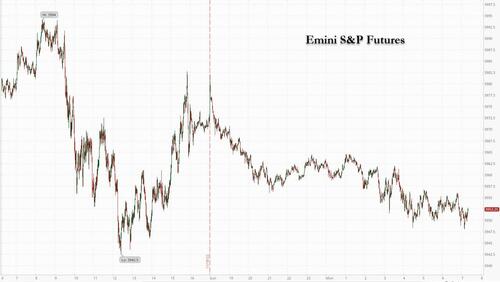

After opening modestly in the green, US equity futures have drifted steadily lower all session and were last trading near their Monday lows as concerns that China may tighten Covid curbs after China reported its first Covid-related death in almost six months and a city near Beijing rumored to be a test case for dropping all curbs enforced a slew of restrictions all weighed on growth in the world’s second-largest economy, as well as the ongoing carnage in the crypto space. At 7:30am ET, S&P futures were down 0.5% to 3,953 while Nasdaq 100 futures slumped 0.9% to session lows, below 11,600. The dollar stormed higher as investors sought shelter in the dollar; 10Y yields rose to 3.83%, while bitcoin traded around $16,000 after dumping over the weekend. Oil dipped but rebounded from session lows on concern of a weakening demand outlook from China and following a $10 price target cut to $100 for Q4 2022 from Goldman overnight.

US-listed Chinese stocks including Alibaba, Baidu and JD.com fell in US premarket trading after China saw its first Covid-related death in almost six months, sparking concern that Beijing could see a return of heightened restrictions on schools, restaurants and shops amid a continuing outbreak in the capital. Worsening outbreaks across the nation are stoking concerns that authorities may again resort to harsh restrictions. A city near Beijing that was rumored to be a test case for the ending of virus restrictions has suspended schools, locked down universities and asked residents to stay at home for five days.

Elsewhere in premarket moves, Walt Disney shares soared 8% after the firm fired embattled CEO Bob Iger and brought back former leader Bob Iger as chief executive officer, a surprise capitulation by the board after a string of disappointing results.

- Cryptocurrency-related stocks declined after the price of Bitcoin retreated amid worries over contagion from the downfall of Sam Bankman-Fried’s FTX empire. Shares in Riot Blockchain -4.5%, Marathon Digital -3.1%, Coinbase -4.6%.

- Squarespace shares gained 2.2% after being upgraded to overweight from neutral at Piper Sandler, which identifies the website- building and hosting company as having the lowest risk to its 2023 numbers among e-commerce stocks.

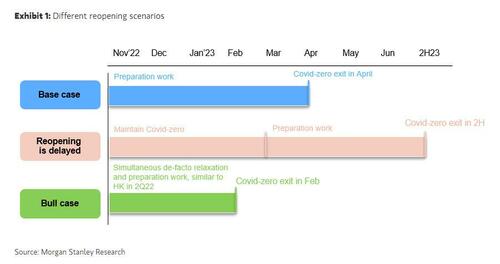

"Markets got their hopes up that the Chinese government might loosen its Covid policy, but despite the slowing economy, there is little chance of that," said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “This is going to be bad for commodity-related stocks as well as luxury companies and other exporters to China.” However, others like Morgan Stanley, remain hopeful and expect that China will end Covid zero in a few months; in its base case the bank sees China reopening by April as shown below.

"Financial markets have caught a cold amid worries that mounting Covid cases in China and a fresh tightening of restrictions will send a fresh shiver through manufacturing output and push down demand for raw materials," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

As Bloomberg notes, trading will be slow this week, with the US market closed Thursday for the Thanksgiving holiday and open for a half day on Friday. Meanwhile, Goldman strategists warned that the bear market had more room to run and that stocks were likely to see more declines and lower valuations in 2023. "The conditions that are typically consistent with an equity trough have not yet been reached,” strategists including Peter Oppenheimer and Sharon Bell wrote in a note on Monday. They said that a peak in interest rates and lower valuations reflecting recession are necessary before any sustained stock-market recovery can happen.

After a sharp rally fueled by signs of cooling inflation, US stocks were subdued last week as Federal Reserve officials indicated they need to see a meaningful slowdown in prices before reducing the pace of their interest rate increases. The big event for the market this week comes Wednesday, when the central bank releases minutes from its latest policy meeting, possibly providing clues on when it will shift to less-aggressive rate hikes.

In Europe, the Stoxx 50 index fell 0.5%, with the IBEX outperforming peers, adding 0.4%, while FTSE MIB lags, dropping 1%. Miners, tech and chemicals are the worst-performing sectors. Here are the notable European movers:

- Virgin Money UK shares rose as much 16%, the most in two years, after the British lender announced an extension of its share buyback program and reported earnings that analysts said could prompt upgrades in profit forecasts.

- Ipsen rose as much as 4.5%, to the highest since April, after JPMorgan said the stock may get a boost from clinical trial data on its Onivyde and elafibranor drugs in 2023.

- Rheinmetall shares jumped as much as 3.7% after Deutsche Bank upgraded the defense and automotive company to buy from hold and Berenberg raised its PT on the stock.

- Diploma shares gained as much as 3.3% after the seals and components distributor reported full-year revenue that beat analyst estimates.

- Next and Boohoo fell after they were both downgraded to hold from buy at Panmure. The broker cited inventory challenges for UK apparel retailers more broadly as demand has fallen in the UK clothing market since early October. Next fell as much as 1.9% while Boohoo dropped 7%; M&S and Asos also fell.

- Shares in Vallourec dropped as much as 13% in Paris trading after the steel and alloy tubing group announced third- quarter results that fell short of analyst expectations.

- Shares in IT services firm Bechtle fell as much as 5.4% after Exane downgraded the stock to neutral, citing concern about how margins will be affected by wage inflation and cost increases.

- SGS shares fell as much as 3.6%. The testing and inspection firm was cut to underweight from neutral at JPMorgan, with the broker saying shares look “mispriced.”

Earlier in the session, Asian stocks also declined, with Hong Kong leading losses, as investors assessed the outlook for China’s reopening while continuing to monitor the Federal Reserve’s policy trajectory. The MSCI Asia Pacific Index dropped as much as 1.2%. Chinese technology stocks were the biggest drags on the gauge, also driving the Hang Seng Index down almost 2%, after fresh reports of Covid deaths and lockdowns in China. Malaysian shares pared losses as a deadline for party leaders to name a prime minister was extended after Saturday’s election produced the country’s first-ever hung parliament. Benchmarks across Asia Pacific also fell, while the dollar strengthened, as Federal Reserve Bank of Boston President Susan Collins reiterated the likelihood of large US interest-rate hikes, with the outlook for inflation still uncertain. US stocks had risen recently on hopes for a slower pace of tightening. “After the recent good US consumer and producer price inflation reports, it was easy to conclude that there are much better times ahead in the asset markets,” said Gary Dugan, chief executive officer at the Global CIO Office in a note. “It just won’t be that easy.” Asian stocks had been rebounding as well, gaining as much as 15% from a trough in October, helped also by hopes for reduced restrictions in China. The advance started to falter last week amid lingering doubts over China’s reopening and US rate policy

India’s major stock indexes posted their biggest decline in more than a month, tracking weaker global markets and as shares of Reliance Industries and index-heavy software makers slipped. The S&P BSE Sensex closed 0.8% lower at 61,144.84 in Mumbai, while the NSE Nifty 50 Index eased by an equal measure. Both indexes posted their biggest single-day slump since Oct. 11, with the Sensex now trading 1.3% off its recent peak. Global stocks fell amid concern that China may tighten Covid curbs after a string of reported deaths. Worsening outbreaks across the nation are stoking concerns that authorities may again resort to harsh restrictions. All but two of the 19 sector sub-gauges compiled by BSE Ltd. traded lower, led by information technology companies.

In FX, the dollar gained as fears of a return to stricter Covid containment measures in China boosted demand for havens. The Bloomberg dollar spot index rises 0.7%. CHF and CAD are the strongest performers in G-10 FX, SEK and JPY underperform.

- The yen plunged by more than 1% dropping as low as 142 per dollar. The Japanese currency held up well throughout most of the Asian session, but began a steep slide shortly before European session began.

- The euro fell by as much as 1% versus the dollar, the biggest slide this month, to touch $1.0226. The Australian dollar and Swedish krona were also among the worst performers It’s not unusual for implied volatility to trail realized in the currency market, especially at times when key risk events like central bank policy meetings are far ahead on the calendar. When it comes to the euro-dollar pair, options are underpriced across the curve, with striking moves on the one- and six-month tenors

- New Zealand dollar short-dated FX option volatility advanced as pricing for a 75- basis-point hike in the official cash rate holds at 60%, two days out from the decision

In rates, Treasuries were mixed with the belly of the curve underperforming, cheapening 2s5s30s fly by 3.2bp on the day. Wider losses were seen across gilts where the front-end underperforms. Treasury yields were cheaper by 0.5bp across belly and richer by 1.5bp across long-end of the curve, flattening 5s30s spread by 1.5bp on the day -- reaching as low as -10.9bp and tightest since Nov. 7. The US 10-year yields around 3.825% and slightly richer on the day; gilts lag by additional 1.5bp in the sector. US session focus includes double auction event for 2- and 5-year notes while Daly is expected to speak in the afternoon. The gilts curve bear-flattens with 2s10s narrowing 2.3bps, while the Bund curve bear-steepens. Peripheral spreads are mixed to Germany; Italy widens, Spain and Portugal tighten.

In commodities, WTI and Brent are lower by around USD 0.50/bbl or 0.50% on the session, but have lifted from earlier lows and as such are some way from Friday's base. The crude complex was weighed by China's COVID controls, with a stronger US dollar also impacting and adding to the broader complex's woes. Goldman Sachs cut its Q4 Brent oil outlook by USD 10/bbl to $100/bbl due to China COVID concerns, while it sees elevated oil flows from China ahead of EU curbs and a price cap; $ forecasts Brent to recovery to USD 110/bbl in 2023, expects oil demand to increase at an above trend rate of circa. 1.6mln BPD in 2023. Spot gold/silver are unable to glean any haven-related upside in wake of the USDs strength, with the yellow metal over $10/oz below the USD 1751/oz 10-DMA despite briefly surpassing the figure overnight; base metals similar dented.

Cryptocurrency prices struggled in the ongoing crisis sparked by the downfall of Sam Bankman-Fried’s once powerful FTX empire. Crypto-exposed stocks fell.

It's a quiet start to the holiday-shortened week, with just the October Chicago Fed national activity index due at 830am. We get earnings from Zoom; On the Fed speaker slate, Fed's Daly talks on price stability.

Market Snapshot

- S&P 500 futures down 0.6% to 3,950.25

- STOXX Europe 600 down 0.2% to 432.60

- MXAP down 1.2% to 150.77

- MXAPJ down 1.4% to 487.13

- Nikkei up 0.2% to 27,944.79

- Topix up 0.3% to 1,972.57

- Hang Seng Index down 1.9% to 17,655.91

- Shanghai Composite down 0.4% to 3,085.04

- Sensex down 0.9% to 61,121.88

- Australia S&P/ASX 200 down 0.2% to 7,139.25

- Kospi down 1.0% to 2,419.50

- German 10Y yield up 1% to 2.03%

- Euro down 0.9% to $1.0230

- Brent Futures down 0.7% to $86.97/bbl

- Gold spot down 0.6% to $1,739.61

- U.S. Dollar Index up 0.86% to 107.85

Top Overnight News from Bloomberg

- Asset managers are turning ever more bearish on the dollar amid bets that the Federal Reserve may be approaching the peak of its interest-rate hike cycle

- Investors are slowly coming to terms with the sheer size of the UK government’s borrowing needs over the next few years and it doesn’t look pretty

- The PBOC net drained 2b yuan ($421m) via its open-market operations on Monday for the first time since Nov. 9, as a selloff in government and corporate bonds eased

- China’s financial regulators have asked banks to stabilize lending to property developers and construction firms, the latest effort by policymakers to turn around the real-estate crisis and bolster economic growth

- More than two years of growth-squelching policies sent international investors fleeing China. It’s taken all of two weeks to lure them back

- Sam Bankman-Fried’s bankrupt crypto empire owes its 50 biggest unsecured creditors a total of $3.1 billion, new court papers show, with a pair of customers owed more than $200 million each

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the week mostly lower amid headwinds from China after several areas announced fresh virus restrictions including lockdowns and the country also reported its first COVID-19 deaths in about six months. ASX 200 was constrained by underperformance in the mining-related sectors amid a decline in commodity prices and with BHP shares pressured amid reports its chairman is considering retiring next year. Nikkei 225 lacked direction amid further political tremors in the Kishida government after Internal Affairs Minister Terada resigned due to involvement in a funding scandal and was the third cabinet member to step down in under a month. KOSPI declined amid geopolitical concerns after North Korea's recent missile launches and with sentiment subdued as data for the first 20 days of November showed exports fell 16.7% Y/Y and imports fell 5.5% Y/Y. Hang Seng and Shanghai Comp suffered losses due to the worsening COVID situation in the mainland, while the Hong Kong benchmark was the worst hit with the special administrative region said to be near to cutting non-emergency services at public hospitals amid a surge in COVID cases and its Chief Executive Lee also tested positive for COVID-19. Furthermore, the PBoC maintained its key lending rates with the 1-Year and 5-Year LPR kept at 3.65% and 4.30%, respectively, although this was widely expected.

Top Asian News

- China reported 2,365 (prev. 2,267) new coronavirus cases in the mainland on November 20th, 24,730 (prev. 22,168) new asymptomatic cases and 2 COVID deaths, which follows its first COVID-related death in six months on Saturday.

- Beijing’s Chaoyang district urged residents to remain at home on Monday as cases continue to rise, according to Reuters. It was also reported that the Baiyun district in China's Guangzhou imposed a 5-day lockdown from November 21st-25th and China's Shijiazhuang city is to conduct mass coronavirus testing in certain areas.

- Beijing City has tightened testing requirements for travellers entering Beijing, according to an official; will now require 3 PCR tests in 3 days upon arrival, via Reuters.

- Hong Kong is near to cutting non-emergency services at public hospitals again amid a surge in COVID cases, according to SCMP. It was also reported that Hong Kong Chief Executive John Lee tested positive for COVID-19.

- Taiwan’s representative at APEC Morris Chang said he had a very happy interaction with Chinese President Xi during a brief meeting, according to Reuters.

- US VP Harris met with Chinese President Xi briefly at APEC and she noted to Xi that they must maintain open lines of communication to responsibly manage the competition between their countries, according to a White House official. Furthermore, Harris said that the US does not seek conflict or confrontation and welcomes competition, while she added that her Asia trip signifies the significance of the relationship between the US and its allies and partners in the region, according to Reuters.

- US House GOP leader McCarthy said he will form a select committee on China if he is elected as House Speaker, according to Reuters.

- Germany plans to tighten disclosure rules for companies exposed to China and plans to assess company disclosures to decide whether they should conduct stress tests on China risks, according to a draft document cited by Reuters.

- APEC leaders’ declaration affirmed the commitment to promote strong, balanced, secure sustainable and inclusive growth and stated that they are determined to uphold and further strengthen the rules-based multilateral trading system, while they welcomed progress this year in advancing the free-trade area of the Asia-Pacific. Furthermore, APEC is determined to achieve a post-COVID economic recovery and recognised that more intensive efforts are needed to address challenges such as rising inflation, food security, climate change and natural disasters, according to Reuters.

- Japanese PM Kishida accepted the resignation of Internal Affairs Minister Terada in order to prioritise parliamentary debate and which follows the latter’s involvement in funding scandals, while it was later reported that Japan appointed former Foreign Minister Matsumoto as the new Internal Affairs Minister, according to Reuters.

European bourses are pressured across the board, Euro Stoxx 50 -0.6%, as China's COVID crackdowns weighs on sentiment in an otherwise limited European morning. Sectors feature a defensive bias with those most sensitive to renewed COVID controls posting modest underperformance. Stateside, futures are similarly pressured, ES -0.6%, given the above headwinds with the US docket slim today at the start of a holiday shortened week. Goldman Sachs equity strategy: bear market is not over, continue to think near-term path is likely to be volatile and down before reaching a final trough in 2023, via Reuters.

Top European News

- ECB's Lane says (when questioned on the increment of upcoming hikes) "what matters is the level we're going to arrive at. The exact allocation across different meetings is a secondary issue", via ECB. Does not think December is going to be the last rate hike, "The logic of a pause for the ECB: we’re not at that point".

- UK PM Sunak will be urged by businesses on Monday to seek better EU relations and will face pressure from businesses to soften the impact of Brexit such as by opening doors to more immigration to fill holes in the nation's labour market, according to FT.

- UK was reportedly considering Swiss-style ties with the EU and the government believes that EU relations are thawing which could lead to 'frictionless' trade, according to The Times. However, UK Health Minister Barclay said he did not recognise a report that the government wants to shift to a Swiss-style relationship with the EU, according to Reuters.

FX

- Dollar benefits from short squeeze amidst latest bout of China-related risk aversion, DXY eyes 108.000 from 106.890 low.

- Yen sinks alongside Yuan, towards 142.00 after breach of 100 DMA near 141.00.

- Euro loses 1.0300+ status as Buck bounces and overshadows hawkish-leaning ECB commentary and firm rebound in EGB yields.

- Aussie undermined by deteriorating Chinese COVID situation, but Kiwi holds up better in hope of hawkish RBNZ hike on Wednesday; AUD/USD hovers on 0.6600 handle, NZD/USD hangs above 0.6100.

- Sterling loses Fib support just over 1.1800 after failing to breach round number above convincingly.

Fixed Income

- Despite pronounced action earlier on, core fixed benchmarks are in relative proximity to the unchanged mark with Bunds just 20 ticks lower overall.

- Bunds were bid on a surprising MM domestic PPI decrease; however, ECB's Lane then pushed the complex back down before the latest Beijing, China updates saw that downside dissipate to leave the benchmark only modestly softer.

- Stateside, USTs have been directionally in-fitting though magnitudes slightly more contained ahead of a holiday-thinned weak and with two lots of supply due later.

Commodities

- Crude benchmarks are weighed on by China's COVID controls, with a stronger USD also impacting and adding to the broader complex's woes.

- Specifically, WTI and Brent are lower by around USD 0.50/bbl or 0.50% on the session, but have lifted from earlier lows and as such are some way from Friday's base.

- BP (BP/ LN) - Stopped production at its Rotterdam Refinery (400k BPD), been taken "completely and safely out of operation". Follows reports via Bloomberg on Friday of a serious incident re. a steam outage, via BP. Subsequently, workers will not assist in restarting operations at the Rotterdam refinery (400k BPD) unless their wage demands are met, via Union.

- A large explosion reportedly hit Russia’s Gazprom pipeline amid suspicions of sabotage related to Russia’s war in Ukraine, according to the Daily Mail.

- Kuwait’s oil revenues for FY21/22 rose 84.5% Y/Y to KWD 16.33bln, according to the Finance Ministry.

- US VP Harris said the US will use its APEC host year to set new ambitious sustainability goals and she proposed setting a new aggregate target for reducing carbon emissions from the power sector in APEC, while she also proposed to set a goal for reducing methane emissions and said the US will introduce a new initiative on a just energy transition, according to a White House official cited by Reuters.

- UN climate agency published a new COP27 cover decision draft deal text and approved a proposal covering funding arrangements loss and damage from climate change suffered by vulnerable countries. However, it was also reported that EU climate policy chief Timmermans said the deal is not enough of a step forward and that the mitigation programme agreement allows some parties to hide from their commitments, while he added that too many parties are not ready to make more progress, according to Reuters.

- Goldman Sachs cut its Q4 Brent oil outlook by USD 10/bbl to USD 100/bbl due to China COVID concerns, while it sees elevated oil flows from China ahead of EU curbs and a price cap; UBS forecasts Brent to recovery to USD 110/bbl in 2023, expects oil demand to increase at an above trend rate of circa. 1.6mln BPD in 2023.

- Russia is now the largest fertiliser supplier to India for the first time as it provides discounts, according to Reuters sources.

- China's NDRC is to lower retail prices of gasoline and diesel by CNY 175/tonne and CNY 165/tonnes respectively as of November 22nd.

- Spot gold/silver are unable to glean any haven-related upside in wake of the USDs strength, with the yellow metal over USD 10/oz below the USD 1751/oz 10-DMA despite briefly surpassing the figure overnight; base metals similar dented.

Geopolitics

- IAEA said powerful explosions shook the area of Ukraine’s Zaporizhzhia nuclear power plant on Saturday evening and Sunday morning with more than a dozen blasts heard within a short period during the morning. It was also reported that Ukraine’s Energoatom said Russia's military shelled the Zaporizhzhia nuclear power plant on Sunday morning and that there were at least 12 hits on the plant’s infrastructure facilities, while Russia’s Defence Ministry said Ukraine fired shells at power lines supplying the nuclear power plant, according to Reuters and TASS.

- US Defense Secretary Austin said Russia is carrying out atrocities in Ukraine and said that ‘these aren’t just lapses’, while he added that China, like Russia, is seeking a world where ‘might makes right’. Austin said autocrats like Russian President Putin are watching the Ukraine conflict and could seek nuclear weapons, while he added autocrats could conclude obtaining ‘nuclear weapons would give them a hunting licence of their own’, according to Reuters.

- UK PM Sunak told Ukrainian President Zelensky that the UK will provide a GBP 50mln air defence package to Ukraine which will include 125 anti-aircraft guns and technology to counter Iranian-supplied drones, according to Reuters.

- Russian President Putin spokesperson says there is no discussion in the Kremlin of a fresh wave of military mobilisation, via Reuters.

- German Defence Ministry spokesperson says air policing is being discussed with Poland, via Reuters.

US Event Calendar

- 08:30: Oct. Chicago Fed Nat Activity Index, est. -0.03, prior 0.10

Central Bank speakers

- 13:00: Fed’s Daly Talks on Price Stability

A more detailed look at global markets courtesy of DB's Jim Reid

This morning my new credit strategy team and I have just published our 2023 credit outlook. Our view on the terminal rate for 2023 credit spreads and peak level 2024 defaults hasn’t changed much since we last updated our spread targets in April, when we became the first bank to warn of a tough 2023 US recession. In this outlook, we slightly increase our targets and see YE ‘23 spreads for EUR and USD IG hitting 245bps and 235bps, and EUR and USD HY hitting 930bps and 860bps, respectively. This is a widening from current levels of +53bps, +100bps, +400bps and +410bps, respectively. Our full-year total return forecasts for EU IG is 1.6%, USD IG -0.2%, USD HY -3.3% and EUR HY -4.4%.

A lack of near-term maturities will limit 2023 defaults, but our models highlight that leverage is 2x more important than maturity walls at explaining historical default patterns. We forecast YE'23 defaults in USD HY of 4.5%, USD Loans of 5.6%, EUR HY of 2.2%, and EUR Loans of 3.7%. But by 2H’24, we forecast peak defaults in USD HY of 9%, USD Loans of 11.3%, EUR HY of 4.3% and EUR loans of 7.1%. Indeed loans worry us more than high-yield bonds in 2023. We see USD loans returning -10.8% over FY'23 as defaults rise and CLO demand is impaired from future downgrades.

In the near-term, European credit should continue to outperform US credit, as event risk in the region falls with spreads still wide to the US. Our bearishness gathers momentum later in 2023. Indeed, the major 2023 theme will be the likely US recession in H2. Whether this happens and how severe it is will make or break 2023. In some ways we feel that this has been a pretty easy US cycle to predict as it's been an old fashioned boom-and-bust cycle. Half the 66 economists who forecast the US economy on Bloomberg now predict at least two consecutive quarters of negative growth for 2023 (albeit mildly negative). Has there ever been such a large number predicting a recession from a starting point of not being in one? The worry we would have is that economists’ models seldom predict a recession. So if they now do, that speaks volumes. The risk is that if and when it arrives, it creates systemic risk from somewhere in the over-levered / illiquid financial system. Something normally breaks when the Fed hikes.

So the main driver of 2023 view is the combination of still relatively high rates, a tough US recession, and what crisis that might subsequently trigger. If we’re wrong on the US recession call, or if it is mild and without systemic risk, then we will be wrong on our forecasts. We suspect most readers will hope we are. See the full report here.

Hopefully this new report won't distract you from the World Cup. I've drawn Argentina and Poland in the office sweepstake which will distract me from England's likely stressful journey through the tournament, however long it lasts.

The start of the World Cup coincides with Thanksgiving week so it will be the usual compressed few days of activity. The FOMC minutes (Wednesday) and the ECB's account of their last meeting (Thursday) will be the key macro events. Focus will likely be on their thinking about the terminal rate (both) and QT plans (ECB), with both now more likely to hike 50bps than 75bps in December. We will also see global flash PMIs on Wednesday.

Other data will include an array of business activity indicators, including durable goods orders in the US. Indeed, Wednesday is a US data dump ahead of Thanksgiving and we will also see the final UoM consumer confidence data which includes the inflation expectations revision which is important. Claims also comes a day early.

The Fed speakers last week helped prompt a big flattening of the US curve as they generally hinted towards a terminal rate of above 5%. As such before we see the FOMC minutes, tomorrow sees three Fed speakers who might add to the debate. They are all hawks (Mester, George and Bullard) though and have all spoken since the FOMC so the market should know their biases. Over the weekend, the Atlanta Fed President Raphael Bostic (non-voter) opined that he believes that the Fed can slow the pace of rate hikes and feels that the Fed's target policy rate need not rise more than 1 percentage point to tackle inflation and help ensure a soft landing. Boston Fed Collins also spoke but kept all options open.

Lastly, with only around 20 S&P 500 firms left to report earnings this season, this week's results line-up will be tech-heavy and feature a number of large Chinese firms. These include Baidu (Tuesday), Xiaomi (Wednesday) and Meituan (Friday). In the US, we will hear from Zoom today and Analog Devices, Autodesk and HP tomorrow.

Risk aversion has resurfaced across Asian equity markets this morning with fresh China COVID-19 fears after the nation witnessed its first Covid-related death in 6 months on Saturday with two more following on Sunday, sparking concerns that Beijing would reimpose strict Covid curbs even as they consider longer-term reopenings. As I type, the Hang Seng (-2.09%) is the largest underperformer with the Shanghai Composite (-0.81%), the CSI (-1.30%) and the KOSPI (-1.11%) all slipping. Elsewhere, the Nikkei (+0.02%) has been wavering between gains and losses.

In overnight trading, stock futures in the DMs are pointing to a weak start with contracts on the S&P 500 (-0.29%), NASDAQ 100 (-0.24%) and the DAX (-0.37%) trading in the red. Meanwhile, yields on the 2 and 10yr USTs are -2.5bps and -4.1bps lower, respectively, with the curve now at -72.6bps, a fresh four decade low.

Coming back to China, the People’s Bank of China (PBOC) left its benchmark lending rates unchanged for the third straight month, maintaining its one-year loan prime rate (LPR) at 3.65%, while the five-year LPR (a reference for mortgages) was kept intact at 4.30%. With the authorities recently extending more support to property developers, the possibility of additional easing seems less likely from the central bank.

In energy markets, oil prices are continuing their recent decline amid China demand concerns. Brent crude futures are down -1.02% at $86.73/bbl with WTI (-1.09%) just below $80/bbl.

Reviewing last week now, US yields and equities sold off while European counterparts rallied, though the moves in equities in particular were small despite another week filled with macro news.

Starting on rates, Fed Vice Chair Brainard kept to the company line in outlining a likely step down to +50bp hikes starting in December, but, unlike her colleagues, did not explicitly tie the slower pace with a higher terminal rate. Regional Fed Presidents were happy to take up that mantle, however, with St. Louis Fed President Bullard continuing to lead the vanguard. Indeed, Bullard noted that policy rates may even need to get as high as 7% to fight inflation, from just under 4% today. The Taylor Rule was invoked in that speech. That sent 2yr Treasury yields +19.2bps higher on the week (+7.2bps Friday). 10yr yields lagged, climbing +1.3bps (+5.9bps Friday), which drove the 2s10s curve to its most inverted of the cycle, ending the week at -70.6bps. While curves also flattened on this side of the Atlantic, Bunds and Gilts outperformed, where 10yr Bunds fell -14.6bps (-0.6bps Friday) and Gilts were -11.9bps (+3.7bps Friday) lower.

Despite continued tech layoffs, fears of a material escalation in the war after the missiles landed in Poland (for which tensions were quickly eased), and tighter expected Fed policy, equities were subdued but resilient. Indeed, the S&P 500, which fell -0.69% over the week (+0.48% Friday), had its first weekly performance that did not exceed +1% in either direction since early August, while the STOXX 600 climbed +0.25% given the move lower in European discount rates. For a truly muted performance, we highlight the Dow Jones, which was -0.01% lower (+0.59% Friday). While aggregate indices put in a lacklustre shift, regional indices in Europe outperformed, with the DAX up +1.46% (+1.16% Friday) and the CAC +0.76% (+1.04% higher), and certain sectors underperformed in the US where the Nasdaq fell -1.57% (+0.01% Friday) and the Russell 2000 was -1.75% lower (+0.58% Friday).

Elsewhere, Brent crude oil pulled back -8.72% (-2.41% Friday), which was its worst weekly return since early August, coincidentally also the last week that the S&P 500 had an absolute value return below 1%.

After opening modestly in the green, US equity futures have drifted steadily lower all session and were last trading near their Monday lows as concerns that China may tighten Covid curbs after China reported its first Covid-related death in almost six months and a city near Beijing rumored to be a test case for dropping all curbs enforced a slew of restrictions all weighed on growth in the world’s second-largest economy, as well as the ongoing carnage in the crypto space. At 7:30am ET, S&P futures were down 0.5% to 3,953 while Nasdaq 100 futures slumped 0.9% to session lows, below 11,600. The dollar stormed higher as investors sought shelter in the dollar; 10Y yields rose to 3.83%, while bitcoin traded around $16,000 after dumping over the weekend. Oil dipped but rebounded from session lows on concern of a weakening demand outlook from China and following a $10 price target cut to $100 for Q4 2022 from Goldman overnight.

US-listed Chinese stocks including Alibaba, Baidu and JD.com fell in US premarket trading after China saw its first Covid-related death in almost six months, sparking concern that Beijing could see a return of heightened restrictions on schools, restaurants and shops amid a continuing outbreak in the capital. Worsening outbreaks across the nation are stoking concerns that authorities may again resort to harsh restrictions. A city near Beijing that was rumored to be a test case for the ending of virus restrictions has suspended schools, locked down universities and asked residents to stay at home for five days.

Elsewhere in premarket moves, Walt Disney shares soared 8% after the firm fired embattled CEO Bob Iger and brought back former leader Bob Iger as chief executive officer, a surprise capitulation by the board after a string of disappointing results.

- Cryptocurrency-related stocks declined after the price of Bitcoin retreated amid worries over contagion from the downfall of Sam Bankman-Fried’s FTX empire. Shares in Riot Blockchain -4.5%, Marathon Digital -3.1%, Coinbase -4.6%.

- Squarespace shares gained 2.2% after being upgraded to overweight from neutral at Piper Sandler, which identifies the website- building and hosting company as having the lowest risk to its 2023 numbers among e-commerce stocks.

“Markets got their hopes up that the Chinese government might loosen its Covid policy, but despite the slowing economy, there is little chance of that,” said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “This is going to be bad for commodity-related stocks as well as luxury companies and other exporters to China.” However, others like Morgan Stanley, remain hopeful and expect that China will end Covid zero in a few months; in its base case the bank sees China reopening by April as shown below.

“Financial markets have caught a cold amid worries that mounting Covid cases in China and a fresh tightening of restrictions will send a fresh shiver through manufacturing output and push down demand for raw materials,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

As Bloomberg notes, trading will be slow this week, with the US market closed Thursday for the Thanksgiving holiday and open for a half day on Friday. Meanwhile, Goldman strategists warned that the bear market had more room to run and that stocks were likely to see more declines and lower valuations in 2023. “The conditions that are typically consistent with an equity trough have not yet been reached,” strategists including Peter Oppenheimer and Sharon Bell wrote in a note on Monday. They said that a peak in interest rates and lower valuations reflecting recession are necessary before any sustained stock-market recovery can happen.

After a sharp rally fueled by signs of cooling inflation, US stocks were subdued last week as Federal Reserve officials indicated they need to see a meaningful slowdown in prices before reducing the pace of their interest rate increases. The big event for the market this week comes Wednesday, when the central bank releases minutes from its latest policy meeting, possibly providing clues on when it will shift to less-aggressive rate hikes.

In Europe, the Stoxx 50 index fell 0.5%, with the IBEX outperforming peers, adding 0.4%, while FTSE MIB lags, dropping 1%. Miners, tech and chemicals are the worst-performing sectors. Here are the notable European movers:

- Virgin Money UK shares rose as much 16%, the most in two years, after the British lender announced an extension of its share buyback program and reported earnings that analysts said could prompt upgrades in profit forecasts.

- Ipsen rose as much as 4.5%, to the highest since April, after JPMorgan said the stock may get a boost from clinical trial data on its Onivyde and elafibranor drugs in 2023.

- Rheinmetall shares jumped as much as 3.7% after Deutsche Bank upgraded the defense and automotive company to buy from hold and Berenberg raised its PT on the stock.

- Diploma shares gained as much as 3.3% after the seals and components distributor reported full-year revenue that beat analyst estimates.

- Next and Boohoo fell after they were both downgraded to hold from buy at Panmure. The broker cited inventory challenges for UK apparel retailers more broadly as demand has fallen in the UK clothing market since early October. Next fell as much as 1.9% while Boohoo dropped 7%; M&S and Asos also fell.

- Shares in Vallourec dropped as much as 13% in Paris trading after the steel and alloy tubing group announced third- quarter results that fell short of analyst expectations.

- Shares in IT services firm Bechtle fell as much as 5.4% after Exane downgraded the stock to neutral, citing concern about how margins will be affected by wage inflation and cost increases.

- SGS shares fell as much as 3.6%. The testing and inspection firm was cut to underweight from neutral at JPMorgan, with the broker saying shares look “mispriced.”

Earlier in the session, Asian stocks also declined, with Hong Kong leading losses, as investors assessed the outlook for China’s reopening while continuing to monitor the Federal Reserve’s policy trajectory. The MSCI Asia Pacific Index dropped as much as 1.2%. Chinese technology stocks were the biggest drags on the gauge, also driving the Hang Seng Index down almost 2%, after fresh reports of Covid deaths and lockdowns in China. Malaysian shares pared losses as a deadline for party leaders to name a prime minister was extended after Saturday’s election produced the country’s first-ever hung parliament. Benchmarks across Asia Pacific also fell, while the dollar strengthened, as Federal Reserve Bank of Boston President Susan Collins reiterated the likelihood of large US interest-rate hikes, with the outlook for inflation still uncertain. US stocks had risen recently on hopes for a slower pace of tightening. “After the recent good US consumer and producer price inflation reports, it was easy to conclude that there are much better times ahead in the asset markets,” said Gary Dugan, chief executive officer at the Global CIO Office in a note. “It just won’t be that easy.” Asian stocks had been rebounding as well, gaining as much as 15% from a trough in October, helped also by hopes for reduced restrictions in China. The advance started to falter last week amid lingering doubts over China’s reopening and US rate policy

India’s major stock indexes posted their biggest decline in more than a month, tracking weaker global markets and as shares of Reliance Industries and index-heavy software makers slipped. The S&P BSE Sensex closed 0.8% lower at 61,144.84 in Mumbai, while the NSE Nifty 50 Index eased by an equal measure. Both indexes posted their biggest single-day slump since Oct. 11, with the Sensex now trading 1.3% off its recent peak. Global stocks fell amid concern that China may tighten Covid curbs after a string of reported deaths. Worsening outbreaks across the nation are stoking concerns that authorities may again resort to harsh restrictions. All but two of the 19 sector sub-gauges compiled by BSE Ltd. traded lower, led by information technology companies.

In FX, the dollar gained as fears of a return to stricter Covid containment measures in China boosted demand for havens. The Bloomberg dollar spot index rises 0.7%. CHF and CAD are the strongest performers in G-10 FX, SEK and JPY underperform.

- The yen plunged by more than 1% dropping as low as 142 per dollar. The Japanese currency held up well throughout most of the Asian session, but began a steep slide shortly before European session began.

- The euro fell by as much as 1% versus the dollar, the biggest slide this month, to touch $1.0226. The Australian dollar and Swedish krona were also among the worst performers It’s not unusual for implied volatility to trail realized in the currency market, especially at times when key risk events like central bank policy meetings are far ahead on the calendar. When it comes to the euro-dollar pair, options are underpriced across the curve, with striking moves on the one- and six-month tenors

- New Zealand dollar short-dated FX option volatility advanced as pricing for a 75- basis-point hike in the official cash rate holds at 60%, two days out from the decision

In rates, Treasuries were mixed with the belly of the curve underperforming, cheapening 2s5s30s fly by 3.2bp on the day. Wider losses were seen across gilts where the front-end underperforms. Treasury yields were cheaper by 0.5bp across belly and richer by 1.5bp across long-end of the curve, flattening 5s30s spread by 1.5bp on the day — reaching as low as -10.9bp and tightest since Nov. 7. The US 10-year yields around 3.825% and slightly richer on the day; gilts lag by additional 1.5bp in the sector. US session focus includes double auction event for 2- and 5-year notes while Daly is expected to speak in the afternoon. The gilts curve bear-flattens with 2s10s narrowing 2.3bps, while the Bund curve bear-steepens. Peripheral spreads are mixed to Germany; Italy widens, Spain and Portugal tighten.

In commodities, WTI and Brent are lower by around USD 0.50/bbl or 0.50% on the session, but have lifted from earlier lows and as such are some way from Friday’s base. The crude complex was weighed by China’s COVID controls, with a stronger US dollar also impacting and adding to the broader complex’s woes. Goldman Sachs cut its Q4 Brent oil outlook by USD 10/bbl to $100/bbl due to China COVID concerns, while it sees elevated oil flows from China ahead of EU curbs and a price cap; $ forecasts Brent to recovery to USD 110/bbl in 2023, expects oil demand to increase at an above trend rate of circa. 1.6mln BPD in 2023. Spot gold/silver are unable to glean any haven-related upside in wake of the USDs strength, with the yellow metal over $10/oz below the USD 1751/oz 10-DMA despite briefly surpassing the figure overnight; base metals similar dented.

Cryptocurrency prices struggled in the ongoing crisis sparked by the downfall of Sam Bankman-Fried’s once powerful FTX empire. Crypto-exposed stocks fell.

It’s a quiet start to the holiday-shortened week, with just the October Chicago Fed national activity index due at 830am. We get earnings from Zoom; On the Fed speaker slate, Fed’s Daly talks on price stability.

Market Snapshot

- S&P 500 futures down 0.6% to 3,950.25

- STOXX Europe 600 down 0.2% to 432.60

- MXAP down 1.2% to 150.77

- MXAPJ down 1.4% to 487.13

- Nikkei up 0.2% to 27,944.79

- Topix up 0.3% to 1,972.57

- Hang Seng Index down 1.9% to 17,655.91

- Shanghai Composite down 0.4% to 3,085.04

- Sensex down 0.9% to 61,121.88

- Australia S&P/ASX 200 down 0.2% to 7,139.25

- Kospi down 1.0% to 2,419.50

- German 10Y yield up 1% to 2.03%

- Euro down 0.9% to $1.0230

- Brent Futures down 0.7% to $86.97/bbl

- Gold spot down 0.6% to $1,739.61

- U.S. Dollar Index up 0.86% to 107.85

Top Overnight News from Bloomberg

- Asset managers are turning ever more bearish on the dollar amid bets that the Federal Reserve may be approaching the peak of its interest-rate hike cycle

- Investors are slowly coming to terms with the sheer size of the UK government’s borrowing needs over the next few years and it doesn’t look pretty

- The PBOC net drained 2b yuan ($421m) via its open-market operations on Monday for the first time since Nov. 9, as a selloff in government and corporate bonds eased

- China’s financial regulators have asked banks to stabilize lending to property developers and construction firms, the latest effort by policymakers to turn around the real-estate crisis and bolster economic growth

- More than two years of growth-squelching policies sent international investors fleeing China. It’s taken all of two weeks to lure them back

- Sam Bankman-Fried’s bankrupt crypto empire owes its 50 biggest unsecured creditors a total of $3.1 billion, new court papers show, with a pair of customers owed more than $200 million each

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the week mostly lower amid headwinds from China after several areas announced fresh virus restrictions including lockdowns and the country also reported its first COVID-19 deaths in about six months. ASX 200 was constrained by underperformance in the mining-related sectors amid a decline in commodity prices and with BHP shares pressured amid reports its chairman is considering retiring next year. Nikkei 225 lacked direction amid further political tremors in the Kishida government after Internal Affairs Minister Terada resigned due to involvement in a funding scandal and was the third cabinet member to step down in under a month. KOSPI declined amid geopolitical concerns after North Korea’s recent missile launches and with sentiment subdued as data for the first 20 days of November showed exports fell 16.7% Y/Y and imports fell 5.5% Y/Y. Hang Seng and Shanghai Comp suffered losses due to the worsening COVID situation in the mainland, while the Hong Kong benchmark was the worst hit with the special administrative region said to be near to cutting non-emergency services at public hospitals amid a surge in COVID cases and its Chief Executive Lee also tested positive for COVID-19. Furthermore, the PBoC maintained its key lending rates with the 1-Year and 5-Year LPR kept at 3.65% and 4.30%, respectively, although this was widely expected.

Top Asian News

- China reported 2,365 (prev. 2,267) new coronavirus cases in the mainland on November 20th, 24,730 (prev. 22,168) new asymptomatic cases and 2 COVID deaths, which follows its first COVID-related death in six months on Saturday.

- Beijing’s Chaoyang district urged residents to remain at home on Monday as cases continue to rise, according to Reuters. It was also reported that the Baiyun district in China’s Guangzhou imposed a 5-day lockdown from November 21st-25th and China’s Shijiazhuang city is to conduct mass coronavirus testing in certain areas.

- Beijing City has tightened testing requirements for travellers entering Beijing, according to an official; will now require 3 PCR tests in 3 days upon arrival, via Reuters.

- Hong Kong is near to cutting non-emergency services at public hospitals again amid a surge in COVID cases, according to SCMP. It was also reported that Hong Kong Chief Executive John Lee tested positive for COVID-19.

- Taiwan’s representative at APEC Morris Chang said he had a very happy interaction with Chinese President Xi during a brief meeting, according to Reuters.

- US VP Harris met with Chinese President Xi briefly at APEC and she noted to Xi that they must maintain open lines of communication to responsibly manage the competition between their countries, according to a White House official. Furthermore, Harris said that the US does not seek conflict or confrontation and welcomes competition, while she added that her Asia trip signifies the significance of the relationship between the US and its allies and partners in the region, according to Reuters.

- US House GOP leader McCarthy said he will form a select committee on China if he is elected as House Speaker, according to Reuters.

- Germany plans to tighten disclosure rules for companies exposed to China and plans to assess company disclosures to decide whether they should conduct stress tests on China risks, according to a draft document cited by Reuters.

- APEC leaders’ declaration affirmed the commitment to promote strong, balanced, secure sustainable and inclusive growth and stated that they are determined to uphold and further strengthen the rules-based multilateral trading system, while they welcomed progress this year in advancing the free-trade area of the Asia-Pacific. Furthermore, APEC is determined to achieve a post-COVID economic recovery and recognised that more intensive efforts are needed to address challenges such as rising inflation, food security, climate change and natural disasters, according to Reuters.

- Japanese PM Kishida accepted the resignation of Internal Affairs Minister Terada in order to prioritise parliamentary debate and which follows the latter’s involvement in funding scandals, while it was later reported that Japan appointed former Foreign Minister Matsumoto as the new Internal Affairs Minister, according to Reuters.

European bourses are pressured across the board, Euro Stoxx 50 -0.6%, as China’s COVID crackdowns weighs on sentiment in an otherwise limited European morning. Sectors feature a defensive bias with those most sensitive to renewed COVID controls posting modest underperformance. Stateside, futures are similarly pressured, ES -0.6%, given the above headwinds with the US docket slim today at the start of a holiday shortened week. Goldman Sachs equity strategy: bear market is not over, continue to think near-term path is likely to be volatile and down before reaching a final trough in 2023, via Reuters.

Top European News

- ECB’s Lane says (when questioned on the increment of upcoming hikes) “what matters is the level we’re going to arrive at. The exact allocation across different meetings is a secondary issue”, via ECB. Does not think December is going to be the last rate hike, “The logic of a pause for the ECB: we’re not at that point”.

- UK PM Sunak will be urged by businesses on Monday to seek better EU relations and will face pressure from businesses to soften the impact of Brexit such as by opening doors to more immigration to fill holes in the nation’s labour market, according to FT.

- UK was reportedly considering Swiss-style ties with the EU and the government believes that EU relations are thawing which could lead to ‘frictionless’ trade, according to The Times. However, UK Health Minister Barclay said he did not recognise a report that the government wants to shift to a Swiss-style relationship with the EU, according to Reuters.

FX

- Dollar benefits from short squeeze amidst latest bout of China-related risk aversion, DXY eyes 108.000 from 106.890 low.

- Yen sinks alongside Yuan, towards 142.00 after breach of 100 DMA near 141.00.

- Euro loses 1.0300+ status as Buck bounces and overshadows hawkish-leaning ECB commentary and firm rebound in EGB yields.

- Aussie undermined by deteriorating Chinese COVID situation, but Kiwi holds up better in hope of hawkish RBNZ hike on Wednesday; AUD/USD hovers on 0.6600 handle, NZD/USD hangs above 0.6100.

- Sterling loses Fib support just over 1.1800 after failing to breach round number above convincingly.

Fixed Income

- Despite pronounced action earlier on, core fixed benchmarks are in relative proximity to the unchanged mark with Bunds just 20 ticks lower overall.

- Bunds were bid on a surprising MM domestic PPI decrease; however, ECB’s Lane then pushed the complex back down before the latest Beijing, China updates saw that downside dissipate to leave the benchmark only modestly softer.

- Stateside, USTs have been directionally in-fitting though magnitudes slightly more contained ahead of a holiday-thinned weak and with two lots of supply due later.

Commodities

- Crude benchmarks are weighed on by China’s COVID controls, with a stronger USD also impacting and adding to the broader complex’s woes.

- Specifically, WTI and Brent are lower by around USD 0.50/bbl or 0.50% on the session, but have lifted from earlier lows and as such are some way from Friday’s base.

- BP (BP/ LN) – Stopped production at its Rotterdam Refinery (400k BPD), been taken “completely and safely out of operation”. Follows reports via Bloomberg on Friday of a serious incident re. a steam outage, via BP. Subsequently, workers will not assist in restarting operations at the Rotterdam refinery (400k BPD) unless their wage demands are met, via Union.

- A large explosion reportedly hit Russia’s Gazprom pipeline amid suspicions of sabotage related to Russia’s war in Ukraine, according to the Daily Mail.

- Kuwait’s oil revenues for FY21/22 rose 84.5% Y/Y to KWD 16.33bln, according to the Finance Ministry.

- US VP Harris said the US will use its APEC host year to set new ambitious sustainability goals and she proposed setting a new aggregate target for reducing carbon emissions from the power sector in APEC, while she also proposed to set a goal for reducing methane emissions and said the US will introduce a new initiative on a just energy transition, according to a White House official cited by Reuters.

- UN climate agency published a new COP27 cover decision draft deal text and approved a proposal covering funding arrangements loss and damage from climate change suffered by vulnerable countries. However, it was also reported that EU climate policy chief Timmermans said the deal is not enough of a step forward and that the mitigation programme agreement allows some parties to hide from their commitments, while he added that too many parties are not ready to make more progress, according to Reuters.

- Goldman Sachs cut its Q4 Brent oil outlook by USD 10/bbl to USD 100/bbl due to China COVID concerns, while it sees elevated oil flows from China ahead of EU curbs and a price cap; UBS forecasts Brent to recovery to USD 110/bbl in 2023, expects oil demand to increase at an above trend rate of circa. 1.6mln BPD in 2023.

- Russia is now the largest fertiliser supplier to India for the first time as it provides discounts, according to Reuters sources.

- China’s NDRC is to lower retail prices of gasoline and diesel by CNY 175/tonne and CNY 165/tonnes respectively as of November 22nd.

- Spot gold/silver are unable to glean any haven-related upside in wake of the USDs strength, with the yellow metal over USD 10/oz below the USD 1751/oz 10-DMA despite briefly surpassing the figure overnight; base metals similar dented.

Geopolitics

- IAEA said powerful explosions shook the area of Ukraine’s Zaporizhzhia nuclear power plant on Saturday evening and Sunday morning with more than a dozen blasts heard within a short period during the morning. It was also reported that Ukraine’s Energoatom said Russia’s military shelled the Zaporizhzhia nuclear power plant on Sunday morning and that there were at least 12 hits on the plant’s infrastructure facilities, while Russia’s Defence Ministry said Ukraine fired shells at power lines supplying the nuclear power plant, according to Reuters and TASS.

- US Defense Secretary Austin said Russia is carrying out atrocities in Ukraine and said that ‘these aren’t just lapses’, while he added that China, like Russia, is seeking a world where ‘might makes right’. Austin said autocrats like Russian President Putin are watching the Ukraine conflict and could seek nuclear weapons, while he added autocrats could conclude obtaining ‘nuclear weapons would give them a hunting licence of their own’, according to Reuters.

- UK PM Sunak told Ukrainian President Zelensky that the UK will provide a GBP 50mln air defence package to Ukraine which will include 125 anti-aircraft guns and technology to counter Iranian-supplied drones, according to Reuters.

- Russian President Putin spokesperson says there is no discussion in the Kremlin of a fresh wave of military mobilisation, via Reuters.

- German Defence Ministry spokesperson says air policing is being discussed with Poland, via Reuters.

US Event Calendar

- 08:30: Oct. Chicago Fed Nat Activity Index, est. -0.03, prior 0.10

Central Bank speakers

- 13:00: Fed’s Daly Talks on Price Stability

A more detailed look at global markets courtesy of DB’s Jim Reid

This morning my new credit strategy team and I have just published our 2023 credit outlook. Our view on the terminal rate for 2023 credit spreads and peak level 2024 defaults hasn’t changed much since we last updated our spread targets in April, when we became the first bank to warn of a tough 2023 US recession. In this outlook, we slightly increase our targets and see YE ‘23 spreads for EUR and USD IG hitting 245bps and 235bps, and EUR and USD HY hitting 930bps and 860bps, respectively. This is a widening from current levels of +53bps, +100bps, +400bps and +410bps, respectively. Our full-year total return forecasts for EU IG is 1.6%, USD IG -0.2%, USD HY -3.3% and EUR HY -4.4%.

A lack of near-term maturities will limit 2023 defaults, but our models highlight that leverage is 2x more important than maturity walls at explaining historical default patterns. We forecast YE’23 defaults in USD HY of 4.5%, USD Loans of 5.6%, EUR HY of 2.2%, and EUR Loans of 3.7%. But by 2H’24, we forecast peak defaults in USD HY of 9%, USD Loans of 11.3%, EUR HY of 4.3% and EUR loans of 7.1%. Indeed loans worry us more than high-yield bonds in 2023. We see USD loans returning -10.8% over FY’23 as defaults rise and CLO demand is impaired from future downgrades.

In the near-term, European credit should continue to outperform US credit, as event risk in the region falls with spreads still wide to the US. Our bearishness gathers momentum later in 2023. Indeed, the major 2023 theme will be the likely US recession in H2. Whether this happens and how severe it is will make or break 2023. In some ways we feel that this has been a pretty easy US cycle to predict as it’s been an old fashioned boom-and-bust cycle. Half the 66 economists who forecast the US economy on Bloomberg now predict at least two consecutive quarters of negative growth for 2023 (albeit mildly negative). Has there ever been such a large number predicting a recession from a starting point of not being in one? The worry we would have is that economists’ models seldom predict a recession. So if they now do, that speaks volumes. The risk is that if and when it arrives, it creates systemic risk from somewhere in the over-levered / illiquid financial system. Something normally breaks when the Fed hikes.

So the main driver of 2023 view is the combination of still relatively high rates, a tough US recession, and what crisis that might subsequently trigger. If we’re wrong on the US recession call, or if it is mild and without systemic risk, then we will be wrong on our forecasts. We suspect most readers will hope we are. See the full report here.

Hopefully this new report won’t distract you from the World Cup. I’ve drawn Argentina and Poland in the office sweepstake which will distract me from England’s likely stressful journey through the tournament, however long it lasts.

The start of the World Cup coincides with Thanksgiving week so it will be the usual compressed few days of activity. The FOMC minutes (Wednesday) and the ECB’s account of their last meeting (Thursday) will be the key macro events. Focus will likely be on their thinking about the terminal rate (both) and QT plans (ECB), with both now more likely to hike 50bps than 75bps in December. We will also see global flash PMIs on Wednesday.

Other data will include an array of business activity indicators, including durable goods orders in the US. Indeed, Wednesday is a US data dump ahead of Thanksgiving and we will also see the final UoM consumer confidence data which includes the inflation expectations revision which is important. Claims also comes a day early.

The Fed speakers last week helped prompt a big flattening of the US curve as they generally hinted towards a terminal rate of above 5%. As such before we see the FOMC minutes, tomorrow sees three Fed speakers who might add to the debate. They are all hawks (Mester, George and Bullard) though and have all spoken since the FOMC so the market should know their biases. Over the weekend, the Atlanta Fed President Raphael Bostic (non-voter) opined that he believes that the Fed can slow the pace of rate hikes and feels that the Fed’s target policy rate need not rise more than 1 percentage point to tackle inflation and help ensure a soft landing. Boston Fed Collins also spoke but kept all options open.

Lastly, with only around 20 S&P 500 firms left to report earnings this season, this week’s results line-up will be tech-heavy and feature a number of large Chinese firms. These include Baidu (Tuesday), Xiaomi (Wednesday) and Meituan (Friday). In the US, we will hear from Zoom today and Analog Devices, Autodesk and HP tomorrow.

Risk aversion has resurfaced across Asian equity markets this morning with fresh China COVID-19 fears after the nation witnessed its first Covid-related death in 6 months on Saturday with two more following on Sunday, sparking concerns that Beijing would reimpose strict Covid curbs even as they consider longer-term reopenings. As I type, the Hang Seng (-2.09%) is the largest underperformer with the Shanghai Composite (-0.81%), the CSI (-1.30%) and the KOSPI (-1.11%) all slipping. Elsewhere, the Nikkei (+0.02%) has been wavering between gains and losses.

In overnight trading, stock futures in the DMs are pointing to a weak start with contracts on the S&P 500 (-0.29%), NASDAQ 100 (-0.24%) and the DAX (-0.37%) trading in the red. Meanwhile, yields on the 2 and 10yr USTs are -2.5bps and -4.1bps lower, respectively, with the curve now at -72.6bps, a fresh four decade low.

Coming back to China, the People’s Bank of China (PBOC) left its benchmark lending rates unchanged for the third straight month, maintaining its one-year loan prime rate (LPR) at 3.65%, while the five-year LPR (a reference for mortgages) was kept intact at 4.30%. With the authorities recently extending more support to property developers, the possibility of additional easing seems less likely from the central bank.

In energy markets, oil prices are continuing their recent decline amid China demand concerns. Brent crude futures are down -1.02% at $86.73/bbl with WTI (-1.09%) just below $80/bbl.

Reviewing last week now, US yields and equities sold off while European counterparts rallied, though the moves in equities in particular were small despite another week filled with macro news.

Starting on rates, Fed Vice Chair Brainard kept to the company line in outlining a likely step down to +50bp hikes starting in December, but, unlike her colleagues, did not explicitly tie the slower pace with a higher terminal rate. Regional Fed Presidents were happy to take up that mantle, however, with St. Louis Fed President Bullard continuing to lead the vanguard. Indeed, Bullard noted that policy rates may even need to get as high as 7% to fight inflation, from just under 4% today. The Taylor Rule was invoked in that speech. That sent 2yr Treasury yields +19.2bps higher on the week (+7.2bps Friday). 10yr yields lagged, climbing +1.3bps (+5.9bps Friday), which drove the 2s10s curve to its most inverted of the cycle, ending the week at -70.6bps. While curves also flattened on this side of the Atlantic, Bunds and Gilts outperformed, where 10yr Bunds fell -14.6bps (-0.6bps Friday) and Gilts were -11.9bps (+3.7bps Friday) lower.

Despite continued tech layoffs, fears of a material escalation in the war after the missiles landed in Poland (for which tensions were quickly eased), and tighter expected Fed policy, equities were subdued but resilient. Indeed, the S&P 500, which fell -0.69% over the week (+0.48% Friday), had its first weekly performance that did not exceed +1% in either direction since early August, while the STOXX 600 climbed +0.25% given the move lower in European discount rates. For a truly muted performance, we highlight the Dow Jones, which was -0.01% lower (+0.59% Friday). While aggregate indices put in a lacklustre shift, regional indices in Europe outperformed, with the DAX up +1.46% (+1.16% Friday) and the CAC +0.76% (+1.04% higher), and certain sectors underperformed in the US where the Nasdaq fell -1.57% (+0.01% Friday) and the Russell 2000 was -1.75% lower (+0.58% Friday).

Elsewhere, Brent crude oil pulled back -8.72% (-2.41% Friday), which was its worst weekly return since early August, coincidentally also the last week that the S&P 500 had an absolute value return below 1%.