As DB's Jim Reid writes this morning, it feels odd to say but US mid-terms (tomorrow) might be more important than US CPI (Thursday). That's because history suggests the mid-terms are a big influence on markets as they always seem to rally once mid-terms (or Presidential elections) are out the way. And although Reid's regular readers are in little doubt that his base case is that 2023 is going to be a bad year for the global economy and risk, he repeats that in every 12-month period post mid-terms over the last century, the equity market has always gone up with the inflection point being immediately after mid-terms.

With that in mind, the DB strategist notes that while he still thinks the US recession of 2023 will overpower that historical track record, "Tuesday being out the way could be a catalyst for a more positive short-term period. So a big moment."

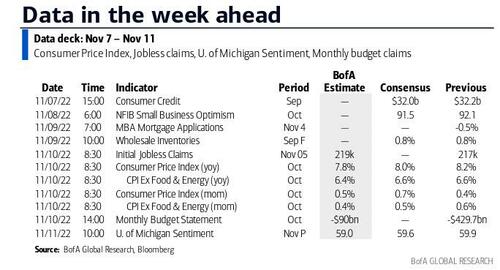

Some more details on this week's main events:

Llooking first at tomorrow’s midterms, DB economists' base case is that Republicans will take the House but Democrats will maintain their slim majority in the Senate, although the latter is a close call. It is highly unlikely that either party will achieve a two-thirds majority in Congress, thus effectively maintaining President Biden's veto power. Currently, FiveThirtyEight's model gives the Republicans a 54% chance of winning the Senate and 82% for the House. Their chance of winning both is 53%.

With regards to US CPI on Thursday, economists believe energy will boost the headline (Consensus forecast at +0.6% vs. +0.39% previously). Last month core surprised on the upside (+0.6% MoM, vs +0.4% consensus) so this month’s reading will get the most focus (Consensus at 0.5%, vs. +0.58% previously). In terms of YoY, DB expect headline to dip -0.2pp and core -0.1pp to 8.0% (consensus 7.9%) and 6.5%, respectively.

Elsewhere in the US this week the highlight will probably be the University of Michigan survey out on Friday with the latest inflation expectations series. It’s a light week for data outside of that. There is plenty of Fed speak so see that in our day-by-day calendar at the end as usual. You’ll also see from that that Lagarde speaks today.

Other important data releases in other parts of the globe will feature trade balances for key global economies as well as CPI and PPI data for China (Wednesday). Here in Europe, GDP from the UK (Friday) and industrial production data from Germany (today) will be in focus.

In terms of corporate earnings, there will be a couple of corporate heavyweights reporting this week even with around 85% of the S&P 500 index having now released Q3 results. The highlights are likely Disney and Occidental (tomorrow) but we also have Activision Blizzard, Lyft (today) and Roblox (Wednesday) in tech and BioNTech (today), adidas (Wednesday), AstraZeneca (Thursday) and SoftBank (Friday) elsewhere.

Elsewhere, COP27 kicked off yesterday so we’ll likely see plenty of headlines from that.

Here is a day by day calendar of events

Monday November 7

- Data: US September consumer credit, China October trade balance, Japan September household spending, labor cash earnings, Germany October construction PMI, September industrial production

- Central banks: Fed's Collins and Barkin speak, ECB's Lagarde and Panetta speak, BoJ summary of opinions

- Earnings: Activision Blizzard, BioNTech, Take-Two, Palantir, Ryanair, SolarEdge, Lyft

Tuesday November 8

- Data: US October NFIB small business optimism, Japan October bank lending, September trade balance, leading and coincident index, France September trade balance, Q3 private sector payrolls, Italy and Eurozone September retail sales

- Central banks: ECB's Wunsch speaks, BoE's Pill speaks

- Earnings: Disney, Occidental, Nintendo, Bayer, Deutsche Post, GlobalFoundries, DuPont de Nemours, Norwegian Cruise Line, Affirm, AMC

- Politics: US midterm elections

Wednesday November 9

- Data: US September wholesale trade sales, China October CPI, PPI, Japan October Eco Watchers survey, M2 and M3

- Central banks: Fed's Williams and Barkin speak, ECB's Elderson speaks, BoE's Haskel speaks

- Earnings: Rivian, Roblox, adidas, Nissan, Wynn Resorts, Telecom Italia

Thursday November 10

- Data: US October CPI, monthly budget statement, initial jobless claims, Japan October PPI, machine tool orders, France Q3 wages, Italy September industrial production

- Central banks: Fed's Waller, Logan, Mester and George speak, ECB's Schnabel, Kazimir and Vasle speak, BoE's Ramsden speaks, ECB's economic bulletin

- Earnings: AstraZeneca, Deutsche Telekom, Allianz, Brookfield, National Grid, Engie, RWE, ArcelorMittal

Friday November 11

- Data: US November University of Michigan sentiment, UK Q3 and September monthly GDP, September construction output, industrial and manufacturing production, index of services, September trade balance, Germany September current account balance

- Central banks: ECB's Holzmann, Panetta, Lane, De Cos, Centeno and Guindos speak, BoE's Tenreyro speaks

- Earnings: SoftBank, Toshiba

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Thursday and the University of Michigan report on Friday. There are several speaking engagements from Fed officials, including Governor Waller and presidents Collins, Barkin, Williams, Logan, Mester, and George.

Monday, November 7

- 03:40 PM Boston Fed President Collins (FOMC voter) and Cleveland Fed President Mester (FOMC voter) speak: Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester will participate in a moderated discussion on women in economics at an event hosted by the Cleveland Fed. A Q&A with audience is expected. On November 4, Collins said, “with rates now in restrictive territory, I believe it is time to shift focus from how rapidly to raise rates, or the pace, to how high – in other words, to determining what is sufficiently restrictive…down the road, when we get there, in my view we'll need to shift again to focus on how long to hold rates at that level.” On October 11, Mester said, “I think the appropriate path is we continue to raise rates a bit more so we get it up to that level where we’re positive in terms of the real funds rate based on expected inflation over the next year, and then we wait and assess data coming in.”

- 06:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in a discussion on inflation. On November 4, Barkin said, “We need to do whatever we need to do with the rates to get inflation back to target, and so I start with inflation.” He said he expects, “a slower pace of rate increases, a longer pace of rate increases and potentially a higher endpoint,” adding that the terminal rate rising above 5% is “entirely conceivable” but not the current plan.

Tuesday, November 8

- 06:00 AM NFIB small business optimism, October (consensus 91.3, last 92.1)

Wednesday, November 9

- 03:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at an event on global risk, uncertainty, and volatility hosted by the Swiss National Bank, Fed, and BIS. On October 7, Williams said the Fed may need to raise rates to “somewhere around 4.5% over time.” He added, “The timing of that and how high do we have to raise interest rates is going to depend on the data…Right now the focus is getting inflation back down to 2% and doing that in a way that keeps the economy growing.”

- 10:00 AM Wholesale inventories, September final (consensus +0.8%, last +0.8%)

- 11:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will discuss the economic outlook at an event hosted by Shenandoah University.

Thursday, November 10

- 02:00 AM Fed Governor Waller speaks: Governor Christopher Waller will discuss central bank digital currencies at an event hosted by Queensland University. A Q&A with audience is expected. On October 6, Waller said, “[The August inflation data] is not the…outcome I am looking for to support a slower pace of rate hikes or a lower terminal policy rate than projected in the September 2022 SEP.”

- 08:30 AM CPI (mom), October (GS +0.49%, consensus +0.6%, last +0.4%); Core CPI (mom), October (GS +0.44%, consensus +0.5%, last +0.6%); CPI (yoy), October (GS +7.80%, consensus +7.9%, last +8.2%); Core CPI (yoy), October (GS +6.46%, consensus +6.5%, last +6.6%): We estimate a 0.44% increase in October core CPI (mom sa), which would lower the year-on-year rate by one tenth to 6.5%. Our forecast reflects a 2.5% decline in the used car category on the back of falling auction prices, as well a sharp negative swing in the health insurance component as annual source data is incorporated (we assume -3% mom nsa). We also assume a 2% pullback in airfares (mom sa). We assume continued strength in new car prices (+1.0%) reflecting price increases on 2023 models, though we note that dealer incentives did rebound in the month. We also look for another very strong set of shelter readings (rent +0.78% and OER +0.75%) as rents on renewing leases continue to converge upward toward market rates. We also assume another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.49% rise in headline CPI, reflecting higher gasoline and food prices.

- 08:30 AM Initial jobless claims, week ended November 5 (GS 220k, consensus 220k, last 217k); Continuing jobless claims, week ended October 29 (consensus 1,500k, last 1,485k): We estimate initial jobless claims increased to 220k in the week ended November 5.

- 09:35 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will discuss energy and the economy at an event hosted by the Dallas Fed and Kansas City Fed. Speech text is expected.

- 12:30 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook and monetary policy at an event hosted by Princeton University. A Q&A with audience is expected.

- 01:30 PM Kansas City Fed President George (FOMC voter) speaks: Kansas City Fed President Esther George will discuss energy and the economy at an event hosted by the Dallas Fed and Kansas City Fed.

Friday, November 11

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 59.9, consensus 59.5, last 59.9); University of Michigan 5-10-year inflation expectations, November preliminary (GS 2.9%, consensus 2.9%, last 2.9%): We expect that the University of Michigan consumer sentiment index (59.9) and 5-10-year inflation expectations (2.9%) were unchanged in the preliminary November report.

Source: DB, Goldman, BofA

As DB’s Jim Reid writes this morning, it feels odd to say but US mid-terms (tomorrow) might be more important than US CPI (Thursday). That’s because history suggests the mid-terms are a big influence on markets as they always seem to rally once mid-terms (or Presidential elections) are out the way. And although Reid’s regular readers are in little doubt that his base case is that 2023 is going to be a bad year for the global economy and risk, he repeats that in every 12-month period post mid-terms over the last century, the equity market has always gone up with the inflection point being immediately after mid-terms.

With that in mind, the DB strategist notes that while he still thinks the US recession of 2023 will overpower that historical track record, “Tuesday being out the way could be a catalyst for a more positive short-term period. So a big moment.”

Some more details on this week’s main events:

Llooking first at tomorrow’s midterms, DB economists’ base case is that Republicans will take the House but Democrats will maintain their slim majority in the Senate, although the latter is a close call. It is highly unlikely that either party will achieve a two-thirds majority in Congress, thus effectively maintaining President Biden’s veto power. Currently, FiveThirtyEight’s model gives the Republicans a 54% chance of winning the Senate and 82% for the House. Their chance of winning both is 53%.

With regards to US CPI on Thursday, economists believe energy will boost the headline (Consensus forecast at +0.6% vs. +0.39% previously). Last month core surprised on the upside (+0.6% MoM, vs +0.4% consensus) so this month’s reading will get the most focus (Consensus at 0.5%, vs. +0.58% previously). In terms of YoY, DB expect headline to dip -0.2pp and core -0.1pp to 8.0% (consensus 7.9%) and 6.5%, respectively.

Elsewhere in the US this week the highlight will probably be the University of Michigan survey out on Friday with the latest inflation expectations series. It’s a light week for data outside of that. There is plenty of Fed speak so see that in our day-by-day calendar at the end as usual. You’ll also see from that that Lagarde speaks today.

Other important data releases in other parts of the globe will feature trade balances for key global economies as well as CPI and PPI data for China (Wednesday). Here in Europe, GDP from the UK (Friday) and industrial production data from Germany (today) will be in focus.

In terms of corporate earnings, there will be a couple of corporate heavyweights reporting this week even with around 85% of the S&P 500 index having now released Q3 results. The highlights are likely Disney and Occidental (tomorrow) but we also have Activision Blizzard, Lyft (today) and Roblox (Wednesday) in tech and BioNTech (today), adidas (Wednesday), AstraZeneca (Thursday) and SoftBank (Friday) elsewhere.

Elsewhere, COP27 kicked off yesterday so we’ll likely see plenty of headlines from that.

Here is a day by day calendar of events

Monday November 7

- Data: US September consumer credit, China October trade balance, Japan September household spending, labor cash earnings, Germany October construction PMI, September industrial production

- Central banks: Fed’s Collins and Barkin speak, ECB’s Lagarde and Panetta speak, BoJ summary of opinions

- Earnings: Activision Blizzard, BioNTech, Take-Two, Palantir, Ryanair, SolarEdge, Lyft

Tuesday November 8

- Data: US October NFIB small business optimism, Japan October bank lending, September trade balance, leading and coincident index, France September trade balance, Q3 private sector payrolls, Italy and Eurozone September retail sales

- Central banks: ECB’s Wunsch speaks, BoE’s Pill speaks

- Earnings: Disney, Occidental, Nintendo, Bayer, Deutsche Post, GlobalFoundries, DuPont de Nemours, Norwegian Cruise Line, Affirm, AMC

- Politics: US midterm elections

Wednesday November 9

- Data: US September wholesale trade sales, China October CPI, PPI, Japan October Eco Watchers survey, M2 and M3

- Central banks: Fed’s Williams and Barkin speak, ECB’s Elderson speaks, BoE’s Haskel speaks

- Earnings: Rivian, Roblox, adidas, Nissan, Wynn Resorts, Telecom Italia

Thursday November 10

- Data: US October CPI, monthly budget statement, initial jobless claims, Japan October PPI, machine tool orders, France Q3 wages, Italy September industrial production

- Central banks: Fed’s Waller, Logan, Mester and George speak, ECB’s Schnabel, Kazimir and Vasle speak, BoE’s Ramsden speaks, ECB’s economic bulletin

- Earnings: AstraZeneca, Deutsche Telekom, Allianz, Brookfield, National Grid, Engie, RWE, ArcelorMittal

Friday November 11

- Data: US November University of Michigan sentiment, UK Q3 and September monthly GDP, September construction output, industrial and manufacturing production, index of services, September trade balance, Germany September current account balance

- Central banks: ECB’s Holzmann, Panetta, Lane, De Cos, Centeno and Guindos speak, BoE’s Tenreyro speaks

- Earnings: SoftBank, Toshiba

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Thursday and the University of Michigan report on Friday. There are several speaking engagements from Fed officials, including Governor Waller and presidents Collins, Barkin, Williams, Logan, Mester, and George.

Monday, November 7

- 03:40 PM Boston Fed President Collins (FOMC voter) and Cleveland Fed President Mester (FOMC voter) speak: Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester will participate in a moderated discussion on women in economics at an event hosted by the Cleveland Fed. A Q&A with audience is expected. On November 4, Collins said, “with rates now in restrictive territory, I believe it is time to shift focus from how rapidly to raise rates, or the pace, to how high – in other words, to determining what is sufficiently restrictive…down the road, when we get there, in my view we’ll need to shift again to focus on how long to hold rates at that level.” On October 11, Mester said, “I think the appropriate path is we continue to raise rates a bit more so we get it up to that level where we’re positive in terms of the real funds rate based on expected inflation over the next year, and then we wait and assess data coming in.”

- 06:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in a discussion on inflation. On November 4, Barkin said, “We need to do whatever we need to do with the rates to get inflation back to target, and so I start with inflation.” He said he expects, “a slower pace of rate increases, a longer pace of rate increases and potentially a higher endpoint,” adding that the terminal rate rising above 5% is “entirely conceivable” but not the current plan.

Tuesday, November 8

- 06:00 AM NFIB small business optimism, October (consensus 91.3, last 92.1)

Wednesday, November 9

- 03:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at an event on global risk, uncertainty, and volatility hosted by the Swiss National Bank, Fed, and BIS. On October 7, Williams said the Fed may need to raise rates to “somewhere around 4.5% over time.” He added, “The timing of that and how high do we have to raise interest rates is going to depend on the data…Right now the focus is getting inflation back down to 2% and doing that in a way that keeps the economy growing.”

- 10:00 AM Wholesale inventories, September final (consensus +0.8%, last +0.8%)

- 11:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will discuss the economic outlook at an event hosted by Shenandoah University.

Thursday, November 10

- 02:00 AM Fed Governor Waller speaks: Governor Christopher Waller will discuss central bank digital currencies at an event hosted by Queensland University. A Q&A with audience is expected. On October 6, Waller said, “[The August inflation data] is not the…outcome I am looking for to support a slower pace of rate hikes or a lower terminal policy rate than projected in the September 2022 SEP.”

- 08:30 AM CPI (mom), October (GS +0.49%, consensus +0.6%, last +0.4%); Core CPI (mom), October (GS +0.44%, consensus +0.5%, last +0.6%); CPI (yoy), October (GS +7.80%, consensus +7.9%, last +8.2%); Core CPI (yoy), October (GS +6.46%, consensus +6.5%, last +6.6%): We estimate a 0.44% increase in October core CPI (mom sa), which would lower the year-on-year rate by one tenth to 6.5%. Our forecast reflects a 2.5% decline in the used car category on the back of falling auction prices, as well a sharp negative swing in the health insurance component as annual source data is incorporated (we assume -3% mom nsa). We also assume a 2% pullback in airfares (mom sa). We assume continued strength in new car prices (+1.0%) reflecting price increases on 2023 models, though we note that dealer incentives did rebound in the month. We also look for another very strong set of shelter readings (rent +0.78% and OER +0.75%) as rents on renewing leases continue to converge upward toward market rates. We also assume another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.49% rise in headline CPI, reflecting higher gasoline and food prices.

- 08:30 AM Initial jobless claims, week ended November 5 (GS 220k, consensus 220k, last 217k); Continuing jobless claims, week ended October 29 (consensus 1,500k, last 1,485k): We estimate initial jobless claims increased to 220k in the week ended November 5.

- 09:35 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will discuss energy and the economy at an event hosted by the Dallas Fed and Kansas City Fed. Speech text is expected.

- 12:30 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook and monetary policy at an event hosted by Princeton University. A Q&A with audience is expected.

- 01:30 PM Kansas City Fed President George (FOMC voter) speaks: Kansas City Fed President Esther George will discuss energy and the economy at an event hosted by the Dallas Fed and Kansas City Fed.

Friday, November 11

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 59.9, consensus 59.5, last 59.9); University of Michigan 5-10-year inflation expectations, November preliminary (GS 2.9%, consensus 2.9%, last 2.9%): We expect that the University of Michigan consumer sentiment index (59.9) and 5-10-year inflation expectations (2.9%) were unchanged in the preliminary November report.

Source: DB, Goldman, BofA