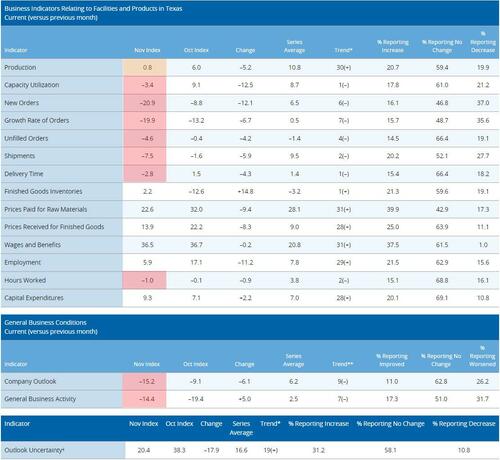

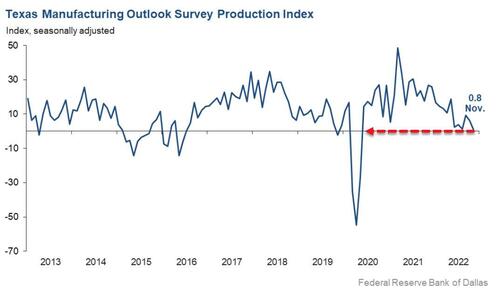

While the headline Dallas Fed Manufacturing survey did not weaken as much as expected, the production index, a key measure of state manufacturing conditions, fell five points to near zero - its weakest level since the COVID lockdowns in 2020...

Under the hood, several other measures of manufacturing activity indicated contraction this month. The new orders index plummeted to -20.9 - its sixth month in a row in negative territory and lowest reading since May 2020. The growth rate of orders index dropped seven points to -19.9. The capacity utilization index turned negative, falling from 9.1 to -3.4, and the shipments index posted a second consecutive negative reading at -7.5, down from -1.6 in October.

Additionally, perceptions of broader business conditions continued to worsen in November. The general business activity index posted a seventh consecutive negative reading but moved up five points to -14.4. The company outlook index pushed down further, from -9.1 to -15.2.

However, it was the comments from respondents that offer the most prescient insight into US economic conditions:

-

Customers are illiquid. Demand is there; there is just no cash to buy food. There is increased tension in terms of demand for skilled workers and retaining them. [Food Manufacturing]

-

Business is slow and slowing. Our outlook for January is hopeful. [Paper Manufacturing]

-

There is less panic buying going on. Inventories are beginning to go down. Lead times we are able to give to our customers are beginning to decrease as input of new orders slows. The slowdown is consistent with normal seasonal factors but way below last year’s very high fourth-quarter order level. We are beginning to see the end of the dislocations caused by the pandemic. [Printing and Related Support Activities]

-

Recession is coming! We are just waiting for the backlog to evaporate. Then layoffs start. [Primary Metal Manufacturing]

-

We are very concerned about the volume of future business activity. We see our customers pulling back their plans for expansion but still planning for the future. This has put us in a position to be very competitive to win every order possible to ensure our cash flow and ability to pay our employees and bills. [Machinery Manufacturing]

-

We are still running strong; however, we believe that it is inevitable that the economy will contract within the next six months. [Machinery Manufacturing]

-

[The Federal Reserve] is going too crazy—that is really affecting the industrial equipment industry and stalling infrastructure spending as I have never seen before. Millions of jobs are at risk in manufacturing. [Computer and Electronic Product Manufacturing]

-

The cost of capital is unbearable for small businesses and will delay or reduce expenditures or hiring unless business drives change. [Computer and Electronic Product Manufacturing]

-

The outlook is troubling and unsettling. Caution is the strategy. The Federal Reserve is too aggressive. Let what’s been done materialize in the economy before piling on. [Transportation Equipment Manufacturing]

Does any of that sound like an economy that is "strong as hell"?

While the headline Dallas Fed Manufacturing survey did not weaken as much as expected, the production index, a key measure of state manufacturing conditions, fell five points to near zero – its weakest level since the COVID lockdowns in 2020…

Under the hood, several other measures of manufacturing activity indicated contraction this month. The new orders index plummeted to -20.9 – its sixth month in a row in negative territory and lowest reading since May 2020. The growth rate of orders index dropped seven points to -19.9. The capacity utilization index turned negative, falling from 9.1 to -3.4, and the shipments index posted a second consecutive negative reading at -7.5, down from -1.6 in October.

Additionally, perceptions of broader business conditions continued to worsen in November. The general business activity index posted a seventh consecutive negative reading but moved up five points to -14.4. The company outlook index pushed down further, from -9.1 to -15.2.

However, it was the comments from respondents that offer the most prescient insight into US economic conditions:

-

Customers are illiquid. Demand is there; there is just no cash to buy food. There is increased tension in terms of demand for skilled workers and retaining them. [Food Manufacturing]

-

Business is slow and slowing. Our outlook for January is hopeful. [Paper Manufacturing]

-

There is less panic buying going on. Inventories are beginning to go down. Lead times we are able to give to our customers are beginning to decrease as input of new orders slows. The slowdown is consistent with normal seasonal factors but way below last year’s very high fourth-quarter order level. We are beginning to see the end of the dislocations caused by the pandemic. [Printing and Related Support Activities]

-

Recession is coming! We are just waiting for the backlog to evaporate. Then layoffs start. [Primary Metal Manufacturing]

-

We are very concerned about the volume of future business activity. We see our customers pulling back their plans for expansion but still planning for the future. This has put us in a position to be very competitive to win every order possible to ensure our cash flow and ability to pay our employees and bills. [Machinery Manufacturing]

-

We are still running strong; however, we believe that it is inevitable that the economy will contract within the next six months. [Machinery Manufacturing]

-

[The Federal Reserve] is going too crazy—that is really affecting the industrial equipment industry and stalling infrastructure spending as I have never seen before. Millions of jobs are at risk in manufacturing. [Computer and Electronic Product Manufacturing]

-

The cost of capital is unbearable for small businesses and will delay or reduce expenditures or hiring unless business drives change. [Computer and Electronic Product Manufacturing]

-

The outlook is troubling and unsettling. Caution is the strategy. The Federal Reserve is too aggressive. Let what’s been done materialize in the economy before piling on. [Transportation Equipment Manufacturing]

Does any of that sound like an economy that is “strong as hell”?