It's been a bad year for Wall Street predictions: actually scratch that, it's been absolutely terrible. Last November when bank after bank released their paperweight 100+ page forecasts for the year ahead (which weren't worth the cost of the paper they were printed on) the average year ahead forecast among Wall Street's firms was above 5,000 with a few exceptions: both Bank of America and Morgan Stanley were well below. As we noted exactly one year ago, Morgan Stanley forecast a "below-consensus forecast for the S&P 500 (4,400 by end-2022). That ‘bearish’ forecast is still a historically high multiple (18x) on an optimistic 2023 EPS number (US$245)." Considering that Goldman was pushing 5,100 and JPMorgan's permabulls led by mARKKo were somewhere in the mid-5000s, Morgan Stanley's Mike Wilson would end up looking positive like Nostradamus compared to all of the bank's ridiculous peers (only BofA's Michael Hartnett was even more accurate, read bearish).

Which is not to say that Morgan Stanley got everything right. On the contrary, as this tweet from one year ago show, the bank's economists were convinced the Fed would not hike at all in 2022. So much for "Team Transitory" after the fastest hiking cycle since Volcker.

Morgan Stanley: "Our economists see two drivers for no hikes in 2022 – falling core PCE inflation and rising labor force participation."

— zerohedge (@zerohedge) November 21, 2021

With that in mind, we will gladly skip anything JPM and Goldman have to say about the year ahead (or maybe we will just highlight it as a scenario that will definitely not happen), and instead will selectively cover what the bank's equity strategist Mike Wilson predicts will happen next year, if for no other reason than he has been unabashedly contrarian - and right for the most part - in 2022.

Ironically, unlike last year when Wilson's downbeat forecast stood out like a sore thumb, in his latest year-ahead preview titled "2023 US Equities Outlook: The Road Not Taken" (available to pro subs), this year even Wilson - who recently turned quite bullish and correctly predicted a few weeks ago that stocks would spike in the current tactical and technical bear market rally and rise as high as 4,150 before they stumble much lower - admits that his year ahead targets are "unexciting with a narrower range than normal", although - in taking a page out of the famous Robert Frost poem - he predicts that the path in 2023 "will not be as smooth. Investors will need to be more tactical and make choices with no regrets."

Here we will cut to the chase, and report upfront that Wilson's year-end 2023 forecast is not that far from where the market closed today. And while the bank does not expect much to change price-wise between now and Dec 31, 2023, it thinks that the way we get there will be quite a rollercoaster, to wit:

While our year end 2023 base case price target of 3,900 is roughly in line with where we're currently trading, it won't be a smooth ride. We remain highly convicted that 2023 bottom up consensus earnings are materially too high. On that score, we revise our '23 EPS forecast another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models. This leaves us 16% below consensus on '23 EPS in our base case and down 11% from a year-over-year growth standpoint. After what's left of this current tactical rally, we see the S&P 500 discounting the '23 earnings risk sometime in Q123 via a ~3,000-3,300 price trough.

We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be a strong rebound where positive operating leverage returns—i.e., the next boom. Equities should begin to process that growth reacceleration well in advance, and rebound sharply to finish the year at 3,900 in our base case.

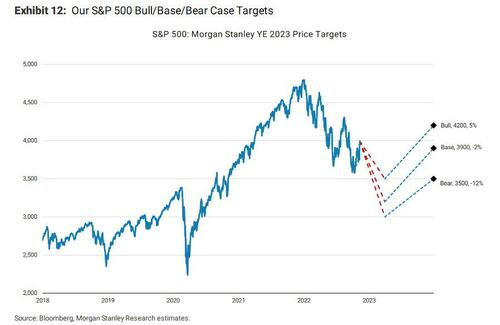

Bear/Base/Bull price skew: 3,500/3,900/4,200

So with the summary out of the way, let's take a closer look at Wilson's forecast starting with where the title comes from. Well, as the strategist explains "last year's Fire and Ice narrative worked so well we decided to dust off another Robert Frost jewel to describe this year's outlook with The Road Not Taken. As described by many literary experts, and Frost himself, the poem presents the dilemma we all face in life that different choices lead to different outcomes, and while the road taken can be a good one, these choices create doubt and even remorse about the road not taken – i.e., what if/could have been? For the year ahead, we think investors will need to be more tactical with their views on the economy, policy, earnings and valuation. This is because we are closer to the end of the cycle at this point, and that means the trends in these key variables can zig and zag before the final path is clear. In other words, while flexibility is always important to successful investing, it's critical now."

In contrast to what lies ahead, Wilson says that "the set-up was so poor a year ago that the trends in all of the variables mentioned above were headed lower, in our view" (although let's just pretend that MS economists did not predict that the first rate hike would take place in 2023). Under these conditions, he goes on, "the right choice/strategy was about managing and/or profiting from the new downtrend. After all, Fire and Ice, the poem, is not a debate about the destination – it's the end of the world. Instead, it's about what causes it and the path to that destination. In the case of our bear market call, it was a combination of both Fire AND Ice – inflation AND slowing growth, a generally toxic cocktail for stocks."

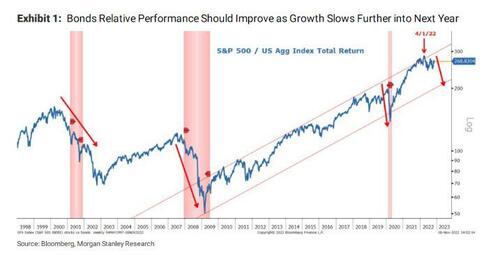

Of course, as it would later turn out, that cocktail proved to be just as bad for bonds, at least so far. However, as the Ice overtakes the Fire and inflation cools off, Wilson is becoming more confident that bonds should handily beat stocks in this final verse that has yet to fully play out .

That divergence, he notes, "can create new opportunities and confusion about the road we are on" and is why as we speculated in recent posts, Wilson has pivoted to a more bullish tactical view.

This sets up a convenient transition to Wilson's well-telegraphed near-term outlook where he maintains a "tactically bullish call" as we transition from Fire to Ice, "a window of opportunity when long-term interest rates typically fall prior to the magnitude of the slowdown being reflected in earnings estimates and the economy. This is the classic late cycle period between the Fed's last hike and the recession." It's also why BofA's Michael Hartnett correctly called for a post-Halloween rally and why this site has been pounding the table on the strong technicals that will drive the market until the fundamentals return with next month's Payrolls, CPI, and FOMC.

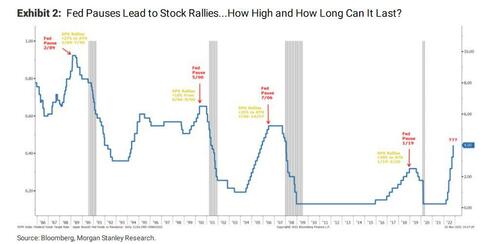

Historically, Wilson writes, this period is a profitable one for stocks as shown in the chart below, denoted by the double-digit rallies that follow the moment the Fed pauses as markets price in the inevitable rate cuts that follow.

What happens after this tactical rally however, is more tricky: three months ago, Wilson suggested the Fed's pause would coincide with the arrival of a recession this cycle given the extreme inflation dynamics. In short, the Fed would not pause until payrolls were negative, the unequivocal indicator of a recession (something which we believe may happen as soon as December, and considering the mass layoff announcements we have seen in recent days we are willing to double down on this forecast). Needless to say, the advent of a recession will make it too late to kick save the cycle or the downtrend for stocks. However, for now, the jobs market - as indicated by the highly politicized BLS - has remained "stronger for longer" even in the face of weakening earnings. And yes, there is a possibility that Biden has instructed the Department of Labor to maintain this charade, and the strong jobs numbers may persist into next year (just ignore the tens of thousands of highly-paid tech workers getting fired every day now), leaving the window open for a period when the Fed can slow/pause rate hikes before we get a negative payroll reading. That hope for a softish landing - in a nutshell - is what Wilson thinks is behind the current rally, and why he thinks it can push further "because we won't have evidence of the hard freeze for a few more months and markets can dream of a less hawkish Fed, lower rates and resilient earnings in the interim." Obviously in this context, last week's softer than expected CPI report was the critically necessary data point to fuel that dream.

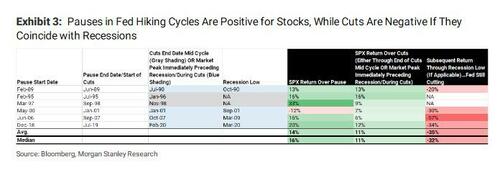

Here Wilson brings up an interesting nuance: while a pause (or semi pivot) is good for stocks, a full-blown pivot (i.e., rate cuts) is actually bad. In his own words:

... we want to remind readers that a pause is different than a cut. While some investors may think a cut is even better than a pause in rates, the evidence does not bear that out. Exhibit 3 shows that when the cuts coincide with a recession, it's not good for equities. So, while we think there is a window for stocks to run into year end as the markets dream of a pause, a Fed that is cutting is probably a bad sign that the recession has arrived (negative payrolls). This is especially true given the uniqueness of this cycle – i.e., higher than target inflation and fear of a resurgence means the Fed may pause, but won't cut rates before a recession arrives.

Needless to say, and as much as it will anger the permabears out there, so far the tactical rally call has played out to a tee. Interestingly, prior to last week's softer than expected CPI release, it's produced very bifurcated performance, with the Dow Industrials and small caps dominating the Nasdaq and S&P 500. However, that all changed last week when bonds moved higher (yields lower) on the softer CPI, a necessary development for the tactical long call to have another leg higher.

How far does the current rally go?

As Wilson discussed in last week's note, lower rate volatility was the key to the first leg of this rally which supported valuations and the more cyclical parts of the equity market initially. But in order to get the next leg of the tactical equity rally, Wilson argued rate levels would need to fall. Furthermore, this leg would be led by a catch up in Nasdaq/long duration growth stocks relative to the Dow Industrials and Russell 2000.

In short, the move lower in yields last week was the catalyst for even higher prices for the S&P 500, even from here. While the lower end of Wilson's prior target for this rally (4000-4150) was achieved on Friday when the S&P hit 4,000, the strategist thinks the upper end of that range will be reached, and he would even not rule out even higher prices should 10-year UST yields fall more precipitously – i.e., 3.25%.

That's the good news. The bad news is that once we do hit the bear market rally target, the bear market will resume with a vengeance. Here is Wilson:

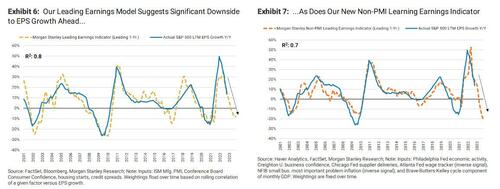

Unfortunately, we have more confidence today than we did a few months ago in our well below bottom-up consensus earnings forecasts for next year. In fact, we are cutting our estimates even further today, essentially moving to the bear case earnings scenario we first presented in early September. More specifically, Morgan Stanley's base case S&P EPS forecast for 2023 is now $195, down from $212, while its bear and bull case forecasts are $180 and $215, respectively. These forecasts are derived from our top down earnings leading indicators (Exhibit 6 and Exhibit 7).

To summarize the story so far: we have about 200 more points left in the bear market rally which rises to 4,200, followed by a 1000 points swoon to 3,200 over the near-to-mid term. What happens then?

Getting back to the narrative for the next 12 months, Wilson concedes that the path forward is much more uncertain than a year ago and likely to bring several twists and days/weeks of remorse for investors regretting they traded it differently – i.e., "The Road Not Taken." If one were to take Wilson's S&P bear/base/bull targets (3500/3900/4200) at face value, they might say it looks like he is expecting a generally boring year. However, as the strategist cautions, "nothing could be further from the truth. In fact, we would argue the past 12 months have been pretty boring because a bear market was so likely we simply set our defensive strategy and stayed with it –i.e., "boring can be beautiful."

Drilling down on Wilson's year-end price forecast matrix, he warns that while his year-end 2023 base case price target of 3,900 is roughly in line with where we're currently trading, it won't be a smooth ride. In short, he expects "a bust before a boom, and it comes down to earnings." Here's why:

Our highest conviction view across the board is that 2023 bottom up consensus earnings are materially too high. On that score, we revise our '23 EPS forecast another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models and increased conviction that margin pressure will be greater than appreciated. This leaves us 16% below consensus on '23 EPS in our base case and down 11% from a year-over-year growth standpoint. After what's left of this current tactical rally, we see the S&P 500 discounting the '23 earnings risk sometime in the first quarter of next year via a ~3,000-3,300 price trough. We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions. In other words, price leads earnings and it's not typical to put a trough multiple on trough earnings. We think that means the Q1 price low is marked by a 13.5-15X multiple on a forward EPS number of ~$220.

The good news for those who survive the coming rollercoaster is that while "2023 will be a very challenging year for earnings growth, 2024 should be the opposite—a rebound growth year where positive operating leverage resumes—i.e., the next boom." As such, Wilson believes that equities should begin to process that growth reacceleration well in advance, rebounding off a ~3,000-3,300 price trough in Q1 and finishing the year at 3,900 in his base case.

We conclude by presenting Wilson's three cases for year-end 2023: the base, the bull and the bear.

Base Case Price Target for Dec. '23: 3,900

In our 3,900 base case, the market puts a 16.1x P/E multiple on forward (2024) EPS of $241. This outcome represents a proper earnings recession (year-over-year EPS growth contracts by 11%). We see nominal top line growth slowing to low single digit territory (from low teens in ‘22). Meanwhile, margins do the heavy lifting to the downside as cost pressures remain stickier than slowing end demand and pricing. On that front, we see margins contracting by ~150 bps next year, taking the net margin time series back just below its 25-year trend line. We see the S&P 500 discounting this earnings risk sometime in the first quarter of next year in advance of the eventual trough in EPS which is typical for earnings recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be the opposite—a rebound growth year where positive operating leverage resumes. As such, equities should process that growth reacceleration well in advance, rebounding off a ~3,000-3,300 price trough in Q1 and finishing the year at ~3,900 in our base case.

Bull Case Price Target for Dec. '23: 4,200

In our 4,200 bull case, the market puts a 16.7x P/E multiple on forward (2024) EPS of $251. This outcome represents a disappointing EPS growth backdrop for ’23 but it’s more of a muddle through (-4% year-over-year EPS growth). The correction of cycle excesses is less pervasive and, as a result, the magnitude of the growth rebound in 2024 is less significant than it is in our base and bear cases. In this scenario, we see nominal top line growth slowing to positive mid single digit territory next year. Margins compress by ~100 bps, a less severe outcome than what we see in our base and bear cases. By the end of next year, the market is processing a healthy mid-teens EPS growth rebound in 2024, and the multiple expands to ~16.7x. Because our bull case presents the least attractive ’24 EPS growth profile as ’23 is more of a muddle through scenario, it also offers a less attractive upside price skew to our base and bear cases than we’ve typically forecasted. In this scenario, we don't expect new Q1 '23 price lows (i.e., we'd expect a retest of 3,500 but not a new low).

Bear Case Price Target for Dec. '23: 3,500

In our 3,500 bear case, the market puts a 15.3x P/E multiple on forward (2024) EPS of $230. This outcome represents a more severe earnings recession in ‘23 as compared to our base case (year-over-year EPS growth contracts by 16%). Margins do the heavy lifting to the downside which is typical even in more significant earnings recessions. On that score, we see margins contracting by ~200-225 bps next year. We think the S&P 500 discounts this earnings risk sometime in the first half of next year at a price level of ~3,000. As in our base case, the market can then look forward to a growth reacceleration in 2024, albeit from a lower price and $ EPS level

Much more in the full MS forecast available to pro subs.

It’s been a bad year for Wall Street predictions: actually scratch that, it’s been absolutely terrible. Last November when bank after bank released their paperweight 100+ page forecasts for the year ahead (which weren’t worth the cost of the paper they were printed on) the average year ahead forecast among Wall Street’s firms was above 5,000 with a few exceptions: both Bank of America and Morgan Stanley were well below. As we noted exactly one year ago, Morgan Stanley forecast a “below-consensus forecast for the S&P 500 (4,400 by end-2022). That ‘bearish’ forecast is still a historically high multiple (18x) on an optimistic 2023 EPS number (US$245).” Considering that Goldman was pushing 5,100 and JPMorgan’s permabulls led by mARKKo were somewhere in the mid-5000s, Morgan Stanley’s Mike Wilson would end up looking positive like Nostradamus compared to all of the bank’s ridiculous peers (only BofA’s Michael Hartnett was even more accurate, read bearish).

Which is not to say that Morgan Stanley got everything right. On the contrary, as this tweet from one year ago show, the bank’s economists were convinced the Fed would not hike at all in 2022. So much for “Team Transitory” after the fastest hiking cycle since Volcker.

Morgan Stanley: “Our economists see two drivers for no hikes in 2022 – falling core PCE inflation and rising labor force participation.”

— zerohedge (@zerohedge) November 21, 2021

With that in mind, we will gladly skip anything JPM and Goldman have to say about the year ahead (or maybe we will just highlight it as a scenario that will definitely not happen), and instead will selectively cover what the bank’s equity strategist Mike Wilson predicts will happen next year, if for no other reason than he has been unabashedly contrarian – and right for the most part – in 2022.

Ironically, unlike last year when Wilson’s downbeat forecast stood out like a sore thumb, in his latest year-ahead preview titled “2023 US Equities Outlook: The Road Not Taken” (available to pro subs), this year even Wilson – who recently turned quite bullish and correctly predicted a few weeks ago that stocks would spike in the current tactical and technical bear market rally and rise as high as 4,150 before they stumble much lower – admits that his year ahead targets are “unexciting with a narrower range than normal”, although – in taking a page out of the famous Robert Frost poem – he predicts that the path in 2023 “will not be as smooth. Investors will need to be more tactical and make choices with no regrets.”

Here we will cut to the chase, and report upfront that Wilson’s year-end 2023 forecast is not that far from where the market closed today. And while the bank does not expect much to change price-wise between now and Dec 31, 2023, it thinks that the way we get there will be quite a rollercoaster, to wit:

While our year end 2023 base case price target of 3,900 is roughly in line with where we’re currently trading, it won’t be a smooth ride. We remain highly convicted that 2023 bottom up consensus earnings are materially too high. On that score, we revise our ’23 EPS forecast another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models. This leaves us 16% below consensus on ’23 EPS in our base case and down 11% from a year-over-year growth standpoint. After what’s left of this current tactical rally, we see the S&P 500 discounting the ’23 earnings risk sometime in Q123 via a ~3,000-3,300 price trough.

We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be a strong rebound where positive operating leverage returns—i.e., the next boom. Equities should begin to process that growth reacceleration well in advance, and rebound sharply to finish the year at 3,900 in our base case.

Bear/Base/Bull price skew: 3,500/3,900/4,200

So with the summary out of the way, let’s take a closer look at Wilson’s forecast starting with where the title comes from. Well, as the strategist explains “last year’s Fire and Ice narrative worked so well we decided to dust off another Robert Frost jewel to describe this year’s outlook with The Road Not Taken. As described by many literary experts, and Frost himself, the poem presents the dilemma we all face in life that different choices lead to different outcomes, and while the road taken can be a good one, these choices create doubt and even remorse about the road not taken – i.e., what if/could have been? For the year ahead, we think investors will need to be more tactical with their views on the economy, policy, earnings and valuation. This is because we are closer to the end of the cycle at this point, and that means the trends in these key variables can zig and zag before the final path is clear. In other words, while flexibility is always important to successful investing, it’s critical now.”

In contrast to what lies ahead, Wilson says that “the set-up was so poor a year ago that the trends in all of the variables mentioned above were headed lower, in our view” (although let’s just pretend that MS economists did not predict that the first rate hike would take place in 2023). Under these conditions, he goes on, “the right choice/strategy was about managing and/or profiting from the new downtrend. After all, Fire and Ice, the poem, is not a debate about the destination – it’s the end of the world. Instead, it’s about what causes it and the path to that destination. In the case of our bear market call, it was a combination of both Fire AND Ice – inflation AND slowing growth, a generally toxic cocktail for stocks.”

Of course, as it would later turn out, that cocktail proved to be just as bad for bonds, at least so far. However, as the Ice overtakes the Fire and inflation cools off, Wilson is becoming more confident that bonds should handily beat stocks in this final verse that has yet to fully play out .

That divergence, he notes, “can create new opportunities and confusion about the road we are on” and is why as we speculated in recent posts, Wilson has pivoted to a more bullish tactical view.

This sets up a convenient transition to Wilson’s well-telegraphed near-term outlook where he maintains a “tactically bullish call” as we transition from Fire to Ice, “a window of opportunity when long-term interest rates typically fall prior to the magnitude of the slowdown being reflected in earnings estimates and the economy. This is the classic late cycle period between the Fed’s last hike and the recession.” It’s also why BofA’s Michael Hartnett correctly called for a post-Halloween rally and why this site has been pounding the table on the strong technicals that will drive the market until the fundamentals return with next month’s Payrolls, CPI, and FOMC.

Historically, Wilson writes, this period is a profitable one for stocks as shown in the chart below, denoted by the double-digit rallies that follow the moment the Fed pauses as markets price in the inevitable rate cuts that follow.

What happens after this tactical rally however, is more tricky: three months ago, Wilson suggested the Fed’s pause would coincide with the arrival of a recession this cycle given the extreme inflation dynamics. In short, the Fed would not pause until payrolls were negative, the unequivocal indicator of a recession (something which we believe may happen as soon as December, and considering the mass layoff announcements we have seen in recent days we are willing to double down on this forecast). Needless to say, the advent of a recession will make it too late to kick save the cycle or the downtrend for stocks. However, for now, the jobs market – as indicated by the highly politicized BLS – has remained “stronger for longer” even in the face of weakening earnings. And yes, there is a possibility that Biden has instructed the Department of Labor to maintain this charade, and the strong jobs numbers may persist into next year (just ignore the tens of thousands of highly-paid tech workers getting fired every day now), leaving the window open for a period when the Fed can slow/pause rate hikes before we get a negative payroll reading. That hope for a softish landing – in a nutshell – is what Wilson thinks is behind the current rally, and why he thinks it can push further “because we won’t have evidence of the hard freeze for a few more months and markets can dream of a less hawkish Fed, lower rates and resilient earnings in the interim.” Obviously in this context, last week’s softer than expected CPI report was the critically necessary data point to fuel that dream.

Here Wilson brings up an interesting nuance: while a pause (or semi pivot) is good for stocks, a full-blown pivot (i.e., rate cuts) is actually bad. In his own words:

… we want to remind readers that a pause is different than a cut. While some investors may think a cut is even better than a pause in rates, the evidence does not bear that out. Exhibit 3 shows that when the cuts coincide with a recession, it’s not good for equities. So, while we think there is a window for stocks to run into year end as the markets dream of a pause, a Fed that is cutting is probably a bad sign that the recession has arrived (negative payrolls). This is especially true given the uniqueness of this cycle – i.e., higher than target inflation and fear of a resurgence means the Fed may pause, but won’t cut rates before a recession arrives.

Needless to say, and as much as it will anger the permabears out there, so far the tactical rally call has played out to a tee. Interestingly, prior to last week’s softer than expected CPI release, it’s produced very bifurcated performance, with the Dow Industrials and small caps dominating the Nasdaq and S&P 500. However, that all changed last week when bonds moved higher (yields lower) on the softer CPI, a necessary development for the tactical long call to have another leg higher.

How far does the current rally go?

As Wilson discussed in last week’s note, lower rate volatility was the key to the first leg of this rally which supported valuations and the more cyclical parts of the equity market initially. But in order to get the next leg of the tactical equity rally, Wilson argued rate levels would need to fall. Furthermore, this leg would be led by a catch up in Nasdaq/long duration growth stocks relative to the Dow Industrials and Russell 2000.

In short, the move lower in yields last week was the catalyst for even higher prices for the S&P 500, even from here. While the lower end of Wilson’s prior target for this rally (4000-4150) was achieved on Friday when the S&P hit 4,000, the strategist thinks the upper end of that range will be reached, and he would even not rule out even higher prices should 10-year UST yields fall more precipitously – i.e., 3.25%.

That’s the good news. The bad news is that once we do hit the bear market rally target, the bear market will resume with a vengeance. Here is Wilson:

Unfortunately, we have more confidence today than we did a few months ago in our well below bottom-up consensus earnings forecasts for next year. In fact, we are cutting our estimates even further today, essentially moving to the bear case earnings scenario we first presented in early September. More specifically, Morgan Stanley’s base case S&P EPS forecast for 2023 is now $195, down from $212, while its bear and bull case forecasts are $180 and $215, respectively. These forecasts are derived from our top down earnings leading indicators (Exhibit 6 and Exhibit 7).

To summarize the story so far: we have about 200 more points left in the bear market rally which rises to 4,200, followed by a 1000 points swoon to 3,200 over the near-to-mid term. What happens then?

Getting back to the narrative for the next 12 months, Wilson concedes that the path forward is much more uncertain than a year ago and likely to bring several twists and days/weeks of remorse for investors regretting they traded it differently – i.e., “The Road Not Taken.” If one were to take Wilson’s S&P bear/base/bull targets (3500/3900/4200) at face value, they might say it looks like he is expecting a generally boring year. However, as the strategist cautions, “nothing could be further from the truth. In fact, we would argue the past 12 months have been pretty boring because a bear market was so likely we simply set our defensive strategy and stayed with it –i.e., “boring can be beautiful.”

Drilling down on Wilson’s year-end price forecast matrix, he warns that while his year-end 2023 base case price target of 3,900 is roughly in line with where we’re currently trading, it won’t be a smooth ride. In short, he expects “a bust before a boom, and it comes down to earnings.” Here’s why:

Our highest conviction view across the board is that 2023 bottom up consensus earnings are materially too high. On that score, we revise our ’23 EPS forecast another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models and increased conviction that margin pressure will be greater than appreciated. This leaves us 16% below consensus on ’23 EPS in our base case and down 11% from a year-over-year growth standpoint. After what’s left of this current tactical rally, we see the S&P 500 discounting the ’23 earnings risk sometime in the first quarter of next year via a ~3,000-3,300 price trough. We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions. In other words, price leads earnings and it’s not typical to put a trough multiple on trough earnings. We think that means the Q1 price low is marked by a 13.5-15X multiple on a forward EPS number of ~$220.

The good news for those who survive the coming rollercoaster is that while “2023 will be a very challenging year for earnings growth, 2024 should be the opposite—a rebound growth year where positive operating leverage resumes—i.e., the next boom.” As such, Wilson believes that equities should begin to process that growth reacceleration well in advance, rebounding off a ~3,000-3,300 price trough in Q1 and finishing the year at 3,900 in his base case.

We conclude by presenting Wilson’s three cases for year-end 2023: the base, the bull and the bear.

Base Case Price Target for Dec. ’23: 3,900

In our 3,900 base case, the market puts a 16.1x P/E multiple on forward (2024) EPS of $241. This outcome represents a proper earnings recession (year-over-year EPS growth contracts by 11%). We see nominal top line growth slowing to low single digit territory (from low teens in ‘22). Meanwhile, margins do the heavy lifting to the downside as cost pressures remain stickier than slowing end demand and pricing. On that front, we see margins contracting by ~150 bps next year, taking the net margin time series back just below its 25-year trend line. We see the S&P 500 discounting this earnings risk sometime in the first quarter of next year in advance of the eventual trough in EPS which is typical for earnings recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be the opposite—a rebound growth year where positive operating leverage resumes. As such, equities should process that growth reacceleration well in advance, rebounding off a ~3,000-3,300 price trough in Q1 and finishing the year at ~3,900 in our base case.

Bull Case Price Target for Dec. ’23: 4,200

In our 4,200 bull case, the market puts a 16.7x P/E multiple on forward (2024) EPS of $251. This outcome represents a disappointing EPS growth backdrop for ’23 but it’s more of a muddle through (-4% year-over-year EPS growth). The correction of cycle excesses is less pervasive and, as a result, the magnitude of the growth rebound in 2024 is less significant than it is in our base and bear cases. In this scenario, we see nominal top line growth slowing to positive mid single digit territory next year. Margins compress by ~100 bps, a less severe outcome than what we see in our base and bear cases. By the end of next year, the market is processing a healthy mid-teens EPS growth rebound in 2024, and the multiple expands to ~16.7x. Because our bull case presents the least attractive ’24 EPS growth profile as ’23 is more of a muddle through scenario, it also offers a less attractive upside price skew to our base and bear cases than we’ve typically forecasted. In this scenario, we don’t expect new Q1 ’23 price lows (i.e., we’d expect a retest of 3,500 but not a new low).

Bear Case Price Target for Dec. ’23: 3,500

In our 3,500 bear case, the market puts a 15.3x P/E multiple on forward (2024) EPS of $230. This outcome represents a more severe earnings recession in ‘23 as compared to our base case (year-over-year EPS growth contracts by 16%). Margins do the heavy lifting to the downside which is typical even in more significant earnings recessions. On that score, we see margins contracting by ~200-225 bps next year. We think the S&P 500 discounts this earnings risk sometime in the first half of next year at a price level of ~3,000. As in our base case, the market can then look forward to a growth reacceleration in 2024, albeit from a lower price and $ EPS level

Much more in the full MS forecast available to pro subs.