Despite US macro data surprising to the upside for the last few months (generally on dismal expectations), US Manufacturing & Services surveys have been trending lower and analysts expected this morning's preliminary November S&P Global PMI data to continue that trend.. and they did but very dramatically.

S&P Global US Manufacturing plunged from 50.4 to 47.6 (contraction), well below the 50.0 expectation. This is the lowest since May 2020.

S&P Global US Services tumbled from 47.8 to 46.1 (contraction), below the 48.0 expectation.

Source: Bloomberg

Contributing to the decrease in the headline manufacturing figure was a renewed fall in output and a sharper decline in new orders. Demand conditions were stymied by inflation and economic uncertainty, according to panellists, with new sales falling at the quickest rate since May 2020. Alongside challenging domestic demand conditions, new export orders contracted at a sharper pace.

Excluding the initial pandemic phase in the first half of 2020, the rate of decline in the headline Services figure was the second-fastest on record. Panellists often stated that the impact of inflation and interest rates on customer disposable income had dented demand conditions. In line with weak demand, new business fell at a solid pace in November. The second successive monthly decrease in new orders was the sharpest seen since May 2020.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

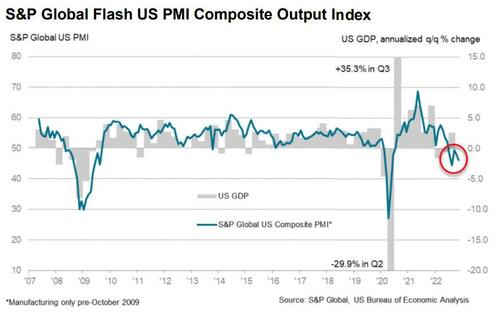

“Business conditions across the US worsened in November, according to the preliminary PMI survey findings, with output and demand falling at increased rates, consistent with the economy contracting at an annualised rate of 1%.

“Companies are reporting increasing headwinds from the rising cost of living, tightening financial conditions – notably higher borrowing costs – and weakened demand across both home and export markets.

“Skill shortages also remain a worrying constraint on expansion, but there is better news on supply chains, with supplier performance improving in November for the first time for over three years.

“While the reduced supply chain stress is partly a symptom of lower demand, the alleviation of supply delays removes a key driver of inflationary pressures and has helped moderate the overall rate of input cost inflation to a near two-year low. November even saw increasing numbers of suppliers, factories and service providers offering discounts to help boost flagging sales. Hiring has also slowed to a crawl so far in the fourth quarter as firms focus on reducing costs.

“In this environment, inflationary pressures should continue to cool in the months ahead, potentially markedly, but the economy meanwhile continues to head deeper into a likely recession.”

It app[ears The Fed is getting what it wanted...

Despite US macro data surprising to the upside for the last few months (generally on dismal expectations), US Manufacturing & Services surveys have been trending lower and analysts expected this morning’s preliminary November S&P Global PMI data to continue that trend.. and they did but very dramatically.

S&P Global US Manufacturing plunged from 50.4 to 47.6 (contraction), well below the 50.0 expectation. This is the lowest since May 2020.

S&P Global US Services tumbled from 47.8 to 46.1 (contraction), below the 48.0 expectation.

Source: Bloomberg

Contributing to the decrease in the headline manufacturing figure was a renewed fall in output and a sharper decline in new orders. Demand conditions were stymied by inflation and economic uncertainty, according to panellists, with new sales falling at the quickest rate since May 2020. Alongside challenging domestic demand conditions, new export orders contracted at a sharper pace.

Excluding the initial pandemic phase in the first half of 2020, the rate of decline in the headline Services figure was the second-fastest on record. Panellists often stated that the impact of inflation and interest rates on customer disposable income had dented demand conditions. In line with weak demand, new business fell at a solid pace in November. The second successive monthly decrease in new orders was the sharpest seen since May 2020.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Business conditions across the US worsened in November, according to the preliminary PMI survey findings, with output and demand falling at increased rates, consistent with the economy contracting at an annualised rate of 1%.

“Companies are reporting increasing headwinds from the rising cost of living, tightening financial conditions – notably higher borrowing costs – and weakened demand across both home and export markets.

“Skill shortages also remain a worrying constraint on expansion, but there is better news on supply chains, with supplier performance improving in November for the first time for over three years.

“While the reduced supply chain stress is partly a symptom of lower demand, the alleviation of supply delays removes a key driver of inflationary pressures and has helped moderate the overall rate of input cost inflation to a near two-year low. November even saw increasing numbers of suppliers, factories and service providers offering discounts to help boost flagging sales. Hiring has also slowed to a crawl so far in the fourth quarter as firms focus on reducing costs.

“In this environment, inflationary pressures should continue to cool in the months ahead, potentially markedly, but the economy meanwhile continues to head deeper into a likely recession.”

It app[ears The Fed is getting what it wanted…