First it was Deutsche Bank, then Bank of America; and while Goldman is still shoving its head in the sand and pretending that somehow a recession can be averted and the Fed can magically spawn a soft landing and that the Fed won't cut in 2023 (with the bank predicting back in October 2021 that the Fed wouldn't hike until Q3 2023) ...

... overnight even the largest and most bullish US bank has - after months of denial and deflection - capitulated and made a 2023 recession its base case.

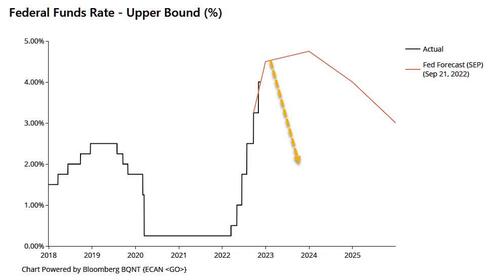

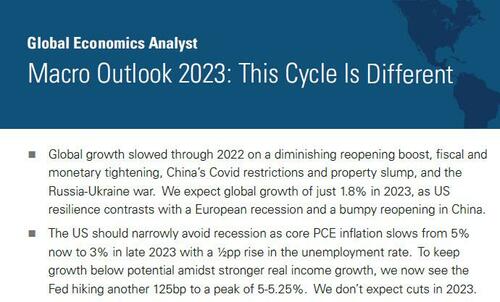

In a note from JPM's top economist Michael Feroli and Daniel Silver, the duo write that with JPMorgan still expecting the FOMC to tighten another 100bp: (50bp in December and 25 by in both February and March), the almost 500bps of expected cumulative hikes is already delivering a commensurate tightening of financial conditions which JPMorgan believes "will tip the economy into mild recession later next year." It wasn't clear what JPM thought would happen if the Fed hikes to the 7% which 2023 Fed non-voter Bullard hinted yesterday, but it certainly would not be "mild" and it almost certainly would be a "depression" (of course, Democrats would never let that happen and will intervene long before we get anywhere close).

We won't bore you with the note's details (pro subs can get it in the usual place), so we'll just excerpt from the punchline:

"No postwar expansion died of old age. They were all murdered by the Fed." Since the late Rudiger Dornbusch reportedly said that, we have had the 'post-modern' recessions of '01 and '08 that were more associated with asset price froth than aggressive Fed actions, and we also had the brief (but severe) COVID-19 downturn, for which it's hard to blame the Fed.

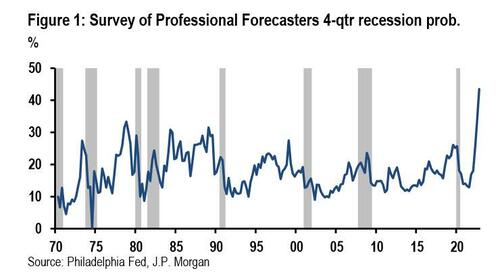

But those subsequent caveats notwithstanding, most postwar expansions were indeed done in by Fed tightening. And the Fed is currently tightening as rapidly as it has ever done, and we now believe it will deliver another 100bp of hikes before going on hold next spring. So it makes sense that forecasters are more convinced than they have ever been of a recession over the next year

Why not a soft landing? Feroli explains (Goldman, are you listening?):

It would be nice to think the Fed could gently nudge the unemployment rate up 0.5-1.0%-pt to restore labor market balance, but the cyclical behavior of the unemployment rate exhibits both asymmetries and non-linearities. As former Fed Vice Chair Kohn used to say, "the unemployment rate goes down by the escalator and up by the elevator." Consistent with this, we also expect slowing aggregate demand eventually leading to labor market weakness that builds on itself, and we anticipate that we could lose over a million jobs by the middle of '24. We also believe that this labor market weakness will convince the Fed that it has generated enough disinflationary impetus that it can start to ease policy toward a more neutral posture.

Of course, the question is when and according to someone who just put a few million where his mouth is, the Fed will make that conclusion some time in early/mid 2023.

And while one can mock JPM for predicting merely a "mild" recession, the bank at least puts in the effort to counter the possibility of being wrong:

So why don't we have a deeper downturn penciled into our outlook? If we do have a downturn next year, it will be the most well-telegraphed recession in modern memory. That fact alone should change the nature of the slowdown. When businesses and households expect good times to last they take on leverage and spend freely, particularly for durables. But as attested to by the Fed's recent Financial Stability Report, you have to squint to see signs of financial excess right now. And after its post-pandemic normalization, the net spending share on durables and structures has flattened off below its historical mean. Like Nineveh's response to Jonah's prophecy, the people have taken heed of what forecasters are saying and are beginning to change their behavior in ways that affect the forecasted outcome.

This thinking is similar to both the Austrian and Pigouvian theories of the business cycle: expansions end when optimistic expectations meet a less optimistic reality. The more conventional thinking, and the one both we and Dornbusch ascribe to, is that expansions end when the Fed takes away the punch bowl. Even so, these other schools of thought can provide useful insight into the nature of any prospective downturn..

More in the full note available to pro subs.

First it was Deutsche Bank, then Bank of America; and while Goldman is still shoving its head in the sand and pretending that somehow a recession can be averted and the Fed can magically spawn a soft landing and that the Fed won’t cut in 2023 (with the bank predicting back in October 2021 that the Fed wouldn’t hike until Q3 2023) …

… overnight even the largest and most bullish US bank has – after months of denial and deflection – capitulated and made a 2023 recession its base case.

In a note from JPM’s top economist Michael Feroli and Daniel Silver, the duo write that with JPMorgan still expecting the FOMC to tighten another 100bp: (50bp in December and 25 by in both February and March), the almost 500bps of expected cumulative hikes is already delivering a commensurate tightening of financial conditions which JPMorgan believes “will tip the economy into mild recession later next year.” It wasn’t clear what JPM thought would happen if the Fed hikes to the 7% which 2023 Fed non-voter Bullard hinted yesterday, but it certainly would not be “mild” and it almost certainly would be a “depression” (of course, Democrats would never let that happen and will intervene long before we get anywhere close).

We won’t bore you with the note’s details (pro subs can get it in the usual place), so we’ll just excerpt from the punchline:

“No postwar expansion died of old age. They were all murdered by the Fed.” Since the late Rudiger Dornbusch reportedly said that, we have had the ‘post-modern’ recessions of ’01 and ’08 that were more associated with asset price froth than aggressive Fed actions, and we also had the brief (but severe) COVID-19 downturn, for which it’s hard to blame the Fed.

But those subsequent caveats notwithstanding, most postwar expansions were indeed done in by Fed tightening. And the Fed is currently tightening as rapidly as it has ever done, and we now believe it will deliver another 100bp of hikes before going on hold next spring. So it makes sense that forecasters are more convinced than they have ever been of a recession over the next year

Why not a soft landing? Feroli explains (Goldman, are you listening?):

It would be nice to think the Fed could gently nudge the unemployment rate up 0.5-1.0%-pt to restore labor market balance, but the cyclical behavior of the unemployment rate exhibits both asymmetries and non-linearities. As former Fed Vice Chair Kohn used to say, “the unemployment rate goes down by the escalator and up by the elevator.” Consistent with this, we also expect slowing aggregate demand eventually leading to labor market weakness that builds on itself, and we anticipate that we could lose over a million jobs by the middle of ’24. We also believe that this labor market weakness will convince the Fed that it has generated enough disinflationary impetus that it can start to ease policy toward a more neutral posture.

Of course, the question is when and according to someone who just put a few million where his mouth is, the Fed will make that conclusion some time in early/mid 2023.

And while one can mock JPM for predicting merely a “mild” recession, the bank at least puts in the effort to counter the possibility of being wrong:

So why don’t we have a deeper downturn penciled into our outlook? If we do have a downturn next year, it will be the most well-telegraphed recession in modern memory. That fact alone should change the nature of the slowdown. When businesses and households expect good times to last they take on leverage and spend freely, particularly for durables. But as attested to by the Fed’s recent Financial Stability Report, you have to squint to see signs of financial excess right now. And after its post-pandemic normalization, the net spending share on durables and structures has flattened off below its historical mean. Like Nineveh’s response to Jonah’s prophecy, the people have taken heed of what forecasters are saying and are beginning to change their behavior in ways that affect the forecasted outcome.

This thinking is similar to both the Austrian and Pigouvian theories of the business cycle: expansions end when optimistic expectations meet a less optimistic reality. The more conventional thinking, and the one both we and Dornbusch ascribe to, is that expansions end when the Fed takes away the punch bowl. Even so, these other schools of thought can provide useful insight into the nature of any prospective downturn..

More in the full note available to pro subs.