The Tesla fairy tale looks like it could be coming to an end for some that rode it up over the last several years...

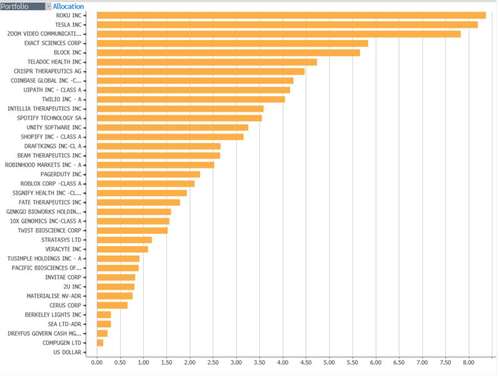

No sooner have both Wedbush and Morgan Stanley soured on Tesla than Cathie Wood's ARKK ETF has dropped the electric vehicle company led by Elon Musk as the fund's top holding.

For the first time in roughly four and a half years, Tesla is no longer the largest holding in Wood's flagship "Innovation" fund.

Tesla had been the largest holding in the fund by value since 2017, Bloomberg noted this week. On Thursday, the top spot was captured by Roku. ARKK held $717 million worth of Roku versus $703 million in Tesla.

ARKK has been selling Tesla for "at least" four quarters in a row, Bloomberg noted. It owns 1.59 million shares, down from 5.79 million a year prior.

Recall, ARKK had its worst ever month in April, we noted last month. ARKK had fallen almost 70% from its all time highs at the time in a plunge that Bloomberg called a "dramatic change in fortunes for Wood" last month.

At the end of April, only one of the fund's 37 holdings - Signify Health - was green for the year.

Russ Mould, investment director at AJ Bell, said last month: “The debate about whether Cathie Wood just rides beta up and beta down, or is genuinely capable of providing alpha, will continue to rage."

The Tesla fairy tale looks like it could be coming to an end for some that rode it up over the last several years…

No sooner have both Wedbush and Morgan Stanley soured on Tesla than Cathie Wood’s ARKK ETF has dropped the electric vehicle company led by Elon Musk as the fund’s top holding.

For the first time in roughly four and a half years, Tesla is no longer the largest holding in Wood’s flagship “Innovation” fund.

Tesla had been the largest holding in the fund by value since 2017, Bloomberg noted this week. On Thursday, the top spot was captured by Roku. ARKK held $717 million worth of Roku versus $703 million in Tesla.

ARKK has been selling Tesla for “at least” four quarters in a row, Bloomberg noted. It owns 1.59 million shares, down from 5.79 million a year prior.

Recall, ARKK had its worst ever month in April, we noted last month. ARKK had fallen almost 70% from its all time highs at the time in a plunge that Bloomberg called a “dramatic change in fortunes for Wood” last month.

At the end of April, only one of the fund’s 37 holdings – Signify Health – was green for the year.

Russ Mould, investment director at AJ Bell, said last month: “The debate about whether Cathie Wood just rides beta up and beta down, or is genuinely capable of providing alpha, will continue to rage.”