The Bureau of Lies and Statistics has done it again: at a time when the best paying tech companies are mass laying off double-digits of their workforce (just ask Twitter today)...

Layoffs announced in the last day:

— Genevieve Roch-Decter, CFA (@GRDecter) November 3, 2022

- Lyft 13% of workers

- Opendoor 18%

- Stripe 14%

- Chime 12%

- Twitter 50%

- Morgan Stanley (% unknown)

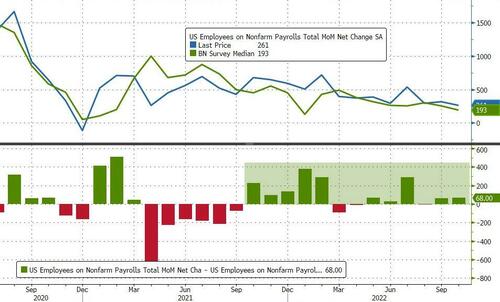

... and even left-leaning, pro-Biden media outlets such as Axios are pushing reports about "Massive wintertime layoff surge", moments ago the highly politicized BLS did what everyone expected it to do just days before the midterms when it reported that in October, payrolls jumped by 261K, far higher than the 195K expected, if another decline from the upward revised 315K in September (previously 263K).

This was the strongest best to expectations going back to July. More remarkably, payrolls have beaten expectations on 10 of the past 13 reports!

Revisions were also solid: the change in total nonfarm payroll employment for August was revised down by 23,000, from +315,000 to +292,000, and the change for September was revised up by 52,000, from +263,000 to +315,000. With these revisions, employment gains in August and September combined were 29,000 higher than previously reported.

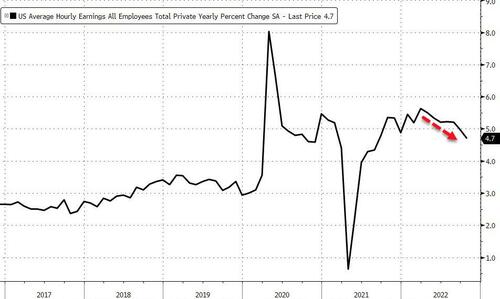

Adding some more fuel to the Fed's inflationary fire, the average hourly earnings came hot on a sequential basis, rising 0.4%, above the 0.3% (and above last month's 0.3% increase), even as the annual increase of 4.7% came in line with expectations and down from September's 5.0%

The average workweek for all employees on private nonfarm payrolls was 34.5 hours for the fifth month in a row, as expected. In manufacturing, the average workweek for all employees was little changed at 40.4 hours, and overtime decreased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls held at 34.0 hours.

Michael Pearce, a senior US economist at Capital Economics, calculates that the annual gain for hourly earnings ran at 3.9% over the past three months. This suggests that wage growth has peaked, he says: “Nonetheless, that is still too fast to be consistent with the Fed’s 2% inflation target, and with employment growth still surprisingly resilient (at least on the payrolls measure) this release will do little to alter the Fed’s resolute hawkishness.”

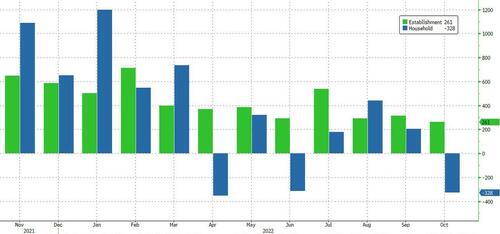

The flipside, however, to the strong employment and wage prints (which come from the far less accurate Establishment survey), is that the unemployment rate unexpectedly jumped from 3.5% to 3.7%...

... as the number of unemployed persons (from the much more accurate Household Survey) rose by 306,000 to 6.1 million, while the number of employed workers slumped by 328K, completely contradicting the Establishment Survey.

Among the major worker groups, the unemployment rates for adult women (3.4 percent) and Whites (3.2 percent) rose in October. The jobless rates for adult men (3.3 percent), teenagers (11.0 percent), Blacks (5.9 percent), Asians (2.9 percent), and Hispanics (4.2 percent) showed little or no change over the month, perhaps as companies pursuing "equity" laid off their white workers first.

And since the number of employed workers actually tumbled, the participation rate did too, sliding to 62.2% from 62.3%, and below the unchanged print expected.

And something even more curious:as noted above, the divergence between the Household and Establishment Surveys is back front and center, as total nonfarm employment (per Est. survey) jumped by 261K, while employment (per Household survey) tumbled by 328K...

... leading to the jump in the unemployment rate, and our favorite chart showing that since March, the US has actually not added any employed workers!

And one more shocker: looking at the composition of the collapse in actual employed workers, we find the following stunner:

- Full-time workers: -433K

- Part-time workers: +164K

(More on all this in a subsequent post).

Alas, since algos and traders are only programmed to look at the Establishment survey, which is based on massive statistics distortions, seasonal adjustments, and goalseeking, here is what the BLS reported on a granular basis within the establishment Survey:

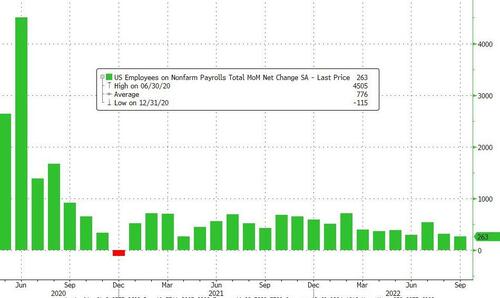

Total nonfarm payroll employment increased by 261,000 in October. Monthly job growth has averaged 407,000 thus far in 2022, compared with 562,000 per month in 2021. In October, notable job gains occurred in health care, professional and technical services, and manufacturing.

- Employment in health care rose by 53,000, with gains in ambulatory health care services (+31,000), nursing and residential care facilities (+11,000), and hospitals (+11,000).

- Professional and technical services added 43,000 jobs in October. Employment continued to trend up in management and technical consulting services (+7,000), architectural and engineering services (+7,000), and scientific research and development services (+5,000).

- Manufacturing added 32,000 jobs in October, mostly in durable goods industries (+23,000). Manufacturing employment has increased by an average of 37,000 per month thus far this year, compared with 30,000 per month in 2021.

- Employment in social assistance increased by 19,000 in October and is slightly below (-9,000) its pre-pandemic level in February 2020. Within social assistance, employment in individual and family services continued to trend up in October (+10,000).

- Wholesale trade added 15,000 jobs in October. Employment in wholesale trade has increased by an average of 17,000 per month thus far in 2022, compared with 13,000 per month in 2021.

- Employment in leisure and hospitality continued to trend up in October (+35,000), with accommodation adding 20,000 jobs. Employment in food services and drinking places changed little over the month (+6,000).

- Employment in transportation and warehousing changed little in October (+8,000). Within the industry, job growth occurred in truck transportation (+13,000), couriers and messengers (+7,000), and air transportation (+4,000). These gains were partially offset by a job loss in warehousing and storage (-20,000).

- In October, financial activities employment was little changed (+3,000). Within the industry, job gains in insurance carriers and related activities (+9,000) and in securities, commodity contracts, and investments (+5,000) were partially offset by a job loss in rental and leasing services (-8,000).

Commenting on the report, Bloomberg chief economist Anna Wong writes that “the jobs report for October sends mixed signals about the labor market, with one survey showing robust job gains while another shows a big jump in unemployment. Filtering the noise in the data, our takeaway is that the labor market is still very tight and much adjustment still needs to occur before unemployment is close to a neutral level. We expect that the Fed will ultimately have to raise rates to 5% next year.”

Her team adds that “the October data mean the unemployment rate will have to average about 3.9% for the rest of the year to reach the median FOMC member’s September forecast of 3.8%. Chances are the FOMC will revise down their unemployment estimate in the December Summary of Economic Projections and revise up their inflation estimates."

“The bottom line is that the labor market is still a long way from a level consistent with non-accelerating inflation. Even though layoffs aren’t yet pervasive, we do expect more to come in the months ahead, ultimately pushing the unemployment rate to 4.9% by 2024.”

Of course, as we said in our preview, nothing in today's report matters - its entire purpose is purely political and meant to set the scene for the midterms. For the real data and the aggressive backward revisions, look to December's number, when the BLS will finally have to admit the dismal truth about the sad state of the US labor market.

Developing.

The Bureau of Lies and Statistics has done it again: at a time when the best paying tech companies are mass laying off double-digits of their workforce (just ask Twitter today)…

Layoffs announced in the last day:

– Lyft 13% of workers

– Opendoor 18%

– Stripe 14%

– Chime 12%

– Twitter 50%

– Morgan Stanley (% unknown)— Genevieve Roch-Decter, CFA (@GRDecter) November 3, 2022

… and even left-leaning, pro-Biden media outlets such as Axios are pushing reports about “Massive wintertime layoff surge“, moments ago the highly politicized BLS did what everyone expected it to do just days before the midterms when it reported that in October, payrolls jumped by 261K, far higher than the 195K expected, if another decline from the upward revised 315K in September (previously 263K).

This was the strongest best to expectations going back to July. More remarkably, payrolls have beaten expectations on 10 of the past 13 reports!

Revisions were also solid: the change in total nonfarm payroll employment for August was revised down by 23,000, from +315,000 to +292,000, and the change for September was revised up by 52,000, from +263,000 to +315,000. With these revisions, employment gains in August and September combined were 29,000 higher than previously reported.

Adding some more fuel to the Fed’s inflationary fire, the average hourly earnings came hot on a sequential basis, rising 0.4%, above the 0.3% (and above last month’s 0.3% increase), even as the annual increase of 4.7% came in line with expectations and down from September’s 5.0%

The average workweek for all employees on private nonfarm payrolls was 34.5 hours for the fifth month in a row, as expected. In manufacturing, the average workweek for all employees was little changed at 40.4 hours, and overtime decreased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls held at 34.0 hours.

Michael Pearce, a senior US economist at Capital Economics, calculates that the annual gain for hourly earnings ran at 3.9% over the past three months. This suggests that wage growth has peaked, he says: “Nonetheless, that is still too fast to be consistent with the Fed’s 2% inflation target, and with employment growth still surprisingly resilient (at least on the payrolls measure) this release will do little to alter the Fed’s resolute hawkishness.”

The flipside, however, to the strong employment and wage prints (which come from the far less accurate Establishment survey), is that the unemployment rate unexpectedly jumped from 3.5% to 3.7%…

… as the number of unemployed persons (from the much more accurate Household Survey) rose by 306,000 to 6.1 million, while the number of employed workers slumped by 328K, completely contradicting the Establishment Survey.

Among the major worker groups, the unemployment rates for adult women (3.4 percent) and Whites (3.2 percent) rose in October. The jobless rates for adult men (3.3 percent), teenagers (11.0 percent), Blacks (5.9 percent), Asians (2.9 percent), and Hispanics (4.2 percent) showed little or no change over the month, perhaps as companies pursuing “equity” laid off their white workers first.

And since the number of employed workers actually tumbled, the participation rate did too, sliding to 62.2% from 62.3%, and below the unchanged print expected.

And something even more curious:as noted above, the divergence between the Household and Establishment Surveys is back front and center, as total nonfarm employment (per Est. survey) jumped by 261K, while employment (per Household survey) tumbled by 328K…

… leading to the jump in the unemployment rate, and our favorite chart showing that since March, the US has actually not added any employed workers!

And one more shocker: looking at the composition of the collapse in actual employed workers, we find the following stunner:

- Full-time workers: -433K

- Part-time workers: +164K

(More on all this in a subsequent post).

Alas, since algos and traders are only programmed to look at the Establishment survey, which is based on massive statistics distortions, seasonal adjustments, and goalseeking, here is what the BLS reported on a granular basis within the establishment Survey:

Total nonfarm payroll employment increased by 261,000 in October. Monthly job growth has averaged 407,000 thus far in 2022, compared with 562,000 per month in 2021. In October, notable job gains occurred in health care, professional and technical services, and manufacturing.

- Employment in health care rose by 53,000, with gains in ambulatory health care services (+31,000), nursing and residential care facilities (+11,000), and hospitals (+11,000).

- Professional and technical services added 43,000 jobs in October. Employment continued to trend up in management and technical consulting services (+7,000), architectural and engineering services (+7,000), and scientific research and development services (+5,000).

- Manufacturing added 32,000 jobs in October, mostly in durable goods industries (+23,000). Manufacturing employment has increased by an average of 37,000 per month thus far this year, compared with 30,000 per month in 2021.

- Employment in social assistance increased by 19,000 in October and is slightly below (-9,000) its pre-pandemic level in February 2020. Within social assistance, employment in individual and family services continued to trend up in October (+10,000).

- Wholesale trade added 15,000 jobs in October. Employment in wholesale trade has increased by an average of 17,000 per month thus far in 2022, compared with 13,000 per month in 2021.

- Employment in leisure and hospitality continued to trend up in October (+35,000), with accommodation adding 20,000 jobs. Employment in food services and drinking places changed little over the month (+6,000).

- Employment in transportation and warehousing changed little in October (+8,000). Within the industry, job growth occurred in truck transportation (+13,000), couriers and messengers (+7,000), and air transportation (+4,000). These gains were partially offset by a job loss in warehousing and storage (-20,000).

- In October, financial activities employment was little changed (+3,000). Within the industry, job gains in insurance carriers and related activities (+9,000) and in securities, commodity contracts, and investments (+5,000) were partially offset by a job loss in rental and leasing services (-8,000).

Commenting on the report, Bloomberg chief economist Anna Wong writes that “the jobs report for October sends mixed signals about the labor market, with one survey showing robust job gains while another shows a big jump in unemployment. Filtering the noise in the data, our takeaway is that the labor market is still very tight and much adjustment still needs to occur before unemployment is close to a neutral level. We expect that the Fed will ultimately have to raise rates to 5% next year.”

Her team adds that “the October data mean the unemployment rate will have to average about 3.9% for the rest of the year to reach the median FOMC member’s September forecast of 3.8%. Chances are the FOMC will revise down their unemployment estimate in the December Summary of Economic Projections and revise up their inflation estimates.”

“The bottom line is that the labor market is still a long way from a level consistent with non-accelerating inflation. Even though layoffs aren’t yet pervasive, we do expect more to come in the months ahead, ultimately pushing the unemployment rate to 4.9% by 2024.”

Of course, as we said in our preview, nothing in today’s report matters – its entire purpose is purely political and meant to set the scene for the midterms. For the real data and the aggressive backward revisions, look to December’s number, when the BLS will finally have to admit the dismal truth about the sad state of the US labor market.

Developing.