The biggest impact from the Midterms, arguably, is the surge in rate-cut expectations in the last 24 hours as gridlock in Washington means a considerably smaller chance of any fiscal response to the recession that The Fed is foisting on Americans, leaving The Fed itself all alone to 'handle' the slump in the economy...

Source: Bloomberg

But it was crypto where the real action was as headlines about Binance maybe pulling out of the FTX rescue deal (while FTX faces a federal probe) tanked everything in that space...

The FTX Token FTT collapsed back to yesterday's spike-down lows (April 2020 lows)...

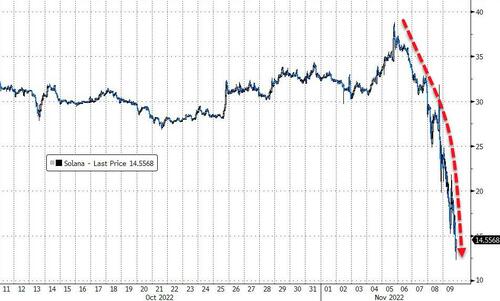

Solana (among FTX reserves) puked to its lowest since March 2021...

Source: Bloomberg

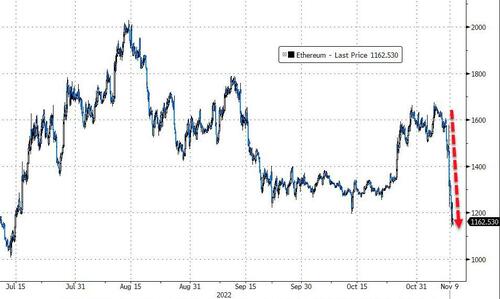

Ethereum (linked via DeFi contracts to FTX) plunged to 4-month lows...

Source: Bloomberg

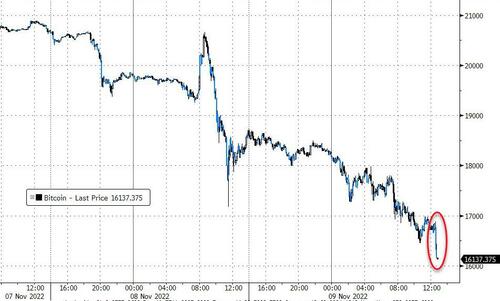

Bitcoin (general collateral) cratered back below $17,000 for the first time since Nov 2020. Late in the day WSJ reported that Binance had rejected the deal with FTX and bitcoin tumbled even further, down to almost $16.000...

Source: Bloomberg

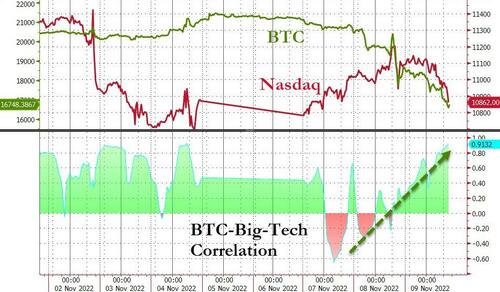

As Bitcoin lurched lower so stocks were monkeyhammered with Nasdaq down over 2.3%

And all the 'bitcoin proxy' stocks were clubbed like baby seals...

Source: Bloomberg

The correlation between bitcoin and big-tech stocks is back near record highs after fading notably...

Source: Bloomberg

The S&P 500 broke below its 50DMA...

Treasuries were mixed today with the long-end weaker (short-end bid), not helped by a really ugly 10Y auction. 2Y yields fell 3bps on the day while 30Y yields rose 4bps. On the week, the belly is outerperforming (5Y -5bps) while the long-end is the only maturity higher in yield (30Y +6bps)...

Source: Bloomberg

The 10Y Yield was the wildest on the day thanks to a massive tail at the auction (but note today's range was actually relatively small). Note that in the last few minutes as the Binance news hit, TSY yields tumbled...

Source: Bloomberg

The dollar rebounded after 3 straight down days back up to the spike lows from FOMC day...

Source: Bloomberg

Oil prices plunged (for the 3rd straight day) on a surprising crude inventory build and no good news on China's Zero-COVID policy. WTI broke below its 50DMA back to a $85 handle at 2-week lows...

Gold clung to its gains from yesterday...

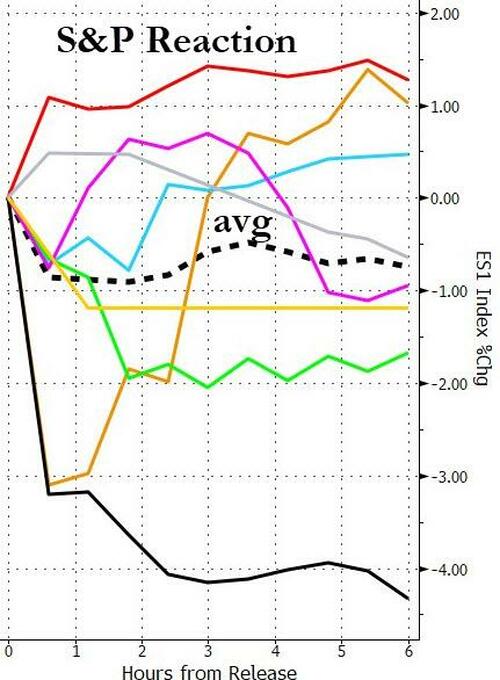

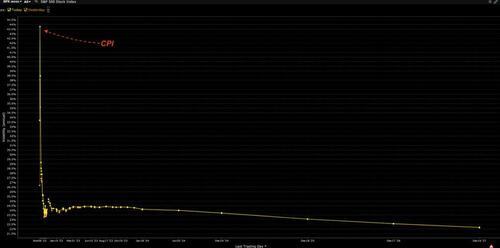

Finally, tomorrow is CPI day. In the last year, CPI has only printed below expectations twice and stocks have fallen an average 0.75% on the day!

Source: Bloomberg

IV for tomorrows expiration is near 44%, while the rest of the curve is extremely flat at 24%. This suggests traders are looking for something near a 2.5% move for tomorrow, then only 1.5% moves for next week.

SpotGamma notes that everything we look at suggests that traders see little risk of any type of tail move lower.

The biggest impact from the Midterms, arguably, is the surge in rate-cut expectations in the last 24 hours as gridlock in Washington means a considerably smaller chance of any fiscal response to the recession that The Fed is foisting on Americans, leaving The Fed itself all alone to ‘handle’ the slump in the economy…

Source: Bloomberg

But it was crypto where the real action was as headlines about Binance maybe pulling out of the FTX rescue deal (while FTX faces a federal probe) tanked everything in that space…

[embedded content]

The FTX Token FTT collapsed back to yesterday’s spike-down lows (April 2020 lows)…

Solana (among FTX reserves) puked to its lowest since March 2021…

Source: Bloomberg

Ethereum (linked via DeFi contracts to FTX) plunged to 4-month lows…

Source: Bloomberg

Bitcoin (general collateral) cratered back below $17,000 for the first time since Nov 2020. Late in the day WSJ reported that Binance had rejected the deal with FTX and bitcoin tumbled even further, down to almost $16.000…

Source: Bloomberg

As Bitcoin lurched lower so stocks were monkeyhammered with Nasdaq down over 2.3%

And all the ‘bitcoin proxy’ stocks were clubbed like baby seals…

Source: Bloomberg

The correlation between bitcoin and big-tech stocks is back near record highs after fading notably…

Source: Bloomberg

The S&P 500 broke below its 50DMA…

Treasuries were mixed today with the long-end weaker (short-end bid), not helped by a really ugly 10Y auction. 2Y yields fell 3bps on the day while 30Y yields rose 4bps. On the week, the belly is outerperforming (5Y -5bps) while the long-end is the only maturity higher in yield (30Y +6bps)…

Source: Bloomberg

The 10Y Yield was the wildest on the day thanks to a massive tail at the auction (but note today’s range was actually relatively small). Note that in the last few minutes as the Binance news hit, TSY yields tumbled…

Source: Bloomberg

The dollar rebounded after 3 straight down days back up to the spike lows from FOMC day…

Source: Bloomberg

Oil prices plunged (for the 3rd straight day) on a surprising crude inventory build and no good news on China’s Zero-COVID policy. WTI broke below its 50DMA back to a $85 handle at 2-week lows…

Gold clung to its gains from yesterday…

Finally, tomorrow is CPI day. In the last year, CPI has only printed below expectations twice and stocks have fallen an average 0.75% on the day!

Source: Bloomberg

IV for tomorrows expiration is near 44%, while the rest of the curve is extremely flat at 24%. This suggests traders are looking for something near a 2.5% move for tomorrow, then only 1.5% moves for next week.

SpotGamma notes that everything we look at suggests that traders see little risk of any type of tail move lower.