Despite crypto evangelists describing the current situation in the cryptocurrency market as just another dip, the phenomenon known as crypto winter has real and possibly lasting consequences for one of the more volatile finance sectors. As Statista's Florian Zandt details below, since May 2022, 38 companies in the crypto industry have laid off employees, among them crypto exchanges BitMEX and Coinbase, crypto service providers Crypto.com and Blockchain.com as well as NFT marketplace OpenSea.

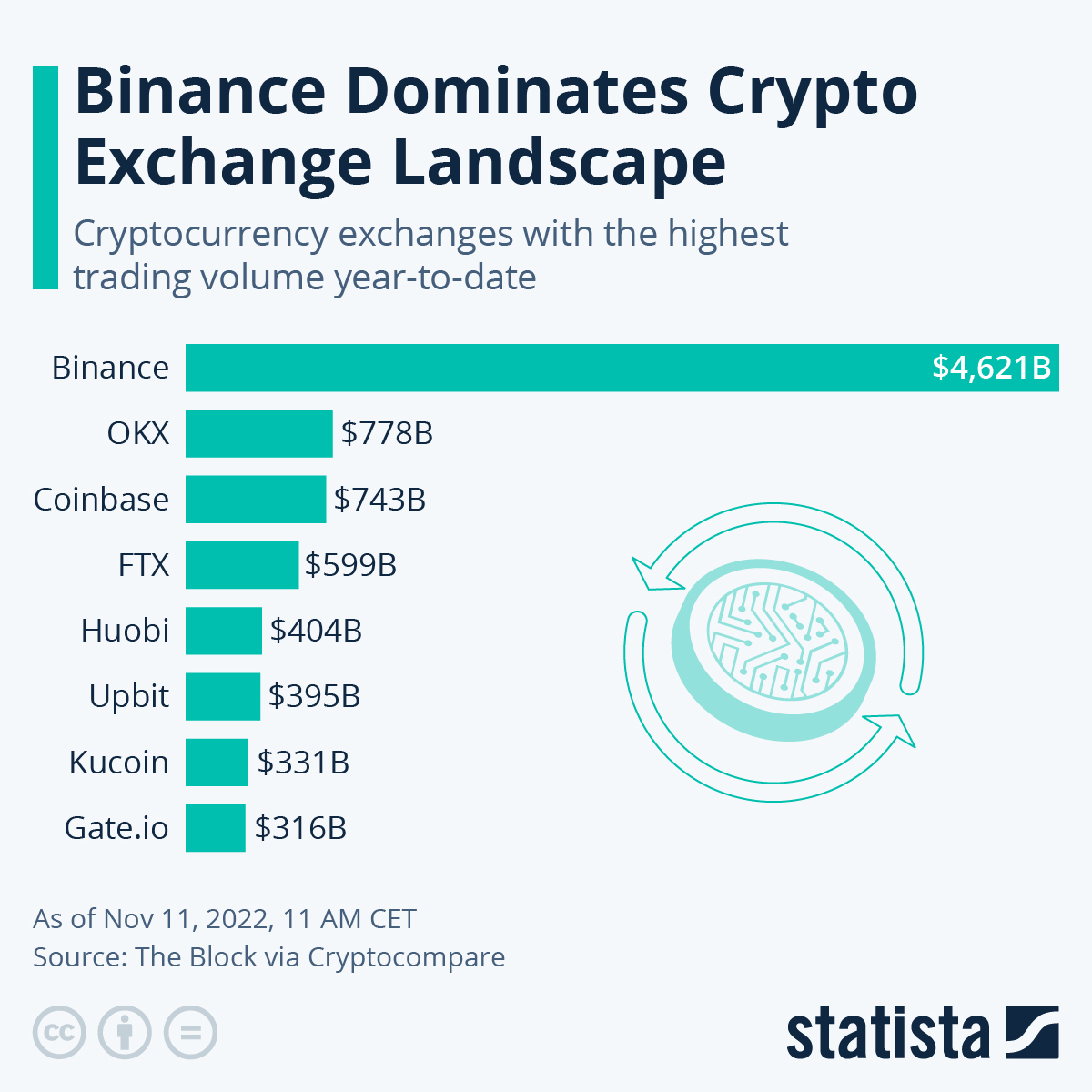

Now, 130 companies in the FTX Group owning the crypto exchange FTX have officially filed for bankruptcy due to a liquidity crunch caused by several factors. The chief reasons cited were increased user withdrawals starting November 6 and the revelation that Alameda Research, a company in the FTX Group, had a significant portion of its holdings in FTX's own FTT coin. Following this discovery, rival company Binance divested its FTT holdings, which caused the coin's value to fall drastically. According to now-resigned Chief Executive Sam Bankman-Fried, the company would have needed $9.4 billion to stave off collapse. As Statista's chart shows, the default of FTX could hurt a shaky-kneed crypto industry even further.

You will find more infographics at Statista

When looking at the year-to-date trading volume on the biggest crypto exchanges as aggregated by analysts at The Block, FTX ranks fourth behind Coinbase and OKX. No single exchange even comes close to Binance's trade volume though, with transactions amounting to $4.6 trillion between January and November 11. Its market leader position allowed Binance to be one of the first companies offering to bail out FTX, but the deal fell through as quickly as it was announced. "As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com", the company announced on Twitter on November 9.

FTX's scrambling to save its business and cryptocurrency valuations further careening downhill also caused U.S. lawmakers concern with calls for tighter regulations of crypto getting louder. "It is crucial that our financial watchdogs look into what led to FTX's collapse so we can fully understand the misconduct and abuses that took place," said Senate Banking Committee Chair Sherrod Brown. U.S. Senate Agriculture Committee chair Debbie Stabenow echoed that sentiment and added: "It is time for Congress to act. The Committee remains committed to advancing the Digital Commodities Consumer Protection Act to bring necessary safeguards to the digital commodities market."

CZ is the king of crypto...

Given the chart above, let's hope there's nothing afoot at Binance.

Despite crypto evangelists describing the current situation in the cryptocurrency market as just another dip, the phenomenon known as crypto winter has real and possibly lasting consequences for one of the more volatile finance sectors. As Statista’s Florian Zandt details below, since May 2022, 38 companies in the crypto industry have laid off employees, among them crypto exchanges BitMEX and Coinbase, crypto service providers Crypto.com and Blockchain.com as well as NFT marketplace OpenSea.

Now, 130 companies in the FTX Group owning the crypto exchange FTX have officially filed for bankruptcy due to a liquidity crunch caused by several factors. The chief reasons cited were increased user withdrawals starting November 6 and the revelation that Alameda Research, a company in the FTX Group, had a significant portion of its holdings in FTX’s own FTT coin. Following this discovery, rival company Binance divested its FTT holdings, which caused the coin’s value to fall drastically. According to now-resigned Chief Executive Sam Bankman-Fried, the company would have needed $9.4 billion to stave off collapse. As Statista’s chart shows, the default of FTX could hurt a shaky-kneed crypto industry even further.

You will find more infographics at Statista

When looking at the year-to-date trading volume on the biggest crypto exchanges as aggregated by analysts at The Block, FTX ranks fourth behind Coinbase and OKX. No single exchange even comes close to Binance’s trade volume though, with transactions amounting to $4.6 trillion between January and November 11. Its market leader position allowed Binance to be one of the first companies offering to bail out FTX, but the deal fell through as quickly as it was announced. “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com”, the company announced on Twitter on November 9.

FTX’s scrambling to save its business and cryptocurrency valuations further careening downhill also caused U.S. lawmakers concern with calls for tighter regulations of crypto getting louder. “It is crucial that our financial watchdogs look into what led to FTX’s collapse so we can fully understand the misconduct and abuses that took place,” said Senate Banking Committee Chair Sherrod Brown. U.S. Senate Agriculture Committee chair Debbie Stabenow echoed that sentiment and added: “It is time for Congress to act. The Committee remains committed to advancing the Digital Commodities Consumer Protection Act to bring necessary safeguards to the digital commodities market.”

CZ is the king of crypto…

Given the chart above, let’s hope there’s nothing afoot at Binance.