

- DuPont gain 3.6% in thin premarket trading after the company scrapped a planned $5.2 billion acquisition of Rogers Corp., a move which analysts say will bolster DuPont’s balance sheet and improve the scope for share buybacks.

- Offerpad Solutions slump 3.8% in US premarket trading on Wednesday, ahead of the real estate firm’s third-quarter results due after the market close.

- TFF Pharmaceuticals Inc. plunges 38% in premarket trading as studies of two inhaled powder therapies have been impacted by challenges tied to “staffing shortages, shipping, and global supply chain delays,” the company said in a release.

- Tupperware shares plunged 33.4% after the company reported worse- than-expected third quarter results, including revenue and adjusted EPS that both missed analyst estimates.

- Yum China shares jump 13.6% in US premarket trading after the restaurant operator reported flat same-store sales growth in the third quarter, enough to impress analysts who had expected a decline, given stringent Covid control measures in China.

- ZoomInfo Technologies (ZI) shares plunge as much as 22% as analysts cut their price targets following 3Q results. Despite a beat-and- raise, comments from the software company that the operating environment is becoming more challenging show that it could be susceptible to a slowdown in the economy, according to analysts, who see growth moderating next year.

European equities are mixed after euro-area manufacturing activity sank to the lowest level since May 2020. Euto Stoxx 50 little changed, erasing earlier gains; the CAC 40 outperforms peers, while FTSE 100 and DAX lag. Healthcare stocks outperformed in Europe after Novo Nordisk A/S raised its operating profit and sales forecasts for the year; consumer products and personal care are among the best performing sectors. Here are some of the biggest European movers today:

- Sinch shares rally as much as 36% after 3Q results, with improved free cash flow, reduced net debt and prolonged short- term financing giving another boost to the heavily shorted stock.

- Shares in Danish wind turbine manufacturer Vestas rose as much as 8.6%, the most since August, after positive pricing concealed a 3Q results miss which led to a 5.5% fall in early trading.

- Novo Nordisk rises as much as 5.9%, hitting the highest since August, with analysts noting the Danish drugmaker’s guidance raise and its confirmation on the timeline for its Wegovy obesity treatment.

- Hiscox climbs as much as 6.2%, the most since August, after the insurer reported smaller-than- anticipated Hurricane Ian losses and solid trading across the rest of its business.

- Next Plc rises as much as 3.7% after maintaining its profit guidance, which is a “small positive read to the online retail space,” RBC said.

- Demant falls as much as 15%, the most since mid August, after the company cut its full- year guidance.

- VGP slumps as much as 12% after Barclays downgraded the real estate developer to underweight from overweight.

- Maersk drops as much as 7.3%, with Citi noting that the shipping firm’s lower expectations for contract rates are likely to weigh on investor sentiment.

- Smurfit Kappa declines as much as 5.1% in Dublin after results, with Goodbody analysts highlighting the company’s “challenging market conditions” and labor inflation pressures. Packaging peer DS Smith also slides.

Euro-area manufacturing activity sank to the lowest level since 2020 and A.P. Moller-Maersk A/S, a bellwether for global trade, cut its forecast for the global container market, saying inflation will persist even as demand drops as much as 4% this year. The company’s shares fell.

Earlier in the session, Asian stocks headed for a three-day advance as growing speculation over China’s reopening spurred another strong rally, while traders awaited the Federal Reserve’s decision on interest rates. The MSCI Asia Pacific Index rose as much as 0.9%, led by the consumer discretionary sector. Chinese and Hong Kong stocks drove gains in the region as investors scooped up shares following wide circulation of unverified posts outlining a loosening of the nation’s Covid Zero policy. Still, enthusiasm that sparked the rally in Chinese stocks could fade if authorities there don’t follow up on the speculation, Jun Rong Yeap, a market strategist at IG Asia Pte, wrote in a note.

The Hang Seng Index had its best two-day run since March before the session was cut short by a storm warning; The Hang Seng China Enterprises Index rose 2.8%, also capping its best two-day rally since March. Trading in Hong Kong closed earlier than usual due to a tropical storm. Most other markets posted modest gains or declines as investors opted to wait and assess the Fed’s policy signals. Data on Tuesday showing a solid US labor market bolstered speculation that policy could remain aggressively tight even with the threat of a recession. The central bank is set to raise rates by 75 basis points for the fourth time in a row on Wednesday.

In rates, Treasuries were mixed ahead of FOMC rate decision at 2pm ET, with long-end yields slightly cheaper on the day and front-end yields richer by ~3bp, steepening the curve as the 2-year yield fell by around 3bps and 30-year yields added 2bps. 10-year TSY yields were little changed around 4.04% as the curve steepens around the sector; 2s10s, 5s30s spreads are wider by ~2bp and ~3bp on the day vs UK 2s10s, 5s30s spreads wider by ~9bp and ~13bp Broadly subdued price action compares with aggressive steepening in gilt curve, where 2- and 5-year UK yields are ~1bp richer on the day. Focus on Fed rate decision may limit price action over early US session; traders have been hedging prospect of Fed to hint at a slowdown in rate hikes for the December policy meeting over the past couple of weeks The quarterly refunding announcement at 8:30am is viewed as having limited potential for auction size changes and may signal progress toward a buyback program. Bunds bear-flattened, as yields rose up to 4bps. Italian bond yields rose by around 5bps across the curve.

In FX, the Bloomberg Dollar Spot Index fell by around 0.2% as the greenback was steady or weaker against all of its Group-of-10 peers amid positioning ahead of today’s Fed meeting. SEK and GBP are the weakest performers in G-10 FX, NZD and JPY outperform

- The euro staged a slight rebound to trade around $0.99 after two days of losses against the dollar.

- The pound was steady around $1.15 while front-end gilts rallied, sending 2- year yields down by around 11bps

- The yen led G-10 gains along with New Zealand’s currency; the yen rose a second day versus the dollar. Bank of Japan Governor Kuroda told parliament the nation’s economy is no longer in deflation since the central bank started its current easing program, though added that inflation was seen slowing in fiscal year 2023; minutes of the BOJ’s September meeting noted it was desirable to keep an easing bias

- The kiwi and sovereign yields advanced as unemployment stayed near a record low in the third quarter while wages surged.

In commodities, wheat futures fell after Turkey’s Erdogan said grain shipments via the Ukraine corridor would resume. oil traded near $88 a barrel ahead of the Fed rate decision. West Texas Intermediate futures pared an earlier gain to trade little changed with prices stuck in a $12 band over the last month. Glencore Plc officials delivered cash in private jets to officials in west Africa, UK prosecutors said as they laid out a web of bribery and corruption orchestrated by the London oil trading desk. President Joe Biden’s threat to slap a tax on oil-company profits is more bluster than threat as the clock runs out on the administration’s efforts to tame fuel prices ahead of midterm elections. Spot gold rises roughly $8 to trade near $1,656/oz as traders mull the possibility of a rate-hike slowdown.

Market Snapshot

- S&P 500 futures up 0.3% to 3,877.75

- STOXX Europe 600 up 0.4% to 416.07

- MXAP up 0.8% to 139.99

- MXAPJ up 0.8% to 448.01

- Nikkei little changed at 27,663.39

- Topix up 0.1% to 1,940.46

- Hang Seng Index up 2.4% to 15,827.17

- Shanghai Composite up 1.2% to 3,003.37

- Sensex down 0.5% to 60,846.16

- Australia S&P/ASX 200 up 0.1% to 6,986.66

- Kospi little changed at 2,336.87

- Brent Futures up 0.2% to $94.81/bbl

- Gold spot up 0.3% to $1,652.92

- U.S. Dollar Index down 0.27% to 111.18

- German 10Y yield up 0.5% to 2.14%

- Euro up 0.3% to $0.9902

Top Overnight News from Bloomberg

- Overnight volatility rallies for the major currencies as traders position for the Federal Reserve monetary policy decision later Wednesday. Pound hedging costs lead the race as the Bank of England also meets Thursday

- The Federal Reserve looks set to deliver a fourth straight super-sized rate increase with Chair Jerome Powell repeating his resolute message on inflation and opening the door to a downshift -- without necessarily pivoting yet

- Euro-area manufacturing activity sank to the lowest level since the first Covid-19 lockdowns in 2020 as record inflation and a weakening global economy erode demand for goods

- German companies have never been so concerned about sales as they struggle with the energy crisis and a gloomy world economy, and they fear the worst is yet to come, a survey found

- People’s Bank of China Governor Yi Gang gave an optimistic outlook for the economy on Wednesday, saying it remains “broadly on track” and he hoped the property market can achieve a “soft landing”

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with the region cautious and price action mostly rangebound after the lacklustre handover from the US where strong JOLTS data spurred a more hawkish Fed terminal rate pricing and as markets await the FOMC. ASX 200 was kept afloat by strength in the commodity-related sectors but with upside capped after PM Albanese rejected providing cash handouts and with the property industry pressured after home loans and building approvals fell. Nikkei 225 was indecisive as earnings releases remained in focus and officials continued their currency jawboning. KOSPI wiped out nearly all its early gains amid geopolitical concerns after North Korea reportedly fired at least 10 missiles and which was the first time its missiles fell near South Korea’s territorial waters. Hang Seng and Shanghai Comp eventually extended their recent rumour-driven surge regarding China reopening despite the denial by a Foreign Ministry spokesperson and with officials pledging policy support measures, while Hong Kong markets were closed after half-day due to a storm signal 8.

Top Asian News

- PBoC Governor Yi said China's economy is broadly on track and potential growth is to remain in a reasonable range, and noted that inflation remains subdued and accommodative monetary policy is to support the economy. PBoC Governor Yi added that they will continue to improve the business environment, while they will deepen supply-side reforms and step up targeted support for key and weak sectors, according to Reuters.

- China state planner official said China's foreign investment increased steadily so far this year and will encourage more foreign investment in the manufacturing industry, according to Reuters.

- China locked down the area around the world's largest iPhone factory, according to Bloomberg.

- BoJ September Meeting Minutes stated a few members said they need to be vigilant to the impact monetary tightening by some central banks could have on global markets, while several members said a weak yen could hurt households, small firms and non-manufacturers. Members agreed that Japan's economy is picking up and several members said the BoJ must communicate to the public its monetary policy does not directly target FX moves.

- RBNZ Financial Stability Report noted that the financial system remains resilient but added some households and businesses will be challenged by the rising interest rate environment, while it also stated that there are increasing downside risks to the global economic outlook and the extent to which the economic activity will slow due to monetary policy tightening remains uncertain. Furthermore, the RBNZ later stated it will consider tightening policy faster or slower at the Monetary Policy Statement.

- Chinese Commerce Ministry says it will expand the imports of advanced technology, key equipment and components, and increase imports of energy and agricultural products in short supply, via a Party Congress supplementary reading cited by Reuters.

European bourses are mixed as the initial positive bias faded amid downward PMI revisions and increasing geopolitical tensions, Euro Stoxx 50 +0.2%. Health Care is the outperforming sector after Q3 earnings from GSK (+1.6%) and Novo Nordisk (+4.5%), more broadly sectors are mixed with no overarching bias. US futures are similarly contained but have been less reactive to the geopolitical and PMI developments as participants remain firmly affixed on the Fed, ES Unch. & NQ +0.2%. A.P. Moeller-Maersk (MAERSK DC) expect a slowdown of the global economy to lead to softer market in ocean. Cuts FY22 global container demand forecast to -2% to -4%. Freight rates have begun normalising during Q3; Maersk -5.0%. Moody's downgrades the outlook for the banking sector in Germany, Italy, Hungary, Poland, Slovakia, to negative from stable; citing energy crisis, high inflation, and rising rates, via Reuters.

Top European News

- Germany's DIHK says German companies are bracing for another economic slump in the next 12 months; 52% of firms see business worsening in the next 12 months; says German GDP should be +1.2% in 2022 and -3% in 2023,

- Germany's VDMA engineering orders in Sep -5% Y/Y (Domestic -4%, Foreign Orders +8%); in first 9M orders +1% Y/Y (Domestic -3%, Foreign +2%)

- Next Sales Better Than Expected Despite UK’s Costs Crisis

- Vestas Cuts Outlook Again as Wind Turbine Industry Spirals

- North Korea Fires 17 Missiles in Biggest-Ever Daily Barrage

- Novo Boosts Sales Forecast on Demand for Obesity Drug Wegovy

- Sampo 3Q Pretax Profit Misses Estimates; Decides on Dual Listing

- Britishvolt Says Loan Gives EV Battery Startup Weeks of Runway

FX

- USD is under modest pressure as we count down to the FOMC, action which is benefiting peers across the board with the antipodeans and JPY currently the main beneficiaries.

- DXY has slipped to a 111.12 low from earlier highs above the 111.50 mark, with brief respite for the USD occurring alongside the NY Times article re. Russia.

- EUR/USD relatively unreactive to the morning's PMI revisions, downbeat commentary and numerous surveys out of Germany featuring a similar narrative, single currency holding around 0.9900.

- NZD outpaces and has lifted to a test of the 0.59 mark, where the current WTD peak resides, following domestic data which seemingly keeps hawkish impulses in focus.

- JPY is the next best performer given its haven status and after BoJ Minutes noted several members said a weak yen could hurt; USD/JPY probing but yet to lose 147.00.

- BoC Governor Macklem said they expect the policy rate will need to rise further and how much further rates will go up depends on how monetary policy is working, how supply chains are resolving and how inflation is responding to tightening. Macklem added that there are no easy outs to restoring price stability and reiterated the tightening phase will draw to a close and they are getting close but are not there yet.

Fixed Income

- EGBs are modestly pressured with yields a touch higher as such, though the complex is currently relatively contained ahead of a busy PM docket incl. the FOMC.

- USTs are essentially flat with yields incrementally steeper but similarly contained as such; note, the pre-FOMC docket is busy and features ADP alongside Quarterly Refunding.

- Back to Europe, Bunds and peers haven't been too reactive to the downbeat PMI releases/commentary, with Bunds also conscious of upcoming Green supply; 10yr yield continues to lift from 2.10%.

Commodities

- Crude benchmarks have given up their USD and China induced APAC upside amid downbeat commentary from Maersk and the EZ Final Manufacturing PMIs.

- Currently, the benchmarks are incrementally softer on the session and in proximity to the USD 88/bbl and USD 94/bbl handles for WTI and Brent respectively.

- Spot gold is deriving support from the USD's pullback and renewed geopolitical focus on both N.Korea and Russia, with the yellow metal having surpassed its 10-DMA but currently capped by the 21-DMA at USD 1659/oz; base metals similarly firmer on the USD action and overnight trade.

- Russia's Kremlin exports of Russian fertiliser was an integral part of grain deal, but difficulties remain; says Russia's participation in the deal remains suspended, via Reuters; prior to this, Turkish President Erdogan said the Russian Defence Minister told his Turkish counterpart the the grain deal will resume; grain deal will resume on mid-day Wednesday.

- Most recently, Russia is to resume participation in the Black Sea grain deal, according to Reuters citing the Defence Ministry; it was possible to obtain written guarantees from Kyiv not to use grain corridor for military operations against Russia.

Geopolitics

- Ukrainian President Zelensky said they need reliable, long-term defence for the grain corridor and that Russia must be told it will receive a firm world response if it takes steps to disrupt Ukrainian food exports, according to Reuters.

- Senior Russian military leaders recently had conversations to discuss when and how Moscow might use a tactical nuclear weapon in Ukraine, according to NYT citing sources, President Putin was not part of the conversations; "The intelligence about the conversations was circulated inside the U.S. government in mid-October.".

- North Korea has reportedly fired at least 23 missiles in total from the east and west coasts on Wednesday the initial rounds of which prompted South Korea to place its Ulleung Island under an air raid warning and was the first time North Korean missiles fell near the South's territorial waters, according to Yonhap and YTN.

- South Korean President Yoon ordered a swift and firm response and South Korea launched air-to-ground missiles which were fired towards the north of the maritime border, while South Korea closed some air routes off the east coast of the Korean peninsula after North Korea's missile launches, according to the Transport Ministry cited by Reuters.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications, prior -1.7%

- 08:15: Oct. ADP Employment Change, est. 185,000, prior 208,000

- 14:00: Nov. FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

As we arrive at the latest decision day for the Fed, any remaining hopes of a dovish pivot continued to fizzle out over the last 24 hours, with futures once again pricing in a terminal fed funds rate above 5%. The main driver behind that was another round of US data yesterday, which showed that labour markets were tighter and the economy was in better shape than previously thought, which in theory should give the Fed more space to keep hiking rates. In turn, that prompted a big turnaround for risk assets, with the S&P 500 (-0.41%) losing ground for a second day running, whilst 10yr Treasury yields shot up by more than +15bps intraday after the releases came out.

Ahead of those releases, there had actually been a strong rally across multiple asset classes thanks to speculation that China might ease up on their Covid restrictions (more on which below). But the latest data caused a sharp reversal shortly after US markets opened, particularly given the news that US job openings had unexpectedly risen in September to 10.717m (vs. 9.750m expected), alongside an upward revision to the August number. That means there were still 1.86 job openings per unemployed worker in September, which is creating significant inflationary pressures, and suggests that the decline in job openings in August to a one-year low might have been a blip. On top of that, the quits rate of those voluntarily leaving their jobs (which is strongly correlated with wage growth) remained at 2.7% for a third month running.

Just as the labour market appeared to be in surprising strength, there was an additional dose of optimism about the economy from the ISM manufacturing reading for October, which came in at 50.2 (vs. 50.0 expected). Although it’s true that was the weakest reading since May 2020, it was still a touch better than expected and came amidst improvements in the employment (50.0) and new orders (49.2) components relative to last month, which gave further ground for optimism. In addition, the final manufacturing PMI for October was revised up half a point from the flash reading to 50.4, leaving it back above the 50-mark that separates expansion from contraction.

When it comes to today’s policy decision, the Fed are widely expected to hike rates by 75bps for a fourth consecutive meeting. But the more important question for markets today (and where there’s considerably more doubt) is whether the Fed might signal a downshift in the pace of hikes at subsequent meetings. This is a tricky balancing act for them, since any signal of a pivot risks leading to easier financial conditions that makes their job of bringing down inflation even harder. That was what happened after the July meeting, where investors interpreted matters in a dovish light, and the Fed had to reiterate their hawkish intent, culminating in Chair Powell’s August speech at Jackson Hole. Our US economists write in their preview (link here) that Chair Powell’s press conference will likely not pre-judge the outcome of the December meeting and will emphasise the data dependence of the decision, not least with another couple of CPI reports and jobs reports beforehand. They expect him to leave open the prospects of another 75bp hike in December, but present a strong base case for downshifting the pace of hikes by early 2023 at the latest.

Ahead of the Fed’s decision, markets moved to ratchet back up their expectations of how high they’re set to take rates over the coming months. Indeed, the rate priced in by end-2023 moved up another +9.9bps to 4.66%, which brings its gains over the last 3 sessions to +37.1bps and means that the bulk of the move lower after October 21 thanks to Nick Timiraos’ WSJ article has now reversed. In light of that, 2yr Treasuries yield gained +6.2bps on the day to reach 4.54%, with the moves higher occurring entirely after those strong US data releases mentioned above. The 10yr Treasury yield (-0.6bps) did close slightly lower at 4.04%, but that was still more than +10bps above its intraday levels prior to the releases and in overnight trading they’re back up +0.9bps to 4.05%. Over in Europe, sovereign bonds followed a similar pattern over the day, with a sharp intraday reversal following the US data, although yields on 10yr bunds (-1.0bps), OATs (-0.1bps) and BTPs (-3.5bps) still ended the session lower.

Those expectations of a more hawkish Fed led to a reversal for equities too, and the S&P 500 (-0.41%) swiftly gave up its gains after the open to fall back for a second consecutive session. Tech stocks led the declines once again, and there was a significant milestone for the FANG+ index (-0.95%) of megacap tech stocks, with the index closing at a 2-year low, having now shed -45.65% since its peak just under a year ago. European equities ended the day in positive territory, albeit only after giving up a decent chunk of their earlier gains, with the STOXX 600 moving from an intraday peak of +1.51% to only close up +0.53%.

That earlier momentum had been propelled in large part thanks to speculation about a potential end to Covid restrictions in China, with that backdrop seeing the CSI 300 post its strongest daily performance since March yesterday. The moves were triggered by unconfirmed posts on social media that China was forming a committee which would look at relaxing restrictions, with a suggestion for reopening in March 2023. However, a spokesman for the Chinese Foreign Ministry said that he was “not aware of what you mentioned” when asked about the issue at a press briefing on Tuesday.

Overnight in Asia, that continued speculation about a policy reversal has seen a fresh outperformance in a number of equity indices, with the Hang Seng (+2.50), the CSI 300 (+1.48%) and the Shanghai Comp (+1.29%) all recording solid gains. That’s in spite of the absence of any official confirmation about a change in China’s policy. Elsewhere, some of the other indices have been more mixed, with the Nikkei (-0.10%) slightly lower and the Kospi (+0.24%) recording a modest advance, although US futures are pointing in a more positive direction, with those on the S&P 500 up +0.32% ahead of the Fed’s decision.

On the data side, there were some fresh indications of global inflationary pressures overnight, with South Korea’s CPI inflation seeing its first rebound in three months as it rose to +5.7% as expected, whilst core CPI surpassed expectations to hit a 13-year high of +4.8% (vs. 4.5% expected). In the meantime, we also heard from Bank of Japan Governor Kuroda who reiterated their dovish policy, saying that they were not thinking of rate hikes or changing their yield curve control policies now.

Back in the US, we’re now less than a week away from the mid-term elections on Tuesday, and momentum has remained with the Republicans in recent days. According to FiveThirtyEight’s model, they now have a 51% chance of taking the Senate, which is up from 30% only six weeks ago, whilst the chances of them regaining the House now stand at 83%.

To the day ahead now, and the main highlight will be the Fed’s latest policy decision and Chair Powell’s press conference. In the meantime, ECB speakers today include Makhlouf, Villeroy and Nagel. On the data side, we’ll get October data on German unemployment, the final Euro Area manufacturing PMIs, and the ADP’s report of private payrolls for the US. Finally, earnings releases include Qualcomm, CVS Health and Booking Holdings.

US equity futures were unchanged after two days of declines in underlying gauges as investors brace for today’s 2pm Fed interest-rate decision along with its monetary policy outlook (although a potentially more surprising treasury buyback announcement could come as soon as 830am when the Treasury publishes its quarterly refunding announcement). Contracts on the S&P 500 were little unchanged, while Nasdaq 100 futures advanced 0.2% as of 7:30 a.m. in New York. Stocks have stabilized after a drop in the S&P 500 on Tuesday that was triggered by a surprise surge in job openings. European stocks erased earlier gains while US-listed Chinese stocks rallied in premarket trading and the Hang Seng Index rose in a session cut short by a storm warning as growing speculation over China’s reopening spurred another rally in Asia. The US dollar dropped for the second day as the yen strengthened in a sign traders anticipate a muted impact of Fed tightening on the currency; 10Y yields traded unchanged around 4.04%.

All eyes will be on the Fed later, when the central bank is widely expected to raise rates by 75 basis points for a fourth time in a row; the question is what the Fed does in December and onward. Here is a summary of Fed rate-hike expectations from major banks for Sept and Dec:

- Bank of America: 75 bps, 50 bps

- Barclays: 75 bps, 75 bps

- Citigroup: 75 bps, 50 bps

- Deutsche Bank: 75 bps, 75 bps

- JPMorgan Chase: 75 bps, 50 bps

- Goldman Sachs: 75 bps, 50 bps

- Morgan Stanley: 75 bps, 50 bps

- Wells Fargo: 75 bps, 50 bps

Goldman expects a more dovish 50bps Dec rate hike, but also a slower rise to peak as it has now added a 25bps rate hike in March which brings the Fed to 5.00%.

Chair Jerome Powell’s comments will be key, especially after a 7.8% rally in the S&P 500 since Oct. 12, triggered mostly by expectations of easing in the central bank’s hawkish narrative given risks to economic growth. Our full FOMC preview can be found here.

“It’s a matter of balance here — the Fed doesn’t want to signal too much hawkishness, but also doesn’t want to sound too dovish as that would result in a huge leg up in share prices and too much of an easing in financial conditions,” said Shane Oliver, head of investment strategy at AMP Services. Oliver feels caution is still needed. “We may have seen the bottom in the share market and certainly sentiment has been very negative, but by the same token given recession risks and the yield curve continuing to invert in the US, that suggests risks are still high,” he said on Bloomberg TV.

“It’s a challenge for messaging because they don’t want to ease financial conditions significantly,” said Julia Coronado, the founder of MacroPolicy Perspectives LLC. “They need tight financial conditions to keep cooling the economy off. So he doesn’t want to sound dovish, but he may want to go slower.”

“Continuation of the year-end rally is contingent on the Fed delivering on the pivot narrative,” said Barclays Plc strategists led by Emmanuel Cau, who see current market optimism as misplaced. “It feels premature for the Fed to loosen financial conditions via equity and bond markets — inflation is just too high.” Former Treasury Secretary Larry Summers also warned that expectations the central bank would pivot were “badly misguided,” saying the Fed should “stay on the current course.”

In premarket trading, US-listed Chinese stocks rallied for the second day and were set to extend Tuesday’s gains, after new unverified social media posts claimed the government is considering a slew of changes to its Covid Zero policy, including a shorter quarantine period for inbound travelers. Chipmaker Advanced Micro Devices rose after topping profit estimates, but Airbnb slumped after its bookings outlook for the fourth quarter fell short of expectations. Apple shares slipped after China ordered a seven-day lockdown of the area around Foxconn Technology Group’s main plant in Zhengzhou, a move that will severely curtail shipments in and out of the world’s largest iPhone factory. Here are all the notable premarket movers:

- AMD rose 4.9% after topping profit estimates as the semiconductor company’s expansion into the server processor market helped offset falling demand for chips used in PCs.

- Airbnb shares decline 6% after giving a downbeat outlook for 4Q bookings. While analysts applauded the firm’s robust 3Q results, they also highlighted the moderately weaker prospects for the alternative accommodation specialist amid FX headwinds.

- Arcturus Therapeutics shares surge 33% in US premarket trading after the biotech entered a collaboration and license agreement with a unit of CSL. The pact reduces execution risk, Cantor Fitzgerald says, prompting the broker to raise its price target.

- Bally’s cut to hold at Stifel, which says macro, regulatory and development risks in the near-term force the broker into “capitulation” and a move to the sidelines. Shares decline 1.8%

- Bandwidth shares jump 15% in US premarket trading after the company forecast fourth-quarter revenue above the average analyst estimate and raised its full-year outlook.

- Benefitfocus shares rise 48% to $10.35 in US premarket trading, after Voya Financial agreed to buy the company at $10.50 a share in cash.

- Canada Goose cut its non-IFRS adjusted earnings per share guidance for the full year; the guidance missed the average analyst estimate. Shares declined as much as 3.6%.

- Coty and L’Oreal declined after peer Estee Lauder’s second-quarter and full-year forecasts trailed consensus estimates, sinking the stock as much as 13% in premarket trading. Coty shares decline 2.8% and L’Oreal shares fell 1.7%.

- Chegg jumps as much as 17.5% after the education-focused company reported better-than-expected third- quarter earnings and boosted its full-year outlook for revenue and adjusted Ebitda.

- Match Group surges as much as 14.7% after the owner of dating apps including Tinder and OkCupid reported third-quarter revenue that beat the average analyst estimate and pledged to control costs. Analysts said that while 4Q and initial 2023 guidance were below expectations, they look achievable based on the current macro environment.

- DuPont gain 3.6% in thin premarket trading after the company scrapped a planned $5.2 billion acquisition of Rogers Corp., a move which analysts say will bolster DuPont’s balance sheet and improve the scope for share buybacks.

- Offerpad Solutions slump 3.8% in US premarket trading on Wednesday, ahead of the real estate firm’s third-quarter results due after the market close.

- TFF Pharmaceuticals Inc. plunges 38% in premarket trading as studies of two inhaled powder therapies have been impacted by challenges tied to “staffing shortages, shipping, and global supply chain delays,” the company said in a release.

- Tupperware shares plunged 33.4% after the company reported worse- than-expected third quarter results, including revenue and adjusted EPS that both missed analyst estimates.

- Yum China shares jump 13.6% in US premarket trading after the restaurant operator reported flat same-store sales growth in the third quarter, enough to impress analysts who had expected a decline, given stringent Covid control measures in China.

- ZoomInfo Technologies (ZI) shares plunge as much as 22% as analysts cut their price targets following 3Q results. Despite a beat-and- raise, comments from the software company that the operating environment is becoming more challenging show that it could be susceptible to a slowdown in the economy, according to analysts, who see growth moderating next year.

European equities are mixed after euro-area manufacturing activity sank to the lowest level since May 2020. Euto Stoxx 50 little changed, erasing earlier gains; the CAC 40 outperforms peers, while FTSE 100 and DAX lag. Healthcare stocks outperformed in Europe after Novo Nordisk A/S raised its operating profit and sales forecasts for the year; consumer products and personal care are among the best performing sectors. Here are some of the biggest European movers today:

- Sinch shares rally as much as 36% after 3Q results, with improved free cash flow, reduced net debt and prolonged short- term financing giving another boost to the heavily shorted stock.

- Shares in Danish wind turbine manufacturer Vestas rose as much as 8.6%, the most since August, after positive pricing concealed a 3Q results miss which led to a 5.5% fall in early trading.

- Novo Nordisk rises as much as 5.9%, hitting the highest since August, with analysts noting the Danish drugmaker’s guidance raise and its confirmation on the timeline for its Wegovy obesity treatment.

- Hiscox climbs as much as 6.2%, the most since August, after the insurer reported smaller-than- anticipated Hurricane Ian losses and solid trading across the rest of its business.

- Next Plc rises as much as 3.7% after maintaining its profit guidance, which is a “small positive read to the online retail space,” RBC said.

- Demant falls as much as 15%, the most since mid August, after the company cut its full- year guidance.

- VGP slumps as much as 12% after Barclays downgraded the real estate developer to underweight from overweight.

- Maersk drops as much as 7.3%, with Citi noting that the shipping firm’s lower expectations for contract rates are likely to weigh on investor sentiment.

- Smurfit Kappa declines as much as 5.1% in Dublin after results, with Goodbody analysts highlighting the company’s “challenging market conditions” and labor inflation pressures. Packaging peer DS Smith also slides.

Euro-area manufacturing activity sank to the lowest level since 2020 and A.P. Moller-Maersk A/S, a bellwether for global trade, cut its forecast for the global container market, saying inflation will persist even as demand drops as much as 4% this year. The company’s shares fell.

Earlier in the session, Asian stocks headed for a three-day advance as growing speculation over China’s reopening spurred another strong rally, while traders awaited the Federal Reserve’s decision on interest rates. The MSCI Asia Pacific Index rose as much as 0.9%, led by the consumer discretionary sector. Chinese and Hong Kong stocks drove gains in the region as investors scooped up shares following wide circulation of unverified posts outlining a loosening of the nation’s Covid Zero policy. Still, enthusiasm that sparked the rally in Chinese stocks could fade if authorities there don’t follow up on the speculation, Jun Rong Yeap, a market strategist at IG Asia Pte, wrote in a note.

The Hang Seng Index had its best two-day run since March before the session was cut short by a storm warning; The Hang Seng China Enterprises Index rose 2.8%, also capping its best two-day rally since March. Trading in Hong Kong closed earlier than usual due to a tropical storm. Most other markets posted modest gains or declines as investors opted to wait and assess the Fed’s policy signals. Data on Tuesday showing a solid US labor market bolstered speculation that policy could remain aggressively tight even with the threat of a recession. The central bank is set to raise rates by 75 basis points for the fourth time in a row on Wednesday.

In rates, Treasuries were mixed ahead of FOMC rate decision at 2pm ET, with long-end yields slightly cheaper on the day and front-end yields richer by ~3bp, steepening the curve as the 2-year yield fell by around 3bps and 30-year yields added 2bps. 10-year TSY yields were little changed around 4.04% as the curve steepens around the sector; 2s10s, 5s30s spreads are wider by ~2bp and ~3bp on the day vs UK 2s10s, 5s30s spreads wider by ~9bp and ~13bp Broadly subdued price action compares with aggressive steepening in gilt curve, where 2- and 5-year UK yields are ~1bp richer on the day. Focus on Fed rate decision may limit price action over early US session; traders have been hedging prospect of Fed to hint at a slowdown in rate hikes for the December policy meeting over the past couple of weeks The quarterly refunding announcement at 8:30am is viewed as having limited potential for auction size changes and may signal progress toward a buyback program. Bunds bear-flattened, as yields rose up to 4bps. Italian bond yields rose by around 5bps across the curve.

In FX, the Bloomberg Dollar Spot Index fell by around 0.2% as the greenback was steady or weaker against all of its Group-of-10 peers amid positioning ahead of today’s Fed meeting. SEK and GBP are the weakest performers in G-10 FX, NZD and JPY outperform

- The euro staged a slight rebound to trade around $0.99 after two days of losses against the dollar.

- The pound was steady around $1.15 while front-end gilts rallied, sending 2- year yields down by around 11bps

- The yen led G-10 gains along with New Zealand’s currency; the yen rose a second day versus the dollar. Bank of Japan Governor Kuroda told parliament the nation’s economy is no longer in deflation since the central bank started its current easing program, though added that inflation was seen slowing in fiscal year 2023; minutes of the BOJ’s September meeting noted it was desirable to keep an easing bias

- The kiwi and sovereign yields advanced as unemployment stayed near a record low in the third quarter while wages surged.

In commodities, wheat futures fell after Turkey’s Erdogan said grain shipments via the Ukraine corridor would resume. oil traded near $88 a barrel ahead of the Fed rate decision. West Texas Intermediate futures pared an earlier gain to trade little changed with prices stuck in a $12 band over the last month. Glencore Plc officials delivered cash in private jets to officials in west Africa, UK prosecutors said as they laid out a web of bribery and corruption orchestrated by the London oil trading desk. President Joe Biden’s threat to slap a tax on oil-company profits is more bluster than threat as the clock runs out on the administration’s efforts to tame fuel prices ahead of midterm elections. Spot gold rises roughly $8 to trade near $1,656/oz as traders mull the possibility of a rate-hike slowdown.

Market Snapshot

- S&P 500 futures up 0.3% to 3,877.75

- STOXX Europe 600 up 0.4% to 416.07

- MXAP up 0.8% to 139.99

- MXAPJ up 0.8% to 448.01

- Nikkei little changed at 27,663.39

- Topix up 0.1% to 1,940.46

- Hang Seng Index up 2.4% to 15,827.17

- Shanghai Composite up 1.2% to 3,003.37

- Sensex down 0.5% to 60,846.16

- Australia S&P/ASX 200 up 0.1% to 6,986.66

- Kospi little changed at 2,336.87

- Brent Futures up 0.2% to $94.81/bbl

- Gold spot up 0.3% to $1,652.92

- U.S. Dollar Index down 0.27% to 111.18

- German 10Y yield up 0.5% to 2.14%

- Euro up 0.3% to $0.9902

Top Overnight News from Bloomberg

- Overnight volatility rallies for the major currencies as traders position for the Federal Reserve monetary policy decision later Wednesday. Pound hedging costs lead the race as the Bank of England also meets Thursday

- The Federal Reserve looks set to deliver a fourth straight super-sized rate increase with Chair Jerome Powell repeating his resolute message on inflation and opening the door to a downshift — without necessarily pivoting yet

- Euro-area manufacturing activity sank to the lowest level since the first Covid-19 lockdowns in 2020 as record inflation and a weakening global economy erode demand for goods

- German companies have never been so concerned about sales as they struggle with the energy crisis and a gloomy world economy, and they fear the worst is yet to come, a survey found

- People’s Bank of China Governor Yi Gang gave an optimistic outlook for the economy on Wednesday, saying it remains “broadly on track” and he hoped the property market can achieve a “soft landing”

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with the region cautious and price action mostly rangebound after the lacklustre handover from the US where strong JOLTS data spurred a more hawkish Fed terminal rate pricing and as markets await the FOMC. ASX 200 was kept afloat by strength in the commodity-related sectors but with upside capped after PM Albanese rejected providing cash handouts and with the property industry pressured after home loans and building approvals fell. Nikkei 225 was indecisive as earnings releases remained in focus and officials continued their currency jawboning. KOSPI wiped out nearly all its early gains amid geopolitical concerns after North Korea reportedly fired at least 10 missiles and which was the first time its missiles fell near South Korea’s territorial waters. Hang Seng and Shanghai Comp eventually extended their recent rumour-driven surge regarding China reopening despite the denial by a Foreign Ministry spokesperson and with officials pledging policy support measures, while Hong Kong markets were closed after half-day due to a storm signal 8.

Top Asian News

- PBoC Governor Yi said China’s economy is broadly on track and potential growth is to remain in a reasonable range, and noted that inflation remains subdued and accommodative monetary policy is to support the economy. PBoC Governor Yi added that they will continue to improve the business environment, while they will deepen supply-side reforms and step up targeted support for key and weak sectors, according to Reuters.

- China state planner official said China’s foreign investment increased steadily so far this year and will encourage more foreign investment in the manufacturing industry, according to Reuters.

- China locked down the area around the world’s largest iPhone factory, according to Bloomberg.

- BoJ September Meeting Minutes stated a few members said they need to be vigilant to the impact monetary tightening by some central banks could have on global markets, while several members said a weak yen could hurt households, small firms and non-manufacturers. Members agreed that Japan’s economy is picking up and several members said the BoJ must communicate to the public its monetary policy does not directly target FX moves.

- RBNZ Financial Stability Report noted that the financial system remains resilient but added some households and businesses will be challenged by the rising interest rate environment, while it also stated that there are increasing downside risks to the global economic outlook and the extent to which the economic activity will slow due to monetary policy tightening remains uncertain. Furthermore, the RBNZ later stated it will consider tightening policy faster or slower at the Monetary Policy Statement.

- Chinese Commerce Ministry says it will expand the imports of advanced technology, key equipment and components, and increase imports of energy and agricultural products in short supply, via a Party Congress supplementary reading cited by Reuters.

European bourses are mixed as the initial positive bias faded amid downward PMI revisions and increasing geopolitical tensions, Euro Stoxx 50 +0.2%. Health Care is the outperforming sector after Q3 earnings from GSK (+1.6%) and Novo Nordisk (+4.5%), more broadly sectors are mixed with no overarching bias. US futures are similarly contained but have been less reactive to the geopolitical and PMI developments as participants remain firmly affixed on the Fed, ES Unch. & NQ +0.2%. A.P. Moeller-Maersk (MAERSK DC) expect a slowdown of the global economy to lead to softer market in ocean. Cuts FY22 global container demand forecast to -2% to -4%. Freight rates have begun normalising during Q3; Maersk -5.0%. Moody’s downgrades the outlook for the banking sector in Germany, Italy, Hungary, Poland, Slovakia, to negative from stable; citing energy crisis, high inflation, and rising rates, via Reuters.

Top European News

- Germany’s DIHK says German companies are bracing for another economic slump in the next 12 months; 52% of firms see business worsening in the next 12 months; says German GDP should be +1.2% in 2022 and -3% in 2023,

- Germany’s VDMA engineering orders in Sep -5% Y/Y (Domestic -4%, Foreign Orders +8%); in first 9M orders +1% Y/Y (Domestic -3%, Foreign +2%)

- Next Sales Better Than Expected Despite UK’s Costs Crisis

- Vestas Cuts Outlook Again as Wind Turbine Industry Spirals

- North Korea Fires 17 Missiles in Biggest-Ever Daily Barrage

- Novo Boosts Sales Forecast on Demand for Obesity Drug Wegovy

- Sampo 3Q Pretax Profit Misses Estimates; Decides on Dual Listing

- Britishvolt Says Loan Gives EV Battery Startup Weeks of Runway

FX

- USD is under modest pressure as we count down to the FOMC, action which is benefiting peers across the board with the antipodeans and JPY currently the main beneficiaries.

- DXY has slipped to a 111.12 low from earlier highs above the 111.50 mark, with brief respite for the USD occurring alongside the NY Times article re. Russia.

- EUR/USD relatively unreactive to the morning’s PMI revisions, downbeat commentary and numerous surveys out of Germany featuring a similar narrative, single currency holding around 0.9900.

- NZD outpaces and has lifted to a test of the 0.59 mark, where the current WTD peak resides, following domestic data which seemingly keeps hawkish impulses in focus.

- JPY is the next best performer given its haven status and after BoJ Minutes noted several members said a weak yen could hurt; USD/JPY probing but yet to lose 147.00.

- BoC Governor Macklem said they expect the policy rate will need to rise further and how much further rates will go up depends on how monetary policy is working, how supply chains are resolving and how inflation is responding to tightening. Macklem added that there are no easy outs to restoring price stability and reiterated the tightening phase will draw to a close and they are getting close but are not there yet.

Fixed Income

- EGBs are modestly pressured with yields a touch higher as such, though the complex is currently relatively contained ahead of a busy PM docket incl. the FOMC.

- USTs are essentially flat with yields incrementally steeper but similarly contained as such; note, the pre-FOMC docket is busy and features ADP alongside Quarterly Refunding.

- Back to Europe, Bunds and peers haven’t been too reactive to the downbeat PMI releases/commentary, with Bunds also conscious of upcoming Green supply; 10yr yield continues to lift from 2.10%.

Commodities

- Crude benchmarks have given up their USD and China induced APAC upside amid downbeat commentary from Maersk and the EZ Final Manufacturing PMIs.

- Currently, the benchmarks are incrementally softer on the session and in proximity to the USD 88/bbl and USD 94/bbl handles for WTI and Brent respectively.

- Spot gold is deriving support from the USD’s pullback and renewed geopolitical focus on both N.Korea and Russia, with the yellow metal having surpassed its 10-DMA but currently capped by the 21-DMA at USD 1659/oz; base metals similarly firmer on the USD action and overnight trade.

- Russia’s Kremlin exports of Russian fertiliser was an integral part of grain deal, but difficulties remain; says Russia’s participation in the deal remains suspended, via Reuters; prior to this, Turkish President Erdogan said the Russian Defence Minister told his Turkish counterpart the the grain deal will resume; grain deal will resume on mid-day Wednesday.

- Most recently, Russia is to resume participation in the Black Sea grain deal, according to Reuters citing the Defence Ministry; it was possible to obtain written guarantees from Kyiv not to use grain corridor for military operations against Russia.

Geopolitics

- Ukrainian President Zelensky said they need reliable, long-term defence for the grain corridor and that Russia must be told it will receive a firm world response if it takes steps to disrupt Ukrainian food exports, according to Reuters.

- Senior Russian military leaders recently had conversations to discuss when and how Moscow might use a tactical nuclear weapon in Ukraine, according to NYT citing sources, President Putin was not part of the conversations; “The intelligence about the conversations was circulated inside the U.S. government in mid-October.”.

- North Korea has reportedly fired at least 23 missiles in total from the east and west coasts on Wednesday the initial rounds of which prompted South Korea to place its Ulleung Island under an air raid warning and was the first time North Korean missiles fell near the South’s territorial waters, according to Yonhap and YTN.

- South Korean President Yoon ordered a swift and firm response and South Korea launched air-to-ground missiles which were fired towards the north of the maritime border, while South Korea closed some air routes off the east coast of the Korean peninsula after North Korea’s missile launches, according to the Transport Ministry cited by Reuters.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications, prior -1.7%

- 08:15: Oct. ADP Employment Change, est. 185,000, prior 208,000

- 14:00: Nov. FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

As we arrive at the latest decision day for the Fed, any remaining hopes of a dovish pivot continued to fizzle out over the last 24 hours, with futures once again pricing in a terminal fed funds rate above 5%. The main driver behind that was another round of US data yesterday, which showed that labour markets were tighter and the economy was in better shape than previously thought, which in theory should give the Fed more space to keep hiking rates. In turn, that prompted a big turnaround for risk assets, with the S&P 500 (-0.41%) losing ground for a second day running, whilst 10yr Treasury yields shot up by more than +15bps intraday after the releases came out.

Ahead of those releases, there had actually been a strong rally across multiple asset classes thanks to speculation that China might ease up on their Covid restrictions (more on which below). But the latest data caused a sharp reversal shortly after US markets opened, particularly given the news that US job openings had unexpectedly risen in September to 10.717m (vs. 9.750m expected), alongside an upward revision to the August number. That means there were still 1.86 job openings per unemployed worker in September, which is creating significant inflationary pressures, and suggests that the decline in job openings in August to a one-year low might have been a blip. On top of that, the quits rate of those voluntarily leaving their jobs (which is strongly correlated with wage growth) remained at 2.7% for a third month running.

Just as the labour market appeared to be in surprising strength, there was an additional dose of optimism about the economy from the ISM manufacturing reading for October, which came in at 50.2 (vs. 50.0 expected). Although it’s true that was the weakest reading since May 2020, it was still a touch better than expected and came amidst improvements in the employment (50.0) and new orders (49.2) components relative to last month, which gave further ground for optimism. In addition, the final manufacturing PMI for October was revised up half a point from the flash reading to 50.4, leaving it back above the 50-mark that separates expansion from contraction.

When it comes to today’s policy decision, the Fed are widely expected to hike rates by 75bps for a fourth consecutive meeting. But the more important question for markets today (and where there’s considerably more doubt) is whether the Fed might signal a downshift in the pace of hikes at subsequent meetings. This is a tricky balancing act for them, since any signal of a pivot risks leading to easier financial conditions that makes their job of bringing down inflation even harder. That was what happened after the July meeting, where investors interpreted matters in a dovish light, and the Fed had to reiterate their hawkish intent, culminating in Chair Powell’s August speech at Jackson Hole. Our US economists write in their preview (link here) that Chair Powell’s press conference will likely not pre-judge the outcome of the December meeting and will emphasise the data dependence of the decision, not least with another couple of CPI reports and jobs reports beforehand. They expect him to leave open the prospects of another 75bp hike in December, but present a strong base case for downshifting the pace of hikes by early 2023 at the latest.

Ahead of the Fed’s decision, markets moved to ratchet back up their expectations of how high they’re set to take rates over the coming months. Indeed, the rate priced in by end-2023 moved up another +9.9bps to 4.66%, which brings its gains over the last 3 sessions to +37.1bps and means that the bulk of the move lower after October 21 thanks to Nick Timiraos’ WSJ article has now reversed. In light of that, 2yr Treasuries yield gained +6.2bps on the day to reach 4.54%, with the moves higher occurring entirely after those strong US data releases mentioned above. The 10yr Treasury yield (-0.6bps) did close slightly lower at 4.04%, but that was still more than +10bps above its intraday levels prior to the releases and in overnight trading they’re back up +0.9bps to 4.05%. Over in Europe, sovereign bonds followed a similar pattern over the day, with a sharp intraday reversal following the US data, although yields on 10yr bunds (-1.0bps), OATs (-0.1bps) and BTPs (-3.5bps) still ended the session lower.

Those expectations of a more hawkish Fed led to a reversal for equities too, and the S&P 500 (-0.41%) swiftly gave up its gains after the open to fall back for a second consecutive session. Tech stocks led the declines once again, and there was a significant milestone for the FANG+ index (-0.95%) of megacap tech stocks, with the index closing at a 2-year low, having now shed -45.65% since its peak just under a year ago. European equities ended the day in positive territory, albeit only after giving up a decent chunk of their earlier gains, with the STOXX 600 moving from an intraday peak of +1.51% to only close up +0.53%.

That earlier momentum had been propelled in large part thanks to speculation about a potential end to Covid restrictions in China, with that backdrop seeing the CSI 300 post its strongest daily performance since March yesterday. The moves were triggered by unconfirmed posts on social media that China was forming a committee which would look at relaxing restrictions, with a suggestion for reopening in March 2023. However, a spokesman for the Chinese Foreign Ministry said that he was “not aware of what you mentioned” when asked about the issue at a press briefing on Tuesday.

Overnight in Asia, that continued speculation about a policy reversal has seen a fresh outperformance in a number of equity indices, with the Hang Seng (+2.50), the CSI 300 (+1.48%) and the Shanghai Comp (+1.29%) all recording solid gains. That’s in spite of the absence of any official confirmation about a change in China’s policy. Elsewhere, some of the other indices have been more mixed, with the Nikkei (-0.10%) slightly lower and the Kospi (+0.24%) recording a modest advance, although US futures are pointing in a more positive direction, with those on the S&P 500 up +0.32% ahead of the Fed’s decision.

On the data side, there were some fresh indications of global inflationary pressures overnight, with South Korea’s CPI inflation seeing its first rebound in three months as it rose to +5.7% as expected, whilst core CPI surpassed expectations to hit a 13-year high of +4.8% (vs. 4.5% expected). In the meantime, we also heard from Bank of Japan Governor Kuroda who reiterated their dovish policy, saying that they were not thinking of rate hikes or changing their yield curve control policies now.

Back in the US, we’re now less than a week away from the mid-term elections on Tuesday, and momentum has remained with the Republicans in recent days. According to FiveThirtyEight’s model, they now have a 51% chance of taking the Senate, which is up from 30% only six weeks ago, whilst the chances of them regaining the House now stand at 83%.

To the day ahead now, and the main highlight will be the Fed’s latest policy decision and Chair Powell’s press conference. In the meantime, ECB speakers today include Makhlouf, Villeroy and Nagel. On the data side, we’ll get October data on German unemployment, the final Euro Area manufacturing PMIs, and the ADP’s report of private payrolls for the US. Finally, earnings releases include Qualcomm, CVS Health and Booking Holdings.