By Todd Maiden of FreightWaves.com

Transportation capacity continued to grow at a high rate during November with prices falling at the fastest rate on record, according to a monthly survey of supply chain executives released Tuesday.

The Logistics Managers’ Index (LMI) displayed a capacity reading of 71.4 in November, 1.7 percentage points lower than the all-time high established in October. The 12-month forward-looking expectation for the subindex is 65.7.

A reading above 50 indicates expansion while one below that indicates contraction.

A new low for the transportation prices subindex was set during the month. A 37.4 reading was 4.8 points lower than October and “the sharpest rate of contraction we have read in the history of the LMI,” the report said. Contraction was more pronounced among downstream respondents, or those in the supply chain that are closer to the end consumer. That group returned a 28.1 reading.

Expectations for prices one year from now stood at 42.1 as “the transportation market continues to fall from the dizzying heights that had become the norm during 2021.”

Transportation utilization was down 2.8 points to a neutral reading of 50. Responses captured in the second half of November were “slightly more negative,” meaning utilization “may be seeing the beginning of a contraction period” after expanding every month since May 2020.

The overall LMI stood at 53.6 in November, 3.9 points lower sequentially and the second-lowest level captured in the data set’s six-year history. The all-time low was recorded in April 2020 during the height of pandemic-related lockdowns.

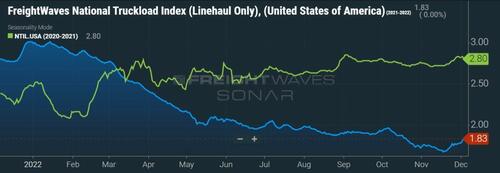

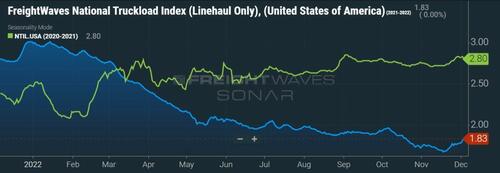

FreightWaves’ National Truckload Index, a measure of TL spot rates, remains well off all-time highs established earlier in the year. However, spot rates are potentially bottoming, up nearly 10% from mid-November lows.

Inventories normalizing further?

Inventory growth rates throughout the supply chain slowed significantly during the month. After average readings of 69.6 this year, 62.7 in 2021 and 58.4 in 2020, the subindex fell 10.7 points to 54.8 in November, with respondents at the wholesale level seeing slower growth.

“Inventory levels have decreased significantly, particularly for upstream respondents,” the report said. “This is likely indicative of goods being positioned downstream for the holiday season and, more importantly for supply chains, being purchased by consumers.”

The inventory levels subindex was neutral at 50 in the back half of November, which “suggests that many firms have successfully threaded the needle and worked through the bulk of the goods that have plagued them through the year.”

The report cautioned that when the inventories subindex falls significantly, there is usually an increase in the following period. “So, there is a chance the inventory level index will bounce back up somewhat, post-holiday,” according to the report.

The forward-looking expectation for inventory levels was 47.2.

“The bullwhip effect was probably inevitable, given the sharp oscillations in supply and demand experienced over the last few years,” the report read. “The key now will be to observe whether supply chains have finally now right-sized their inventories, or if they have overcorrected back into a mild shortage.”

Inventory costs (73.4) continued to grow but at a rate 7.5 points lower than in October as warehousing prices (74.4) remained firmly in expansion territory. Higher warehousing costs were driven by contracting capacity (46.8) and growing utilization rates (56.8).

“It will be crucial to observe whether or not transportation metrics begin to bounce back at all in the new year, once the glut of inventory has been wound down further,” the report said.

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.

By Todd Maiden of FreightWaves.com

Transportation capacity continued to grow at a high rate during November with prices falling at the fastest rate on record, according to a monthly survey of supply chain executives released Tuesday.

The Logistics Managers’ Index (LMI) displayed a capacity reading of 71.4 in November, 1.7 percentage points lower than the all-time high established in October. The 12-month forward-looking expectation for the subindex is 65.7.

A reading above 50 indicates expansion while one below that indicates contraction.

A new low for the transportation prices subindex was set during the month. A 37.4 reading was 4.8 points lower than October and “the sharpest rate of contraction we have read in the history of the LMI,” the report said. Contraction was more pronounced among downstream respondents, or those in the supply chain that are closer to the end consumer. That group returned a 28.1 reading.

Expectations for prices one year from now stood at 42.1 as “the transportation market continues to fall from the dizzying heights that had become the norm during 2021.”

Transportation utilization was down 2.8 points to a neutral reading of 50. Responses captured in the second half of November were “slightly more negative,” meaning utilization “may be seeing the beginning of a contraction period” after expanding every month since May 2020.

The overall LMI stood at 53.6 in November, 3.9 points lower sequentially and the second-lowest level captured in the data set’s six-year history. The all-time low was recorded in April 2020 during the height of pandemic-related lockdowns.

FreightWaves’ National Truckload Index, a measure of TL spot rates, remains well off all-time highs established earlier in the year. However, spot rates are potentially bottoming, up nearly 10% from mid-November lows.

Inventories normalizing further?

Inventory growth rates throughout the supply chain slowed significantly during the month. After average readings of 69.6 this year, 62.7 in 2021 and 58.4 in 2020, the subindex fell 10.7 points to 54.8 in November, with respondents at the wholesale level seeing slower growth.

“Inventory levels have decreased significantly, particularly for upstream respondents,” the report said. “This is likely indicative of goods being positioned downstream for the holiday season and, more importantly for supply chains, being purchased by consumers.”

The inventory levels subindex was neutral at 50 in the back half of November, which “suggests that many firms have successfully threaded the needle and worked through the bulk of the goods that have plagued them through the year.”

The report cautioned that when the inventories subindex falls significantly, there is usually an increase in the following period. “So, there is a chance the inventory level index will bounce back up somewhat, post-holiday,” according to the report.

The forward-looking expectation for inventory levels was 47.2.

“The bullwhip effect was probably inevitable, given the sharp oscillations in supply and demand experienced over the last few years,” the report read. “The key now will be to observe whether supply chains have finally now right-sized their inventories, or if they have overcorrected back into a mild shortage.”

Inventory costs (73.4) continued to grow but at a rate 7.5 points lower than in October as warehousing prices (74.4) remained firmly in expansion territory. Higher warehousing costs were driven by contracting capacity (46.8) and growing utilization rates (56.8).

“It will be crucial to observe whether or not transportation metrics begin to bounce back at all in the new year, once the glut of inventory has been wound down further,” the report said.

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.