By Ye Xie, Bloomberg markets live reporter and analyst

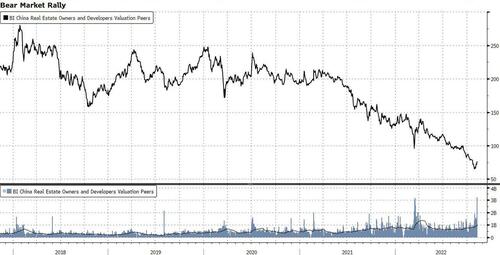

Another day, another measure to support the beleaguered Chinese property sector. Developers rallied Wednesday after Beijing expanded a funding program to support debt sales by private companies, including builders.

It’s a positive that the authorities are doing more to bolster the housing sector. But it’s another bandage that’s unlikely to turn around the market.

Stocks of developers such as Country Garden Holdings and CIFI Holdings surged after the National Association of Financial Market Institutional Investors widened the bond financing program to about 250 billion yuan ($35 billion) for private companies, including developers.

The program, first introduced in late-2018, is one of the “three arrows” that the People’s Bank of China uses to help private companies raise capital. The other two channels include bank loans and equity financing.

In September, Bloomberg reported that policymakers have asked state banks to increase lending to developers to ease their liquidity crunch. After firing the first arrow, Beijing is now pulling the trigger on the second one.

But as Nomura’s economist Lu Ting pointed out, there are reasons to question the effectiveness of the program. First, new home sales revenue is the largest funding source for developers, far more than any other channels. It accounted for 53% of overall funding for developers last year, compared with 12% from bank loans.

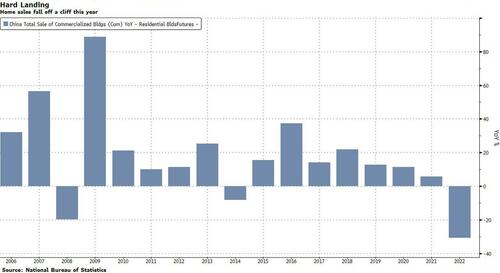

In the first nine months, new home sales contracted 31%. At this rate, developers’ funding from home sales will fall by 3.3 trillion yuan ($456 billion) this year, according to Nomura’s estimate. That’s too big of a funding hole.

Secondly, the $35 billion bond financing quota is for all private companies, not just for developers. Builders accounted for 15% of all private bond issuance between 2018 and 2020, before falling to around 9% in 2021, according to Nomura.

Lastly, developers still need to pay off a large amount of maturing bonds in coming months, with about 30 billion yuan worth of onshore debt due by March. The implication is that even if they can access the bond market, the net fundraising would be limited after paying off the debt.

All in all, the second arrow is literally more like an arrow, not a bazooka.

By Ye Xie, Bloomberg markets live reporter and analyst

Another day, another measure to support the beleaguered Chinese property sector. Developers rallied Wednesday after Beijing expanded a funding program to support debt sales by private companies, including builders.

It’s a positive that the authorities are doing more to bolster the housing sector. But it’s another bandage that’s unlikely to turn around the market.

Stocks of developers such as Country Garden Holdings and CIFI Holdings surged after the National Association of Financial Market Institutional Investors widened the bond financing program to about 250 billion yuan ($35 billion) for private companies, including developers.

The program, first introduced in late-2018, is one of the “three arrows” that the People’s Bank of China uses to help private companies raise capital. The other two channels include bank loans and equity financing.

In September, Bloomberg reported that policymakers have asked state banks to increase lending to developers to ease their liquidity crunch. After firing the first arrow, Beijing is now pulling the trigger on the second one.

But as Nomura’s economist Lu Ting pointed out, there are reasons to question the effectiveness of the program. First, new home sales revenue is the largest funding source for developers, far more than any other channels. It accounted for 53% of overall funding for developers last year, compared with 12% from bank loans.

In the first nine months, new home sales contracted 31%. At this rate, developers’ funding from home sales will fall by 3.3 trillion yuan ($456 billion) this year, according to Nomura’s estimate. That’s too big of a funding hole.

Secondly, the $35 billion bond financing quota is for all private companies, not just for developers. Builders accounted for 15% of all private bond issuance between 2018 and 2020, before falling to around 9% in 2021, according to Nomura.

Lastly, developers still need to pay off a large amount of maturing bonds in coming months, with about 30 billion yuan worth of onshore debt due by March. The implication is that even if they can access the bond market, the net fundraising would be limited after paying off the debt.

All in all, the second arrow is literally more like an arrow, not a bazooka.