By Peter Tchir of Academy Securities

Positioning & Key Drivers

As we head into what in theory should be a quiet period for markets (though it certainly wasn’t in December 2018), we try to address positioning (very difficult to get a good read) and what our drivers for the next few weeks will be.

Positioning

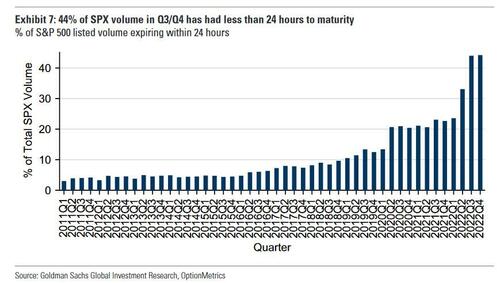

There are reports circulating that everyone is bearish. Those reports seem to focus on words (there is a lot of airtime being given to the bears) and on things like equity put/call ratios. The argument against looking at put/call ratios is that they have been oscillating back and forth (almost wildly) and they may not do a good job of capturing the weekly and daily expiration options markets. It is truly fascinating to watch (and to understand) the implications of the rise of daily expiration options. I cannot think of a more leveraged bet than daily and weekly options. Most (not surprisingly) expire out of the money, but the lottery ticket nature seems to encourage the large swings (in either direction) to become even larger (see "What's Behind The Explosion In 0DTE Option Trading").

This is an added dose of gamma to an already illiquid market – which is a recipe for large moves.

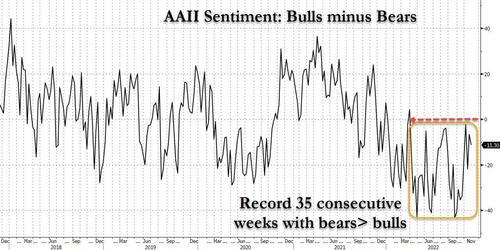

Measures like the CNN Fear & Greed index remain firmly in “Greed” territory. Certainly not “Extreme Greed” but not indicative that “everyone” is bearish. On AAII we pulled back from last week’s more bullish reading, but it is still more neutral than anything else.

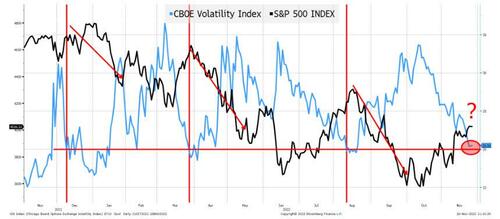

Looking at QQQ RSI (relative strength indicator) it is by and large in the middle which indicates neutral positioning. Nothing in the “technical charts” I look at (not my area of expertise, but not something I ignore completely) was jumping out at me as bullish or bearish except for the VIX.

VIX has drifted back to just over 20, which has been problematic for equities this year.

Will VIX, QT, weakening economic data, and abysmal liquidity set up a December 2018 type of scenario?

Stock buybacks (which may be loosely interpreted as company positioning) influence markets and it seems like we have developed a pattern where we hold our breath during earnings season and breathe a sigh of relief as earnings are done and cannot undo any of the good that the buybacks have done. Unfortunately, this is a three-month cycle and by late December we go back to holding our breath again!

On the fund flows, ARKK hit a record for shares outstanding two weeks ago and has seen a slight pullback. TQQQ hit the record three weeks ago but has also seen small but steady outflows. I use those two ETFs as they capture the zeitgeist of the moment, and they seem to support the fact that markets actually got bullish and are now more neutral.

I see little evidence to support the “everyone is bearish” camp (at least not in equities). If anything, we could be setting up for selling pressure into year-end as the “Fed is slowing down on hikes” story is getting largely priced in. Additionally, the “need to chase seasonality” trade has been put on and quantitative tightening will (over time) give investors the opportunity to take less risk for similarly expected returns.

On the bond side, you could convince me that people are still too bearish (because that’s what I’d like to believe) and it may be true here, but with the recent move stopping out a lot of short positions, I suspect that bonds are more neutrally positioned.

Key Drivers

With positioning likely neutral, markets will be influenced by data and important narratives. For the coming weeks and months these are the drivers that we will be keeping a close eye on. They are what we will be examining closely to see if we need to adjust our opinions and outlooks on the economy and markets!

- The Wealth Effect. The wealth effect isn’t getting the attention it deserves.

- Housing is down. For most, home values are higher today than a couple of years ago, but the psychological impact of having home values decline (in response to much higher mortgage rates) is problematic.

- Bonds have been hit hard. Anyone hoping bonds would zig when stocks zagged is having a tough year. The so-called 60/40 funds (funds that invest in stocks and bonds specifically to capture the typically negative correlation) have had one of their worst years on record.

- Stocks have been hit hard. While the S&P 500 is “only” down 15% this year, the Nasdaq is down 28%, and “disruptive” companies (I will use the ARKK ETF as a proxy) are down 62%. It isn’t just the wealth effect of the average investor that is problematic, but it is also the destruction of what was “paper” wealth for many employees of these companies.

- Crypto was hit hard. Many seem to ignore crypto, but in a little over a year, the value of cryptocurrencies has gone from $3 trillion to maybe $0.7 trillion. The entities involved in the space have also seen their valuations plunge.

- The Growth Company “Wealth Effect.” If you go back to early 2021, growth was everywhere. Raising equity (publicly or privately) was relatively easy even at large valuations. That money was raised and was spent because showing growth was the key objective. Now, with valuations low (and more of an emphasis on cashflow) these companies which were big engines of growth will be much more careful with their spending.

- Inventory, Demand, and Supply Chains. These factors could just as easily drag inflation down.

- Demand seemed high, but was it sustainable? Consumers had wealth (see above), stimulus, and responded to potential supply shortages by buying more last year than they needed and effectively pulled demand forward. There is evidence (in inventory data) that companies didn’t see this.

- Supply chain overcompensation. Companies responded to supply chain risks by ordering more. Demand seemed robust and it also seemed “safer” to have more inventory than less. As supply chains are normalizing (lots of evidence that this is occurring, even with China still enforcing a zero-COVID policy), we can see more inventory build-up.

- Russia, Ukraine, and Energy Prices. The base case is for the status quo to continue, which will keep upward pressure on energy and commodity prices, but much has been priced in and global supply chains are shifting to adapt to this new universe.

- If anything, the “surprise” would be some sort of truce. The expense of military equipment is weighing on many NATO nations. Ukraine cannot really “win” and Russia cannot afford to lose, so trying to avert further infrastructure damage (and permanently displacing citizens) is a reasonable goal. Sanctions seem to hurt us as much as Russia, which is yet another reason to try to come to the table. One of the outcomes of the sanctions is that moving oil by tanker has become difficult and expensive because shipping routes have lengthened to adjust for “who can buy or sell oil to whom.”

- China continues its re-assertion of the communist party and is extending its “client” state relationships. I do not expect much help from China in the global economy.

- Xi is re-asserting the authority of the communist party. It was always in charge, but even internally the perception of the party’s power relative to successful businesspeople (as one example) is being clamped down on.

- Expecting China to do what we wish they would do has been and will continue to be a flawed strategy. There remains a “hope” that China really wants to be like us, and they will come around to that way of thinking. This is highly unlikely to happen.

- Shifting economic ties. China and Russia, in many ways, make better trading partners than the U.S. and Russia (Russia wants high tech from China and has a trade surplus from selling commodities). This relationship exists with many countries, especially the autocratic/resource rich nations of the world. The Belt and Road Initiative has been an extremely effective way (from the Chinese perspective) of solidifying relationships with countries that China wants resources, access, or other things from.

- Taiwan. The GIG sees a military invasion as unlikely, but look for political and economic pressure to be ratcheted up, while maintaining an intimidating military presence.

- Jobs. The job data has been strong and could be one area that continues to show strength, which would be a threat to our rate outlook as we are less sanguine about that market.

- Jobs (always a lagging indicator) will be even more lagging this time. After a year or more where it was extremely difficult to hire, companies will not fire people any time soon! Firing will be a last resort (even more than usual). You will see cutbacks in services used (legal, consulting, cloud, advertising, etc.) first and there is evidence we are seeing some of that.

- What sort of jobs will be lost? This time around, it seems like many job cuts (at least in the early rounds of layoffs) will be higher paying jobs. This won’t be a job market that hits low-income earners hard because it will hit high income jobs more than usual. That will matter as it will take fewer jobs lost to tilt the economy down.

- Not all jobs data passes the “smell” test. The Household Survey shows 2 million fewer jobs created than the Establishment Survey. The JOLTs data has been showing more and more jobs relative to hiring since more job searches went online. There are also some “wonky” but realistic questions about various metrics in the jobs data.

- The Service Sector. This is another area that has held in there and this might bode well for the future. However, there is a risk that similar to inventory (where supply chain fears overstated demand), a similar phenomenon could be occurring in the services space. The contention is that after an extended period where travel or seeing your family was difficult, there is a “catch up” effect that may not be as robust once we make it through this year’s holiday season.

- Inflation. I expect deflation to be as much of a topic of conversation next year as inflation.

Longer-term factors. While these drivers are unlikely to cause major market moves in the coming weeks, they will shape next year, and it is important to keep an eye on how they are developing as getting these right will be a key component of successfully navigating 2023.

Supply Chain Management. Companies will create simpler and “safer” or more “secure” supply chains. That will create jobs domestically, in Mexico, and in other areas. That will create opportunity and will be somewhat inflationary. It will create more “middle” class jobs, not just in manufacturing, but in the logistics around these new supply chains. This will be good for American jobs, but not great for inflation.

Sustainable AND Traditional Energy build-out. We need to build out sustainable energy faster and more aggressively than previously thought. We need to ensure that the backbone of our energy system is big enough (for long enough) to let that transformation occur smoothly. This will eventually be deflationary, but it will be inflationary in the near-term as immense amounts of money will need to be spent on the materials and people needed to create the world for which we are striving.

India. This is my “outlier” and doesn’t get enough attention. India is set to surpass China in terms of total population with a much better demographic mix! India is also set to gain China’s “losses” on the supply chain side. India was growing rapidly before Covid and seems to be back on that trajectory. There are many obstacles (some of which are their own making), but if there was one outlier that I’d be looking for it would be an “early 2000s like” China commodity boom! Let’s not forget that India is buying Russian commodities because cheap resources are critical for India. They work with Venezuela too and seem to be mimicking China’s playbook for resource accumulation in many ways. It seems shocking how seldom India comes up in conversations, yet this could be the shock to the global system for which we aren’t prepared.

Bottom Line

I still like bonds, though less than I did a few weeks ago! The rally has been intense, and we are nearing levels that seem difficult to justify without much worse data coming through. From our key drivers section, I expect the data to be weaker than consensus, but if the bearish positioning has been reduced in bonds, it will take a lot more to propel them to much lower yields.

Skew positioning to the 2-to-5-year range as they should benefit the most as data comes in that compels the Fed to stop hiking sooner and the markets can price in a lower terminal rate. As of now, though there is more data to come, we can expect a 50bps hike in December, but that could be it (and might be too much). The market is pricing in a 5% terminal rate in May. However, sub 4.5% appeals to me.

Commodities may continue to struggle here, led by energy prices. Recent price declines have not impacted stocks significantly, but that commodity weakness could translate into commodity stock weakness (XLE and XLM have been resilient, near the highs in XLE’s case, but look for some profit taking to weigh on these stocks as markets struggle to see growth into 2023).

I wouldn’t touch crypto with a ten-foot pole here. Maybe we see some of the various “exchange” and “custodial” entities and companies in the headline sort out their alleged issues and the market rebounds, but I don’t see that happening. Bitcoin should drift lower and sub $10,000 is my target (given everything that is going on and the number of questions institutional investors are facing).

Which leaves the question – will there be an “everything rally” or will it actually be “risk-off” into year- end for equities?

A week or so ago, I would have expected an “everything rally” into year-end. However:

- Treasury yields are quite low and stocks didn’t lift much. The S&P 500 is close to its mid-September closing high (4,110) which should function as resistance.

- The minutes should have helped stocks more than they did. Markets got less than a 0.5% rally in the S&P on Wednesday and the Nasdaq 100 is closer to Tuesday’s closing price than Wednesday’s price (not the sort of price action that bodes well for a sustained rally into year-end).

- The PMI data was abysmal. It wasn’t just bad, it was abysmal. Services, the alleged backbone of the economy, growth, and inflation, hit 46.1 (down from 48.2). That is disturbing.

- QT doesn’t help and if the “seasonality” trade has already been embraced, that could unwind.

So, weighing all the evidence, I am slightly bearish on equities for now. Weirdly, the bearishness has little to do with the Fed trying to jawbone things down (because the market has moved beyond that). The bearishness is because we have shifted from a “bad news is good news” world to a “bad news is bad news” world for risky assets.

Credit will outperform equities and there is a path to further spread tightening even if equities don’t rally. There are signs that some of the “hung” deals the banks have on the high yield side are working themselves out, so they won’t continue to be an overhang on the high yield and leveraged loan market. Maybe the pop, ironically, is more likely to occur in that space than in investment grade.

In any case, on an all-in yield basis credit looks good, but on a spread basis it is time to opportunistically reduce risk, even in the face of a light calendar. Hope you had a great Thanksgiving!

By Peter Tchir of Academy Securities

Positioning & Key Drivers

As we head into what in theory should be a quiet period for markets (though it certainly wasn’t in December 2018), we try to address positioning (very difficult to get a good read) and what our drivers for the next few weeks will be.

Positioning

There are reports circulating that everyone is bearish. Those reports seem to focus on words (there is a lot of airtime being given to the bears) and on things like equity put/call ratios. The argument against looking at put/call ratios is that they have been oscillating back and forth (almost wildly) and they may not do a good job of capturing the weekly and daily expiration options markets. It is truly fascinating to watch (and to understand) the implications of the rise of daily expiration options. I cannot think of a more leveraged bet than daily and weekly options. Most (not surprisingly) expire out of the money, but the lottery ticket nature seems to encourage the large swings (in either direction) to become even larger (see “What’s Behind The Explosion In 0DTE Option Trading“).

This is an added dose of gamma to an already illiquid market – which is a recipe for large moves.

Measures like the CNN Fear & Greed index remain firmly in “Greed” territory. Certainly not “Extreme Greed” but not indicative that “everyone” is bearish. On AAII we pulled back from last week’s more bullish reading, but it is still more neutral than anything else.

Looking at QQQ RSI (relative strength indicator) it is by and large in the middle which indicates neutral positioning. Nothing in the “technical charts” I look at (not my area of expertise, but not something I ignore completely) was jumping out at me as bullish or bearish except for the VIX.

VIX has drifted back to just over 20, which has been problematic for equities this year.

Will VIX, QT, weakening economic data, and abysmal liquidity set up a December 2018 type of scenario?

Stock buybacks (which may be loosely interpreted as company positioning) influence markets and it seems like we have developed a pattern where we hold our breath during earnings season and breathe a sigh of relief as earnings are done and cannot undo any of the good that the buybacks have done. Unfortunately, this is a three-month cycle and by late December we go back to holding our breath again!

On the fund flows, ARKK hit a record for shares outstanding two weeks ago and has seen a slight pullback. TQQQ hit the record three weeks ago but has also seen small but steady outflows. I use those two ETFs as they capture the zeitgeist of the moment, and they seem to support the fact that markets actually got bullish and are now more neutral.

I see little evidence to support the “everyone is bearish” camp (at least not in equities). If anything, we could be setting up for selling pressure into year-end as the “Fed is slowing down on hikes” story is getting largely priced in. Additionally, the “need to chase seasonality” trade has been put on and quantitative tightening will (over time) give investors the opportunity to take less risk for similarly expected returns.

On the bond side, you could convince me that people are still too bearish (because that’s what I’d like to believe) and it may be true here, but with the recent move stopping out a lot of short positions, I suspect that bonds are more neutrally positioned.

Key Drivers

With positioning likely neutral, markets will be influenced by data and important narratives. For the coming weeks and months these are the drivers that we will be keeping a close eye on. They are what we will be examining closely to see if we need to adjust our opinions and outlooks on the economy and markets!

- The Wealth Effect. The wealth effect isn’t getting the attention it deserves.

- Housing is down. For most, home values are higher today than a couple of years ago, but the psychological impact of having home values decline (in response to much higher mortgage rates) is problematic.

- Bonds have been hit hard. Anyone hoping bonds would zig when stocks zagged is having a tough year. The so-called 60/40 funds (funds that invest in stocks and bonds specifically to capture the typically negative correlation) have had one of their worst years on record.

- Stocks have been hit hard. While the S&P 500 is “only” down 15% this year, the Nasdaq is down 28%, and “disruptive” companies (I will use the ARKK ETF as a proxy) are down 62%. It isn’t just the wealth effect of the average investor that is problematic, but it is also the destruction of what was “paper” wealth for many employees of these companies.

- Crypto was hit hard. Many seem to ignore crypto, but in a little over a year, the value of cryptocurrencies has gone from $3 trillion to maybe $0.7 trillion. The entities involved in the space have also seen their valuations plunge.

- The Growth Company “Wealth Effect.” If you go back to early 2021, growth was everywhere. Raising equity (publicly or privately) was relatively easy even at large valuations. That money was raised and was spent because showing growth was the key objective. Now, with valuations low (and more of an emphasis on cashflow) these companies which were big engines of growth will be much more careful with their spending.

- Inventory, Demand, and Supply Chains. These factors could just as easily drag inflation down.

- Demand seemed high, but was it sustainable? Consumers had wealth (see above), stimulus, and responded to potential supply shortages by buying more last year than they needed and effectively pulled demand forward. There is evidence (in inventory data) that companies didn’t see this.

- Supply chain overcompensation. Companies responded to supply chain risks by ordering more. Demand seemed robust and it also seemed “safer” to have more inventory than less. As supply chains are normalizing (lots of evidence that this is occurring, even with China still enforcing a zero-COVID policy), we can see more inventory build-up.

- Russia, Ukraine, and Energy Prices. The base case is for the status quo to continue, which will keep upward pressure on energy and commodity prices, but much has been priced in and global supply chains are shifting to adapt to this new universe.

- If anything, the “surprise” would be some sort of truce. The expense of military equipment is weighing on many NATO nations. Ukraine cannot really “win” and Russia cannot afford to lose, so trying to avert further infrastructure damage (and permanently displacing citizens) is a reasonable goal. Sanctions seem to hurt us as much as Russia, which is yet another reason to try to come to the table. One of the outcomes of the sanctions is that moving oil by tanker has become difficult and expensive because shipping routes have lengthened to adjust for “who can buy or sell oil to whom.”

- China continues its re-assertion of the communist party and is extending its “client” state relationships. I do not expect much help from China in the global economy.

- Xi is re-asserting the authority of the communist party. It was always in charge, but even internally the perception of the party’s power relative to successful businesspeople (as one example) is being clamped down on.

- Expecting China to do what we wish they would do has been and will continue to be a flawed strategy. There remains a “hope” that China really wants to be like us, and they will come around to that way of thinking. This is highly unlikely to happen.

- Shifting economic ties. China and Russia, in many ways, make better trading partners than the U.S. and Russia (Russia wants high tech from China and has a trade surplus from selling commodities). This relationship exists with many countries, especially the autocratic/resource rich nations of the world. The Belt and Road Initiative has been an extremely effective way (from the Chinese perspective) of solidifying relationships with countries that China wants resources, access, or other things from.

- Taiwan. The GIG sees a military invasion as unlikely, but look for political and economic pressure to be ratcheted up, while maintaining an intimidating military presence.

- Jobs. The job data has been strong and could be one area that continues to show strength, which would be a threat to our rate outlook as we are less sanguine about that market.

- Jobs (always a lagging indicator) will be even more lagging this time. After a year or more where it was extremely difficult to hire, companies will not fire people any time soon! Firing will be a last resort (even more than usual). You will see cutbacks in services used (legal, consulting, cloud, advertising, etc.) first and there is evidence we are seeing some of that.

- What sort of jobs will be lost? This time around, it seems like many job cuts (at least in the early rounds of layoffs) will be higher paying jobs. This won’t be a job market that hits low-income earners hard because it will hit high income jobs more than usual. That will matter as it will take fewer jobs lost to tilt the economy down.

- Not all jobs data passes the “smell” test. The Household Survey shows 2 million fewer jobs created than the Establishment Survey. The JOLTs data has been showing more and more jobs relative to hiring since more job searches went online. There are also some “wonky” but realistic questions about various metrics in the jobs data.

- The Service Sector. This is another area that has held in there and this might bode well for the future. However, there is a risk that similar to inventory (where supply chain fears overstated demand), a similar phenomenon could be occurring in the services space. The contention is that after an extended period where travel or seeing your family was difficult, there is a “catch up” effect that may not be as robust once we make it through this year’s holiday season.

- Inflation. I expect deflation to be as much of a topic of conversation next year as inflation.

Longer-term factors. While these drivers are unlikely to cause major market moves in the coming weeks, they will shape next year, and it is important to keep an eye on how they are developing as getting these right will be a key component of successfully navigating 2023.

Supply Chain Management. Companies will create simpler and “safer” or more “secure” supply chains. That will create jobs domestically, in Mexico, and in other areas. That will create opportunity and will be somewhat inflationary. It will create more “middle” class jobs, not just in manufacturing, but in the logistics around these new supply chains. This will be good for American jobs, but not great for inflation.

Sustainable AND Traditional Energy build-out. We need to build out sustainable energy faster and more aggressively than previously thought. We need to ensure that the backbone of our energy system is big enough (for long enough) to let that transformation occur smoothly. This will eventually be deflationary, but it will be inflationary in the near-term as immense amounts of money will need to be spent on the materials and people needed to create the world for which we are striving.

India. This is my “outlier” and doesn’t get enough attention. India is set to surpass China in terms of total population with a much better demographic mix! India is also set to gain China’s “losses” on the supply chain side. India was growing rapidly before Covid and seems to be back on that trajectory. There are many obstacles (some of which are their own making), but if there was one outlier that I’d be looking for it would be an “early 2000s like” China commodity boom! Let’s not forget that India is buying Russian commodities because cheap resources are critical for India. They work with Venezuela too and seem to be mimicking China’s playbook for resource accumulation in many ways. It seems shocking how seldom India comes up in conversations, yet this could be the shock to the global system for which we aren’t prepared.

Bottom Line

I still like bonds, though less than I did a few weeks ago! The rally has been intense, and we are nearing levels that seem difficult to justify without much worse data coming through. From our key drivers section, I expect the data to be weaker than consensus, but if the bearish positioning has been reduced in bonds, it will take a lot more to propel them to much lower yields.

Skew positioning to the 2-to-5-year range as they should benefit the most as data comes in that compels the Fed to stop hiking sooner and the markets can price in a lower terminal rate. As of now, though there is more data to come, we can expect a 50bps hike in December, but that could be it (and might be too much). The market is pricing in a 5% terminal rate in May. However, sub 4.5% appeals to me.

Commodities may continue to struggle here, led by energy prices. Recent price declines have not impacted stocks significantly, but that commodity weakness could translate into commodity stock weakness (XLE and XLM have been resilient, near the highs in XLE’s case, but look for some profit taking to weigh on these stocks as markets struggle to see growth into 2023).

I wouldn’t touch crypto with a ten-foot pole here. Maybe we see some of the various “exchange” and “custodial” entities and companies in the headline sort out their alleged issues and the market rebounds, but I don’t see that happening. Bitcoin should drift lower and sub $10,000 is my target (given everything that is going on and the number of questions institutional investors are facing).

Which leaves the question – will there be an “everything rally” or will it actually be “risk-off” into year- end for equities?

A week or so ago, I would have expected an “everything rally” into year-end. However:

- Treasury yields are quite low and stocks didn’t lift much. The S&P 500 is close to its mid-September closing high (4,110) which should function as resistance.

- The minutes should have helped stocks more than they did. Markets got less than a 0.5% rally in the S&P on Wednesday and the Nasdaq 100 is closer to Tuesday’s closing price than Wednesday’s price (not the sort of price action that bodes well for a sustained rally into year-end).

- The PMI data was abysmal. It wasn’t just bad, it was abysmal. Services, the alleged backbone of the economy, growth, and inflation, hit 46.1 (down from 48.2). That is disturbing.

- QT doesn’t help and if the “seasonality” trade has already been embraced, that could unwind.

So, weighing all the evidence, I am slightly bearish on equities for now. Weirdly, the bearishness has little to do with the Fed trying to jawbone things down (because the market has moved beyond that). The bearishness is because we have shifted from a “bad news is good news” world to a “bad news is bad news” world for risky assets.

Credit will outperform equities and there is a path to further spread tightening even if equities don’t rally. There are signs that some of the “hung” deals the banks have on the high yield side are working themselves out, so they won’t continue to be an overhang on the high yield and leveraged loan market. Maybe the pop, ironically, is more likely to occur in that space than in investment grade.

In any case, on an all-in yield basis credit looks good, but on a spread basis it is time to opportunistically reduce risk, even in the face of a light calendar. Hope you had a great Thanksgiving!